-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Tsy Yields Gain on Strong GDP Data

- MNI WHITE HOUSE: NEC's Brainard-Reason To Believe Inflation Near 2% Pre-Election

- MNI RUSSIA: Prigozhin Told Wagner Fighters Will No Longer Participate In Ukraine War

- THE MORE BOE RAISES RATES, THE FASTER IT MUST CUT: TENREYRO - bbg

- US 5-YEAR TIPS YIELD TOPS 2% FOR FIRST TIME SINCE 2008, Bbg

Key Links: MNI INTERVIEW: Fed Could Hike Rates Three More Times-Kaplan / MNI: Fed Can Expect Inflation Progress Without Hikes - Bostic / MNI: Fed’s Powell Wants Stronger Bank Regulation, Supervision / MNI: Canada Firms Plan Smallest Price Hikes In 2 Years- CFIB / MNI INTERVIEW: Riksbank Only Needs Gradual Hikes - Gov Thedeen

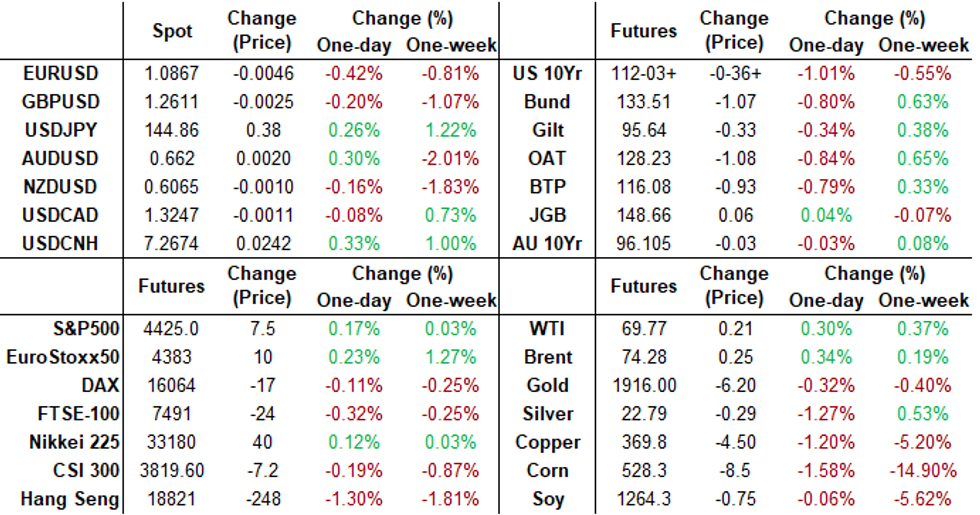

US TSYS: Hugging Session Lows After Economy Grows Faster Than Expected

- Treasury futures have moved sideways since marking session lows in midmorning trade, curves still flat (2s10s -1.536 at -102.364) but off deeper inverted levels (-106.695 low) as intermediates to long end led the sell-off.

- At the moment, front month 10Y futures trading 112-05 (-103) vs. 112-01 low, just above technical support of 112-00 (March 10 low) where a breach puts focus on 111-14+ (March 9 low) then key support of 110-27+ (March 2 Low).

- Morning data triggered new lows in Tsys as economy grew faster than anticipated GDP Annualized QoQ 2.0% vs. 1.4% est, 1.3% prior. Weekly claims recede (239k vs. 265k est, 264k prior) after showing stronger than expected gains the last few weeks. Latest pending home sales moderating, however, -2.7% MoM vs. -0.5% est.

- In turn, Secured Overnight Financing Rate 3M futures extending session lows as projected rate hike(s) gaining traction. Front month Sep'24 SOFR futures are currently trading -0.05 at 94.585 (3M SOFR settled -0.00443 to 5.53343% this morning); balance of Whites (SFRZ3-SFRM4) are trading -0.115-0.195, Reds-Golds (SFRU4-SFRM8) -0.195-0.140.

- Projected rate hikes gaining: July 26 FOMC has climbed to 84% w/ implied rate of +21bp to 5.283%. September fully pricing hike w/ cumulative of +28.7bp at 5.361%, November cumulative climbs to 35.1 at 5.425%, December cumulative 31.6 at 5.395%. Fed terminal at 5.42% in Nov'23 vs. 5.445% earlier.

