-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Risk Appetite Improves Late

HIGHLIGHTS

- MNI CHINA-RUSSIA: China UN Envoy Says Beijing Ready To Play Role In Resolving War

- MNI EU-RUSSIA: EU Diplomats Fail To Agree On New "Anniversary" Sanctions On Russia

- MNI EU-RUSSIA: Scholz Rules Out Sending Warplanes To Ukraine

- US BIDEN’S FED VICE CHAIR SEARCH NARROWS AS TOP TIER SEEN EMERGING, bbg

US TSYS: Real Yields Gradually Decline

Tsy futures trade near late session highs, yield curves flatter with short end underperforming. Generally muted second half after whip-saw action this morning. Several underlying factors to consider

- Tsys gap bid after headlines that WH narrowing choices over Fed Gov Brainard: "GOOLSBEE, DALY, CARPENTER ALSO UNDER SERIOUS CONSIDERATION" Bbg. Desks see less hawks in the roost as bond positive.

- Some trading desks suggest early month-end positioning a factor, though hard to tell with massive March/June Tsy futures roll volume so far (TYH/TYM>1.3M already, TYH3 total volume >2.2M) as well as large curve flattener Block (-38,200 TUM3 102-01.62, sell through 102-03 post-time bid vs. +20,200 TYM3 111-21 post-time offer) and outright selling in 2s.

- Rate locks and pre-auction short sets into support: corporate bond issuance returns after plying sidelines ahead morning data. Tsys pared support briefly following weak $35B 7Y note auction (91282CGO8) tails: 4.062% high yield vs. 4.047% WI; 2.49x bid-to-cover vs. 2.69x last month.

- Risk appetite improved late as real yield recede (10Y -4.5bp to 1.46% - pre FOMC minutes levels).

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00771 to 4.56457% (+0.00771/wk)

- 1M +0.01271 to 4.61700% (+0.02571/wk)

- 3M +0.02972 to 4.95786% (+0.04257/wk)*/**

- 6M +0.00600 to 5.27700% (+0.03400/wk)

- 12M +0.02243 to 5.64186% (-0.00100/wk)

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 4.95786% on 2/23/23

- Daily Effective Fed Funds Rate: 4.58% volume: $109B

- Daily Overnight Bank Funding Rate: 4.57% volume: $298B

- Secured Overnight Financing Rate (SOFR): 4.55%, $1.129T

- Broad General Collateral Rate (BGCR): 4.52%, $457B

- Tri-Party General Collateral Rate (TGCR): 4.52%, $445B

- (rate, volume levels reflect prior session)

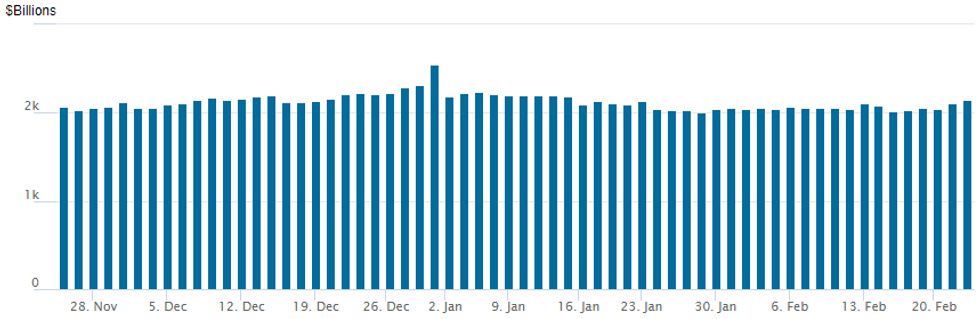

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,147.417B w/ 102 counterparties vs. prior session's $2,113.849B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Despite underlying futures whipsawing off first half lows, better put buying continued through Thu's session, late Jun'23 SOFR put strip buy block for example as accts look to hedge potential return of 50bp hikes in 2023.- SOFR Options:

- Block, 20,000 SFRM3 94.43/94.50 put strip, 7.25 vs. 94.67

- Block, 7,500 OQM3 95.50 puts, 22.0 vs. 95.705/0.38%

- Block, 30,000 SFRH3 95.00 puts, 4.0 vs. 94.9925/0.54%

- -10,000 OQM3 95.00/95.50 put spds, 14.25

- Block, 7,500 OQM3 95.43 puts, 19.0 vs. 95.725/0.37%

- Block, 3,000 OQJ3 95.25/95.50/95.75 3x5x2 put flys, 0.0 net ref 95.70

- 2,000 SFRM4 94.00/95.75/

- 1,500 SFRZ3 94.87/95.37 2x1 put spds ref 94.85

- 3,150 SFRJ3 94.68/94.81 1x2 call spds, 1.5 ref 94.645

- 3,250 SFRM3 94.68/94.81 put spds, ref 94.645

- Block, 4,000 SFRJ3 94.50/94.62 put spds, 4.0 vs 94.65/0.10%

- Treasury Options:

