-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Tsy Yields Recede Ahead Fed Powell

- Treasury futures climb to the highest level since February 13 hot CPI read.

- Broad based risk-off ahead day one of Fed Chairman Powell's policy testimony tomorrow.

- Projected rate cuts in second half of 2024 gain momentum.

Treasuries at Pre-CPI Levels Ahead Chairman Powell Policy Testimony

- Treasury futures are broadly higher after the bell, off midmorning highs - yet more than making up for Monday's sell-off. Treasury futures gapped higher, extended session highs after this morning's lower than expected ISM Services Index (52.6 vs. 53.0 est) and Prices Paid (58.6 vs. 62.0 est) -- as well as lower than expected Factory Orders (-3.6% vs. -2.9% est); Ex Trans (-0.8% vs. -0.1% est) data.

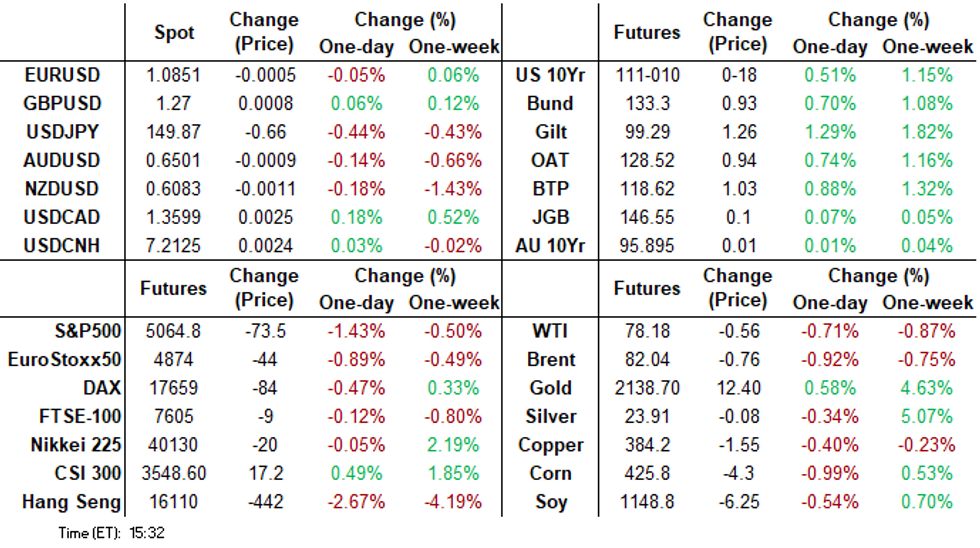

- Jun'24 10Y futures currently +18 at 111-10 vs. 111-15 high, through technical resistance at 111-11.5 (38.2% retracement of the Feb 1 - 23 bear leg), focus on 111-24.5 (High Feb 13). Curves bull flatten: 2s10s -2.578 at -41.656.

- Treasury futures had pared gains briefly after higher than estimated S&P Global US Services PMI final (52.3 vs. 51.4 est) and Composite PMI final (52.5 vs. 51.4 est) data. Otherwise, the balance of data largely in-line: Durable Goods Orders final (-6.2% vs. -6.1% est) Ex Trans (-0.43% vs. -0.3% est), Cap Goods Orders Nondef Ex Air final (0.0% vs. 0.1% prior), Cap Goods Ship Nondef Ex Air final (0.9% vs. 0.8% prior).

- Late markets traded with a broad based risk-off tone ahead Fed Chairman Powell's semi-annual policy testimony to Congress tomorrow and Thursday as well as NFP on Friday.