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.01051 to 5.11300 (+.02933/wk)

- 3M +0.00478 to 5.24665 (+.00795/wk)

- 6M +0.00918 to 5.34588 (+.01680/wk)

- 12M +0.00012 to 5.29945 (+.01585/wk)

US DOLLAR LIBOR: Latest settlements:

- O/N -0.01485 to 5.05129%

- 1M +0.01200 to 5.20500%

- 3M -0.00443 to 5.53343% */**

- 6M +0.00857 to 5.73957%

- 12M +0.01685 to 5.96014%

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.55743% on 6/12/23

- Daily Effective Fed Funds Rate: 5.07% volume: $140B

- Daily Overnight Bank Funding Rate: 5.06% volume: $290B

- Secured Overnight Financing Rate (SOFR): 5.05%, $1.499T

- Broad General Collateral Rate (BGCR): 5.04%, $588B

- Tri-Party General Collateral Rate (TGCR): 5.04%, $576B

- (rate, volume levels reflect prior session)

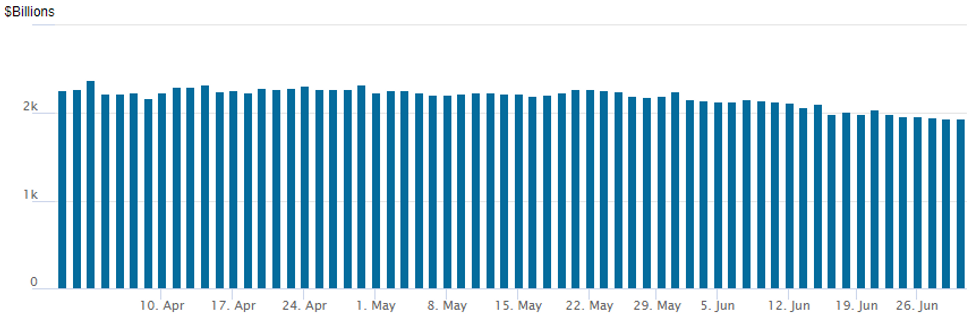

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage continues to decline, latest at $1,934.684B w/ 102 counterparties, compared to $1,945.211B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

SOFR/TREASURY OPTION SUMMARY

- Mixed trade on light summer volumes continued overnight into Thursday' session. Underlying futures broadly weaker, initially tracking Bunds after German regional CPI metrics climb, while GDP data showing economy grew faster than anticipated. Projected consecutive 25bp rate hikes between Sep'23-Dec'23 gradually pricing in, while majority of Fed officials anticipate two hikes by year end, Fed Chair Powell reiterated in comments at Bank of Spain conf overnight.

- SOFR Options:

- +5,000 SFRZ3 93.75/94.00/94.25 put flys, 3.25

- Block, 6,000 OQU3 96.00/96.50 put spds 13.0 over 2QU3 96.25/96.75 put spds

- +10,000 SFRU3 94.37/94.43 put spds, 1.75 vs. 94.60/0.12%

- 5,600 SFRZ4 94.00 puts, 2.0 ref 94.70

- 1,500 SFRU3 96.18 calls, 2.25 ref 94.625

- 1,500 SFRQ3 95.81 calls, 1.75 ref 94.62

- Block, 4,000 SFRZ3 94.62/94.75 put spds, 8.0 vs. 94.72/0.10%

- 1,750 2QN3 96.87/97.06 call spds ref 96.655

- Treasury Options:

- Block, 12,000 wk1 TY 112.75/113.25 call spds 8 vs. 112-05.5/0.12%

- over 5,000 TYQ3 114.25/114.75 call spds, 4 ref 112-08.5 to -06

- over 9,900 TYQ3 113.25 calls, 21 last ref 112-04

- over 10,500 TYU3 108 puts, 12 last ref 112-03

- +2,500 FVQ3 106.75/107.25 put spds, 13.5 ref 107-06.75

- +3,500 TYZ3 113 puts, 155 to 203

- +4,000 TYQ3 113 straddles, 126-127

- over 4,200 wk5 TY 113.5 calls, 4 ref 112-30

- Block, 5,000 wk5 FV 108..5 calls, 1 ref 107-20.25

- 5,100 TYQ3 112 puts, 20 ref 112-31.5

- 5,300 TYQ3 114 calls, 20 ref 113-00

EGBs-GILTS CASH CLOSE: Data Induces Selloff

Gilts and Bunds remained under pressure Thursday amid a combination of solid Eurozone inflation data and continued signs of US economic resilience.

- The German curve belly underperformed as national inflation came in slightly above expectations, following Spanish core coming in above survey - all but cementing a 25bp July ECB rate hike (90+% priced).

- The UK curve bear flattened as Wednesday's dovish central bank repricing was reversed (BoE terminal +7bp on the day), pushing up 2Y yields by 8bp.

- The selloff accelerated in the afternoon on US jobless claims coming in lower than expected and Q1 GDP revised higher, underpinning the "higher for longer" rate expectations theme of the week.

