-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Tsys Back Near Mid April Levels

- MNI WHITE HOUSE: Biden Will Veto Republican Debt Limit Bill

- MNI US: Poll Shows Voters Not Keen On Biden Or Trump Running Again:

- MNI US: ROK: President Yoon- South Korea And US Are Ideal Partners For Friend-shoring

- BOE'S HUW PILL: INFLATION IS MAKING THE UK AS A WHOLE WORSE OFF

- BOE'S HUW PILL: PEOPLE IN UK `NEED TO ACCEPT' THEY'RE POORER

Key Links:MNI INTERVIEW: Community Bankers Say U.S. Already In Recession / MNI US TSY SEC YELLEN: A Default Would Cause An Economic And Financial Catastrophe

US TSYS: Rates Near Mid-Apr/Pre-Retail Sales Highs, 50Bp Dec Rate Cut In Play

- Front month Treasury futures extended session highs in late trade, partially driven by sell-off in stocks, SPX Eminis through 20-day EMA support of 4128.95 to 4097.50 low, just shy of 50-day EMA support at 4086.73.

- Underperforming sectors: Energy, Materials and Industrials continue to lead the sell-off in SPX, Financials near the middle of the pack while shares of First Republic Bank (FRC) falling 50% in late trade.

- Treasury curves bull steepening (2s10s +5.964 at -54.276 as 2s surged 13.5 to 103-15 following today's 2Y auction: 3.969% high yield vs. 3.965% WI; 2.68x bid-to-cover. Implied rate cuts into year end surged back over 50bp for Dec'23, Jan'24 -75bp cumulative.

- The rally in 10s undermines the recent bearish theme with price trading above both the 20- and 50-day EMAs. A continuation higher would signal scope for a climb towards 116-08, the Apr 12 high and expose the key resistance at 117-01+, the Mar 24 high.

- Wednesday Data Calendar, focus on Wholesale/Retail Inv, Durables and Capital Goods. Next legs of the week's Treasury coupon supply with $24B 2Y FRN (91282CGY1, $36B 17W bill auction at 1130ET; $43B 5Y Note auction (91282CHA2) and $45B 17D bill CMB auction at 1300ET.

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.01904 to 4.99648 (+.09650 total last wk)

- 3M +0.01074 to 5.07877 (+.09561 total last wk)

- 6M +0.00233 to 5.09070 (+.14765 total last wk)

- 12M -0.01428 to 4.86300 (+.18392 total last wk)

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00700 to 4.80071%

- 1M +0.00157 to 5.01771%

- 3M +0.02343 to 5.29157% */**

- 6M -0.02814 to 5.40586%

- 12M -0.05471 to 5.37300%

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.26500% on 4/17/23

- Daily Effective Fed Funds Rate: 4.83% volume: $110B

- Daily Overnight Bank Funding Rate: 4.81% volume: $275B

- Secured Overnight Financing Rate (SOFR): 4.80%, $1.298T

- Broad General Collateral Rate (BGCR): 4.77%, $533B

- Tri-Party General Collateral Rate (TGCR): 4.77%, $521B

- (rate, volume levels reflect prior session)

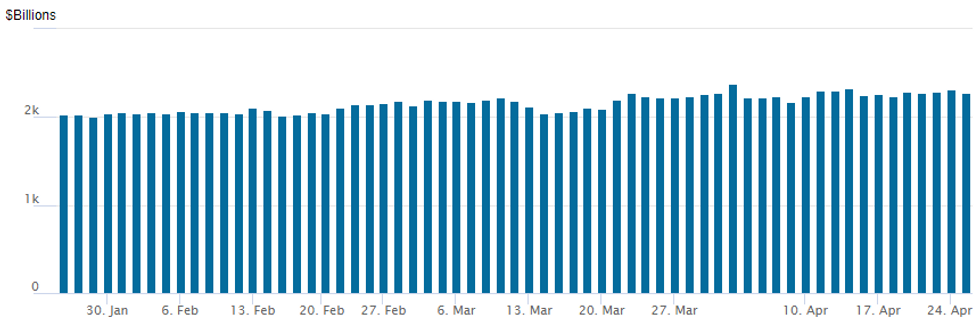

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $2,275.402B w/ 100 counterparties, compares to prior $2,038.538B. Compares to high usage for 2023: $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

