-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Eurozone Inflation Insight – November 2024

MNI ASI OPEN: Fed Bostic Still Confident of Waning Inflation

MNI ASIA MARKETS ANALYSIS: Tsy Curves Twist Flatter

MNI ASIA MARKETS ANALYSIS: Tsy 10Y Yield Back to Pre-CPI Level

HIGHLIGHTS

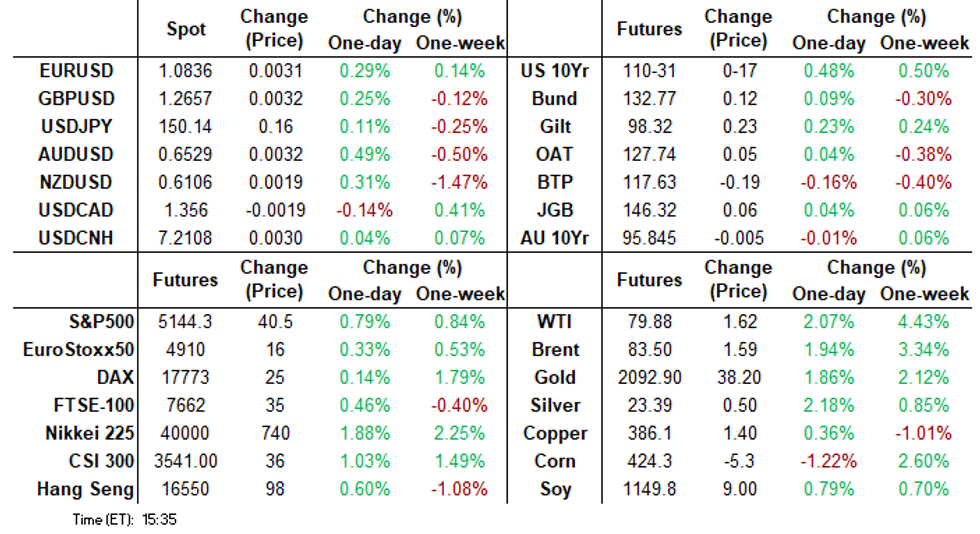

Treasury futures near late session highs as disinflationary data greenlights softer policy.

Treasury 10Y yield falls back to mid-February, pre-CPI levels at 4.1759% low.

Fed is "acutely aware" of challenges of high inflation, is "strongly committed" to its 2% target.

AI demand for chip stocks pushes S&P Eminis to new high of 5149.25.

US TSYS Yields Extend Late Session Lows - Back to Mid-Feb CPI Levels

- Balanced commentary from several Fed speakers and the preview of Chairman Powell's monetary policy report to Congress next week has done little to forestall the drop in Treasury yields today.

- Falling to 4.1759% this afternoon - 10Y yield is back to pre-CPI level on February 13 as markets take the latest round of data as supportive of softer policy as inflation metrics cool: lower than expected ISM Mfg (47.8 vs. 49.5 est), Prices Paid (52.5 vs. 53.2 est) and New Orders (49.2 vs. 52.7 est); as well as U. of Mich. Sentiment (76.9 vs. 79.6 est) while expectations are in line with estimates: 1 Yr Inflation (3.0% vs. 3.0% est) 5-10 Yr Inflation (2.9% vs. 2.9% est).

- Lead quarterly Jun'24 10Y futures currently at 111-00.5 (+18.5) vs. 111-02, breached initial technical resistance of 110-26+ (20-day EMA) with next level at 111-07 (50-day EMA). Curves steeper 2s10s +2.520 at -34.543, 10Y yield 4.1798 (-.0704).

- Short end support buoyed Mid-year projected rate cut pricing: March 2024 chance of 25bp rate cut currently -5.4% w/ cumulative of -1.4bp at 5.318%; May 2024 at -24.8% vs. -18.4% late Thursday w/ cumulative -7.6bp at 5.255%; June 2024 -67.9% from -56.4% late Thursday is nearing first full 25bp cut w/ cumulative cut -24.5bp at 5.086%. July'24 cumulative meanwhile has risen to -40.4bp at 4.927%.

- Look ahead: data resumes Tuesday with S&P Global US Services PMI, ISM Services, Factory and Durable Goods Orders.

