-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: BOJ Tankan: Key Sentiment Rises, Solid Capex Plans

MNI ASIA OPEN: Weak 30Y Reopen, ECB Forward Guidance Weighing

MNI ASIA MARKETS ANALYSIS: Tsys Reverse Early Data Driven Gain

MNI ASIA MARKETS ANALYSIS: Tsys Bear Flatten And EUR Underperforms After PMIs

- Treasuries bear flatten in a move initially driven by front end flow, with the move held after a small tail for the 2Y auction.

- Softer than expected European and US preliminary PMIs for July provide a softer growth outlook, going against some potential China stimulus judging by Politburo headlines.

- The weak PMIs saw the euro underperform on the day, especially to commodity-tied peers with oil seeing solid gains on further supply tightness and with technical resistance levels cleared.

- German IFO data marks the highlight of the European docket on Tuesday before consumer confidence and Richmond manufacturing data in the US. All eyes will then be on Australian CPI Wednesday and especially the FOMC July decision & press conference.

US TSYS: Flow-Led Bear Flattening With 2024 Rate Cuts Also Trimmed

- Cash Tsys head towards the end of the session with a bear flattening as the front end underperforms in a move that was kickstarted by sizeable flow just before 1200ET with an almost 43k block in TUU3.

- Some of those losses were pared heading into the 2Y auction, which saw a small tail with details generally stronger than the five-auction average but weaker than June’s, before some two-way trade which leaves 2YY +5.2bps and 10YY +1.8bps.

- Today’s limited data has helped the flattening at the margin, with continued service price pressures in the S&P Global US preliminary PMI along with softer than expected business activity. Weaker activity was also seen in European PMIs which has helped counter some potential impetus from China stimulus.

- The long-end sell-off has been further limited by technicals, with TYU3 setting a low of 111-31+ as it probed support at 112-00 (Jul 20 low), with cumulative volumes still lagging at currently just shy of 1M. A more concerted push could open 111-22+ (50% retrace of Jul 7-18 rally) after which lies 111-11 (61.8% retrace of the same move).

- Fed implied rates only creep up 0.5bp for the next two meetings coming so close to Wednesday’s decision (+24.5bp priced). There have been larger increases further out though with the Nov terminal now seen after a cumulative +34.5bps (+1.5bp) and 2024 cuts trimmed with 59bp from terminal to Jun’24 (from 62bp) and 132bp from terminal to Dec’24 (from 137bp).

EGBs-GILTS CASH CLOSE: Weak PMIs Give ECB Something To Ponder

European FI closed Monday stronger though off the best levels seen earlier in the session after weaker-than-expected European PMIs.

- Bunds held on to most of their early gains triggered after flash July French PMIs provided the initial indication that overall Eurozone PMIs would miss expectations to the downside, with manufacturing heading even deeper into contraction and the services sector starting to fade quickly. UK PMIs proved poor as well.

- Coming ahead of Thursday's ECB decision and communications, the data delivered a signal of slowing price pressures alongside weaker demand.

- The German short end/belly held gains with yields down almost 5bp on the day. Gilts underperformed, with the early rally fading over the course of the session amid China stimulus speculation and a mixed US PMI reading.

- An early widening in periphery EGB spreads - after the weekend's Spanish election delivered a hung parliament - faded over the course of the session.

- The early highlight of Tuesday's schedule is German IFO.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 4.8bps at 3.045%, 5-Yr is down 4.8bps at 2.506%, 10-Yr is down 4.4bps at 2.425%, and 30-Yr is down 1.2bps at 2.476%.

- UK: The 2-Yr yield is down 1.7bps at 4.938%, 5-Yr is down 2.8bps at 4.343%, 10-Yr is down 2.4bps at 4.256%, and 30-Yr is down 0.8bps at 4.421%.