SOFR/TREASURY OPTIONS SUMMARY

Trade volumes were much improved Tuesday, option flow gaining momentum as underlying futures continued to extend session highs in the second half (futures volume nearly twice that on Monday's close). Call structures dominated the second half as implied rate hikes in the near term receded, and rate cuts by year end moved back to mid-April levels, Dec'23 just over -51.0bp at 4.370%. Salient trade:- SOFR Options:

- -20,000 SFRZ3 96.50/97.50 1x2 call spds from 1.0-0.50, 2-legs over

- +10,000 SFRZ3 95.75/96.50/97.25 call flys vs. SFRZ 94.00/94.62 put spds, 0.0 net

- Block, 5,000 SFRM4 93.50/94.50/95.50 1x4x2 put fly, 14.5 net ref 96.59

- +2,500 SFRZ3 95.50/96.00/96.50 call flys, 5.0 ref 95.635

- 2,000 SFRN3 94.93/95.12/95.18/95.43 call condors, ref 95.21

- 4,000 SFRK3 95.06/95.18/95.31/95.43 put condors, ref 94.935

- 2,000 OQK3 96.62/96.75/96.87/97.00 call condors ref 96.545

- 2,000 SFRK3 94.87/95.00 put spds vs. SFRK3 95.43 calls ref 94.935

- Block, 12,000 OQM3 95.87/96.25 put spds, 11.0 ref 96.525

- Blocks, total 14,500 OQK3 96.00 puts, 2.5-3.0 ref 96.53 to -.515

- Tsy Options:

- +7,500 TYN3 113-120 call over risk reversal, 13 net ref 116-18

- +31,000 TYM 119.5 calls, 12 ref 115-23.5 to -24

- 2,000 USM3 126/128/130 put flys, 17 ref 132-06

- 2,600 TYM3 117/118/119 call flys, 1 net, ref 115-19.5

- over 5,400 TYM3 117 calls, 32 ref 115-16

- Block, 10,740 wk4 5Y 110.5/111 call spds 4 ref 109-28.5

- Block, 5,000 wk4 5Y 108.25 puts, .5 ref 109-29

- 6,800 FVM3 108.5/109.5 put spds 25.5 ref 109-28.25

- 2,000 TYM3 114.5/116.5 call spds, 56 ref 115-14.5

- 2,500 FVM3 111/112 call spds, ref 109-28.75

- over 8,200 wk4 TY 116 calls, 11 ref 115-14.5

- 7,800 TYM3 116.5 calls, 34-36 ref 115-06.5

- 2,500 TYM3 115 puts, 54 ref 115-12.5

- 1,500 TYM2 117.5/119.5 call spds ref 115-05.5

- 3,000 TYM3 113.5 puts, 25 ref 115-06

EGBs-GILTS CASH CLOSE: Bunds Outperform As Bank Woes Resurface

Bunds outperformed Gilts amid a strong risk-off core FI rally Tuesday, with banking sector concerns returning to market consciousness.

- Cyclical stocks led equities lower, with financials the biggest drag on European indices following poor results by beleaguered US bank First Republic. The German curve bull steepened while the UK's bull flattened.

- Weak Spanish PPI set a bullish tone for bonds, but Bunds' outperformance was helped by a sharp 10bp pullback in ECB peak rate expectations, partly explained as a retracement of a bearish move on hawkish commentary by ECB's Schnabel late in Monday's session.

- BoE pricing retraced slightly less (-5bp), though a dovish move on comments by Chief Econ Pill seemed unwarranted as they were stale (recorded Apr 18, prior to CPI data).

- Despite equity weakness, EGBs held in fairly well, with spreads widening only modestly (Greece worst off, with 10Y GGBs 4.5bp wider to Bunds).

- Wednesday hosts another 2nd tier data slate, but we get the Swedish Riksbank decision (MNI preview here) as well as multiple ECB speakers including Vujcic, Guindos and Herodotou.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 13.2bps at 2.845%, 5-Yr is down 14.5bps at 2.415%, 10-Yr is down 12.4bps at 2.384%, and 30-Yr is down 10.8bps at 2.451%.

- UK: The 2-Yr yield is down 7.1bps at 3.733%, 5-Yr is down 9.3bps at 3.561%, 10-Yr is down 8.6bps at 3.695%, and 30-Yr is down 7.7bps at 4.043%.

