-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Stocks Hit New Cycle Highs

- MNI ECB'S KNOT: OPTIMISTIC TO SEE INFLATION HITTING 2% IN 2024

- KBW REGIONAL BANKING INDEX RISES 3.3% TO HIGHEST SINCE MARCH 27 - bbg

- BOJ GOV UEDA: STILL SOME DISTANCE TO SUSTAINABLY ACHIEVE 2% INFLATION TARGET, Bbg

Key Links:MNI UK Inflation Preview: June 2023: Services inflation key / MNI POLICY: Fed Worried Shorter Lags Require More Tightening / US Treasury Auction Calendar

US TSYS: Markets Roundup: Curves Bend Flatter Late, Hike Projections Firm

- Rates trade mixed after the bell, well off early session highs after June Retail Sales comes out weaker than expected at +0.2% vs. +0.5% est (May up-revised to +0.5%, however, from 0.3%). Tsys gained slightly after Industrial Production comes out lower than expected (-0.5% vs. 0.0% est) May IP down-revised to -0.5% vs. -0.2%.

- Futures receded, curves bending flatter as support gradually waned (partially tied to larger than expected $8.5B Wells Fargo 2-part issuance, additional rate locks weighing on 5s-10s through the second half, 2s10s -2.877 at -96.865. Sep'23 10Y futures at 112-22 (-1) holding above initial technical support of 112-07.5 (Jul 13 low).

- Projected rate hike expectations through year end gained: July 26 FOMC is 93.6% w/ implied rate of +23.4bp to 5.313%. September cumulative of +27.4bp at 5.352%, November cumulative of 32.6bp at 5.404%, and December cumulative of 27bp at 5.348%. Fed terminal holding at 5.41% in Nov'23.

- Focus turns to release of Building Permits and Housing Starts data tomorrow, US Tsy $12B 20Y Sale re-open.

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00846 to 5.25457 (+.02463/wk)

- 3M +0.00602 to 5.32614 (+.01625/wk)

- 6M +0.00409 to 5.40044 (+.02490/wk)

- 12M +0.00757 to 5.3009 (+.04648/wk)

- Daily Effective Fed Funds Rate: 5.08% volume: $112B

- Daily Overnight Bank Funding Rate: 5.07% volume: $265B

- Secured Overnight Financing Rate (SOFR): 5.06%, $1.524T

- Broad General Collateral Rate (BGCR): 5.03%, $591B

- Tri-Party General Collateral Rate (TGCR): 5.03%, $583B

- (rate, volume levels reflect prior session)

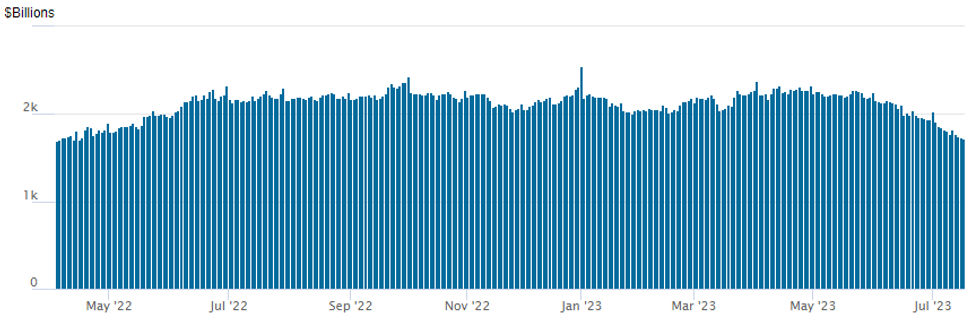

FED Reverse Repo Operation

NY Federal Reserve/MNI

The latest operation falls to $1,716.862B (lowest since early April May'22), w/ 94 counterparties, compared to $1,728.322B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

SOFR/TREASURY OPTIONS SUMMARY

FI options segued from better Treasury option trade overnight mostly 5- and 10Y calls, to downside puts through the session as underlying futures pared morning gains. Short end rates weaker as as rate hike projections through year end firmed slightly, July running around 94% while September through December fully priced in at a 25bp hike.