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00018 to 5.32262 (-0.00151/wk)

- 3M -0.00240 to 5.33112 (+0.00055/wk)

- 6M -0.00762 to 5.26731 (-0.00620/wk)

- 12M -0.01531 to 5.05654 (-0.01589/wk)

- Secured Overnight Financing Rate (SOFR): 5.32% (+0.01), volume: $1.951T

- Broad General Collateral Rate (BGCR): 5.31% (+0.01), volume: $683B

- Tri-Party General Collateral Rate (TGCR): 5.31% (+0.01), volume: $675B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $96B

- Daily Overnight Bank Funding Rate: 5.32% (+0.01), volume: $252B

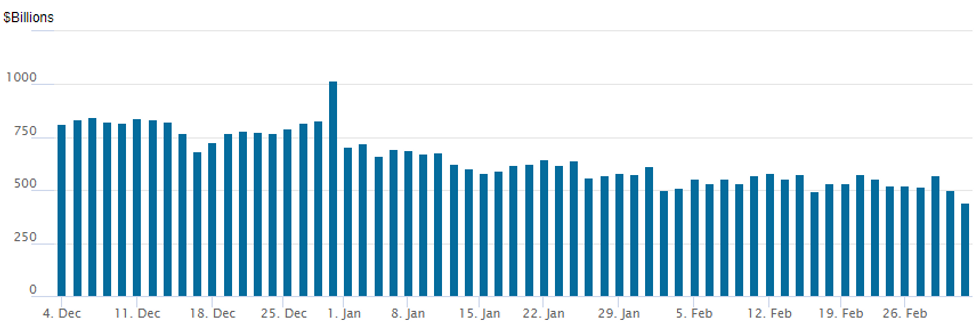

FED Reverse Repo Operation:

NY Federal Reserve/MNI

- RRP usage falls to the lowest level since May 2021 today: $441.265B vs. $502.074B Thursday. Today's drop compares to prior low of $493.065B on February 15 -- was the lowest since early June 2021 .

- Meanwhile, the latest number of counterparties slips to 73 from 83 Thursday (compares to 65 on January 16, the lowest since July 7, 2021).

SOFR/TREASURY OPTION SUMMARY:

Focus on June rate cut hedging continued Friday after Paper bought over +39,250 SFRM4 95.00/95.25/95.50 call flys at 3.0 -- Jun'24 SOFR options expire two days after the FOMC policy annc on June 12. Friday's FI rally buoyed mid-year projected rate cut pricing: March 2024 chance of 25bp rate cut currently -5.4% w/ cumulative of -1.4bp at 5.318%; May 2024 at -24.8% vs. -18.4% late Thursday w/ cumulative -7.6bp at 5.255%; June 2024 -67.9% from -56.4% late Thursday is nearing first full 25bp cut w/ cumulative cut -24.5bp at 5.086%. July'24 cumulative meanwhile has risen to -40.4bp at 4.927%. Salient SOFR and Treasury option trades include:

- SOFR Options:

- Block, +39,250 SFRM4 95.00/95.25/95.50 call flys, 3.0

- Block, 5,000 SFRM4 94.81/94.93 put spds 1.5 over SFRU4 94.87/95.00 put spds

- -3,000 0QM4 96.37 straddles, 62.0

- +5,000 SRZ4 95.75/96.00/96.25/96.50 call condors, 3.5

- -5,000 SRZ4 95.25 puts, 24.5 vs. 95.565/0.38%

- +4,000 SRM4 94.62/94.68/94.75/94.81 put condor 1.5

- -10,000 SRJ4 95.25/95.50/96.00 call flys .5 ref 94.93

- +3,000 SRU4 94.50/94.62/94.75/94.87 put condor 2.25 ref 95.19

- -4,000 SFRH4 94.81/94.93 call spds, .25

- +4,000 SFRJ4 95.00/95.12/95.25 call flys, 1.25

- Block, 3,985 SFRK4 94.68/94.81/94.93 put flys, 2.5 ref 94.89

- Block, 2,500 SFRH4 94.75 calls, 1.25 ref 94.685, more on screen

- 3,000 SFRJ4 94.87 puts

- Block, 2,500 SFRM4 94.87/94.93/95.00/95.06 put condors, 1.5 ref 94.89

- Treasury Options:

