-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Tsy Borrow Estimates Rise

- Treasuries see-sawed higher Monday, pared gains after higher than expected Tsy borrow estimates.

- Treasuries recover from last Thursday's sell-off on lower than expected weekly claims and strong PCE data.

- Japan holiday didn't stop officials from intervention to stabilize the yen, USDJPY off 160 cycle high to 156.06.

US Tsys Briefly Trim Gains After Higher Than Expected Tsy borrow Estimates

- Treasury futures continued to climb off last Thursday's approximate 5-month lows Monday, completely recovering from a sell-off on lower than expected weekly claims and strong PCE data that saw 10Y yield climb to 4.7351% high.

- Tsys pared gains briefly after higher than expected Tsy borrow estimates to $243 billion in privately held net marketable debt in the second quarter, USD41 billion more than previously announced in January due to lower cash receipts. Officials expect to borrow $847 billion in the third quarter.

- Otherwise, generally subdued week opener with focus on Wednesday's FOMC policy announcement and April employment report on Friday.

- Generally, Powell is expected to tilt more cautious on the inflation outlook than in previous appearances, with potential flashpoints for markets including whether he acknowledges that 3 cuts are less likely to be the base case for the FOMC in 2024, and/or whether June is too early for the first cut.

- Projected rate cut pricing largely eased slightly: May 2024 -2.1% w/ cumulative -0.5bp at 5.324%; June 2024 at -10.6% w/ cumulative rate cut -3.2bp at 5.297%, July'24 cumulative at -8.1bp, Sep'24 cumulative -18.1bp.

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00256 to 5.31317 (-0.00117 total last wk)

- 3M -0.00269 to 5.32681 (+0.00310 total last wk)

- 6M -0.00475 to 5.30909 (+0.01094 total last wk)

- 12M -0.00727 to 5.23653 (+0.02929 total last wk)

- Secured Overnight Financing Rate (SOFR): 5.32% (+0.01), volume: $1.795T

- Broad General Collateral Rate (BGCR): 5.31% (+0.01), volume: $688B

- Tri-Party General Collateral Rate (TGCR): 5.31% (+0.01), volume: $673B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $94B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $270B

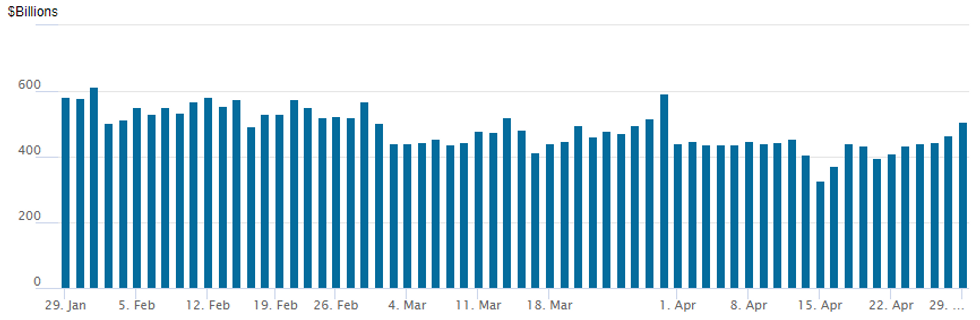

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage climbs back over $500B to $505.530B vs. $464.912B last Friday. Compares to $327.066B on Monday, April 15 -- the lowest level since mid-May 2021.

- Meanwhile, the latest number of counterparties slips to 75 vs. 78 prior.

SOFR/TEASURY OPTION SUMMARY

SOFR and Treasury options held mixed through Monday's session, SOFR switched to calls late, while Treasury switched to better 5Y and 10Y puts inthe second half. Modest overall volumes in the lead-up to Wednesday's FOMC policy announcement. Underlying futures firmer, off highs after larger than est Tsy borrow estimates. Projected rate cut pricing largely eased slightly: May 2024 -2.1% w/ cumulative -0.5bp at 5.324%; June 2024 at -10.6% w/ cumulative rate cut -3.2bp at 5.297%, July'24 cumulative at -8.1bp, Sep'24 cumulative -18.1bp.

- SOFR Options:

- +10,000 0QK4 95.75 calls, 2.0 vs. 95.39/0.10%

- -10,000 SFRM4 94.81/94.87/94.93/95.00 put condors, 0.25 ref 94.715

- -1,500 SFRU4 94.87 straddles 30.0-29.5 ref 94.855/0.10%

- Block, +5,000 SFRZ4 94.18/94.56 put spds, 4.5 vs. 95.01/0.10%

- +2,500 SFRZ4 94.00/94.25 3x2 put spds 0.0

- +4,000 SFRZ4 94.87/95.12/95.75/96.00 iron condor, 16.75 ref 94.855

- 4,000 SFRZ4 95.50/95.75 call spds vs. 2,000 SFRZ4 94.62 puts ref 95.02

- 8,500 SFRM4 94.68/94.75/95.00 call trees ref 94.705

- Treasury Options:

- Block +20,000 FVM4 104.25/104.75 put spds, 11 ref 105-02.5 at 1318:37ET.

