-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI ASIA MARKETS ANALYSIS: Rates Pare Gains AheaD FOMC Minutes

HIGHLIGHTS

- US: McCarthy Fails To Secure Speaker's Gavel In First Round Of Voting

- EX-FED CHAIR ALAN GREENSPAN SAYS RECESSION MOST LIKELY OUTCOME, Bbg

- DUDLEY: US RECESSION PRETTY LIKELY BECAUSE OF WHAT FED MUST DO, Bbg

US Tsys: Rates Paring Early Gains, Heavy Rate Lock Hedging

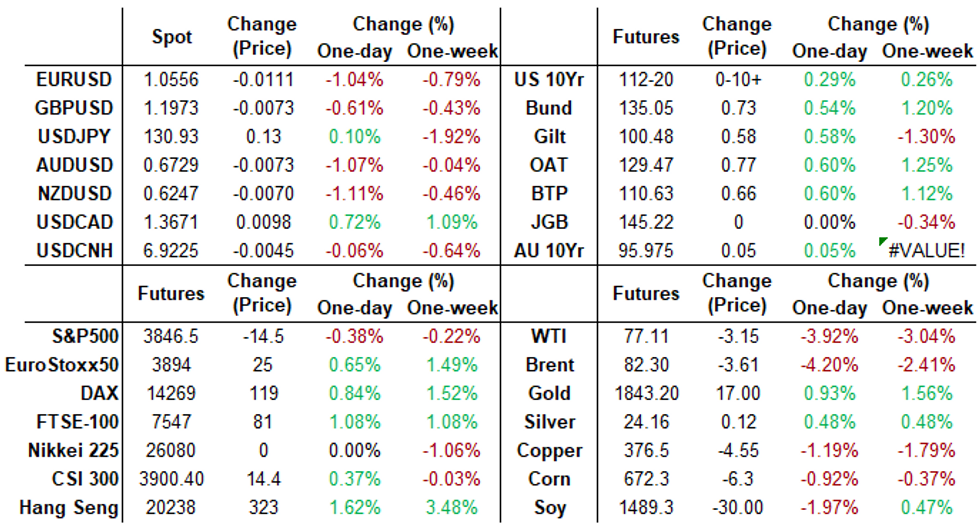

Tsys hold firmer by the close, but well off first-half highs, yield curves bull-flattening on wide ranges (2s10s -6.060 at -61.783; -64.324L, -50.971H)).

- Tsys broke narrow range in late overnight trade, largely tracking German bunds, particularly after latest German CPI reading for Dec: below exp (-0.8% MoM vs. -0.6% est, 8.6% YoY vs. 9.0% est).

- FI support eased after US S&P Global manufacturing PMI was unrevised in the final December reading at 46.2, leaving it down from 47.7 in Nov and the lowest since May'20.

- Coming ahead of tomorrow's ISM manufacturing survey, the confirmed decline in the PMI goes against the sizeable bounce in last week's MNI Chicago PMI from 37.2 to 44.9 (albeit clearly from weaker levels).

- Heavy corporate bond issuance helped keep rate rally in check amid rate lock hedging vs more than $30B debt issuance across the curve.

- Focus turns to Dec FOMC minutes release Wed at 1400, APD private employ data (150k est vs. 127k prior) on Thursday and headline NFP data (+200k est vs. +263k prior) Friday at 0830ET.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00086 to 4.31886% (+0.00129 total last wk)

- 1M +0.00972 to 4.40129% (+0.00471 total last wk)

- 3M +0.01457 to 4.78186% (+0.04176 total last wk)*/**

- 6M -0.00272 to 5.13614% (-0.01428 total last wk)

- 12M -0.03528 to 5.44686% (+0.03828 total last wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.78186% on 1/3/23

- Daily Effective Fed Funds Rate: 4.33% volume: $67B

- Daily Overnight Bank Funding Rate: 4.33% volume: $126B

- Secured Overnight Financing Rate (SOFR): 4.30%, $1.004T

- Broad General Collateral Rate (BGCR): 4.26%, $354B

- Tri-Party General Collateral Rate (TGCR): 4.26%, $325B

- (rate, volume levels reflect prior session)

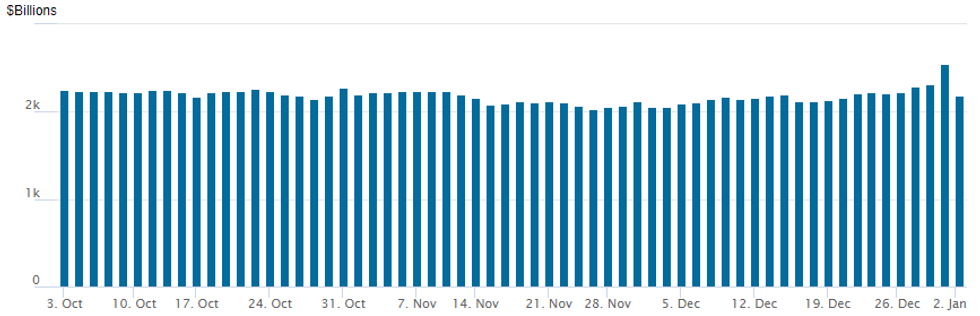

FED Reverse Repo Operation: Off Year-End Record High

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $2,188.272B w/ 99 counterparties vs. last Friday's record high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30).

