-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Regional Bank Cares Subsiding

HIGHLIGHTS

- MNI WHITE HOUSE: Biden Invokes Defense Production Act To Increase Chip Production

- ISRAELI PM NETANYAHU -THERE IS AN EXTREMIST MINORITY READY TO DIVIDE OUR NATION Rtrs

- FED VC BARR: WE PLAN TO PROPOSE LONG-TERM DEBT REQUIREMENT FOR LARGE REGIONAL BANKS, NEED TO ENHANCE STRESS TESTING, EXPLORE CHANGES TO LIQUIDITY RULES, Rtrs

- ECB CENTENO: HAVEN'T SEEN DEANCHORING OF INFLATION EXPECTATIONS, Rtrs

- ECB SCHNABEL: CORE INFLATION IS STILL `ON THE UPSIDE', Bbg

US TSYS: Bear Flattening Extends, Bank Cares Moderate

Tsy futures drifted near late session lows Monday, yield curves bear flattening (2s10s -9.438 at -49.302, well off early high of -40.518) as regional bank share panic moderated to a degree.

- Early support for bank shares cooled around midday, KBW Bank index (BKK) gave up a more than half of their gains made on the open to a session low of 79.69, drifted off lows in the second half to approximately 80.75 in late trade. KBW "is a modified cap-weighted index consisting of 24 exchange-listed National Market System stocks, representing national money center banks and leading regional institutions."

- Front month 2Y futures extended lows (103-12.75, -15.75) after the $42B Treasury 2Y note auction (91282CGU9) tailed (second consecutive): 3.954% high yield vs. 3.915% WI; 2.44x bid-to-cover vs. 2.61x prior.

- Meanwhile, 10Y futures at 114-31.5 (10Y yield at 3.5261%). For a technical perspective, early 10Y signals suggest that Friday’s candle pattern - a shooting star formation - represents a possible short-term reversal. If correct, this suggests scope for weakness towards the 20-day EMA, at 114-00.

- Focus turns to Tuesday's Wholesale/Retail Inventories early, home price data and consumer confidence at midmorning. $43B 5Y Note auction (91282CGT2) auction at 1300ET.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00015 to 4.90871% (+0.24800 total last wk)

- 1M +0.02172 to 4.85229% (+0.00457 total last wk)

- 3M +0.04171 to 5.14314% (+0.10300 total last wk)*/**

- 6M +0.17385 to 5.16114% (-0.06500 total last wk)

- 12M +0.25228 to 5.06114% (-0.22528 total last wk)

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.15371% on 3/9/23

- Daily Effective Fed Funds Rate: 4.83% volume: $92B

- Daily Overnight Bank Funding Rate: 4.82% volume: $271B

- Secured Overnight Financing Rate (SOFR): 4.80%, $1.290T

- Broad General Collateral Rate (BGCR): 4.78%, $513B

- Tri-Party General Collateral Rate (TGCR): 4.78%, $505B

- (rate, volume levels reflect prior session)

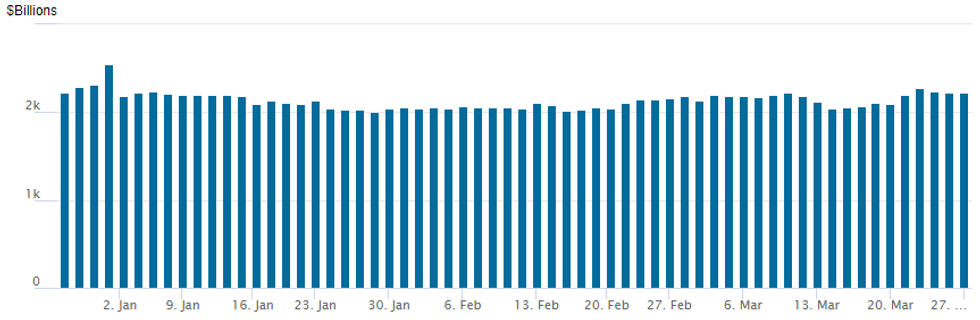

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,220.131B w/ 98 counterparties vs. the prior session's $2,.218.458B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Modest volume recorded overnight, SOFR/Treasury options tended toward downside puts - carry over from Friday as downside put buying gained momentum in the second half, accounts faded the bank-panic driven safe haven support. Second half volume evaporated while interest in upside calls climbed, accounts fading the sell-off in underlying futures.

- SOFR Options:

- +9,000 OQJ3 96.50/OQM3 97.00 call spds, 0.0

- Block, 10,000 SFRZ3 98.00/98.50 call spds, 5.0 ref 95.855

- Block, 10,000 SFRU3 94.37/94.50 put spds, 2.0 ref 95.56

- Block/screen 5,000 SFRK3 94.18/94.31/94.37/94.50 put condors, 0.0 ref 95.265

- Block/screen, over 7,500 OQM3 95.75 puts, 14.0 vs. 96.675

- 4,000 SFRM3 95.12/95.25/95.37/95.50 put condors ref 95.285

- 2,000 SFRM3 94.62/94.81 put spds

- 2,000 OQJ3 96.50/96.87 2x1 put spds, ref 96.66

- 1,000 SFRN3 94.81/95.18/95.56 put flys

- 3,000 SFRZ3 95.50 puts, 42.0 ref 95.95

- Treasury Options:

- 1,000 TUK3 101.5/102.25/103 put fly ref 103-14.25

- Over +12,000 TYK3 120 calls 12 ref 115-03 to -08.5

- 2,000 TYK3 107.5/108/110 broken put flys, ref 115-15.5

- over 5,300 TYM3 112 combos ref 115-19.5

- 2,600 TYK3 119 calls, 27 ref 115-24.5

- over 7,000 TYK3 112 puts, partly tied to 112/114 2x1 put spd

EGBs-GILTS CASH CLOSE: Curves Bear Flatten As Bank Fears Subside

The UK and German curves bear flattened Monday with the latter underperforming, as weekend headlines propped up confidence in the US banking sector.