- -10,000 TYM4 106.5/109.5 strangles, 35 ref 107-30

- over 30,900 TYM4 106 puts, 13-15, 13 last ref 107-29

- -14,000 TUM4 101.5/102 call spds, 9 ref 101-14.5

- 1,400 TYM4 109.5/110.5/113 call flys ref 107-25.5

- 1,800 TYM4 107/108/109 call flys, 10 net/wings over

- 1,500 wk1 TY 104.5/105.75 call spds

- 4,700 TYM4 106.75/107.75 2x1 put spds ref 107-23

- 3,500 TYM4 107/107.75 2x1 put spds

- Block +20,000 FVM4 104.25/104.75 put spds, 11 ref 105-02.5 at 1318:37ET.

FOREX JPY Volatility In Focus To Start The Week

- USDJPY posted an impressive 563-pip range on Monday as fresh cycle highs above 160.00 likely prompted Japanese officials to intervene and stabilise the yen. In early Europe, USDJPY printed as low as 154.54 with holiday-thinned trade potentially exacerbating the price swings.

- USDJPY spent a lot of the US session edging back to the high 156’s, however, renewed weakness saw a quick late dip to 155.10, as markets remain wary over any sudden moves. As a reminder, initial key technical support to watch lies at 154.01, the 20-day EMA.

- There has been no official confirmation on intervention from Japanese authorities, with top currency official Kanda stating he has ‘no comment for now’ and that the market will find out of possible intervention when data is posted in late May.

- As a result, the USD index resides 0.40% lower, in fitting with modestly lower US yields. Stock markets trade marginally in the green, which assists the likes AUD (+0.55%) and NZD (+0.65%) which outperform in G10 and is bolstering the performance of EM FX.

- With Aussie retail sales and China PMIs due overnight, attention will be on a developing bullish phase for AUDUSD. Resistance at 0.6526, the 50-day EMA, has been breached and the clear break highlights a stronger reversal that signals scope for a climb towards 0.6644, the Apr 9 high.

- GBPUSD is also now up over half a percent on the session, trading above 1.2550. Despite the trend condition in GBPUSD remaining bearish, a corrective cycle continues to play out, which is allowing an oversold condition to unwind. Price action has narrowed the gap to resistance at 1.2580, the 50-day EMA.

- Key attention this week will rest on Wednesday’s Fed meeting and press conference, as well as Friday’s release of NFP.

Late Equities Roundup: Gains Pared After Tsy Borrow Estimate Increase

- Stocks reversed course, extend lows briefly before recovering slightly after the Tsy raises April-June borrow estimates to $243B from $202B. Not a big move for stocks, more caution in lead up to Wednesday's FOMC and jobs report this Friday. Currently, DJIA is up 76.31 points (0.2%) at 38317.08, S&P E-Minis up 0.25 points (0%) at 5132, Nasdaq up 6.1 points (0%) at 15934.19.

- Leading gainers: Consumer Discretionary and Utilities sector shares continue to outperform in late trade, EV maker Tesla +14.27% and parts makers Aptiv +1.32%, Borg Warner +1.21% supported the Discretionary sector. Utilities were supported by independent power and electricity providers: NextEra Energy +2.09%, First Energy +1.32%, Dominion +1.29%.

- Laggers: Communication Services and Financials sectors underperformed late: unwinding a portion of Friday's rally, Google receded -3.76%, Meta -3.22%, Netflix -1.09%. Financial Services shares underperformed late: Franklin Resources -5.96%, Invesco -2.32%, T Rowe Price -2.16%.

- Expected corporate earnings announcements after today's close: SBA Communication, Paramount Global, Welltower and Transocean. the pace picks up Tuesday: Coca-Cola, Molson Coors, Sirius XM, McDonalds, Corning, PACCAR, Martin Marietta Materials, 3M, American Tower, GE Health, Sysco, Eli Lilly, PayPal Holdings, Archer-Daniels-Midland, Eaton Corp, Stryker, Prudential Fncl, ONEOK, Boston Properties, Diamondback Energy, Public Storage, Pinterest, Amazon, Starbucks, Advanced Micro Designs, Super Micro Computer.

E-MINI S&P TECHS: (M4) Watching Resistance At The 20-Day EMA

- RES 4: 5333.50 High Apr 1 and the bull trigger

- RES 3: 5285.00 High Apr 10

- RES 2: 5213.25 High Apr 15

- RES 1: 5138.19/5147.00 20-day EMA / Intraday high

- PRICE: 4144.50 @ 14:27 BST Apr 29

- SUP 1: 4963.50 Low Apr 19 and the bear trigger

- SUP 2: 4907.57 50.0% retracement of the Oct 27 ‘23 - Apr 1 bull leg

- SUP 3: 4863.75 Low Jan 19

- SUP 4: 4799.50 Low Jan 17

The S/T trend condition in S&P E-Minis remains bearish and the latest recovery appears to be a correction. The contract has recently cleared the 50-day EMA, signalling scope for a continuation lower. A resumption of the bear leg would open 4907.57, a Fibonacci retracement. Firm resistance at 5138.19, the 20-day EMA, has been pierced, a clear break would instead signal a reversal and expose key resistance at 5333.50, the Apr 1 high.