- Block, +7,500 TYK4 116 calls, 7 vs. 111-00

- Block, 10,000 TYK4 116 calls, 7 vs. 111-01.5/0.05%

- 3,000 FVJ4 107.25 calls, 30 ref 107-03.25

- over 6,700 wk1 TY 111 calls, 4 ref 110-21 (expire today)

- 1,600 FVJ4 105.5/108.5 strangles ref 106-30

- 3,000 FVJ4 107.5 calls ref 106-30.25

EGBS/Gilts Near Flat As Markets Digest Mixed US Data

Core/semi-core EGBs and Gilts move to trade broadly flat on the day, as markets digest mixed signals from the US manufacturing PMI and ISM prints.

- A 1.5% rise in Brent crude has failed to cap a late rally in the space. Our commodities team has not noted any clear drivers for today's price action.

- Bunds are +1 at 132.66, having traded in a volatile fashion through the day. Well defined technical parameters remain intact.

- Gilts sit +17 at 98.26, through yesterday's high of 98.18. Hawkish-leaning comments from BoE's Pill ("the time for cutting Bank Rate remains some way off") had a limited impact overall.

- Periphery spreads to Bunds are wider as European equities remain short of intraday highs, following NYC Bancorp-related risk-off earlier this morning.

- ECB and BoE implied rates sit within the past week's ranges: There are 66bps of BoE cuts priced through the remainder of 2024 and 91bps of cuts priced for the ECB.

- The first full 25bps cut is priced through the August BoE meeting in the UK (26bps priced) and the July ECB meeting in the Eurozone (36bps priced).

FOREX USD Index Slips As Equities Resume Rally, AUD and NOK Outperform

- The USD index is 0.3% lower on Friday amid front-end US yields shifting lower and major US equity benchmarks extending too fresh record highs. However, the DXY remains close to unchanged on the week, having traded in a tight 0.7% range, which appears to be in keeping with one-month implied vols for the index remaining close to two-year lows.

- Equity outperformance is benefitting the higher beta currencies in G10, in particular the Norwegian krone and the Australian dollar are the standouts, rising 0.96 and 0.52% respectively.

- For AUDUSD, trend signals remain bearish and a clear break of the 50-day EMA, at 0.6567 is required to suggest scope for a stronger recovery. On the downside, the bear trigger lies at 0.6443, the Feb 13 low.

- A volatile 48 hours comes to a close in USDJPY, with the pair hugging tight to the 150.00 figure. Price action overnight saw the pair erase the entirety of Thursday’s move lower which was fuelled by some renewed verbal intervention calls from BOJ officials. After printing a low of 149.21 shortly before February’s month-end fix, the pair rallied to 150.71 on Friday, however, the greenback weakness sapped any further topside momentum. The bull trigger is 150.89, Feb 13 high.

- Swiss CPI highlights the docket on Monday next week and is made slightly more interesting by today’s announcement that SNB’s Jordan will be stepping down this year and as EURCHF prints fresh three-month highs.

- Elsewhere next week, there will be central bank decisions from the ECB and BOC, a UK budget and the March employment report from the US.

FX Expiries for Mar04 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0800(E2.3bln), $1.0830(E500mln), $1.0850-70(E1.3bln), $1.0890-00(E620mln)

- USD/JPY: Y149.70-80($537mln), Y149.95-00($665mln), Y150.45-55($626mln), Y150.85-00($742mln)

- GBP/USD: $1.2650-55(Gbp2.1bln)

- AUD/USD: $0.6515(A$1.3bln), $0.6630(A$2bln)

- USD/CAD: C$1.3335-40($841mln), C$1.3460-65($1.8bln)

- USD/CNY: Cny7.1800($510mln), Cny7.2010($653mln)

Late Equities Roundup: Chip Stocks Lead S&P Eminis to New Highs

- Stocks remain strong in late afternoon trade, carry-over rally in semiconductor stocks helping S&P Eminis extend new contract highs: S&P E-Minis currently up 40 points (0.78%) at 5144.25, Nasdaq up 180 points (1.1%) at 16272.41, DJIA up 76.22 points (0.2%) at 39071.61.