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Better low-delta put trade on net Tuesday, fading stronger underlying futures at the start of 2023.

SOFR Options:- 24,600 2MF3 111.5/114 put over risk reversals, 2 ref 112-21.5

- +30,000 SFRG3 95.06/95.18/95.31 call flys, 3.25-3.50

- Blocks, total 15,000 SFRZ3 95.06/95.25 put spds,

- Block, 2,500 SFRU3 94.68/94.81/94.93/95.06 put condors, 1.75

- Block, 2,500 SFRZ3 94.68/94.81/94.93/95.06 put condors, 1.25

- Block, 2,500 SFRM3 94.68/94.81/94.93/95.06 put condors, 2.5

- +8,000 SFRM3 95.25/95.50 1x2 call spds, 2.25-2.0

- +4,000 2QJ3 97.12/97.37 call spds, 7.75

- 2,700 2QH3 96.87/97.37 2x3 call spds ref 96.80

- 5,000 OQH3 95.25/95.75 put spds ref 95.92 to .915

- Block, 2,500 OQH3 95.50/95.75 put spds, 8.0 vs. 95.955/0.13%

- 2,100 SFRF 95.18/95.31 call spds

- 3,000 OQF3 95.50/95.75/96.00 2x3x1 put flys ref 95.885

- Another 6,000 FVG 108 puts, 37.5 ref 108-01.25

- Block, 20,000 FVG3 106 puts, 6 vs. 108-00.5/0.11%, 14.5k more on screen

- 4,000 FVH 109.5/111/112.5 call flys, ref 108-07

- 3,000 FVG 108 puts, 33 ref 108-07.75

- 4,000 USG 116/118 put spds legged, 4 ref 126-20 to -16

- 1,000 TYG 114/115/116/117 call condors

- 2,000 TYG 112.75/113.75 call spds vs. 111.5 puts

EGBs-GILTS CASH CLOSE: Early Gains Fade

European bond yields closed mostly lower Tuesday, though well off session lows. Germany's curve bull flattened, with the UK's twist flattening, and periphery EGB spreads tightened modestly.

- Weaker-than-expected German inflation data initially drove EGB and Gilt yields lower, in the first full trading session of 2023 (Gilts were closed Monday).

- But bonds pared gains later in the session, with short-end and intermediate Gilt yields fully round-tripping.

- The afternoon session's weakness is not easily explained by any particular catalyst, though the UK move appeared to match a rebound in the GBP vs USD, with a bit of a lag.

- Though there was no sovereign bond supply today, Austria and Slovenia announced mandates, and there was a fairly busy EUR corporate issuance slate. Weds sees Germany sell E5bln of Schatz.

- French flash Dec inflation features early Wednesday.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 3.9bps at 2.67%, 5-Yr is down 5.8bps at 2.418%, 10-Yr is down 5.5bps at 2.389%, and 30-Yr is down 8.7bps at 2.313%.

- UK: The 2-Yr yield is up 2bps at 3.595%, 5-Yr is unchanged at 3.618%, 10-Yr is down 2.1bps at 3.651%, and 30-Yr is down 0.2bps at 3.954%.

- Italian BTP spread down 0.7bps at 211.3bps / Spanish down 0.4bps at 106.6bps

EGB Options: Mixed Trade As 2023 Gets Underway

Tuesday's Europe rates / bond options flow included:

- DUG3 105.50/105.30/105.10p fly, bought for 2.5 in 5k

- RXG3 137/139cs, bought for 27 in 1.82k

- ERH3 97.00/96.875/96.75p fly, bought for 3 in 5k

FOREX: Greenback Consolidates Solid Gains To Start New Year

- Despite a firm start for major equity index futures and the EuroStoxx50 topping its mid-December resistance, the greenback was the strongest currency across G10 in early trade on Tuesday. The USD index has since consolidated these gains amid renewed equity weakness and looks set to post a 1% advance to start the year.

- Despite a strong wave of JPY buying in APAC trade, which saw USDJPY slip to near seven-month lows of 129.52, the subsequent greenback strength has seen EUR, CHF AUD and NZD leading the weakness in G10.

