-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Rates Ignore Debt Ceiling Optimism

- MNI INTREVIEW: Fed Seen Pausing In June, Could Restart-Acharya

- MNI US: Democrat Leader Jeffries To File Debt Ceiling Discharge Petition Today

US

FED: The Federal Reserve is nearing a pause in its interest rate increases at the June meeting, but compared to past tightening cycles there remains a heightened chance the central bank will have to hike again, possibly later in the year, former Reserve Bank of India deputy governor Viral Acharya told MNI.

- "Depending on how the next two or three quarters pan out, there might have to be potential for a hike," he said. "We are heading in the right direction of the inflation trajectory but it doesn't mean that you can give up on the inflation target."

- While the central bank may refrain from an eleventh straight hike in June, the Fed will keep a hawkish bias, said Acharya this week at an Atlanta Fed conference, suggesting that bias could be signaled in the Summary of Economic Projections. There are some, he said, "who think the Fed lost a little bit of credibility through this inflation cycle and I think they've got to restore it because you can't allow an unanchoring of long-term market expectations." For more see MNI Policy main wire at 0953ET

- Jeffries writes: "In the next few weeks, at the reckless urging of former President Trump, we confront the possibility that right-wing extremists will intentionally plunge our country into a default crisis."

US TSYS: Markets Roundup: Rates Ignore Debt Ceiling Optimism

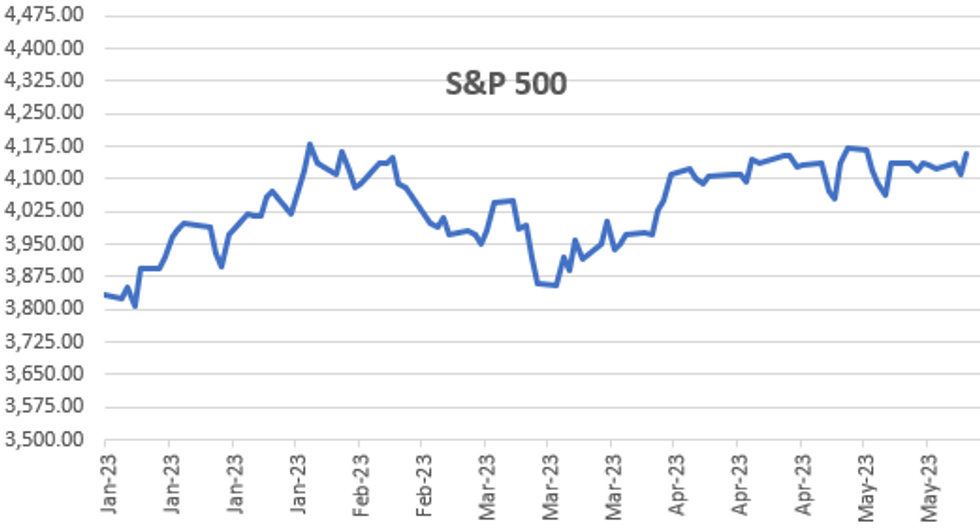

Treasury futures are holding modestly weaker levels across the board after the bell, gradually paring losses over the last hour (10Y futures -10 at 114-19.5 vs. 114-15.5 low) while curves maintain flatter profiles (2s10s -57.626 vs. -60.549 low).- Markets remained sensitive to debt ceiling headlines, though the phenomena was not as apparent in rates as it was in equities as stocks rallied on hopes over a "doable" debt ceiling plan by Sunday. Treasury futures uncoupled from the improved risk appetite and instead traded weaker/curves flatter as projected rate cuts by year end softened (Fed fund futures now only pricing in 55.1bp in cumulative cuts by December to 4.524% vs. over a full point a week ago).

- Rates showed little initial reaction to latest housing starts (1.401M) building permits (1.416M) data, and inching off lows briefly after the $15B 20Y bond auction (912810TS7) trades through: 3.954% high yield vs. 3.962% WI; 2.56x bid-to-cover vs. prior month's 2.66x.

- CNN has reported that Treasury Secretary Janet Yellen will meet with bank CEOs, including JPMorgan Chase's Jamie Dimon and Citigroup's Jane Fraser on Thursday. The meeting has been previously reported but unconfirmed.

