-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY37.3 Bln via OMO Wednesday

MNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

MNI ASIA MARKETS ANALYSIS: Soft Landing Odds Improved

HIGHLIGHTS

- MNI BRIEF: Fed Chair Powell Has Covid, Working From Home

- MNI: US: TURKEY: FM Cavusoglu To Discuss NATO And F-16s With Sec State Blinken

- MNI JAPAN: Kishida Approval Remains Underwater Amid Concern Over Defense Overhaul

- STL FED BULLARD: PROSPECTS FOR US ECONOMIC SOFT LANDING HAVE IMPROVED, Bbg

- BULLARD: NEED ABOVE-5% RATES TO CONTINUE TO PUSH INFLATION DOWN, Bbg

Key links: MNI: Fed’s Harker Repeats Call To Slow Hikes To 25BPS / MNI BRIEF: Fed's George To Step Down 'In A Few Days' / MNI BRIEF: George Says Fed Committed To 2% Inflation Mandate / US% Credit Supply Pipeline / US Treasury Auction Calendar

US TSYS: Yields Fall to Mid-Dec Levels

Tsy yields fell back to mid-December levels Wednesday (30YY 3.5185% low), futures back near first half highs after the bell.

- Initial support overnight, Tsys gap bid on BoJ policy annc: monetary policy settings steady, yield curve control unchanged.

- Tsys surged higher following weak Retail Sales (-1.0%, ex-motor -0.6%) and weaker PPI (-0.5%, ex food/energy +0.13%) - lowest since Nov'20.

- Short end well bid as markets price in policy pivot. Fed funds implied hike for Feb'23 -.7 to 27.2bp, Mar'23 cumulative 45.6bp (-1.8) to 4.788%, May'23 54.5bp (-2.8) to 4.876%, terminal at slips to 4.875% in Jun'23 from 4.905% earlier.

- From Philly Fed Harker: “Hikes of 25 basis points will be appropriate going forward,” he said in prepared remarks. “I expect that we will raise rates a few more times this year, though, to my mind, the days of us raising them 75 basis points at a time have surely passed.”

- Tsy futures bid accelerates after strong $12B 20Y bond auction re-open (912810TM0) trades through: 3.678% high yield vs. 3.702% WI; 2.83x bid-to-cover vs. prior month's 2.68x.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00614 to 4.31043% (-0.000328/wk)

- 1M +0.01571 to 4.48571% (+0.03128/wk)

- 3M +0.01014 to 4.80771% (+0.01528/wk)*/**

- 6M -0.01271 to 5.10800% (+0.00686/wk)

- 12M -0.03086 to 5.36414% (+0.00714/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.82971% on 1/12/23

- Daily Effective Fed Funds Rate: 4.33% volume: $94B

- Daily Overnight Bank Funding Rate: 4.32% volume: $276B

- Secured Overnight Financing Rate (SOFR): 4.31%, $1.248T

- Broad General Collateral Rate (BGCR): 4.28%, $449B

- Tri-Party General Collateral Rate (TGCR): 4.28%, $429B

- (rate, volume levels reflect prior session)

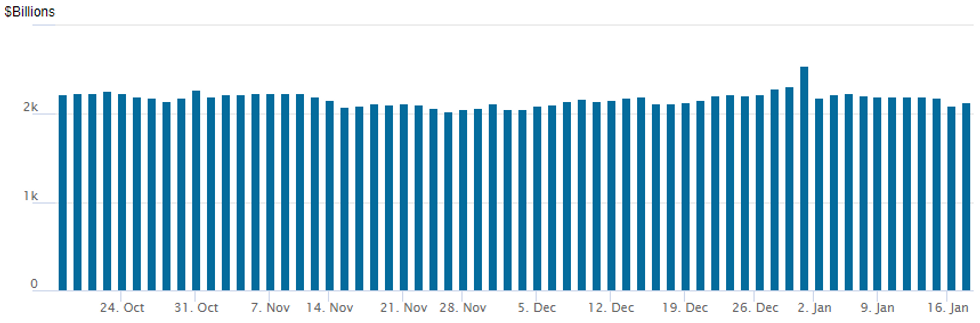

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage rebounds to $2,131.678B w/ 103 counterparties vs. prior session's $2.093.328B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Chasing Direction, early session wing trade turned bearish briefly as underlying futures scaled off first half highs.- SOFR Options:

- Block, 2,500 SFRG3 95.12/95.18/95.25 call flys, 2.0 ref 95.17

- Block, 10,000 SFRU3 96.25/96.75 call spds, 2.5 ref 95.335

- Block, 7,500 SFRU3 94.75/95.00 put spds, 0.5 over OQU3 95.62 puts

- 4,000 SFRK3 94.62/94.87/95.38/95.62 call condors ref 95.135

- Block, 2,500 OQH3 95.00/95.62 put spds vs. SFRK3 94.75/95.00 put spds, 1.0 net, May over

- 2,600 SFRG3 95.06/95.18 put spds, 3.75 ref 95.16

- 5,000 2EG3 97.12/97.37 call spds, ref 96.92 -.915

- 9,700 SFRZ3 93.00/94.00 put spds ref 95.665-.675

- Eurodollar Options:

- 14,000 EDM3 94.75 puts, 6.5 ref 94.895

- Treasury Options:

- 5,000 USM3 129/130 put spds, 21 ref 113-11

- 5,000 TYH3/TYG3 118 1x2 call calendar spd, 11 ref 115-23.5

- -1,250 TYG 116 calls, 22, total volume over 23k

- +5,000 USJ 129/130 put spds, 21 ref 132-29

- -5,000 FVG3 110.5 calls, 12.5 ref 110-04, total volume over 14.5k

- Block, 7,500 TYG3 114.75/115 call spds, 11 ref 115-23.5, more on screen

- Block, 15,000 FVG3 109.5/110 call spds, 21 ref 110-06

- 5,000 TYG3 114 puts, 7 ref 115-10, total volume over 28k

- Update, over +30,000 TYG 116.5 calls, 7-11

- over 40,000 TYG3 112/113 put spds, 2 ref 115-06

- 5,000 weekly midcurve 10Y 114/114.5 put spds

- 4,000 wk3 10Y 112.75/113.75 put spds, 0.0

- 3,600 FVH3 108.25 calls, 142 ref 109-20.75

EGBs-GILTS CASH CLOSE: Weak US Data And BoJ Decision Boost Long End

The UK and German curves twist flattened Wednesday after the Bank of Japan decision maintained downside pressure on long-end yields with their decision to maintain their 10Y JGB yield-capping regime.

- The short end of European curves weakened early as UK CPI came in above expectations, and ECB speakers Villeroy and Rehn pushed back against Tuesday's Bloomberg story that pointed to a downshift in rate hikes after Feb.

- But global yields headed lower in the European afternoon as a slew of weak US data spurred recession speculation and pushed Fed terminal rate pricing down.

- Periphery spreads tightened against this backdrop, with 10Y BTP/Bund spreads touching a fresh post-April 2022 low of 170bp.

- Attention turns to an appearance by ECB's Lagarde and the Norges Bank decision early Thursday.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 0.6bps at 2.463%, 5-Yr is down 4.7bps at 2.061%, 10-Yr is down 6.8bps at 2.023%, and 30-Yr is down 10.2bps at 1.989%.

- UK: The 2-Yr yield is up 3.3bps at 3.495%, 5-Yr is down 1.3bps at 3.263%, 10-Yr is down 1bps at 3.314%, and 30-Yr is up 0.6bps at 3.673%.

