-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Tsy Cuts Q1 Borrow Ests

- MNI Treasury cuts Jan-March borrowing estimates from $816B to $760B, estimates April-June at $202B

- MNI SECURITY: WH Kirby: President Biden Will Determine Response To Jordan Attack

- MNI SECURITY: Meeting In Cairo On Three-Phase Ceasefire Agreement In "Coming Days"

- MNI HUNGARY: Opp. Calls For Emergency Parl't Session To Approve Sweden NATO Bid

- MNI ISRAEL: NBC News-Israel Agrees On Hostage Deal, Could Pave Way To Ceasefire

- US KIRBY: HOSTAGE DEAL NOT IMMINENTLY READY TO BE ANNOUNCED, Bbg

- US SET TO RENEW VENEZUELA OIL SANCTIONS AFTER CANDIDATE BARRED, Bbg

US TSYS FI Extends Rally on Lower Tsy Borrow Ests.

- Tsy futures as well as stocks extending session highs (contract highs on latter) after the Treasury cut Jan-March borrow est's from $816B to $760B, and estimates April-June at $202bn. The refunding announcement is scheduled for Wednesday at 0830ET.

- Mar'24 10Y futures (TYH4 tapped 111-23 high, +22) continues to see-saw near the top end of range since January 18. Initial technical resistance at 112-01+ (High Jan 17). 10Y yield slipped to 4.0568% low.

- Focus remains on gradually lower inflation and timing of first FOMC rate cut since March 2020 in the lead up to this Wednesday's policy announcement. No action expected from the Fed Wednesday, but dealer estimates of when and by how much is varied (GS: 25bp cut in March, 5 total cuts in 2024 to 4.25%; DB 3.75% by year end, UBS 2.75% year end; flipside: Santander est's 50bp by year end to 5%).

- Cross asset summary: stocks near recent highs (SPX eminis 4953.25 vs. Fri's 4956.0 contract high), Crude weaker (WTI -1001 at 77.01), gold firmer (+13.32 at 2031.84.

FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00387 to 5.33260 (+0.00053 total last wk)

- 3M -0.00477 to 5.31266 (+0.00225 total last wk)

- 6M -0.00471 to 5.15269 (-0.00193 total last wk)

- 12M +0.00005 to 4.79903 (+0.00049 total last wk)

- Secured Overnight Financing Rate (SOFR): 5.32% (+0.01), volume: $1.712T

- Broad General Collateral Rate (BGCR): 5.31% (+0.01), volume: $676B

- Tri-Party General Collateral Rate (TGCR): 5.31% (+0.01), volume: $668B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $100B

- Daily Overnight Bank Funding Rate: 5.31% (+0.00), volume: $270B

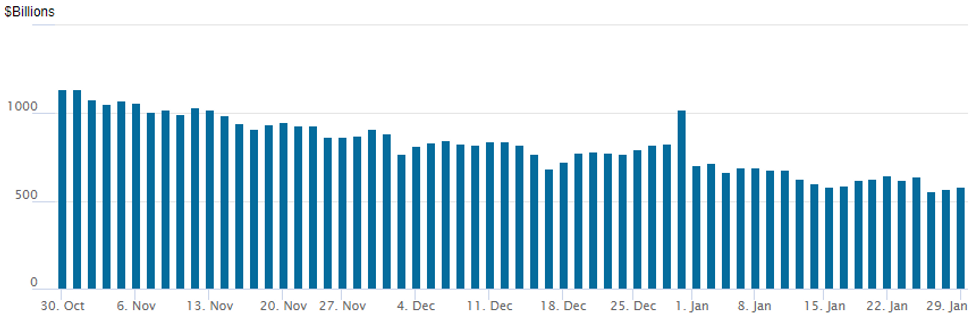

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage climbs to $581,410B vs. $570.828B last Friday. Compares to cycle low of $557.687B on Thursday, January 25, lowest level since mid-June 2021.

- Meanwhile, the number of counterparties climbs to 81 vs. 77 on Friday (compares to 65 on January 16, the lowest since July 7, 2021).

SOFR/TREASURY OPTION SUMMARY

Better upside call structures reported in SOFR and Treasury options Monday, with one exception: large buy of 10Y weekly midcurve put that covers this Wednesday's FOMC.. Underlying futures extending highs on the close after the US Tsy reduced Q1 borrow estimates to $760B from $816B. Focus on Wed's FOMC, no action expected from the Fed Wednesday, but dealer estimates of when and how much are varied (GS: 25bp cut in March, 5 total cuts in 2024 to 4.25%; DB 3.75% by year end, UBS 2.75% year end; flipside: Santander est's 50bp by year end to 5%).- Projected rate cuts in H1 2024 steady to mixed: January 2024 cumulative -.5bp at 5.324%, March 2024 chance of 25bp rate cut -46.5% vs. -50.3 this morning w/ cumulative of -12.1bp at 5.198%, May 2024 at -82.7% vs -80.8% earlier w/ cumulative -32.8bp at 5.001%, June 2024 -99.1% vs. -95.4% earlier w/ cumulative -57.6bp at 4.753%. Fed terminal at 5.325% in Feb'24.

