-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY37.3 Bln via OMO Wednesday

MNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

MNI ASIA MARKETS ANALYSIS: Tsy Curves Climb To 3M Highs

- MNI CHINA-RUSSIA: Foreign Ministers Wang & Lavrov Hold Call Ahead Of BRICS Summit

- MNI TURKEY: Foreign Min's Iraq Visit To Test Waters Ahead Of Potential Erdogan Trip

- FED GOVERNOR BOWMAN: EXPECTS ADDITIONAL RATE INCREASES WILL LIKELY BE NEEDED TO LOWER INFLATION TO TARGET .. WILL BE LOOKING FOR EVIDENCE INFLATION IS ON A 'CONSISTENT AND MEANINGFUL' DOWNWARD PATH IN MAKING DECISIONS, Reuters

Key Links: MNI DATA FORECASTS: All Eyes On US Inflation Data / MNI BRIEF: Rate Hikes Not Feeding Through Faster - BOE Pill

US TSYS Markets Roundup

- Treasury curves hold steeper profiles after the close with short end rates marking steady to higher vs. weaker intermediates to long end futures: 3M10Y +4.766 at -133.066, 2s10s +4.843 at -68.812.

- FI markets ha a rather whippy session amid modest overall volumes (TYU3 1.1M), not unusual for summer trade with many accounts close to the sidelines, awaiting the first significant data release of July CPI this Thursday.

- Little reaction to an increase in Consumer Credit by more than expected in June at $17.8B (cons $13.55B) after a particularly low $9.5B in May had marked the softest increase since Nov’20.

- Some interesting details, with revolving credit (credit cards and the like) seeing its first decline since Apr’21 at -$0.6B after +$8.5B in what could be down to lower gross issuance under tightening conditions or greater repayments to reduce higher yielding data, or a combination of the two.

- Early Morning comments from Fed Gov Bowman: EXPECTS ADDITIONAL RATE INCREASES WILL LIKELY BE NEEDED TO LOWER INFLATION TO TARGET .. WILL BE LOOKING FOR EVIDENCE INFLATION IS ON A 'CONSISTENT AND MEANINGFUL' DOWNWARD PATH IN MAKING DECISIONS, Reuters.

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M -0.00141 to 5.31583 (-.00083 total last wk)

- 3M -0.00315 to 5.36743 (-0.00133 total last wk)

- 6M -0.00664 to 5.42755 (-0.01382 total last wk)

- 12M -0.02284 to 5.33951 (-0.04553 total last wk)

- Daily Effective Fed Funds Rate: 5.33% volume: $112B

- Daily Overnight Bank Funding Rate: 5.32% volume: $270B

- Secured Overnight Financing Rate (SOFR): 5.30%, $1.369T

- Broad General Collateral Rate (BGCR): 5.28%, $580B

- Tri-Party General Collateral Rate (TGCR): 5.28%, $567B

- (rate, volume levels reflect prior session)

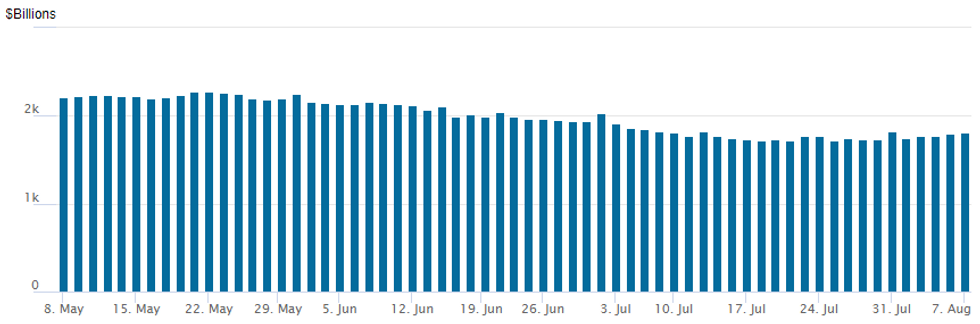

FED REVERSE REPO OPERATION

The latest operation climbs up to $1,810.583B, w/102 counterparties, compared to $1,793.804B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

SOFR/TREASURY OPTION SUMMARY

FI option trade remained mixed Monday, SOFR options pared but leaning slightly toward low delta puts (new and position rolls or unwinds) while Treasury options leaned toward calls as underlying futures see-sawed off lows to near top end of the range. Rate hike projections through year end receded from early highs: Sep 20 FOMC is 12% vs. 16% early w/ implied rate change of +3bp to 5.359%. November cumulative of +9.1bp at 5.419, December cumulative of 4.9bp at 5.377%. Fed terminal at 5.415% in Nov'23.