- Italian BTP spread down 6.3bps at 173.8bps / Spanish down 3.7bps at 94bps

EGB Options: Flurry Of Euribor Trades Post BoJ

Wednesday's European rates / bond options flow included:

- OEH3 27k at 118.29, 2x 13.5k, (may be mis-cross for one 13.5k). Related to:OEH3 116.75/119.25 RR, bought the put for -5 in 25k vs 13.5k at 118.29

- OEG3 118.50/118.75cs, bought for 13.5 in 7k

- RXH3 136/134ps, bought for 22 and 23 in 3k

- ERJ3 96.75/97.00cs, bought for 7 in 12k

- ERM3 97.00/97.25 call spread bought for 3.5 in 15.5k

- ERM3 96.12/96.37/97.00/97.25c condor, bought up to 19 in 5k

- ERM3 96.75/96.50/96.37p ladder vs 97.00c, bought the ladder for -0.5 in 6k

- Buys ERM3 96.00 put, Sells 0RM3 95.75 put, net paid 0.25 in 37k

FOREX: AUD & CAD Bearing The Brunt of Late Equity Weakness, JPY Spin Cycle

- Wednesday has been highlighted by the impressive 400 pip intra-day range for USDJPY. Following the Bank of Japan standing pat, hawkish pre-positioning was aggressively unwound to reach highs of 131.58 before the start of European trade. However, with topside momentum unable to be sustained, the pair saw a swift and powerful reversal throughout the session, culminating in the pair printing fresh daily lows of 127.57.

- The US session was a real tale of two halves. With the early JPY action heavily weighing on the broad USD index, the ensuing substantial weakness across major equity indices underpinned the greenback recovery.

- AUD was one of the notable laggards, sinking around 1.7% from intra-day highs, with both AUD and CAD leading G10 losses approaching the APAC crossover. AUDUSD overall maintains a bullish technical theme and supports to watch reside at 0.6930/6860 (lows Jan 17 / 9) and 0.6854, the 20-day EMA.

- In the same vein, the weaker risk sentiment prompted declines across emerging market FX, with specific weakness in the LatAm region. In particular USDMXN failed just shy of the 2020 lows around 18.52 and has since bounced over 1% to 18.85. Initial firm resistance is at 19.0401, the recent breakout point.

- Aussie employment data kicks off Thursday’s docket, before US Philly Fed, Jobless Claims and Housing Starts highlight the US calendar.

- On the speaker slate, ECB President Lagarde is due to participate in a panel discussion titled "Finding Europe's New Growth" at the World Economic Forum, in Davos before potential comments from Fed’s Collins, Brainard and Williams in the US session.

FX: Expiries for Jan19 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0550(E548mln), $1.0635-55(E1.7bln), $1.0800-20(E1.3bln), $1.0980(E519mln)

- USD/JPY: Y127.95-14($3.0bln), Y128.50($1.4bln), Y130.00($1.3bln), Y131.00-10($1.1bln), Y132.00($2.6bln)

- EUR/JPY: Y140.00(E1.6bln)

- GBP/USD: $1.2100-20(Gbp741mln)

- USD/CNY: Cny6.5900($1.3bln), Cny6.7000($1.5bln), Cny6.7500($931mln)

Late Equity Roundup: Consumer Staples, Utilities, Financials Lagging

Major indexes weaker, near session lows w/ Consumer Staples, Utilities and Financials sectors underperforming. Stocks reversed early gains after PNC and Charles Schwab each missed earning est this morning, weighing on financials. SPX eminis currently trades -44.75 (-1.12%) at 3964.75; DJIA -444.37 (-1.31%) at 33466.41; Nasdaq -84.9 (-0.8%) at 11010.67.

- SPX leading/lagging sectors: Consumer Staples (-2.37%) lead by weaker food, beverage and tobacco shares (KHC -5.94%, CAG -4.07%, MKC -3.91%); Utilities (-2.21%) and Financials (-1.61%) follow, PNC Financial -5.59% in late trade.

- Leaders: Communication Services (-0.61%) lead by Match Grp (MTCH) +0.66% and Google (+0.10%). Next up: Information Technology (-0.84%) and Consumer Discretionary (-0.90%), internet and direct marketing names supporting latter.