- SOFR Options:

- 2,500 SFRH4 94.87/94.93/95.00 call flys ref 94.875

- +10,000 SFRH4 95.12/95.25 call spds .25 vs. 94.85/0.05%

- -1,000 SFRZ4 95.12/96.12/97.12 iron fly w/ 95.00/96.00/97.00 iron flys, 128.0

- +5,000 SFRH4 94.93/95.06 1x2 call spds, 1.5

- over 5,000 0QG4 96.12/96.25 put spds ref 96.34

- over -15,700 SFRM4 95.00/95.18 call spds ref 95.305

- 2,000 SFRZ4 95.00/95.37/95.75 put trees ref 96.065

- 3,000 SFRH4 94.87/94.93/95.00 call flys ref 94.885

- 4,000 2QG4 96.50/96.25 put spds vs. 96.87 calls ref 96.655 to -.66

- 2,500 SFRZ4 96.50/97.25 4x5 call spds vs. SFRZ4 95.50 puts x2 ref 96.055 to -0.065

- 1,500 0QH4 96.25/96.75/97.00 broken call flys vs. 0QH4 95.75/96.00 put spds

- Block, 3,000 SFRH4 94.87/95.00 call spds, 4.75

- Block, 5,000 SFRU4 97.50/98.00 1x2 call spds, -1.25/splits

- Treasury Options:

- +80,000 wk1 TY 110/110.75 put spds, 9 ref 111-12.5

- 3,000 TYH4 114/114.5/115/115.5 call condors ref 111-14 to -14.5

- 2,000 TYH4 111.5/112/112.5/113 call condors, 7 ref 111-14

- 3,700 TYH4 110.5/112.5 call spds ref 111-15.5

- 1,800 TYH4 110.5 puts, 24 ref 111-13.5

- 1,200 TYH4 114.5/115.5/116 broken call trees ref 111-14

- 7,500 TYH4 111.5/113 call spds, 33 ref 111-15

FOREX Greenback Pares Gains Post Treasury Announcement, USDJPY Drops 40 Pips

- Upward pressure for both equities and treasuries in the aftermath of the Treasury’s quarterly refunding announcement sees the USD index paring its prior advance on the session.

- This has been most notable in the decline for USDJPY to fresh session lows at 147.26 in recent trade. Outperformance evident in the likes of Aussie and Kiwi sees further downward pressure on EURAUD and EURNZD, with the latter extending declines to 1.00% on the session.

- Australian retail sales data is due overnight before Spanish CPI and other European GDP figures. In the US, JOLTS data and consumer confidence will cross before Wednesday’s Fed Decision & presser.

FX EXPIRY for Tuesday, January 30

EURUSD: 1.0815 (289mln), 1.0820 (385mln), 1.0825 (579mln), 1.0865 (280mln_), 1.0875 (511mln).

USDJPY: 147.20 (551mln), 148.00 (679mln).

AUDUSD: 0.6640 (276mln).

USDCNY: 7.2000 (419mln).

Late Equities Roundup: SPX Eminis Back Near Contract Highs

- Stocks are drifting higher in late Monday trade, S&P Eminis climbing to new contract high of 4956.00 after the Tsy Dep lowered it's Q1 borrowing estimates. Currently, S&P E-Mini futures are up 36 points (0.73%) at 4952.25, Nasdaq up 169.9 points (1.1%) at 15625.54, DJIA up 199.52 points (0.52%) at 38311.87.

- Leading gainers: Consumer Discretionary and Communication Services sectors outperformed in late trade. Auto makers buoyed the Discretionary sector for the second day running: Tesla up +3.2% after falling over -12% last Thursday on poor sales guidance and several downgrades, while parts maker Aptiv gained 0.94%. Meanwhile, interactive media and entertainment shares led Communication Services higher in the second half: Meta +1.61%, Disney +1.29%, Netflix +0.80%.

- Laggers: Energy and Financial sector shares underperformed late Monday, oil and gas shares weighed on the former: OneOK -1.69%, APA Corp -1.43%, Coterra Energy -1.44% as crude pared last week's late gains (WTI currently -1.07 at 76.94). Meanwhile, insurance names weighed on the Financials sector: Arthur J Gallagher, Aon and Aflac all down appr 1.3%.

- Looking ahead: flood of earnings announcements this week: Nucor Corp, Corning, Pfizer, UPS, GM, MSFT, Alphabet, Starbucks, Boeing, Boston Scientific. Mastercard, MetLife and Meta by Wednesday.