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00038 to 5.32088 (-0.00174/wk)

- 3M +0.00263 to 5.32639 (-0.00473/wk)

- 6M +0.00698 to 5.25245 (-0.01486/wk)

- 12M +0.02018 to 5.03557 (-0.02097/wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (+0.00), volume: $1.858T

- Broad General Collateral Rate (BGCR): 5.30% (-0.01), volume: $692B

- Tri-Party General Collateral Rate (TGCR): 5.30% (+0.00), volume: $680B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $91B

- Daily Overnight Bank Funding Rate: 5.31% (+0.00), volume: $280B

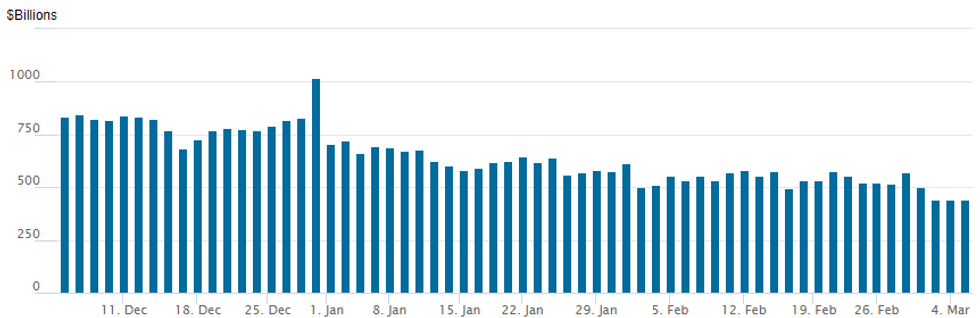

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage rebounds to $444.474B vs. $439.793B Monday -- the lowest since May 2021.

- Meanwhile, the latest number of counterparties slips to 74 from 75 Monday (compares to 65 on January 16, the lowest since July 7, 2021).

SOFR/TEASURY OPTION SUMMARY

SOFR and Treasury option trade remain mixed overnight, modest volumes as traders appear cautious in committing capital ahead Fed Chairman Powell's semi-annual policy testimony to Congress on Wed-Thu and NFP Friday. Projected rate cut pricing are steady to slightly higher vs. late Monday levels: March 2024 chance of 25bp rate cut currently -2.3% w/ cumulative of -0.6bp at 5.323%; May 2024 at -18.6% w/ cumulative -5.2bp at 5.276%; June 2024 -60% from -57.4% late Monday w/ cumulative cut -20.2bp at 5.126%. July'24 cumulative -34.6bp at 4.983%.

- SOFR Options:

- +5,000 0QH4 96.00/96.25 call spds 0.25 over 2QH4 96.56/96.81 call spds

- +60,000 SFRU 96.00/97.00 call spds, 6.5 ref 95.24

- +5,000 SRJ4 94.93/95.00/95.06/95.12 call condors 1.25ref 94.93

- +15,000 SRM4 94.43 puts 1.25 ref 9493

- SRU4 9475/9487/9525p tree -5K @9.25-9 (1 leg, 9523)

- 2,000 SFRM4 94.75/95.12 strangles

- 2,000 3QH4 96.00/96.25/96.37/96.62 call condors ref 96.45

- Block, 6,000 0QM4 97.00 calls, 6.5 vs. 96.11/0.10%

- 5,000 0QJ4 96.12 calls vs. 0QK4 95.75 puts ref 96.075

- 2,000 SFRM4 94.50/95.00 2x1 put spds

- Block, 5,750 SFRZ4 94.62/95.00 2x1 put spds 0.5 ref 95.545

- 4,000 0QH4 95.50/95.62 put spds

- Treasury Options:

- -7,500 TYK4 109.5/113 strangles, 63

- 4,000 TYJ4 112 calls, 24 ref 111-05.5

- 4,000 FVM4 112/112.75/113.5/114.25 call condors ref 107-12.25

- appr -9,000 TYJ4 114.5/115/115.5/116 call condors vs. 106/106.5/107/107.5 put condors 0.0 net