- Dow Industrials Leaders/Laggers: After heavy sell-off Tuesday - Goldman Sachs bounces +1.74 to 351.66, Apple (APPL) -0.14 at 135.80, Travelers (TRV) -0.28 at 184.72. Laggers: McDonalds (MCD) -7.49 at 266.57, Honeywell (HON) -6.86 at 205.38, United Health (UNH) -5.78 at 479.30.

E-MINI S&P (H3): Trend Needle Points North

- RES 4: 4194.25 High Sep 13

- RES 3: 4180.00 High Dec 13 and the bull trigger

- RES 2: 4090.75 High Dec 14

- RES 1: 4043.00 High Dec 15

- PRICE: 3965.00 @ 1415ET Jan 18

- SUP 1: 3891.50 Low Jan 10

- SUP 2: 3788.50/78.45 Low Dec 22 / 61.8% of Oct 13-Dec 13 uptrend

- SUP 3: 3735.00 Low Nov 3

- SUP 4: 3670.00 76.4% retracement of the Oct 13 - Dec 13 uptrend

S&P E-Minis are trading at their recent highs and conditions remain bullish. The contract has cleared resistance at the 50-day EMA and this has strengthened the short-term bullish condition. Price has also traded above the 4000.00 handle to open 4043.00 next, the Dec 15 high. Key support and the bear trigger has been defined at 3788.50, the Dec 22 low. A reversal lower and a break of this support would resume bearish activity.

COMMODITIES: Mid-Session About Turn As Equities Sour

- Crude oil prices have seen a sharp reversal of earlier further gains on China re-opening stoking demand expectations, sliding as equities fell belatedly after weaker US data in contrast to the relief rallies of recent weeks from lower Fed hiking expectations.

- WTI is -1.1% at $79.30 off a high of $82.38 that had cleared the bull trigger at $81.5 (Jan 3 high) and next opened sights on key resistance at $83.27 (Dec 1 high). It ends an eight session streak.

- Brent is -1.3% at $84.80 off a high of $87.85 that had cleared the bull trigger at $87.00 (Jan 3 high) and opened $89.18 (Dec 1 high).

- Gold also reverses earlier gains with a bout of USD strength later in the session, sitting -0.2% at $1904.48 off a high of $1925.90. It doesn’t trouble support at $1874.4 (Jan 12 low) whilst resistance is intact at $1934.4 (Apr 25, 2022 high).

- Separately for natural gas, the latest EIA STEO forecasts Henry Hub prices will average 4.9$/mmbu in 2023, more than 1.5$/mmbtu lower than in 2022. Meanwhile in Europe, cold weather pushed front TTF prices up 2.7% on the day.

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 19/01/2023 | 0030/1130 | *** |  | AU | Labor force survey |

| 19/01/2023 | 0900/1000 | *** |  | NO | Norges Bank Rate Decision |

| 19/01/2023 | 1000/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 19/01/2023 | 1000/1100 | ** |  | EU | EZ Current Account |

| 19/01/2023 | 1030/1130 |  | EU | ECB Lagarde Panellist at World Economic Forum | |

| 19/01/2023 | 1100/0600 | * |  | TR | Turkey Benchmark Rate |

| 19/01/2023 | 1330/0830 | ** |  | US | Jobless Claims |

| 19/01/2023 | 1330/0830 | *** |  | US | Housing Starts |

| 19/01/2023 | 1330/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 19/01/2023 | 1400/0900 |  | US | Boston Fed's Susan Collins | |

| 19/01/2023 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 19/01/2023 | 1600/1100 | ** |  | US | DOE weekly crude oil stocks |

| 19/01/2023 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 19/01/2023 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 19/01/2023 | 1700/1800 |  | EU | ECB Schnabel in Finanzwende Webinar | |

| 19/01/2023 | 1800/1300 | ** |  | US | US Treasury Auction Result for TIPS 10 Year Note |

| 19/01/2023 | 1800/1300 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 19/01/2023 | 1815/1315 |  | US | Fed Vice Chair Lael Brainard | |

| 19/01/2023 | 2335/1835 |  | US | New York Fed's John Williams | |

| 20/01/2023 | 2350/0850 | *** |  | JP | CPI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.