-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Taking Policy Hawks Seriously

HIGHLIGHTS

Key links: MNI INTERVIEW: Fed Can Tame Inflation Without Slump-Andolfatto / MNI BRIEF: Americans’ Pay Floor Rises To Record-NY Fed / MNI ECB Review - December 2022: A Hawkish 50bp

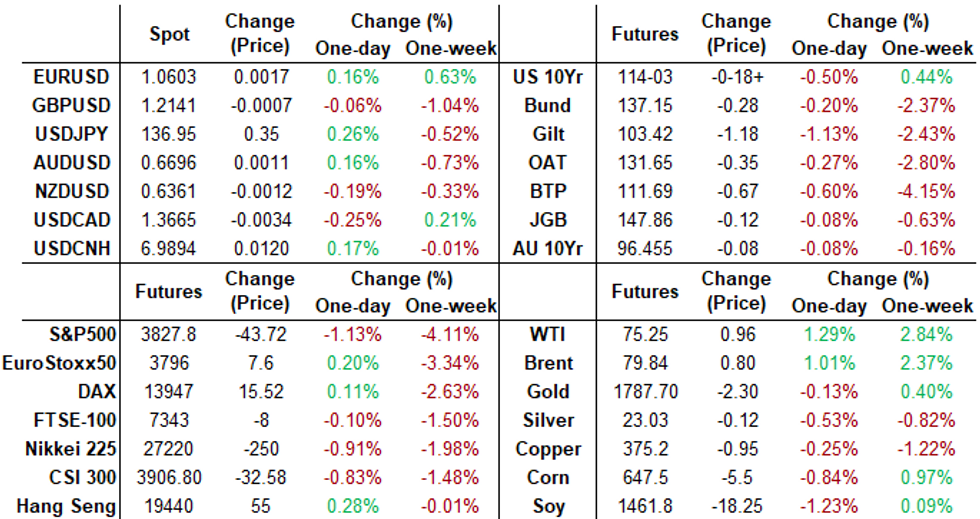

US TSYS: Tsys Reverse Friday's Optimism

Tsy futures broadly weaker after the close but off midday lows when 30YY tapped 3.6553% high. Light holiday volumes w/ TYH just over 700k after the close. Yield curves steeper (2s10s +2.604 at-67.630 vs. -64.130 high) but off early session highs amid orderly selling across the board.

- No real catalyst to the move, Tsys initially followed Bunds and Gilts lower early in the first half. Underlying weakness most likely unwinds of last Fri's rally despite the hawkish Fed speak from SF Fed Daly and Cleveland Fed Mester.

- Large 10Y Block sale (-10,120 TYH3 at 114-00, was well through the session low of 114-02.5 at the time (1105:00ET).

- No scheduled Fed speakers today, no react to slightly better than expexted NAHB Housing Market Index (36 vs. 34 est).

- Data picks up Tuesday w/ Building Permits (1.512M rev, 1.499M); MoM (-3.3% rev, -0.9%) and Housing Starts (1.425M, 1.404M); MoM (-4.2%, -1.5%) at 0830ET.

- Christmas holiday hours update:

- Trading floor closes at 1300ET while Globex close runs to 1600ET. Monday, Dec 26 is a full close w/ Globex reopening 1700ET

- Link to CME for reference

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00329 to 4.32029% (+0.49900 total last wk)

- 1M +0.00100 to 4.35386% (+0.08257 total last wk)

- 3M -0.00757 to 4.73829% (+0.01372 total last wk)*/**

- 6M -0.03700 to 5.14986% (+0.04715 total last wk)

- 12M -0.05115 to 5.42771% (-0.02057 total last wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.77857% on 11/30/22

- Daily Effective Fed Funds Rate: 4.33% volume: $99B

- Daily Overnight Bank Funding Rate: 4.32% volume: $267B

- Secured Overnight Financing Rate (SOFR): 4.32%, $1.091T

- Broad General Collateral Rate (BGCR): 4.28%, $414B

- Tri-Party General Collateral Rate (TGCR): 4.28%, $391B

- (rate, volume levels reflect prior session)