- -5,000 TYM2 111.5/112 strangles, 261-260

- BLOCK, 14,000 TYJ3 107/108 put spds, 2 vs. 112-00/0.04%

- 2,000 FVJ3 106.5/107 3x4 put spds (wrong way)

- 4,000 FVM 105.5/106 put spds, 9 ref 107-09.25

- 4,200 FVH3 107.5 calls, 1 ref 106-26.25

- +15,000 wk1 TY 110p 5 vs 111-17 to -18/0.08%

- 2,000 TYK3 111.5 straddles ref 111-18.5

- over 3,600 TYH3 112 calls, 2 ref 111-03

- over 4,200 TYH3 110.25 puts, 3 ref 111-02.5

- 1,300 TYJ 114/116 2x3 call spds, 20 ref 111-20

EGBs-GILTS CASH CLOSE: Early Intraday Weakness Fades Again

European curves bull flattened Thursday, with early weakness fading and long end yields pulling back as the session progressed.

- For the second consecutive session, Gilts staged an afternoon rally, driven by a pullback in BoE hike expectations (down ~6bp from intraday highs set after a speech by BoE hawk Mann).

- And as with Wednesday, 10Y bund yields pulled back just shy of the 11-year high of 2.5744%, with long-end yields fading globally.

- With no particular catalyst (and unlike BoE, hike expectations for the ECB didn't shift much Thursday, with peak depo rate still seen at ~3.75%), BTPs outperformed with sharp spread tightening vs Bunds in the afternoon.

- Eurozone HICP and core CPI picked up 0.1pp in the final reading, but this didn't have a major market impact. Attention early Friday is on final German GDP and comments by Germany's Nagel.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 0.8bps at 2.913%, 5-Yr is down 3bps at 2.551%, 10-Yr is down 4.2bps at 2.478%, and 30-Yr is down 8.5bps at 2.423%.

- UK: The 2-Yr yield is down 0.4bps at 3.919%, 5-Yr is up 0.9bps at 3.571%, 10-Yr is down 1.3bps at 3.587%, and 30-Yr is down 0.6bps at 3.982%.

- Italian BTP spread down 3.6bps at 190.4bps / Spanish down 2bps at 96.5bps

EGB Options: Mixed Trade Thursday Includes More Midcurve Euribor Call Structures

Thursday's Europe rates/bond options flow included:

- OEJ3 117.25/117.75/118.25c fly Bot for 4.5 and 5 in 5k

- RXJ3 136/137.5cs 1x1.5 sold at 12 in 2k

- 0RK3 96.87/97.25/97.50c fly, bought for 6 in 6k

FOREX: Greenback Unchanged, JPY Moderately Firmer Ahead Of Ueda Hearing

- G10 currency markets made very minor adjustments on Thursday with the lack of meaningful data keeping volatility depressed. The most notable move has seen USDJPY reverse from intra-day highs of 135.56 to trade as low as 134.50 approaching the APAC crossover.

- USDJPY only sits down 0.25% on the session, however, the yen bounce comes just hours before new Bank of Japan Governor nominee will make remarks in front of the Lower House’s steering committee. The hearing on the governor nomination will start at 0930 JST (0030 GMT).

- Markets will be very attentive to his remarks, however, his views look likely to be a continuation of current easy policy for at least the short-term, having previously pushed back against the idea of swift policy tightening.

- Vol band resistance in USDJPY is layered between 136.14 and 136.48 ahead of Fib retracements at 136.67. Firm support to watch remains much lower at 128.09, the Feb 2 low. The bear trigger is at 127.23, the Jan 16 low - a break would resume the downtrend.

- GBPUSD briefly slipped below the pre-services PMI level of 1.2016 and narrowed the gap with the week’s lows at 1.1987, however the late bounce for equities provided firm support for a bounce towards 1.2020 approaching the close.

- EURUSD has held a tight range either side of the 1.0600 mark and will look for direction on Friday amid multiple US data points, most notably US Core PCE price index. Personal spending, new home sales and revised UMich sentiment figures will also all cross ahead of the weekend.

FX Expiries for Feb24 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0535-50(E1.9bln), $1.0560(E548mln), $1.0600(E627mln), $1.0680-00(E2.7bln)

- USD/JPY: Y134.00($678mln), Y134.50($1.5bln)

- GBP/USD: $1.1950-52(Gbp510mln), $1.2200-10(Gbp644mln)

- AUD/USD: $0.6750(A$1.4bln), $0.6790-00(A$822mln)

- USD/CAD: C$1.3485-00($1.1bln)

- USD/CNY: Cny6.7000($1.6bln), Cny6.7180($1.4bln)

Late Equity Roundup: Risk Appetite Up as Real Yld Declines

Stocks regaining ground after SPX eminis fell to lowest level since Jan 25 this morning (3976.0), risk appetite improving as real yield recede (10Y -4.5bp to 1.46% - pre FOMC minutes levels). Otherwise, chip makers strong, boosting IT sector. SPX eminis currently trading +15.75 (0.39%) at 4014.5; DJIA +58.9 (0.18%) at 33103.7; Nasdaq +72.6 (0.6%) at 11579.54.