- First Citizens' takeover of Silicon Valley Bank and a Bloomberg sources piece ("US Mulls More Support for Banks While Giving First Republic Time") drove European equities and yields higher in early trade, with US bank stocks soaring at the US cash open.

- Rates continued rising in early afternoon on BBG sources story saying Exec Board's Schnabel pushed for a clearer signal in the ECB's March statement on further rate hikes.

- This continued to pressure the short end, with the implied ECB rate hike path seeing near 90% chance of a 25bp raise in May, and just over 50bp cumulative left in the cycle (vs 60% and 20bp at Friday's lows, respectively).

- A beat in German IFO kept sentiment bearish, but didn't really move the needle.

- The bear flattening move petered out a little by mid-afternoon as global bank stocks gave up some of their earlier gains. 10Y BTP spreads likewise failed to decisively break through the 183bp mark vs Bunds.

- BoE Gov Bailey speaks after the cash close, while the schedule early Tuesday includes appearances by ECB hawks Rehn and Muller, and French confidence surveys.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 12.8bps at 2.521%, 5-Yr is up 11.2bps at 2.211%, 10-Yr is up 9.8bps at 2.227%, and 30-Yr is up 9bps at 2.308%.

- UK: The 2-Yr yield is up 10bps at 3.311%, 5-Yr is up 9.2bps at 3.219%, 10-Yr is up 8.3bps at 3.366%, and 30-Yr is up 3.9bps at 3.807%.

- Italian BTP spread down 4.4bps at 183.7bps / Greek down 7.8bps at 188bps

EGB Options: Monday Sees Upside In Euribor, Downside In Bund

Monday's Europe rate/bond options flow included:

- RXK3 136/134 put spread sold at 75 in 5k

- RXK3 130.00/129.00 put spread bought for 6.5 in ~4.7k

- ERZ3 97.125/97.625 call spread bought for 11.75 in 4k (v 96.63)

FOREX: JPY Underperforms Amid Pressure In Core Fixed Income

- With core fixed income under pressure and equities trading on the front foot, pressure on the Japanese Yen has resumed on Monday and is the notable underperformer for today’s trading session.

- USDJPY (+0.65%) has had a solid bounce from the overnight 130.41 lows, however, the slightly more optimistic backdrop has more notably supported the crosses with CADJPY leading the way, rising 1.3% to start the week.

- Elsewhere, EURJPY trades buoyantly and technically eyes the key short-term resistance at 143.63 where a break is required to reinstate the bullish theme. Note that moving average studies remain in a bull mode set-up - this suggests the latest pullback has been a correction. A break of 143.63 would initially open 143.98, 76.4% of the Mar 2 - 20 bear cycle.

- USD/CNH also inched higher with the pair briefly clearing 6.8942 - the Mar 22 (and FOMC day) high. Further gains here would open more meaningful resistance at the 100- and 200-dmas of 6.9258 and 6.9326 respectively.

- The moves follow the overnight industrial profits data, which showed January-February profits slipping 23% Y/Y - that's the third fastest pace of decline on record, after only the GFC in '08 and onset of the COVID pandemic in 2020.

- Additionally, the previously announced RRR cut came into effect Monday, pressuring interbank rates (overnight repo rate dropped to lowest since early January). This effect was compounded by PBOC OMOs, further supporting liquidity in Asia-Pac trade.

- Outgoing Bank of Japan Governor Kuroda is due to speak on Tuesday at the FIN/SUM 2023, in Tokyo. There may be further comments from BOE’s Bailey as well as ECB’s Lagarde, due to speak at the opening ceremony of Bank of International Settlements Innovation Hub Eurosystem Centre, in Frankfurt. US consumer confidence highlights a quiet data docket.

FX: Expiries for Mar28 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0875-80(E1.1bln), $1.0945-55(E1.8bln)

- USD/JPY: Y128.50-70($875mln)

- AUD/USD: $0.6500(A$575mln), $0.6750(A$652mln)

Tuesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 28/03/2023 | 2301/0001 | * |  | UK | BRC Monthly Shop Price Index |

| 28/03/2023 | 0030/1130 | ** |  | AU | Retail Trade |

| 28/03/2023 | 0645/0845 | ** |  | FR | Manufacturing Sentiment |

| 28/03/2023 | 0800/1000 | ** |  | IT | ISTAT Business Confidence |

| 28/03/2023 | 0800/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 28/03/2023 | 1230/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 28/03/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 28/03/2023 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 28/03/2023 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 28/03/2023 | 1315/1515 |  | EU | ECB Lagarde Speech at BIS Innovation Hub Opening | |

| 28/03/2023 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 28/03/2023 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 28/03/2023 | 1400/1000 |  | US | Senate Banking Committee Hearing | |

| 28/03/2023 | 1430/1030 | ** |  | US | Dallas Fed Services Survey |

| 28/03/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 28/03/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 28/03/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

| 28/03/2023 | 2000/1600 |  | CA | Federal budget (Release around 4pm, as finance minister delivers it to Parliament) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.