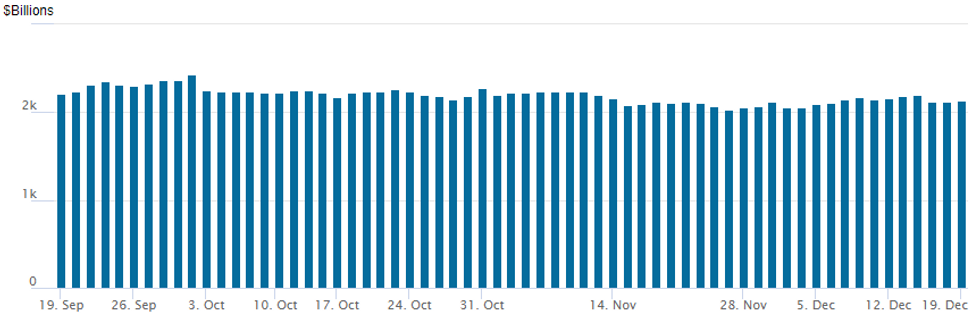

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,134.765B w/ 95 counterparties vs. $2,126.540B in the prior session. Prior record high stands at $2,425.910B on Friday, September 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Option accts continued to trade low delta puts Monday, carry-over from last week, hedging further weakness in underlying futures: Highlight trade:- SOFR Options:

- +2,000 0QH3 95.25/95.50/95.62/95.87 put condors, 4.0 ref 95.11

- Block, 10,000 SFRH3 94.81/95.12/95.50 put flys, 17.5 ref 95.175

- Block, 2,500 SFRZ3 94.25/95.00/95.50 broken put flys, 4.0 vs. 95.67/0.05%

- 4,000 SFRU 95.50 calls vs. EDU 95.25 calls

- Block, 3,000 SFRF 93.5/96.5 strangles, 0.5

- Block, 4,000 SFRH3 95.31 calls, 6.5 ref 95.185

- Block, 10,000 SFRU3 94.75/95.00/95.25, 3.0 ref 95.395, 3.5k more on screen

- Block, 2,750 SFRZ3 95.00/95.12/95.37 put flys 0.5 over SFRH3 95.37 calls

- Treasury Options:

- 1,500 USG 126 puts, 50 ref 129-15

- 5,000 TYF 113.5 puts, 8 ref 114-07 total volume >12k from 7-8

- 4,600 wk1 TY 113.25/114.25 2x1 put spds

- 3,000 TYG 113/114 put spds, 25 ref 114-06

- 4,700 wk5 TY 113/113.75 put spds, 5 ref 114-06.5

- 2,000 TYF3 112.5/113 put spds, 2 ref 114-07.5

EGBs-GILTS CASH CLOSE: Gilts Lead Broad Decline

European core FI sold off Monday, led by Gilts, with periphery EGBs putting in a mixed performance.

- Gilt yields soared following late Friday's BoE bond sale announcement and reports of potential energy cap pledges for businesses through 2024 The curve bear flattened sharply.

- The German curve bear steepened. Stronger-than-expected German IFO data contributed to the weak tone, with ECB speakers including de Guindos repeating last week's meeting message that 50bp hikes would be ongoing.

- On the EU level, we got supply plans from for H1 2023 (E80bln) and agreement on a gas price cap of E180/MWh. We also got EFSF / ESM 2023 funding plans.

- BTPs underperformed, with spreads widening once again in tandem with higher ECB terminal rate expectations.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 1.5bps at 2.44%, 5-Yr is up 1.9bps at 2.239%, 10-Yr is up 5.1bps at 2.203%, and 30-Yr is up 7.6bps at 2.063%.

- UK: The 2-Yr yield is up 20bps at 3.687%, 5-Yr is up 18.3bps at 3.491%, 10-Yr is up 17.3bps at 3.502%, and 30-Yr is up 15.2bps at 3.824%.

- Italian BTP spread up 3.4bps at 217.9bps / Spanish down 0.9bps at 108.8bps

EGB Options: Plenty Of Early '23 Bund Downside

Monday's Europe rates / bond options flow included:

- RXG3 132/129.5 put spread 20 paid 2500

- RXG3 135/132 put spread 61 paid 4000

- RXG3 130/129 put spread bought for 5.5 in 12.5k

- ERU3 96.00/96.12/96.25/96.37 put condor bought for 1.5 in 5k

FOREX: US Yields the Key Driver, as Stocks Extend Post-Fed Weakness

- The greenback pulled lower to begin the pre-holiday trading week, with the USD Index shedding 0.2% to the benefit of CAD, AUD and EUR. JPY was the poorest performer, however, prompting EUR/JPY to add well over 1% off the overnight Asia-Pac lows.