- -12,615 TYJ4 110 puts, 16

- -10,000 wk2 FV 107.5 straddles, 35.5-35.0 followed by +5k at 35.5

- +10,000 TYJ 109/110 put spds, 12

- +7,000 TYJ4 110.5/112 call over risk reversals, 0.0 vs. 111-08/0.66%

- 1,900 TYJ4 106 puts ref 111-05

- 1,600 TYM4 113/115 call spds, 22 ref 111-05

- 1,500 FVJ4 106.75/107.75 strangles ref 107-07.75

- 1,600 TYM4 110/112 call spds ref 110-31

FOREX: US Data Initially Weighs On Greenback As Event Risk Set To Intensify

- US ISM services saw a small miss in February at 52.6 (est. 53.0), however there were more notable misses for prices paid 58.6 (est. 62.0) and employment 48.0 (est. 51.4) which contributed to some downside for the greenback on Tuesday. However, depressed vols and upcoming event risk later in the week stalled any downside momentum, with some weakness for equities also bolstering the USD bounce as we approach the APAC crossover.

- Overall, lower yields in the US have supported the Japanese Yen, with USDJPY (-0.30%) hovering right around the 150.00 mark, but off the 149.71 lows. USDJPY support seen scant into 149.84, but seen stronger into 149.21, last week's low in the pair.

- In similar vein, EUR/USD reversed well off the post-ISM services intraday peak, keeping today's highs at 1.0876 and just short of key resistance and a notable upside level at 1.0888 - the top of the tail of a shooting star pattern printed on Feb 22, which continues to highlight a possible bearish reversal. The tail of the inverted hammer intersected with the 50-dma - a level pierced, but not convincingly broken in Tuesday trade.

- This raises focus on the heavier frequency of risk events this week, with Powell's House/Senate testimonies on Weds/Thurs, the ECB decision on Thurs and the NFP release on Friday.

- A EUR negative, USD positive theme over the next three days would raise focus on 1.0791 - the 50% retracement of the recovery bounce off Feb14's 1.0695. Below here, the bounce would be deemed corrective and could signal a resumption of the over-arching downtrend off the Dec28 high.

- A busier global docket on Wednesday, with Australian GDP kicking things off, followed by the UK budget release. UK construction PMI and Eurozone retail sales also cross. Later in the day, the Bank of Canada decision and US Jolts will accompany the Fed Chair’s testimony.

Expiries for Mar06 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0760(E1.2bln), $1.0800(E1.8bln), $1.0840-50(E2.6bln), $1.0865-75(E4.1bln), $1.0950(E1.8bln)

- USD/JPY: Y149.50($524mln), Y149.80($907mln), Y150.00($684mln), Y150.20-25($800mln), Y151.10($1.1bln)

- AUD/USD: $0.6500-05(A$687mln)

Late Equities Roundup: IT Shares Underperform

- Stocks continue to extend lows in late Tuesday trade as Information Technology and Consumer Discretionary sectors continued to underperform. Currently, DJIA is down 391.53 points (-1%) at 38596.71, S&P E-Minis down 57.25 points (-1.11%) at 5080.75, Nasdaq down 297.7 points (-1.8%) at 15908.05.

- Laggers: While poor China iPhone sales weighed on Apple (-2.86%), they were not the worst performer on the day -- software, services and hardware shares continued to underperform: Intel -5.6%, Qorvo -5.48%, Salesforce -5.43% Intuit -5.35%. Incidentally, chip stocks drew some profit taking after leading Eminis to new contract highs late Tuesday, Nvidia -0.39%, Applied Materials -1.59%. Automakers weighed on the Consumer Discretionary sector for the second day running, led by Tesla again -3.65%, while Ford traded -1.3%, GM -0.89%.

- Leading Gainers: Energy and Consumer Staples sectors outperformed in late trade, oil and gas shares buoyed the former despite crude trading weaker (WTI -0.45 at 78.29): Targa Resources +2.15%, Devon Energy +2.01%, APA +1.95%. Meanwhile, sales and distribution shares supported the Consumer Staples sector, particularly Target +12.31% after beating earnings estimates this morning. Dollar General +3.64%, Dollar Tree +2.64%.

- The earnings cycle has largely run it's course, but there are a few notable names to still announce: Crowdstrike Holdings late Tuesday, Foot Locker Abercrombie & Fitch, Kroger and Burlington Stores Early Wednesday.