- Italian BTP spread up 2bps at 189.2bps / Greek up 4.5bps at 183.4bps

EGB Options: Schatz Downside Features Tuesday

Tuesday's Europe rates / bond options flow included:

- DUM3 104.50p, bought for 7 and 8 in 6k

- ERN3 96.25/96.375/96.50/96.625 c condor, bought for 2 in 7k

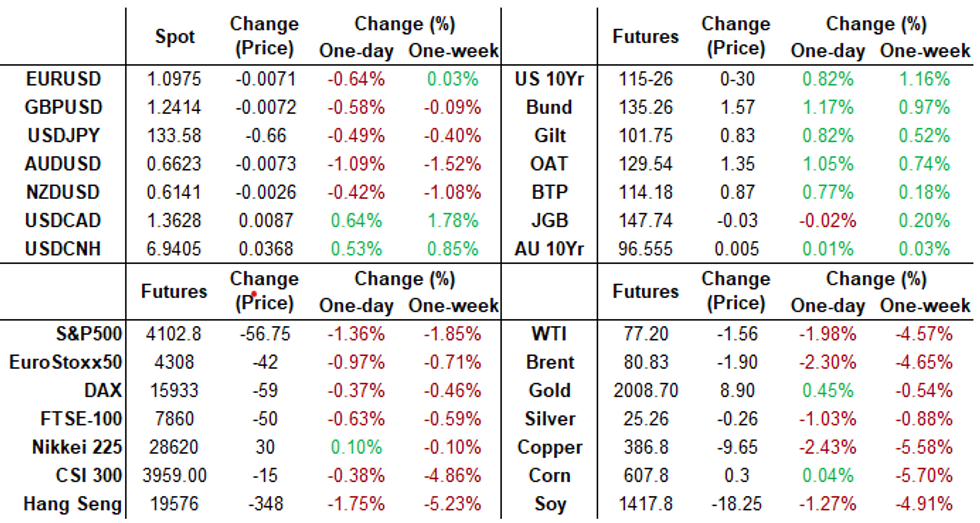

FOREX: Poorer Risk Sentiment Prompts Safe Haven Demand, AUDJPY Slides 1.7%

- Worsening risk sentiment across global markets on Tuesday prompted a flight to quality. Historical safe havens are leading the charge with the USD index rallying half a percent and the Japanese Yen also benefitting.

- The session saw significant pressure on First Republic Bank with shares down as much as 45% at one point which filtered through to major indices. Furthermore, a strong rally for front end treasury futures, increasing bets for FED rate cuts this year, provided an additional JPY tailwind which resulted in AUDJPY registering declines of 1.7% as we approach the APAC crossover.

- With risk-tied AUD faring only behind NOK as the worst performers in G10, it is worth noting that AUDJPY has unwound the majority of the April bounce, significantly narrowing the gap with the month’s lows around 87.60. The move comes ahead of key CPI data due overnight for both March and the first quarter.

- Additionally, for EURJPY, after breaching the 2022 highs on Monday and reaching the highest level since late 2014 overnight at 148.62, the pair registered a 230 pip reversal with EURUSD sinking back below 1.10 heaping on the pressure. Overall, technical conditions remain bullish for the pair and today’s price action may be allowing an overbought condition to unwind. Initial firm support lies at 145.84, the 20-day EMA.

- USD/CNH briefly matched the 200-dma to the upside at 6.9507 – a significant resistance point for the pair. A break above here would be the first since February and open scope for further gains toward mid-March highs of 6.9971. Worsening trade tensions with the US remain a key driver - particularly following weekend reports that the US requested South Korean firms do not backfill chip orders to China should US-listed firms be barred access to China.

- As mentioned, Australian CPI highlights Wednesday’s docket. In the US, March durable goods figures will precede Thursday’s advanced Q1 GDP reading.