- We get the final major pieces of the Eurozone June inflation puzzle early Friday, with Dutch and French flash readings, ahead of the bloc-wide print later in the morning. We also get UK GDP.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 9.2bps at 3.196%, 5-Yr is up 10.4bps at 2.568%, 10-Yr is up 10.1bps at 2.416%, and 30-Yr is up 6.6bps at 2.427%.

- UK: The 2-Yr yield is up 8.2bps at 5.228%, 5-Yr is up 5.6bps at 4.624%, 10-Yr is up 6.6bps at 4.382%, and 30-Yr is up 5.4bps at 4.433%.

- Italian BTP spread up 2bps at 168.3bps Spanish up 1.4bps at 99.1bps

EGB Options: Vol And Downside Selling Thursday

Thursday's Europe rates / bond options flow included:

- 0RU3 96.125 put v ERU3 96.00 put, buys the mid for up to 10 in 2k

- ERU3 95.75/95.50/95.25p fly, sold at 5 in 5k

- ERH4 94.75/98.00^^, sold at 8 in 4k

- ERH4 98.00c, sold at 4.75 in 4k

- OEU3 116.00/115.50/115.00 put fly paper paid 4.5 on 3K.

FOREX: Greenback Maintains Upward Bias Following Stronger US GDP Revision

- The USD index has risen a further 0.4% on Thursday, extending on Wednesday’s firmer price action. The main impetus came from a strongly revised first quarter GDP figure from 1.3% to 2.0% Q/q. With markets not expecting a surprise, given it was the third reading for the data, the greenback surged in the immediate aftermath and has broadly consolidated at the week’s best levels approaching the close.

- The euro is one of the worst performers, with EURUSD down 0.42% approaching the APAC crossover. The pair was unable to hold onto moderate gains above the 1.09 handle following some marginally firmer Eurozone inflation figures and this may have exacerbated the reversal lower following US GDP. Price has narrowed the gap with key support at 1.0852, the 50-day EMA. A clear break of this average would strengthen a bearish threat and signal scope for a deeper corrective pullback.

- USDJPY maintained its string of positive trading sessions, making fresh trend highs in the process. Spot looks set to close right on session highs, very close to significant pivot resistance around the 145.00 mark. While topside momentum appears unwavering, with yield differentials continuing to be the dominant driver, market participants remain cautious as we approach historical levels where Japanese officials have decided to intervene to bolster the JPY.

- The focus overnight on Friday will be on China’s official PMI data for the latest signs regarding the health of the Chinese economy. Japanese Tokyo Core CPI will also cross. In Europe the focus will be on the latest flash estimate for Eurozone HICP inflation, which precedes US Core PCE Price Index and Canadian GDP.

FX Expiries for Jun30 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0730(E926mln), $1.0800(E741mln), $1.0855(E500mln), $1.0870-75(E582mln), $1.0900(E1.1bln), $1.0940-50(E2.1bln), $1.0960(E553mln)

- USD/JPY: Y142.80-00($1.1bln), Y143.90-00($1.2bln), Y144.50($557mln)

- EUR/GBP: Gbp0.8650(E580mln)

- AUD/USD: $0.6600(A$586mln), $0.6650(A$635mln), $0.6690-00(A$542mln)

- NZD/USD: $0.6175(N$1.7bln)

- USD/CAD: C$1.3200($540mln), C$1.3425-45($1.7bln)

- USD/CNY: Cny7.2000($1.1bln), Cny7.2200($697mln)

Late Equities Roundup: Banks Buoyed After Passing Fed Stress Test

- Stocks trading mostly higher, near the middle of a narrow session range with S&P E-Mini futures up 9.25 points (0.21%) at 4427, DJIA up 219.95 points (0.65%) at 34074.67, while Nasdaq lagged, down 21.8 points (-0.2%) at 13570.13.

- Leading gainers: It's been a while, but Financial sector shares are outperforming after the Federal Reserve's stress test results, released late Thursday, showed "large banks are well positioned to weather a severe recession and continue to lend to households and businesses even during a severe recession."

- Banks are outpacing insurance and financial services companies with Wells Fargo +4.2%, Goldman Sachs +3.3%, JP Morgan +3.15% in late trade. Materials and Energy sector shares are next up, buoyed by a wide swath of construction material, container/packaging, chemical and metals/mining stocks.

- Laggers: Communication Services, Consumer Staples and Consumer discretionary stocks lagged. Media and entertainment shares underperformed tele-comm services on the day: Omnicom -1.95%, Google -1.15%, Meta -1.15% and Warner Brothers/Discovery -1.0%.