- Leading Gainers: Information Technology and Energy sectors outperformed Friday, AI demand driving continued broad-based support for chip makers: Broadcom +8.13%, Micron Tech +5.61%, KLA Corp +5%, Advanced Micro Devices +4.93%.

- Energy sector shares were supported by oil and gas shares as crude prices rallied (WTI +1.62 at 79.88): APA +2.72%, Marathon +2.38%, ConocoPhillips +1.88%.

- Laggers: Utilities and Financial sectors underperformed in the first half, multi-energy and electricity shares weighed the former: Dominion Energy -6.19%, Xcel Energy -6.04%, Edison Int -1.93%.

- Insurance names continued to weigh on the Financials sector (more so than banks after NY Comm Bancorp after the bank reported "material weakness" in internal loan review and controls late Thursday): Allstate -2.45%, Hartford -1.40%, Prudential Financial -1.25%.

E-MINI S&P TECHS: (H4) Trend Needle Continues To Point North

- RES 4: 5180.34 3.0% Bollinger Band

- RES 3: 5170.86 2.236 proj of Nov 10 - Dec 1 - 7 price swing

- RES 2: 5162.04 2.0% 10-dma envelope

- RES 1: 5123.50 High Feb 23 and bull trigger

- PRICE: 5103.50 @ 14:56 GMT Mar 1

- SUP 1: 5024.54 20-day EMA

- SUP 2: 4936.50 Low Feb 13

- SUP 3: 4904.10/4866.000 50-day EMA / Low Jan 31 and key support

- SUP 4: 4808.50 Low Jan 19

The trend condition in S&P E-Minis remains bullish and the contract continues to trade closer to its recent highs. Price action also continues to highlight the fact that corrections remain shallow - a bullish signal. Support to watch is 5024.54, the 20-day EMA. A clear break of this average would signal potential for a deeper retracement towards 4936.50, the Feb 13 low. A resumption of gains would open vol-band based resistance at 5153.29.

COMMODITIES USD Tailwind Adds Fuel To Gold And WTI Rallies

- WTI has strengthened strongly on the day and is set for gains of around 4.5% on the week. Support on the day has come from a weaker US dollar, along with upside risks from a possible OPEC+ production cut extension and ongoing Middle East tensions.

- US oil and gas rig count rose by 3 to 629 rigs according to Baker Hughes March 1.

- The number of supertankers signalling China as their destination rose to the highest level in six weeks, according to Bloomberg.

- OPEC+ are expected to gradually store barrels back to the market at the next ministerial meeting on June 1 according to Christyan Malek at JP Morgan.

- WTI is +2.2% at $79.95, off an earlier high of $80.85, through yesterday’s high and a step closer to resistance at $81.70 (Fibo retrace of Sep 19 – Dec 13 bear cycle).

- Brent is +2.0% at $83.56, off $84.34 having cleared $83.65 (Jan 29 high) after which lies $85.57 (Fibo retrace of Sep 15 – Dec 13 bear cycle).

- Gold is +2.0% at $2084.33, off a high of $2088.37 that surged beyond a key resistance at $2065.5 (Feb 1 high) and stopped marginally short of $2088.5 (Dec 28 high). It’s driven by the lower Treasury yields and softer USD index seen after the ISM mfg miss, adding to continued Red Sea geopolitical tension.

- Weekly moves: WTI +4.5%, Brent +2.3%, Gold +2.4%, US HH nat gas +14.7%, EU TTF nat gas +12.5%

MONDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 04/03/2024 | 0030/1130 | * |  | AU | Building Approvals |

| 04/03/2024 | 0030/1130 |  | AU | Business Indicators | |

| 04/03/2024 | 0700/0200 | * |  | TR | Turkey CPI |

| 04/03/2024 | 0730/0830 | *** |  | CH | CPI |

| 04/03/2024 | 1600/1100 |  | US | Philly Fed's Pat Harker | |

| 04/03/2024 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 04/03/2024 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 05/03/2024 | 2330/0830 | ** |  | JP | Tokyo CPI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.