- Note, Fed Chairman Powell and former Fed Chairman Bernanke will have live discussion on policy this Friday at 1100ET.

OVERNIGHT DATA

- US APR HOUSING STARTS 1.401M; PERMITS 1.416M

- US MAR STARTS REVISED TO 1.371M; PERMITS 1.437M

- US APR HOUSING COMPLETIONS 1.375M; MAR 1.534M (REV)

- US MBA: REFIS -8% SA; PURCH INDEX -4.8% SA THRU MAY 12 WK

- US MBA: UNADJ PURCHASE INDEX -26% VS YEAR-EARLIER LEVEL

- US MBA: 30-YR CONFORMING MORTGAGE RATE 6.57% VS 6.48% PREV

- US MBA: MARKET COMPOSITE -5.7% SA THRU MAY 12 WK

- FOREIGN HOLDINGS OF CANADA SECURITIES -19.1B CAD IN MAR

- CANADIAN HOLDINGS OF FOREIGN SECURITIES -5.6B CAD IN MAR

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 383.87 points (1.16%) at 33397.73

- S&P E-Mini Future up 48.25 points (1.17%) at 4171.5

- Nasdaq up 160.3 points (1.3%) at 12503.47

- US 10-Yr yield is up 3.6 bps at 3.5698%

- US Jun 10-Yr futures are down 9/32 at 114-20.5

- EURUSD down 0.002 (-0.18%) at 1.0842

- USDJPY up 1.18 (0.87%) at 137.57

- WTI Crude Oil (front-month) up $1.95 (2.75%) at $72.81

- Gold is down $5.37 (-0.27%) at $1983.81

- EuroStoxx 50 up 7.72 points (0.18%) at 4323.23

- FTSE 100 down 27.85 points (-0.36%) at 7723.23

- German DAX up 53.37 points (0.34%) at 15951.3

- French CAC 40 down 6.57 points (-0.09%) at 7399.44

US TREASURY FUTURES CLOSE

- 3M10Y -1.279, -166.86 (L: -174.959 / H: -166.127)

- 2Y10Y -2.531, -57.793 (L: -60.549 / H: -53.213)

- 2Y30Y -4.383, -27.846 (L: -30.803 / H: -21.184)

- 5Y30Y -3.489, 28.968 (L: 26.963 / H: 33.811)

- Current futures levels:

- Jun 2-Yr futures down 4.625/32 at 102-28 (L: 102-26.125 / H: 103-01.875)

- Jun 5-Yr futures down 9/32 at 109-15.25 (L: 109-12 / H: 109-26.5)

- Jun 10-Yr futures down 9/32 at 114-20.5 (L: 114-15.5 / H: 115-03)

- Jun 30-Yr futures down 8/32 at 128-28 (L: 128-22 / H: 129-21)

- Jun Ultra futures down 4/32 at 136-25 (L: 136-14 / H: 137-23)

US 10YR FUTURE TECHS: (M3) Has Pierced The 50-Day EMA

- RES 4: 117-29+ High Aug 26 2022 (cont)

- RES 3: 117-01+ High Mar 24 and bull trigger

- RES 2: 117-00 High May 4

- RES 1: 115-18+/116-16 High May 16 / 11

- PRICE: 115-00+ @ 11:20 BST May 17

- SUP 1: 114-16 May 17 intra-day low

- SUP 2: 114-10 Low May 1

- SUP 3: 113-30+ Low Apr 19 and a key support

- SUP 4: 113-26 Low Mar 22

Treasury futures traded lower Tuesday and the contract breached support at 115-01+, the May 9 low, and pierced the 50-day EMA, at 114-30+. A clear break of this average would signal scope for a deeper retracement and open 114-10 initially, May 1 low. For bulls, a reversal higher would refocus attention on resistance at 117-01+, the Mar 24 high. This is the bull trigger - a break would highlight an important bullish development.