- Italian BTP spread down 0.9bps at 160bps / Spanish up 0.4bps at 101.3bps

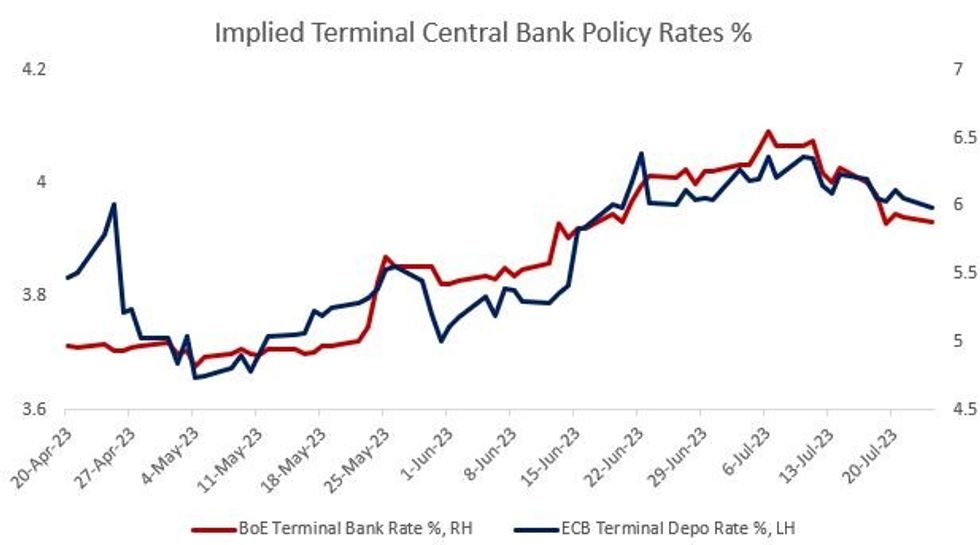

EU STIR: Weak PMIs Pull Down ECB / BoE Terminal Hike Pricing

ECB and BoE terminal hike pricing are set for their lowest closes in - respectively - 26 and 3 sessions, as weak European PMIs out Monday pointed to diminishing demand and price pressures.

- ECB terminal depo Rate pricing -1.6bp to 3.96% (46bp of further hikes left in the cycle to Dec 2023). While a 25bp hike this Thursday is all but assured (over 96% implied), conviction for tightening beyond July is waning after today's weak PMIs, with peak pricing closing at the lowest levels since June 16th. 39bp is priced through September's meeting, suggesting little better than 55% odds of a follow-up 25bp hike.

- BoE terminal Bank Rate pricing -4.1bp to 5.88% (88bp of further hikes left in the cycle to Feb 2024). Peak pricing remained below 6% for the 4th consecutive session, falling to the lowest close since last Wednesday. Aug MPC pricing sits at 35bp, suggesting around 40% probability of a 50bp as opposed to 25bp hike. 62bp is cumulatively priced through September.

FOREX: EUR Underperforms Amid Weak PMIs, China Politburo Stokes Broader Optimism

- The single currency underperforms all others in G10 on Monday following a softer-than-expected set of flash PMI figures. Manufacturing was a particular weakpoint, with Germany's figures the standout. Germany's July flash manufacturing PMI fell to 38.8 vs. Exp. 41.0 (Prev. 40.6) – pulling down ECB terminal hike pricing and prompting broad Euro weakness

- EURUSD slipped to a low of 1.1066 in Europe, the lowest level since Jul12, narrowing the gap with key support at 1.1055, the 50% retracement for the early July upleg. Price spent the majority of the US session consolidating around the 1.1075 mark.

- More notable was the weakness for Euro crosses, with the likes of EURNZD and EURCAD dropping as much as 1% on the session. These moves have been spurred on by details emerging from the heavily anticipated China Politburo meeting, from which an optimistic tone has resulted.

- The Politburo noted that it will enact a plan to resolve local government debt risks alongside strengthening counter-cyclical adjustments, as well as increasing support for the property market and actively boost domestic demand.

- GBP was the other laggard on the session with some similarly disappointing data to its European counterparts. Cable printed as low as 1.2798 before moderately improving ahead of the APAC crossover. A lower close today would be the seventh consecutive lower close for the pair - a losing streak last equalled in August last year. Attention will be on the 50-day EMA which intersects at 1.2714.

- German IFO data marks the highlight of the European docket on Tuesday before consumer confidence and Richmond manufacturing data in the US. All eyes will then be on Australian CPI Wednesday and the FOMC July decision & press conference.

EU FI OPTIONS: Multiple Call Structures In Rates Feature Monday

Monday's Europe rates/bond options flow included:

- ERU4 96.50^ bought for 100 in 750

- ERU4 95.50 put sold at 12.5 in 4k

- ERU3 96.25/96.37/96.50c fly, bought for 1 in 2.5k

- ERU3 96.25/96.375 call spread paper paid 1.25 on 8K

- ERU3 96.25/96.12/96.00/95.75p condor, sold at 6.25 in 3k straight and 6.5 in 7k vs 96.12

- ERV3/ERX3/ERZ3 96.25/96.37/96.50c fly strip, bought for 4 in 3k

- SFIZ3 94.10/94.25/94.65/95.00 broken call condor bought for 1.5 in 4k

US STOCKS: Energy And Bank Stocks Lead Gains, Solid Earnings Docket Tomorrow

- The S&P e-mini holds most of its gains, currently +0.5% and within 4 pts of its latest high of 4592.50.