FX: Expiries for Apr26 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0835-55(E2.4bln), $1.0900(E2.7bln), $1.0930-50(E4.8bln), $1.0955-60(E1.2bln), $1.0970-75(E1.2bln), $1.1000(E1.5bln), $1.1035-45(E1.7bln)

- USD/JPY: Y130.00($1.1bln), Y132.25-30($585mln), Y133.00($585mln), Y135.00($1bln), Y135.30-50($747mln)

- GBP/USD: $1.2400-10(Gbp670mln)

- AUD/USD: $0.6650-60(A$1.1bln)

- USD/CNY: Cny6.90($558mln), Cny6.9250($553mln)

Equities Roundup: Near Midday Resistance

- Stocks weaker but off second half lows after SPX Eminis breached 20-day EMA support of 4128.95 to 4097.5 low, shy of 4086.73, the 50-day EMA.

- Despite the dip, the trend outlook in S&P E-minis remains bullish with attention on the 4200.00 handle, clearance of this level would resume the uptrend and open 4205.50, Feb 16 high ahead of 4244.00, Feb 2 high and key resistance.

- At the moment, Energy, Materials and Industrial sectors underperforming.

- Salient stocks expected to announce after today's close:

- Alphabet Inc

- Microsoft Corp

- Texas Instruments Inc

- Juniper Networks Inc

- Visa

- Link to MNI's earnings calendar and analysis for the month: REPORT

E-MINI S&P TECHS: (M3) Correction remains In Play

- RES 4: 4244.00 High Feb 2 and a bull trigger

- RES 3: 4223.00 High Feb 14

- RES 2: 4205.50 High Feb 16

- RES 1: 4200.00 Round number resistance

- PRICE: 4101.00 @ 1513ET Apr 25

- SUP 1: 4097.50 Low Apr 25

- SUP 2: 4086.73 50-day EMA

- SUP 3: 3980.75 Low Mar 28

- SUP 4: 3937.00 Low Mar 24

The trend outlook in S&P E-minis remains bullish and the latest move lower is considered corrective. Support to watch lies at 4128.95, the 20-day EMA where a break is required to suggest scope for a deeper pullback - this would expose 4086.73, the 50-day EMA. Attention is on the 4200.00 handle, clearance of this level would resume the uptrend and open 4205.50, Feb 16 high ahead of 4244.00, Feb 2 high and key resistance.

COMMODITIES: Crude Falters On Demand Fears, Gold Resilient To Late USD Pick Up

- Crude oil is down -2% but with most of the day’s losses coming prior to the belated slide in equities and jump in the USD index after headlines that First Republic Bank is considering asset sales of up to $100B.

- Earlier declines were attributed to uncertainty over the US and global economy weighing on future oil demand growth expectations and pressured by a strong US dollar. It saw Brent back below the start of week levels and with time spreads falling back towards the lowest since the start of the month.

- WTI is -2.3% at $76.97, fulfilling bearish outlook as it comes closer to support at $75.83 (Mar 31 high). Further bearish plays headline the session in options space, with most active strikes in the CLM3 at $70/bbl puts.

- Brent is -2.4% at $80.75, moving nearer to support at $79.95 (Mar 31 high).

- Gold is +0.6% at $2000.47 with notable resilience to the stronger US. Resistance remains at $2015.1 (Apr 17 high) whilst it shifts further away from support at $1969.3 (Apr 19 low).

Wednesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 26/04/2023 | 2301/0001 | * |  | UK | XpertHR pay deals for whole economy |

| 26/04/2023 | 0130/1130 | *** |  | AU | CPI inflation |

| 26/04/2023 | 0130/1130 | *** |  | AU | CPI Inflation Monthly |

| 26/04/2023 | 0600/0800 | * |  | DE | GFK Consumer Climate |

| 26/04/2023 | 0600/1400 | ** |  | CN | MNI China Liquidity Suvey |

| 26/04/2023 | 0600/0800 | ** |  | SE | Unemployment |

| 26/04/2023 | 0645/0845 | ** |  | FR | Consumer Sentiment |

| 26/04/2023 | 0730/0930 | ** |  | SE | Riksbank Interest Rate |

| 26/04/2023 | 1000/1100 | ** |  | UK | CBI Distributive Trades |

| 26/04/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 26/04/2023 | 1200/1400 |  | EU | ECB de Guindos Panels Delphi Economic Forum | |

| 26/04/2023 | 1230/0830 | ** |  | US | Durable Goods New Orders |

| 26/04/2023 | 1230/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 26/04/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 26/04/2023 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 26/04/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

| 26/04/2023 | 1730/1330 |  | CA | BOC minutes from last rate meeting |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.