SOFR FUTURES CLOSE

- Jun 23 -0.028 at 94.868

- Sep 23 -0.030 at 95.120

- Dec 23 -0.050 at 95.530

- Mar 24 -0.080 at 96.035

- Red Pack (Jun 24-Mar 25) -0.10 to -0.065

- Green Pack (Jun 25-Mar 26) -0.055 to -0.045

- Blue Pack (Jun 26-Mar 27) -0.04 to -0.03

- Gold Pack (Jun 27-Mar 28) -0.03 to -0.015

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00561 to 5.07326 (+.01635/wk)

- 3M +0.01441 to 5.11233 (+.04253/wk)

- 6M +0.02671 to 5.06888 (+.08341/wk)

- 12M +0.05057 to 4.75436 (+.15322/wk)

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00143 to 5.06043%

- 1M +0.02114 to 5.13243%

- 3M +0.02386 to 5.36900% */**

- 6M +0.01972 to 5.39886%

- 12M +0.06757 to 5.34571%

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.36900% on 5/17/23

- Daily Effective Fed Funds Rate: 5.08% volume: $124B

- Daily Overnight Bank Funding Rate: 5.07% volume: $290B

- Secured Overnight Financing Rate (SOFR): 5.05%, $1.466T

- Broad General Collateral Rate (BGCR): 5.02%, $588B

- Tri-Party General Collateral Rate (TGCR): 5.02%, $578B

- (rate, volume levels reflect prior session)

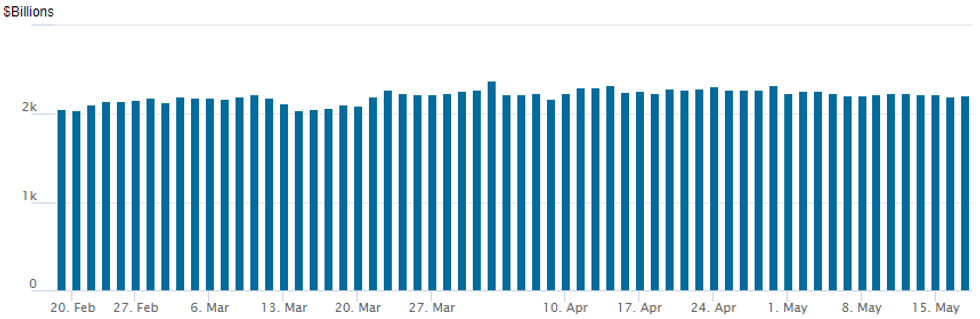

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage bounces back to $2,213.676B w/ 103 counterparties, compares to prior $2,203.214B. Compares to high usage for 2023: $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

PIPELINE: $3B EDF 3Pt Launched

- Date $MM Issuer (Priced *, Launch #)

- 05/17 $3B #EDF $1B 5Y +215, $1B 10Y +270, $1B 30Y +310

- 05/17 $2.5B #Schwab $1.2B 6NC5 +205, $1.3B 11NC10 +227

- 05/17 $1.25B #Blackrock 10Y +130

- 05/17 $1B *NRW Bank 3Y +32

- 05/17 $1B #SoCal Gas 10Y +165, 30Y +190

- 05/17 $800M #ITC $300M 5Y +135, $500M 10Y +185

- 05/17 $500M #BNY Mellon 3NC2 +100

- 05/17 $500M #LYB Int Finance 10Y +205

- 05/17 $500M #Amcor Finance 10Y +217

- 05/17 $Benchmark Southern California Edison 3Y +112.5, 30Y +200

- 05/17 $3.5B Venture Global 5NC2, 8NC3 investor calls

EGBs-GILTS CASH CLOSE: Peripheries Outperform

Gilt yields pushed to one-week highs Wednesday, underperforming Bunds, with curve bear flattening in the afternoon contrasting with earlier bull/twist flattening.

- The morning saw strong auctions for the UK, Germany and France, which along with mixed risk appetite (markets focused on US debt default potential) helping core instruments hit session's best levels by midday.

- An optimistic statement on debt limit negotiations by US Pres Biden pushed European yields to session highs in late afternoon, but the move faded.

- Periphery EGB spread narrowing, led by Greece, progressed steadily as risk appetite picked up with equities edging into positive territory.