E-MINI S&P TECHS: (H4) Uptrend Remains Intact

- RES 4: 5000.00 Psychological round number

- RES 3: 4982.62 1.50 proj of Nov 10 - Dec 1 - 7 price swing

- RES 2: 4956.00 Intra-Day High

- RES 1: 4952.45 1.382 proj of Nov 10 - Dec 1 - 7 price swing

- PRICE: 4950.25 @ 1537 ET Jan 29

- SUP 1: 4832.56/4736.42 20- and 50-day EMA values

- SUP 2: 4702.00 Low Jan 5

- SUP 3: 4594.00 Low Nov 30

- SUP 4: 4550.75 Low Nov 16

The uptrend in S&P E-Minis remains intact and last week’s move higher reinforces current conditions. Resistance at 4841.50, the Dec 28 high, has recently been cleared, confirming an extension of the price sequence of higher highs and higher lows. Moving average studies remain in a bull-mode condition, highlighting positive market sentiment. Sights are on 4952.45 next, a Fibonacci projection. Key support lies at 4736.42, the 50-day EMA.

COMMODITIES Crude Oil Pulls Back From Highs As OPEC Exports Higher Than Planned

- Crude prices have fallen on the day, as signs that OPEC exports are higher than planned and returning North Dakota production weigh against ongoing concerns in the Middle East.

- North Dakota's oil production is disrupted by around 10-40kbpd as of 29 January due to the recent cold spell according to the pipeline authority.

- OPEC+ appears to be making a slow start to its new output cuts, according to Kpler.

- The US is set to review oil sanctions on Venezuela’s energy sector if the country upholds its ban on opposition candidates running in the presidential election, according to Bloomberg.

- WTI is -1.45% at $76.86 having consistently pulled back from a high of $79.29 shortly after the open. That high came close to a key resistance at $79.56 (Nov 30 high).

- Brent is -1.3% at $82.49 off an overnight high of $84.80, clearing the next key hurdle for bulls at $84.22 (Nov 30 high) and opening $86.64 (76.4% retrace of Sep 15 – Dec 13 bear cycle).

- Gold is +0.4% at $2027.00 , holding gains despite net USD strength on the day as geopolitical risks remain at the fore after US troop deaths in Jordan. Resistance is seen at $2039.4 (Jan 19 high).

TUESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 30/01/2024 | 0001/0001 | * |  | UK | BRC Monthly Shop Price Index |

| 30/01/2024 | 0030/1130 | ** |  | AU | Retail Trade |

| 30/01/2024 | 0630/0730 | ** |  | FR | Consumer Spending |

| 30/01/2024 | 0630/0730 | *** |  | FR | GDP (p) |

| 30/01/2024 | 0800/0900 | *** |  | ES | HICP (p) |

| 30/01/2024 | 0800/0900 | *** |  | ES | GDP (p) |

| 30/01/2024 | 0800/0900 | ** |  | CH | KOF Economic Barometer |

| 30/01/2024 | 0800/0900 | ** |  | SE | Economic Tendency Indicator |

| 30/01/2024 | 0900/1000 | *** |  | IT | GDP (p) |

| 30/01/2024 | 0900/1000 | ** |  | IT | PPI |

| 30/01/2024 | 0900/1000 |  | EU | ECB's Lane on 'a year with the euro in Croatia' | |

| 30/01/2024 | 0900/1000 | *** |  | DE | GDP (p) |

| 30/01/2024 | 0930/0930 | ** |  | UK | BOE M4 |

| 30/01/2024 | 0930/0930 | ** |  | UK | BOE Lending to Individuals |

| 30/01/2024 | 1000/1100 | *** |  | EU | EMU Preliminary Flash GDP Q/Q |

| 30/01/2024 | 1000/1100 | *** |  | EU | EMU Preliminary Flash GDP Y/Y |

| 30/01/2024 | 1000/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 30/01/2024 | 1000/1100 | ** |  | EU | EZ Economic Sentiment Indicator |

| 30/01/2024 | 1000/1100 | * |  | EU | Consumer Confidence, Industrial Sentiment |

| 30/01/2024 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 30/01/2024 | 1400/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 30/01/2024 | 1400/0900 | ** |  | US | FHFA Home Price Index |

| 30/01/2024 | 1400/0900 | ** |  | US | FHFA Home Price Index |

| 30/01/2024 | 1500/1000 | *** |  | US | Conference Board Consumer Confidence |

| 30/01/2024 | 1500/1000 | ** |  | US | housing vacancies |

| 30/01/2024 | 1500/1000 | *** |  | US | JOLTS jobs opening level |

| 30/01/2024 | 1500/1000 | *** |  | US | JOLTS quits Rate |

| 30/01/2024 | 1530/1030 | ** |  | US | Dallas Fed Services Survey |

| 30/01/2024 | 1630/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 31/01/2024 | 2350/0850 | * |  | JP | Retail sales (p) |

| 31/01/2024 | 2350/0850 | ** |  | JP | Industrial production |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.