- SPX gains are led by energy (+2.1%) after another strong day for WTI futures on tighter supply and potential stimulus in China following the Politburo meeting. Financials follow (+1.1%) driven by a strong day for banks (+2.2%) with the separate KBW indicating regionals are outperforming at +2.5% for fresh highs since Mar 10.

- Earnings: This week is the busiest of the quarter, with 35% of the S&P 500's market cap set to report. Tomorrow’s highlights include Microsoft, Alphabet and Visa. See our earnings calendar here: https://roar-assets-auto.rbl.ms/files/54818/MNIUSEARNINGS240723.pdf.

- Th S&P 500 e-mini contract is trading below last week's high of 4,609.25. A clear channel breakout of a bull channel interesting at 4616.73 is required to strengthen bullish conditions and open the March 29 '22 high at 4,631.00. A corrective pullback would initially target the 20-day EMA at 4,498.10 for support.

COMMODITIES: Crude Oil Clears Resistance Levels On Twin Supply and Demand Boost

- WTI has seen further solid gains today from a combination of tighter supply and potential stimulus in China following the long-awaited Politburo meeting.

- On the supply side: Saudi and Russia are showing signs of the pledge supply cuts while Kazakhstan’s daily oil production fell to 1.67mbbl on July 23 from 1.78m bbl on July 20 according to ministry data. The reason for the current drop is not apparent but follows a reduction due to power cuts earlier in the month.

- Further, flow from Nigeria’s Forcados oil terminal has been halted since July 12 due to a leak at the facility with repair work reported late last week expected to take between five and 10 days.

- WTI is +2.3% at $78.85 having cleared $77.38 (76.4% retrace of Apr 12 – May 4 bear leg) and $78.10 (Apr 24 high) to open $80.05 (Apr 18 high).

- Brent is +2.2% at $82.85 having cleared both $81.75 (Jul 13 high) and $82.06 (76.4% retrace of Apr 12 – May 4 bear leg) to open $83.77 (Apr 19 high).

- Gold is -0.3% at $1955.52, yielding earlier gains as USD strength built and Treasury yields climbed through the session. It pushes it closer to support at $1949.6 (50-day EMA)

FED: All Analysts See A July Hike, But Opinions Start To Diverge On Cuts

From the Analyst Views update of our updated July FOMC preview:

- All 29 analysts whose previews MNI read ahead of the July FOMC meeting expect a 25bp hike.

- Minority Expect Further Hikes: 4 of those 29 said they expect a further hike this year beyond July to represent the last of the cycle: BofA, CIBC, and Mizuho see a 25bp hike in September, with Citi looking for a November raise. That said, most analysts see risks to the upside on rate hikes this year.

- Increasing Focus On Cuts: There is increasing focus on the Fed’s next steps, expectations for which center on a pause until early 2024 before beginning to lower rates.

- Most analysts see cuts beginning in H1 2024, split roughly between Q1 and Q2. One or two see cuts beginning in H2 2024, with many having low conviction on timing.

- The earliest expected cuts are for late 2023 (NatWest, UBS).

BOC: Most Analysts See BoC Having Peaked, First Cut April 2024

- The Bloomberg survey of analysts shows that a clear majority expect rates to have peaked at 5% this year (taken July 14-19 in the week following the latest 25bp hike to 5%).

- The exceptions are CIBC and PNC looking for a 25bp hike in September and GS and JPM looking for a 25bp hike in October.

- The median response sees the first cut coming in Apr’24 with only two responses coming earlier in March, whilst CIBC gets another mention in that they also pencil in the lowest rate come Oct’24 at 3.50%.

FED: RRP Uptake Unchanged From Friday Despite Estimated GSE Withdrawal

- Reverse repo operation usage held exactly the same as Friday at $1771B with an unchanged 99 counterparties.

- Some had been looking for a continued step lower as cash from GSEs exited funding markets and with further heavy T-bill supply, although that could continue to emerge over the next couple days.

- As it is, usage continues to see a clear trend decline despite being $54B off the Jul 18 low of $1717B.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.