- The main European data of the session - Eurozone final CPI - was mostly in line (M/M revised down 0.1pp), and had no market impact. Likewise, commentary by ECB's de Cos and de Guindos, and by BoE's Bailey, brought little new.

- Note that Thursday's Ascension Day holiday will likely see lighter trade volumes in a thin European calendar outside of central bank speakers (including ECB's Muller, and BoE's Pill and Bailey) and Spanish bond supply.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is up 4.4bps at 2.701%, 5-Yr is up 2.1bps at 2.327%, 10-Yr is down 1.7bps at 2.336%, and 30-Yr is down 3.8bps at 2.512%.

- UK: The 2-Yr yield is up 5.5bps at 3.867%, 5-Yr is up 6bps at 3.688%, 10-Yr is up 2.1bps at 3.837%, and 30-Yr is up 1.2bps at 4.269%.

- Italian BTP spread down 2.1bps at 184.7bps / Greek down 4.6bps at 166.3bps

FOREX: NZDJPY Rises To 5-Month High, USD Index Extends Gains

- The USD index traded on the front foot on Wednesday, eclipsing last week’s highs during early European trade and then consolidating these gains in US hours just below the 103.00 mark. Major equity benchmarks have rallied, underpinned by post-Biden-Congressional leadership meeting rhetoric pointing to some limited positive developments. Firmer stocks have been unable to dent the optimism for the greenback, but this has in turn left the Japanese Yen as the poorest performer in G10.

- USDJPY currently trades +0.88% approaching the APAC crossover and looks set to extend its winning streak to five trading sessions. More buoyant price action for major indices and higher front-end US yields appear to be underpinning the bid for cross/JPY, most notably seen by the 1.30% climb for NZDJPY.

- Resistance for USDJPY at 136.63, the May 3 high, has been cleared and this signals scope for a continuation towards 137.77, the May 2 high and the 2023 highs of 137.91. A break of this resistance zone would strengthen bullish conditions and would open the potential for a move to 139.59/140.00. On the downside, initial firm support is seen at 134.96, the 20-day EMA.

- The NZD outperformance comes off the back of a revision higher for RBNZ rate expectations at ANZ, who now see the OCR hitting 5.75% at its peak.

- USD/CNH reached as high as 7.0229 on Wednesday, the best level for the pair dating back to early December last year. When it comes to USD/CNY flows Citi noted that “exporter activity remains muted as high U.S. rates give them less incentive to sell the USD. There might be a bumpy road ahead as profit taking activities and expectations of potential intervention may self-fulfil around CNY7.00 level.”

- Australian unemployment headlines the overnight docket on Thursday, along with the New Zealand annual budget release. US Philly Fed Manufacturing and existing home sales are notable US releases.

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 18/05/2023 | 2350/0850 | ** |  | JP | Trade |

| 18/05/2023 | 0130/1130 | *** |  | AU | Labor force survey |

| 18/05/2023 | 0630/0830 |  | EU | ECB de Guindos Remarks at PwC Seminar | |

| 18/05/2023 | 0745/0845 |  | UK | BOE Pill Opens CCBS Macro-finance Workshop | |

| 18/05/2023 | 0915/1015 |  | UK | BOE Bailey Broadbent, Ramsden give TSC evidence on QE, QT at Bank, Threadneedle St | |

| 18/05/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 18/05/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 18/05/2023 | 1230/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 18/05/2023 | 1305/0905 |  | US | Fed Governor Philip Jefferson | |

| 18/05/2023 | 1330/0930 |  | US | Fed Vice for Supervision Michael Barr | |

| 18/05/2023 | 1400/1000 | *** |  | US | NAR existing home sales |

| 18/05/2023 | 1400/1000 |  | US | Dallas Fed's Lorie Logan | |

| 18/05/2023 | 1400/1000 |  | CA | BOC publishes Financial System Review | |

| 18/05/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 18/05/2023 | 1500/1100 |  | CA | BOC Governor press conference to discuss Financial System Review | |

| 18/05/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 18/05/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 18/05/2023 | 1700/1300 | ** |  | US | US Treasury Auction Result for TIPS 10 Year Note |

| 18/05/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 18/05/2023 | 1900/1500 | *** |  | MX | Mexico Interest Rate |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.