- SOFR Options:

- 9,500 SFRU3 95.75 puts, 1.15 vs. 94.60 / parity

- 3,000 SFRH4 93.75 puts, 2.0 ref 94.93

- Block, 6,250 SFRM4 94.25/94.5 put spds, 5.0 ref 95.305

- Block, +5,000 SFRU3 94.12/94.50 put spds, 1.5 ref 94.595

- 2,000 SFRQ3 94.62/94.68 1x2 call spds

- -12,250 SFRU3 94.50 puts 1.75 ref 94.595 at 0910:43ET

- Screen trade shortly after: 9,250 SFRH4 94.00/95.25 2x1 put spds ref 94.92

- 3,750 SFRH4 94.00/95.25 put spds

- +10,000 SFRZ5 95.00/95.50/96.00 put flys, 4.5 ref 96.46

- +2,000 2QU34 96.75/97.00/97.25/97.50 call condors

- 7,000 SFRH4 94.50 puts, 14 ref 94.885

- over 3,700 0QM3 110 puts, 12 last

- over 4,000 0QM3 111 puts, 39 last

- over 8,400 0QM3 111.75 calls, 13 last

- over 5,100 2MQ3 112/112.25 call spds ref 110-24

- Block, 2,500 0QQ3 95.37/95.43 put spds, 1.5 ref 95.63

- Treasury Options:

- +21,800 TYw2 111.5/112.5 call spds, 15 ref 111-03.5

- +8,000 FVU3 108.5/109/109.5 call flys, 1.5 vs. 106-27.25 to -27/0.08%

- 3,000 FVU3 108 calls, 10.5 ref 106-28

- Update, +25,000 wk2 FV 107.5/108/108.5 call flys ref 106-20.75

- 3,800 FVU3 108.5 calls, 5.5

- +2,500 TYU 109.5 puts, 20

- 2,000 TYX3 115/117/119/121 call condors ref 111-08

- over 4,600 TYU3 109 puts, 13 last

- over 5,300 TYU3 110 puts, 29 last

- over 6,000 FVU3 106.5 puts, 23.5-30 ref 106-27.75

EGBs-GILTS CASH CLOSE: German Short End Gains Stand Out

The German short-end was the standout outperformer Monday, contrasting with yield rises across the rest of the curve and in the UK.

- With relatively few macro / headline triggers (weak German industrial production data may have helped Bunds strengthen on the margin), the main driver of morning price action was the Bundesbank's remuneration tweak on government deposits.

- Announced late Friday, the news that gov't deposits would receive 0% returns as of October helped fuel a scarcity-related bid for Schatz while widening swap spreads.

- The German curve twist steepened, with the UK's bear steepening, with the space giving up part of Friday's post-US jobs data rally.

- Greece ended up underperforming periphery peers, following early session outperformance after attaining investment grade status from Scope on Friday.

- Tuesday morning brings some final CPI readings, but the main highlight is the ECB Consumer Expectations Survey.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 2.7bps at 2.987%, 5-Yr is up 0.9bps at 2.59%, 10-Yr is up 3.9bps at 2.601%, and 30-Yr is up 7bps at 2.694%.

- UK: The 2-Yr yield is up 4.3bps at 4.963%, 5-Yr is up 5.6bps at 4.458%, 10-Yr is up 8.1bps at 4.461%, and 30-Yr is up 8.7bps at 4.656%.

- Italian BTP spread up 1bps at 166bps / Greek up 5.1bps at 127.7bps

EGB Options: Distant Bund Strikes Remain In Favour

Monday's Europe rates / bond options flow included:

- ERU3 96.25/96.37cs 1x2, bought for 1.5 and 1 in 8k

- DUU3 105.40/105.70/106.00c fly, bought for 2.5 in 1.5k

- RXV3 126/124ps, bought for 12 in 1k. This was bought last Thursday for 13.5 in 5k.The 125.00 strike would equate to 3.22% in 10yr Yields

- RXU3 133/133.5/135.5c fly 1x1.25x0.25, bought for 6.25 in 4k

FOREX: Initial USD Strength Shrugged Off As Yields Reverse Course

- Despite rising around 0.35% following some hawkish remarks from Fed’s Bowman over the weekend, the USD index is now trading close to unchanged levels for Monday’s session. Broad moves for the greenback have been closely correlated with the moves in US yields, which have drifted back towards their post payrolls lows.

- Standing out is the Japanese Yen which has underperformed on the session. USDJPY trades within 10 pips of session highs at 142.58, however remains well short of the Friday high at 142.89 in a relatively thin session. Volumes were notably lower than average across both futures and options markets, keeping focus on risk events set for later in the week, namely US CPI and the prelim UMich set for Friday. The pullback off last week's high found support at the 141.32 50-dma, which has provided some early stability this week. This leaves 143.89 as primary resistance before any test on the cycle best at 145.07.

- Elsewhere, GBP has received a moderate boost as BOE Chief Economist Huw Pill pointed out that latest data shows more persistent inflation. Conversely, the Chinese Yuan has underperformed amid ongoing concerns surrounding the domestic growth outlook.

- In emerging markets, there was some renewed pressure on the EMFX basket, which has declined around 0.2%. The most notable move was a 1.2% advance for USDZAR, which has reversed the entirety of the post payrolls decline and bolsters the likelihood of a move to 18.8587, the Jul 11 high.

- Tuesday contains trade balance data for both China and the US. China will also report inflation data on Wednesday before the market switches focus to July CPI prints from the US. Comments may also arise from Fed’s Harker and Barkin.