- The primary driver for markets Monday were Treasury yields playing catch-up, with the 10y yield adding 11bps to touch the best levels since last week's Fed decision.

- Yield gains worked against spot gold, which inched to session lows alongside the closing bell in London. Volumes across gold futures ticked higher on the move, but thin volumes and low liquidity were evident, with activity running at 40% below average.

- Stock markets extended their post-Fed decline, with the e-mini S&P pushing to a fresh December low of 3848.75. This makes for a clean break of the 50-dma at 3906.6, opening November's 3735.00 as the next major support.

- Focus Tuesday turns to RBA minutes and the Bank of Japan decision slated for release during the Asia-Pac trading day, while US housing starts and building permits make for the focus of the European/US trading day. ECB's Kazimir and Muller make up the speaker slate.

Expiries for Dec20 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0350-55(E725mln), $1.0549-50(E518mln), $1.0700-05(E557mln)

- USD/JPY: Y136.32($573mln)

- AUD/USD: $0.6640-60(A$1.4bln), $0.6725(A$649mln), $0.6900(A$679mln)

- NZD/USD: $0.6179-95(N$725mln)

- USD/CNY: Cny7.0000($580mln), Cny7.2000($991mln)

Late Equity Roundup

Major indexes continued to drift lower in the second half, at/near late session lows with Communication Services and IT sectors underperforming. SPX eminis currently trade -42.5 (-1.1%) at 3836; DJIA -272.3 (-0.83%) at 32647.08; Nasdaq -162.8 (-1.5%) at 10541.79.

- SPX leading/lagging sectors: Communication Services (-2.15%) weighed by media & entertainment shares: Warner Bros/Discovery -8.32%, Disney (-4.66%) followed by Information Technology (-1.72%) weighed by as software and servicers underperformed hardware/storage makers (ACN -3.71, FTNT -3.62, Adobe -3.10, MSFT -2.26%).

- Leaders: Energy sector outperformed (+0.51%) partially tied to firmer crude prices (WTI +0.96 at 75.25) w/ O&G refiners leading: Marathon (MPC) +0.71%, SLB +0.45% Valero (VLO) +0.1%,; Consumer Staples next up (-0.51%) lead by food/beverage and tobacco shares.

- Dow Industrials Leaders/Laggers: Boeing (BA) +1.75 at 186.48, Travelers Ins (TRV) +0.4 at 183.20, MMM +0.16 at 121.85.

- Laggers: Microsoft (MSFT) -5.49 at 239.20, Home Depot (HD) -6.99 at 316.35, Disney (DIS) -4.04 at 86.04.

E-MINI S&P (H3): Remains Vulnerable

- RES 4: 4361.00 High Aug 16 and a key M/T resistance

- RES 3: 4250.00 High Aug 26

- RES 2: 4194.25 High Sep 13 and a key resistance

- RES 1: 4043.00/4180.00 High Dec 15 / 13 and the bull trigger

- PRICE: 3880.00 @ 14:25 GMT Dec 19

- SUP 1: 3855.13 50.0% retracement of the Oct 13 - Dec 13 uptrend

- SUP 2: 3800.00 Round number support

- SUP 3: 3778.45 61.8% retracement of the Oct 13 - Dec 13 uptrend

- SUP 4: 3735.00 Low Nov 3 and a key support

The S&P E-Minis appears vulnerable following last week’s sharp move lower. Thursday’s sell-off reinforced a bearish threat and note that this also highlights the importance of a shooting star candle formation on Dec 13 - a reversal signal. A continuation lower would open 3855.13, a Fibonacci retracement. Key resistance is unchanged at 4180.00, the Dec 13 high, where a break is required to resume the recent uptrend.

Tuesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 20/12/2022 | 0115/0915 |  | CN | PBOC LPR announcement | |

| 20/12/2022 | 0700/0800 | ** |  | DE | PPI |

| 20/12/2022 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 20/12/2022 | 1000/1100 | ** |  | EU | EZ Current Account |

| 20/12/2022 | - | *** |  | JP | BOJ policy announcement |

| 20/12/2022 | 1330/0830 | ** |  | CA | Retail Trade |

| 20/12/2022 | 1330/0830 | *** |  | US | Housing Starts |

| 20/12/2022 | 1330/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 20/12/2022 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 20/12/2022 | 1500/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.