E-MINI S&P TECHS: (H4) Corrective Pullback

- RES 4: 5193.61 3.0% Bollinger Band

- RES 3: 5172.19 2.0% 10-dma envelope

- RES 2: 5170.86 2.236 proj of Nov 10 - Dec 1 - 7 price swing

- RES 1: 5157.75 High Mar 1

- PRICE: 5115.00 @ 14:28 GMT Mar 5

- SUP 1: 5045.84 20-day EMA

- SUP 2: 4936.50 Low Feb 13

- SUP 3: 4929.61/4866.00 50-day EMA / Low Jan 31 and key support

- SUP 4: 4808.50 Low Jan 19

The trend condition in S&P E-Minis remains bullish and the contract traded higher Monday. Price action continues to highlight the fact that corrections remain shallow - this is a bullish signal. Support to watch is 5045.84, the 20-day EMA. A clear break of this average would signal potential for a deeper retracement towards 4936.50, the Feb 13 low. For bulls, sights are on 5170.86, a Fibonacci projection. The latest pullback is considered corrective.

COMMODITIES Gold Hits New All-Time High Ahead Of Powell, Crude Slips Further

- Gold is +0.7% at $2129.7 off the earlier, new all-time high of $2141.58. The break of the prior high at $2135.4 (Dec 4) reinforces a bullish condition and signals scope for a climb towards $2177.6 (Fibo proj).

- Today’s gains have been buoyed by lower Treasury yields along with some mild net USD weakness, with gold resilient to the bounce off lows for the latter. TD Securities point to macro funds and momentum buying by commodity trading advisors further contributing.

- WTI heads towards US close trading lower, as economic data from the USA and China continues to draw an uncertain demand picture.

- HSBC forecasts an oil market deficit of above 1mbpd in Q2 and Q3, including the newly announced Russian output cuts and a partial unwinding of OPEC+ cuts starting from July.

- OPEC+ appears more unified for now after the group’s extension of the voluntary output cuts, RBC said in a note. Separately, the OPEC+ alliance aims at price stability in the oil market, not endless price increases, and so far it is succeeding at this, Interfax quoted Putin as saying March 5, cited by Reuters.

- WTI is -0.75% at $78.15 for a modest step closer to support at $76.16 (50-day EMA).

- Brent is -0.9% at $82.05 for a limited step towards support at $80.61 (50-day EMA).

WEDNESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 06/03/2024 | 0030/1130 | *** |  | AU | Quarterly GDP |

| 06/03/2024 | 0700/0800 | ** |  | DE | Trade Balance |

| 06/03/2024 | 0830/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 06/03/2024 | 0930/0930 | ** |  | UK | IHS Markit/CIPS Construction PMI |

| 06/03/2024 | 1000/1100 | ** |  | EU | Retail Sales |

| 06/03/2024 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 06/03/2024 | 1230/1230 |  | UK | Budget Statement | |

| 06/03/2024 | 1315/0815 | *** |  | US | ADP Employment Report |

| 06/03/2024 | 1445/0945 | *** |  | CA | Bank of Canada Policy Decision |

| 06/03/2024 | 1500/1000 | * |  | CA | Ivey PMI |

| 06/03/2024 | 1500/1000 | ** |  | US | Wholesale Trade |

| 06/03/2024 | 1500/1000 | *** |  | US | JOLTS jobs opening level |

| 06/03/2024 | 1500/1000 | *** |  | US | JOLTS quits Rate |

| 06/03/2024 | 1500/1000 |  | US | Fed Chair Jay Powell | |

| 06/03/2024 | 1530/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 06/03/2024 | 1530/1030 |  | CA | BOC Press Conference | |

| 06/03/2024 | 1700/1200 |  | US | San Francisco Fed's Mary Daly | |

| 06/03/2024 | 1900/1400 |  | US | Fed Beige Book | |

| 06/03/2024 | 2115/1615 |  | US | Minneapolis Fed's Neel Kashkari |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.