- SPX leading/lagging sectors: Information Technology took the lead in late trade (+1.53%) lead by strong chip-maker performance (NVDA +14.5%, AMD +4.05%, MU +2.65%), Energy sector a close second (+1.5%) lead by equipment and servicer shares (BKR +2.10%, HAL +1.9%, SLB +1.75%).

- Laggers: Utilities (-0.60%), Communication Services (-0.57%) weighed by tele-comm shares and Consumer Staples (-0.34%) weighed by food retailers (WMT -1.52%, KR -1.46%).

- Dow Industrials Leaders/Laggers: Boeing (BA) +3.04 at 208.80, Microsoft (MSFT) +2.34 at 253.82, Chevron (CVX) +2.11 at 162.46. Laggers: McDonalds (MCD) -2.18 at 266.46, Walmart (WMT) -2.08 142.16, Travelers (TRV) -1.20 at 184.92.

- Equity earnings continue after the close: Autodesk (ADSK, $1.81 est), EOG Resources (EOG, $3.39 est), Booking Holdings (BKNG $21.51 est), Carvana (CVNA -$2.18), Intuit (INTU, $1.44),

US STOCKS (ESH3): Hits February Pullback Low

- RES 4: 4361.00 High Aug 16

- RES 3: 4300.00 Round number resistance

- RES 2: 4250.00 High Aug 26, 2022

- RES 1: 4208.50 High Feb 2 and the bull trigger

- PRICE: 4015.50 @ 1455ET Feb 23

- SUP 1: 3975.25 Low Feb 23

- SUP 2: 3962.47 3.0% 10-dma envelope

- SUP 3: 3901.75 Low Jan 19

- SUP 4: 3788.50 Low Dec 22 and a key support

COMMODITIES: Crude Holds Onto Eventual Bounce Despite US Inventory Build

- Crude oil ends a six-day losing streak, holding onto the prior move after latest EIA data showed a larger than expected crude build and another drop in refinery utilisation in the US. Gasoline cracks rallied with a pick up in demand but diesel remained lower.

- At least 23mbbls of Russian crude and additional volumes of refined fuels have been transferred from one tanker to another in the coast of Greece since the start of the year according to tanker tracking by Bloomberg, one of a series of workarounds that traders have used to overcome EU sanctions.

- WTI is +2.0% at $75.43, which after the recent rout is still a little way off next resistance at $80.62 (Feb 13 high). Renewed downside would see support at $73.80 (Feb 23 low).

- Downside protection leads options activity in the CLJ3 today, with most active strikes at $70/bbl puts.

- Brent is +2.0% at $82.21, also some way off next resistance at $86.95 (Feb 14 high). Renewed downside would see support at $80.40 (Feb 23 low).

- Gold is -0.1% at $1823.65, off a low of $1817.58 that fleetingly cleared $1819.0 (Feb 17 low), a stronger clearance of which could open $1805.3 (2.0% 10-dma envelope).

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 24/02/2023 | 0001/0001 | ** |  | UK | Gfk Monthly Consumer Confidence |

| 24/02/2023 | 0700/0800 | *** |  | DE | GDP (f) |

| 24/02/2023 | 0700/0800 | * |  | DE | GFK Consumer Climate |

| 24/02/2023 | 0745/0845 | ** |  | FR | Consumer Sentiment |

| 24/02/2023 | 0800/0900 | ** |  | SE | Economic Tendency Indicator |

| 24/02/2023 | 0800/0900 | ** |  | ES | PPI |

| 24/02/2023 | - |  | EU | ECB Lagarde & Panetta at G20 Finance Minister Meet | |

| 24/02/2023 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 24/02/2023 | 1330/0830 | ** |  | US | Personal Income and Consumption |

| 24/02/2023 | 1500/1000 | *** |  | US | New Home Sales |

| 24/02/2023 | 1500/1000 | *** |  | US | Final Michigan Sentiment Index |

| 24/02/2023 | 1515/1015 |  | US | Fed Governor Philip Jefferson | |

| 24/02/2023 | 1515/1015 |  | US | Cleveland Fed's Loretta Mester | |

| 24/02/2023 | 1600/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) | |

| 24/02/2023 | 1630/1130 |  | US | St. Louis Fed's James Bullard | |

| 24/02/2023 | 1630/1630 |  | UK | BOE Tenreyro Panellist at NY Fed | |

| 24/02/2023 | 1830/1330 |  | US | Boston Fed's Susan Collins | |

| 24/02/2023 | 1830/1330 |  | US | Fed Governor Christopher Waller |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.