- The technical bull theme in S&P E-minis remains intact as the recent pullback still appears to be a correction. The latest move lower has allowed an overbought trend condition to unwind. Attention is on initial key support at the 20-day EMA, which intersects at 4370.75. A break of this average would strengthen a short-term bearish theme and signal scope for a deeper pullback. On the upside, the bull trigger is 4493.75, the Jun 16 high.

E-MINI S&P TECHS: (U3) Support Remains Intact

- RES 4: 4556.71 2.382 projection of the May 4 - 19 - 24 price swing

- RES 3: 4532.08 2.236 projection of the May 4 - 19 - 24 price swing

- RES 2: 4530.58 Bull channel top drawn from the Mar 13 low

- RES 1: 4493.75 High Jun 16 and the bull trigger

- PRICE: 4430.00 @ 1515 ET Jun 29

- SUP 1: 4370.75 20-day EMA

- SUP 2: 4288.93 50-day EMA

- SUP 3: 4154.75 Low May 24

- SUP 4: 4098.25 Low May 4 and a key support

A bull theme in S&P E-minis remains intact and the recent pullback still appears to be a correction. The latest move lower has allowed an overbought trend condition to unwind. Attention is on initial key support at the 20-day EMA, which intersects at 4370.75. A break of this average would strengthen a short-term bearish theme and signal scope for a deeper pullback. On the upside, the bull trigger is 4493.75, the Jun 16 high.

COMMODITIES: Gold Bounces After Push Below $1900, Oil Consolidates Prior EIA Jump

- Crude oil is edging gains after what’s been a mixed session full of two-way trading, ultimately consolidating yesterday’s jump on a larger than expected draw on US inventories. Strong US GDP revisions and a surprise drop in initial jobless claims also helped see a bid in risk assets before continued USD strength helped weigh against it.

- WTI is +0.3% at $69.75 with a high of $70.55 not troubling resistance at $72.72 (Jun 21 high).

- Highlighting the two-way trade, highest volumes for CLQ3 options have been in $65/bbl puts (6.2k) and $72/bbl calls (4.1k) at typing.

- Brent is +0.2% at $74.17 also not troubling resistance at $77.24 (Jun 21 high).

- Gold is +0.01% at $1907.54 after a volatile session that saw a low of $1893.22 after the US data before the move below $1900 sparked dip buying that helped spark some potential short covering to drive spot back little changed on the day . The trend still points south though, with the move opening next support at $1885.8 (Mar 15 low).

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 30/06/2023 | 2330/0830 | ** |  | JP | Tokyo CPI |

| 30/06/2023 | 2330/0830 | * |  | JP | labor forcer survey |

| 30/06/2023 | 0130/0930 | *** |  | CN | CFLP Manufacturing PMI |

| 30/06/2023 | 0130/0930 | ** |  | CN | CFLP Non-Manufacturing PMI |

| 30/06/2023 | 0600/0700 | *** |  | UK | GDP Second Estimate |

| 30/06/2023 | 0600/0700 | * |  | UK | Quarterly current account balance |

| 30/06/2023 | 0600/0800 | ** |  | DE | Import/Export Prices |

| 30/06/2023 | 0600/0800 | ** |  | DE | Retail Sales |

| 30/06/2023 | 0630/0830 | ** |  | CH | Retail Sales |

| 30/06/2023 | 0645/0845 | *** |  | FR | HICP (p) |

| 30/06/2023 | 0645/0845 | ** |  | FR | PPI |

| 30/06/2023 | 0645/0845 | ** |  | FR | Consumer Spending |

| 30/06/2023 | 0700/0900 | * |  | CH | KOF Economic Barometer |

| 30/06/2023 | 0755/0955 | ** |  | DE | Unemployment |

| 30/06/2023 | 0900/1100 | *** |  | EU | HICP (p) |

| 30/06/2023 | 0900/1100 | ** |  | EU | Unemployment |

| 30/06/2023 | 1230/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 30/06/2023 | 1230/0830 | ** |  | US | Personal Income and Consumption |

| 30/06/2023 | 1342/0942 | ** |  | US | MNI Chicago PMI |

| 30/06/2023 | 1400/1000 | ** |  | US | U. Mich. Survey of Consumers |

| 30/06/2023 | 1430/1030 | ** |  | CA | BOC Business Outlook Survey |

| 30/06/2023 | 1500/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) | |

| 30/06/2023 | 1600/1200 | *** |  | US | USDA Acreage - NASS |

| 30/06/2023 | 1600/1200 | ** |  | US | USDA GrainStock - NASS |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.