- SOFR Options:

- +8,000 SFRZ3 93.87/94.00/94.12/94.25 put condors, 1.25

- +20,000 SFRZ3 94.12/94.18 put spds, 0.75

- -1,000 SFRU3 94.62 straddles, 13.5

- Block, 5,000 SFRU3 94.50/95.00/95.50 put flys, 11.0 vs. 94.62

- Block, 4,000 SFRH4 96.75/97.50/98.25 call flys, 2.0 ref 95.065

- 1,500 SFRV3 94.68 puts ref 94.71

- 1,000 SFRQ3 94.75/95.00 call spds

- Treasury Options:

- 3,650 TYU3 111.5/114.5 strangles, 55 ref 112-28.5

- 3,000 FVU3 105.5/106.5 put spds, 9 ref 107-27.75

- 5,000 FVU3 108.25 calls, 32.5 ref 107-28

- 5,000 TYQ3 111.5/112 put spds, 3 ref 112-31

- 2,000 TYQ3 110.75/111.25/111.75/112.25 put condors, ref 113-00

- 2,000 TYQ3 113.75/114 call spds ref 113-01.5

- 5,200 TYQ3 114 calls, 3 ref 113-01

- 2,200 TYQ3 113.25 calls, 9 ref 112-28.5

- 2,500 FVU3 109.5/110/111/111.5 call condors ref 107-25.25

- 1,000 TYQ3 113.5/114.5 call spds ref 113-24

EGBs-GILTS CASH CLOSE: German Bull Steepening On A Dovish Knot

Dovish comments from the ECB's Klaas Knot triggered a global bond rally Tuesday, ahead of next week's Governing Council decision and tomorrow's key UK CPI reading.

- Uncharacteristically dovish comments by Knot pared expectations for a hike beyond July's near-certain 25bp ("for July I think it is a necessity, for anything beyond July it would at most be a possibility but by no means a certainty").

- ECB pricing pulled back 5bp, driving bull steepening in the German curve (Schatz rallied the most since early May, with yields down 13bp).

- Periphery spreads tightened, with BTPs outperforming and 10Y hitting the tightest levels to Bund since late June.

- Gilts lagged the EGB rally, but still strengthened in a bull flattening move as BoE terminal pricing pulled back 9bp to the lowest since Jun 21.

- That price action suggested little apparent concern over yet another hawkish surprise in the UK inflation print Wednesday (0700BST) which is easily the data highlight of the week - our preview is here.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 13.1bps at 3.058%, 5-Yr is down 9.6bps at 2.483%, 10-Yr is down 9.1bps at 2.389%, and 30-Yr is down 8.1bps at 2.425%.

- UK: The 2-Yr yield is down 7.7bps at 5.091%, 5-Yr is down 8.6bps at 4.47%, 10-Yr is down 10bps at 4.331%, and 30-Yr is down 7.9bps at 4.477%.

- Italian BTP spread down 4.9bps at 162.5bps / Spanish down 2.9bps at 100.2bps

EGB Options: Euribor Flies Dominate Proceedings Tuesday

Tuesday's Europe rates / bond options flow included:

- ERM4 97.00/98.00/99.00 call fly paper bought for 7.25 in 6K (also bought yest for 7 in 4k)

- ERU3 96.125/96.25/96.50 broken call fly bought for 2.25 in 4k

- ERU3 96.00/96.12 2x1 put spds, 3.75 bought in 5k

- ERU3 96.125/96.25/96.375 call fly bought for 2.5 in 4k

- ERV3 96.12/96.25/96.37 call flys bought for 1.75 in 5k

- ERV3 96.00/95.875/95.75 put fly v ERU3 95.75 put. Sells the put fly at 1 in3.5k

- ERX3 96.25/96.375/96.50 call fly bought for 1 in 4.5k

- ERZ3 96.00/95.75/95.625 put ladder sold down to 3 in 9.5k

- 2RQ3 97.25/97.375/97.50/97.625 call condor bought for 2.5 in 5k

- SFIQ3 93.80/93.90/94.00 call fly bought for 1.25 in 2k

FOREX: BOJ’s Ueda Underpins USDJPY Recovery, NZD Underperforms

- Despite some intra-day volatility, overall adjustments across G10 currency markets remained limited on Tuesday with the USD index around a tenth of a percent higher as we approach the end of the session.

- The modest USD strength on Tuesday comes in the face off higher major equity benchmarks as the greenback looks to take a breather from its recent weakening trend. Perhaps the most notable intra-day move was for USDJPY, both following the US retail sales data release and after BOJ headlines hit the wires.

- The weaker headline US retail sales prompted a quick selloff to lows of 137.70, however as details of the release (including a much firmer control group) transpired, USDJPY bounced sharply to trade as high as 138.60 shortly afterwards. The pair then gradually softened back below the 138.00 mark before BOJ headlines hit the wires and prompted another bout of significant JPY selling.

- BOJ’s Ueda stated that there was still some distance to sustainably and stably achieving the central bank's 2% inflation target, signalling his resolve to maintain ultra-loose monetary policy for the time being. USDJPY traded as high 139.14 on the back of the move, before declining around 30 pips ahead of the close.

- NZD remains the poorest performer across G10, despite the buoyant equity markets. This has helped keep NZD/SEK under pressure and extend its recent losing streak. The cross has fallen in 8 of the past 9 sessions, now sitting at the lowest levels since mid-May.