FX Expiries for Aug08 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0790-00(E571mln), $1.0870(E1.3bln), $1.0895-10(E880mln), $1.0970-80(E679mln), $1.1300(E602mln)

- GBP/USD: $1.2980-00(Gbp554mln)

- EUR/GBP: Gbp0.8700-25(E1.1bln)

- AUD/USD: $0.6450(A$1.4bln)

- NZD/USD: $0.6235(N$553mln)

- USD/CAD: C$1.3335($580mln)

Late Equity Roundup: Near Highs

- Stocks trading at/near late session highs after the bell, Nasdaq shares rebounding late. Currently, DJIA shares are up 405.05 points (1.16%) at 35474.67, S&P E-Mini futures up 39.75 points (0.88%) at 4537.75, Nasdaq up 84.6 points (0.6%) at 13992.52.

- Leading gainers: Communication Services, Financials and Real Estate sectors outperformed Monday. Media and entertainment shares buoyed Communication services: Paramount +2.90%, Warner Bros +2.75%, Google +2.67% while Netflix climbed 1.75%.

- Financial services companies outperformed banks: Berkshire Hathaway gained 3.5% after reporting better than expected quarterly earnings Saturday. Other gainers included Lincoln National +2.62%, PayPal +2.45%. Real Estate investment trusts rallied late w/ office and health care REITS leading.

- Laggers: Utilities, Energy and Information Technology underperformed. Electricity providers weighed on Utilities in the second half: Pinnacle West Cap -2.2%, XCel Energy -0.95%, and AEP -.3%. Hardware makers weighed on IT: Apple -1.85%, Trimble -1.6%, Zebra Tech -1.15%.

E-MINI S&P TECHS: (U3) Bear Threat Remains Present

- RES 4: 4708.98 3.0% 10-dma envelope

- RES 3: 4670.58 2.00 proj of the Jun 26 - 20 - Jul 7 price swing

- RES 2: 4665.19 Bull channel top drawn from the Mar 13 low

- RES 1: 4593.50/4634.50 High Aug 2 / Jul 27

- PRICE: 4516.75 @ 14:17 BST Aug 7

- SUP 1: 4493.75 Low Aug 4

- SUP 2: 4453.93 50-day EMA

- SUP 3: 4423.98 Bull channel base drawn from the Mar 13 low

- SUP 4: 4411.25 Low Jul 10

Bearish conditions in the E-mini S&P contract remain intact. Last week’s move lower reinforces a bearish theme and resulted in a break of support at the 20-day EMA. The recent failure at the top of the bull channel also highlights a bearish development and the risk of an extension lower near-term. Further downside would open 4453.93, the 50-day EMA. First key resistance is at 4634.50, the Jul 27 high.

COMMODITIES: Crude Eases Back Towards Friday’s Lows

- Crude eases back towards the lows from Friday just above 85$/bbl for Brent as the market assesses the tighter market supply against ongoing global economic concerns.

- On Saturday, Saudi Arabia raised nearly all OSPs to Asia and Europe for September with Arab Light crude to Asia up 0.3$/bbl. Saudi Aramco CEO Amin Nasser said supply for customers remains adequate despite the country’s voluntary production cuts.

- Poland has stopped oil through part of a western section of the Druzhba pipeline after a leak late on Saturday. Crude flows are expected to resume on Tuesday morning whilst Germany’s Leuna oil refinery has adjusted its processes as a precaution.

- Friday’s rig count showed global oil and gas rig counts including US and Canada rose by 20 in July driven by a +40 increase from Canada.

- WTI is -1.2% at $81.85, pulling away from resistance at $83.59 (Nov 7, 2022 high) but still off support at $78.69 (Aug 3 low).

- Brent is -1.1% at $85.27, having set a new recent high of $86.73 after which the next step was the $90/bbl round number. It remains off support at $82.36 (Aug 3 low).

- Gold is -0.3% at $1936.34, remaining off support at $1924.5 (Jul 11 low).

TUESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 08/08/2023 | 2301/0001 | * |  | UK | BRC-KPMG Shop Sales Monitor |

| 08/08/2023 | 0405/1205 | *** |  | CN | Trade |

| 08/08/2023 | 0600/0800 | *** |  | DE | HICP (f) |

| 08/08/2023 | 0645/0845 | * |  | FR | Foreign Trade |

| 08/08/2023 | 0900/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 08/08/2023 | 1000/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 08/08/2023 | 1215/0815 |  | US | Philadelphia Fed's Pat Harker | |

| 08/08/2023 | 1230/0830 | ** |  | CA | International Merchandise Trade (Trade Balance) |

| 08/08/2023 | 1230/0830 | ** |  | US | Trade Balance |

| 08/08/2023 | 1230/0830 |  | US | Richmond Fed's Tom Barkin | |

| 08/08/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 08/08/2023 | 1400/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 08/08/2023 | 1400/1000 | ** |  | US | Wholesale Trade |

| 08/08/2023 | 1530/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 08/08/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 08/08/2023 | 1700/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.