- Weaker than expected German CPI data was the key contributor to the single currency weakness ahead of key Eurozone releases later this week. EURUSD has traded sharply lower and in the process has breached support at the 20-day EMA at 1.0587 and briefly traded below 1.0528, the Dec 13 low. Continued weakness may expose a key short-term support at 1.0443, the Dec 7 low.

- AUD/USD had breached the Dec29 low to near the 50-dma of 0.6662. Weakness through the moving average would open 0.6629 and levels not seen since mid-November. Similarly, NZD/USD did trade through the 200-dma of 0.6232 with the focus on first support at 0.6156.

- On Wednesday the ISM Manufacturing PMI and JOLTS job openings are main data points before the release of the FOMC December meeting minutes. Focus then quickly turns to Friday’s US employment report.

Expiries for Jan04 NY cut 1000ET (Source DTCC)

- USD/JPY: Y129.30($595mln), Y130.00($640mln), Y134.30($1.4bln)

- AUD/USD: $0.6800-05(A$1.2bln)

Equity Roundup: Communication Services, IT Underperforming

Major indexes trading weaker but off early session lows, Communication Services and Information Technology sectors underperforming. SPX eminis currently trade -19.5 (-0.5%) at 3851; DJIA -145.14 (-0.44%) at 33073; Nasdaq -65.6 (-0.6%) at 10410.68.

- SPX leading/lagging sectors: Paring gains from the previous session, Communication Services (-1.07%) and Information Technology (-1.03%) sectors underperformed, interactive media and services subsector weighing on the former w/ Google -1.62%, Meta -1.41%. Semiconductor makers weighed on IT: Micron (MU) -2.37%, Teradyne (TER) -1.54%, Nvidia -1.31%.

- Leaders: Energy (+0.22%), Financials (-0.28%) and Utilities (-0.49%), energy sector making gains for second consecutive session.

- Dow Industrials Leaders/Laggers: Chevron (CVA) +0.71 at 179.03, JPM +0.47 at 133.69, Boeing (BA) +0.36 at 189.27. Laggers: Home Depot (HD) -5.34 at 315.07, Microsoft (MSFT) -3.48 at 237.53, United Health (UNH) -3.19 at 526.69.

COMMODITIES: Crude Oil Slides Amidst Broader Risk-Off

- Crude oil has slid lower through most of the session, down circa 4% as equity market losses accelerated and the US dollar saw a resurgence amidst risk off.

- OPEC crude output edged higher last month as Nigeria partially reversed a long-term slump by cracking down on oil theft with a 8-month high of 1.35mbpd whilst separately, Mexico expects Pemex to pay its debt without government intervention.

- WTI is -4.0% at $77.10, approaching key short-term support at $76.79 (Dec 29 low), clearance of which could open $73.40 (Dec 16 low).

- Brent is -4.2% at $82.30 as it eyes key short-term support at $81.85 (Dec 29 low), clearance of which could open $78.76 (Dec 16 low).

- Gold is +0.7% at $1837.2 in the middle of a wide range from a volatile session with an intraday high of $1850.0 and further resistance at $1857.6 (Jun 16 high). Lower Tsy yields on balance offset the impact from a stronger dollar.

Wednesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 04/01/2023 | 0001/0001 | * |  | UK | BRC Monthly Shop Price Index |

| 04/01/2023 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Manufacturing PMI |

| 04/01/2023 | 0730/0830 | *** |  | CH | CPI |

| 04/01/2023 | 0745/0845 | ** |  | FR | Consumer Sentiment |

| 04/01/2023 | 0745/0845 | *** |  | FR | HICP (p) |

| 04/01/2023 | 0815/0915 | ** |  | ES | IHS Markit Services PMI (f) |

| 04/01/2023 | 0845/0945 | ** |  | IT | IHS Markit Services PMI (f) |

| 04/01/2023 | 0850/0950 | ** |  | FR | IHS Markit Services PMI (f) |

| 04/01/2023 | 0855/0955 | ** |  | DE | IHS Markit Services PMI (f) |

| 04/01/2023 | 0900/1000 | ** |  | EU | IHS Markit Services PMI (f) |

| 04/01/2023 | 0930/0930 | ** |  | UK | BOE M4 |

| 04/01/2023 | 0930/0930 | ** |  | UK | BOE Lending to Individuals |

| 04/01/2023 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 04/01/2023 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 04/01/2023 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 04/01/2023 | 1500/1000 | *** |  | US | ISM Manufacturing Index |

| 04/01/2023 | 1500/1000 | ** |  | US | JOLTS jobs opening level |

| 04/01/2023 | 1500/1000 | ** |  | US | JOLTS quits Rate |

| 05/01/2023 | 2200/0900 | * |  | AU | IHS Markit Final Australia Services PMI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.