- UK inflation data takes focus on Wednesday where the majority of analyst previews seen by MNI look for headline CPI to fall from 8.7%Y/y to 8.1%Y/y. Elsewhere, final Eurozone CPI will also be released, as well as US housing starts for June.

FX Expiries for Jul19 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1250-70(E1.5bln)

- USD/JPY: Y138.00($646mln)

- USD/CAD: C$1.3350($622mln)

- USD/CNY: Cny7.2000($1.5bln)

Late Equity Roundup: Cycle Highs Extended

- Stocks drifting near the late session highs, S&P E-minis Sep'23 futures contract rallying to a new cycle high last seen April 2022. Currently, S&P E-Mini Future are up 37.25 points (0.82%) at 4591.75, DJIA up 372.31 points (1.08%) at 34957.19, Nasdaq up 142.8 points (1%) at 14388.02.

- The break above resistance at 4498.00 (Jun 30 high) confirms a resumption of the uptrend and maintains a bullish price sequence of higher highs and higher lows. The contract now eyes 4631.00, the high from March 29th 2022, as the next medium-term upside level.

- Leading gainers: Information Technology, Energy and Financial shares continue to outperform. Software and services shares underpin IT, outpacing chip stocks which drew some profit taking (Nvidia, however, continues to gain, +2.85% on the day to 477.15 -- up a whopping 230% TYD). At the moment, Microsoft leads software stocks, up +5.6% after MSFT announced pricing of corporate AI software tools.

- A rebound in crude prices (WTI +1.5 at 75.65) underpinned refiner/distributor stocks: APA +4.45%, Marathon +3.6%, Devon Energy +3.25%.

- Banks buoy Financials, outpacing insurance and financial services shares: Bank of America (+4.25%) after beating Q2 earnings ests (0.88 eps vs. 0.84 est). Others also beat ests: Bank of NY Mellon (+4.27%), CSFB (+12.98%) and MS (+6.53%).

- Laggers: Utilities and Real Estate sectors underperform for the second consecutive session.

- Look ahead: Wednesday earnings include Citizens Financial, M&T Bank, Northern Trust, US Bancorp, Goldman Sachs, Discover Financial, Fifth Third Bancorp, KeyCorp, Truist Financial, Capital One, Comerica, Huntington Bancshares and American Express.

E-MINI S&P TECHS: (U3) Capped by Envelope Resistance

- A bull theme in S&P E-minis made itself felt Tuesday, with the U3 contract rallying to a new cycle high. This week’s rally accelerated on a break of resistance at 4498.00, the Jun 30 high, with envelope resistance managing to slow the rally above. The break confirms a resumption of the uptrend and maintains a bullish price sequence of higher highs and higher lows. The contract now eyes 4631.00, the high from March 29th 2022, as the next medium-term upside level. First support lies at 4439.81, the 20-day EMA. Clearance of this level would highlight a S/T bearish threat.

COMMODITIES: Oil Bounces With Supply Constraints and Gold Opens Key Resistance

- Front oil futures have seen solid gains today amid signs of Russian compliance with its pledged output curbs, an anticipated decline is US shale oil production in August and stocks advancing ever since the US open after some earlier positive bank earnings.

- Specifically, Russia’s pledge to cut crude output and exports is starting to show with seaborne crude shipments in the four-week period to 16 July fell to a six-month low. US shale oil production is projected to see in August its first monthly decline since Dec’22 according to EIA data.

- WTI is +2.3% at $75.83 but still off resistance at $78.03 (Fibo retracement of Apr 12 – May 4 bear leg).

- Brent is +1.6% at $79.71 but also still off resistance at $82.06 (Fibo retracement of Apr 12 – May 4 downleg).

- Gold is +1.1% at $1976.58 showing surprisingly large gains considering an intraday climb in the USD index and yields relatively little changed on the day. Some technical factors could have been at play, clearing resistance at $1968.0 (Jun 16 high) to open key resistance at $1985.3 (May 24 high).

WEDNESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 19/07/2023 | 0600/0700 | *** |  | UK | Consumer inflation report |

| 19/07/2023 | 0600/0700 | *** |  | UK | Producer Prices |

| 19/07/2023 | 0830/0930 | * |  | UK | ONS House Price Index |

| 19/07/2023 | 0900/1100 | *** |  | EU | HICP (f) |

| 19/07/2023 | 0900/1100 | ** |  | EU | Construction Production |

| 19/07/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 19/07/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 19/07/2023 | 1230/0830 | *** |  | US | Housing Starts |

| 19/07/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 19/07/2023 | 1600/1700 |  | UK | BoE Ramsden speech on QT - Money Macro and Finance Society | |

| 19/07/2023 | 1700/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.