COMMODITIES WTI Falls As Risk Premium Shrinks, Copper Hits Two-Year High

- WTI has moved lower as the risk premium associated with potential disruption to Middle Eastern supply shrinks further. The market is gathering hopes of momentum towards a cease-fire in Gaza.

- WTI Jun 24 is down 1.5% at $82.6/bbl.

- WTI futures continue to trade above key short-term support at $81.19, the 50-day EMA. On the upside, key resistance and the bull trigger has been defined at $86.97, the Apr 12 high.

- By contrast, Henry Hub front month is set for its highest close since February 5, as returning flows to Freeport LNG is boosting demand.

- US Natgas Jun 24 is up 5.6% at $2.03/mmbtu

- Spot gold is broadly unchanged on the day at $2,339/oz, as the yellow metal remains rangebound ahead of Wednesday’s FOMC decision.

- Gold remains in consolidation mode. Having last week pierced the 20-day EMA, a continuation lower would signal scope for an extension towards $2238.8, the 50-day EMA. Key resistance and the bull trigger is at $2431.5, the recent Apr 12 high.

- Meanwhile, copper has risen by another 2.4% to $467/lb, a new two-year high. The metal has now rallied around 26% since its mid-February YTD low, as supply concerns continue to bite.

- A bullish theme in copper futures remains intact, with attention on $468.90, a Fibonacci projection.

TUESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 30/04/2024 | 2301/0001 | * |  | UK | BRC Monthly Shop Price Index |

| 30/04/2024 | 2330/0830 | * |  | JP | Labor Force Survey |

| 30/04/2024 | 2330/0830 | ** |  | JP | Industrial Production |

| 30/04/2024 | 2330/0830 | * |  | JP | Retail Sales (p) |

| 30/04/2024 | 0130/0930 | *** |  | CN | CFLP Manufacturing PMI |

| 30/04/2024 | 0130/0930 | ** |  | CN | CFLP Non-Manufacturing PMI |

| 30/04/2024 | 0130/1130 | ** |  | AU | Retail Trade |

| 30/04/2024 | 0145/0945 | ** |  | CN | IHS Markit Final China Manufacturing PMI |

| 30/04/2024 | 0530/0730 | *** |  | FR | GDP (p) |

| 30/04/2024 | 0530/0730 | ** |  | FR | Consumer Spending |

| 30/04/2024 | 0600/0800 | ** |  | DE | Retail Sales |

| 30/04/2024 | 0600/0800 | ** |  | DE | Import/Export Prices |

| 30/04/2024 | 0645/0845 | *** |  | FR | HICP (p) |

| 30/04/2024 | 0645/0845 | ** |  | FR | PPI |

| 30/04/2024 | 0700/0900 | *** |  | ES | GDP (p) |

| 30/04/2024 | 0700/0900 | ** |  | CH | KOF Economic Barometer |

| 30/04/2024 | 0755/0955 | ** |  | DE | Unemployment |

| 30/04/2024 | 0800/1000 | *** |  | IT | GDP (p) |

| 30/04/2024 | 0800/1000 | *** |  | DE | GDP (p) |

| 30/04/2024 | 0830/0930 | ** |  | UK | BOE M4 |

| 30/04/2024 | 0830/0930 | ** |  | UK | BOE Lending to Individuals |

| 30/04/2024 | 0900/1100 | *** |  | EU | HICP (p) |

| 30/04/2024 | 0900/1100 | *** |  | EU | EMU Preliminary Flash GDP Q/Q |

| 30/04/2024 | 0900/1100 | *** |  | EU | EMU Preliminary Flash GDP Y/Y |

| 30/04/2024 | 0900/1100 | *** |  | IT | HICP (p) |

| 30/04/2024 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 30/04/2024 | 1100/1200 |  | UK | Asset Purchase Facility Quarterly Report 2024 Q1 | |

| 30/04/2024 | 1230/0830 | *** |  | US | Employment Cost Index |

| 30/04/2024 | 1230/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 30/04/2024 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 30/04/2024 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 30/04/2024 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 30/04/2024 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 30/04/2024 | 1345/0945 | *** |  | US | MNI Chicago PMI |

| 30/04/2024 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 30/04/2024 | 1400/1000 | ** |  | US | housing vacancies |

| 30/04/2024 | 1430/1030 | ** |  | US | Dallas Fed Services Survey |

| 30/04/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 01/05/2024 | 2245/1045 | *** |  | NZ | Quarterly Labor market data |

| 01/05/2024 | 2300/0900 | ** |  | AU | IHS Markit Manufacturing PMI (f) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.