-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS:US Back From Holiday, Decent 2Y Sale

- MNI US: US Extends China Tariff Exclusion Deadline

- APPLE APPEALS ITC BAN ON SALES OF WATCHES, Bbg

- Japan Plans Monopoly Rules Targeting Apple, Google, Nikkei, Bbg

- Fed Likely to End Term Funding Program in March, Wrightson, Bbg

- Bristol-Myers Squibb to Acquire RayzeBio in All-Cash $4.1 Billion Deal, MT

- Iran Triples Production of Uranium Enriched Near Weapons Grade, Bbg

Key Links: US Treasury Auction Calendar

2024 Projected Rate Cuts Moderate Slightly

- Tsys hold firm, inside relatively narrow session range by Tuesday's close. March'24 10Y futures (TYH4) currently +2 at 112-21 vs. 112-24 intraday high on very light volume (TYH4 350k) with European exchanges closed for Boxing Day holiday. Initial technical resistance above at 113-04.5 (Dec 21 high), followed by 113-12+, a Fibonacci projection point. Key short-term support is at 109-31+, the Dec 11 low. Initial firm support is at 111-09+, the Dec 7 high.

- Limited reaction, if any after FHFA House Price Index comes in weaker than expected at +0.3% (+0.5% est), S&P CoreLogic CS mildly stronger than expected for MoM (0.64% vs. 0.60% est; YoY 4.87% vs. 4.85% est.).

- Tsy futures bounce (TYH4 +2 at 112-21, FVH4 steady) after the $57B 2Y note auction (91282CJS1) trades through: 4.314% high yield vs. 4.320% WI; 2.68x bid-to-cover vs. 2.54x prior.

- Indirect take-up climbed back to 61.85% vs. 57.38% prior (5-auction average of 65.2%), directs took 19.51% vs. 23.86% last month (20.05% 5-auction average), primary dealer take-up 18.63%

- Projected rate cuts for early 2024 holding steady to mildly softer vs. Friday with short end futures weaker: January 2024 cumulative -3.8bp at 5.290%, March 2024 chance of rate cut -81.4% vs. -90.1% late Friday w/ cumulative of -24.1bp at 5.087%, May 2024 pricing in a full 25bp cut with cumulative -49.8bp at 4.829%, June'24 cumulative -75.8bp at 4.570%. Fed terminal at 5.325% in Jan'24.

- Wednesday Data Calendar: Richmond, Dallas Fed Data; 2Y FRN and 5Y Note Sales

FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00158 to 5.35694 (-0.00039 total last wk)

- 3M -0.00320 to 5.34791 (-0.01288 total last wk)

- 6M -0.01052 to 5.17674 (-0.03260 total last wk)

- 12M -0.02256 to 4.77613 (-0.05926 total last wk)

- Secured Overnight Financing Rate (SOFR): 5.32% (+0.01), volume: $1.667T

- Broad General Collateral Rate (BGCR): 5.30% (+0.00), volume: $631B

- Tri-Party General Collateral Rate (TGCR): 5.30% (+0.00), volume: $620B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $90B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $234B

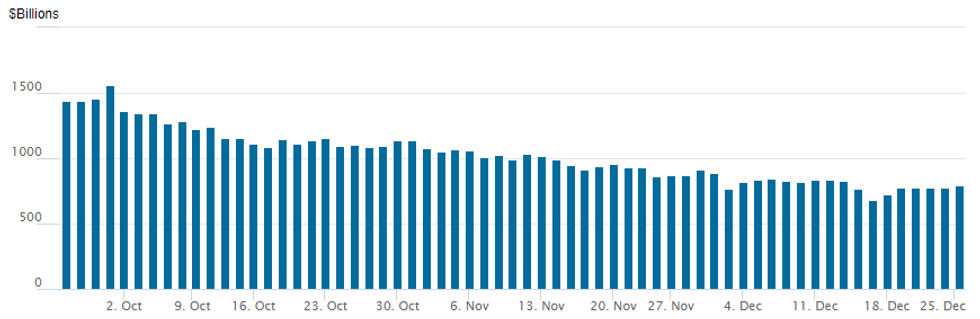

RRP USAGE

NY Federal Reserve/MNI

- RRP usage rebounds to $793.937B from $772.285B in the prior session, compares December 15 when usage fell to the lowest level since mid-June 2021: $683.254B.

- The number of counterparties inched up to 86 from 85 in the prior session.

SOFR/TREASURY OPTION SUMMARY

SOFR Options:

+4,000 SFRM4 97.00/98.37 call spds, 3.25

+2,000 SFRF4 94.87/95.06/95.25 call flys, 7.0

+2,500 SFRH4 95.12/95.43/95.75 call trees, 0.25

Treasury Options:

+3,000 wk5 US 122.5/125 call over risk reversals, 6-11 (expire Friday)

EGBS

European markets closed for Boxing Day holiday.

FOREX

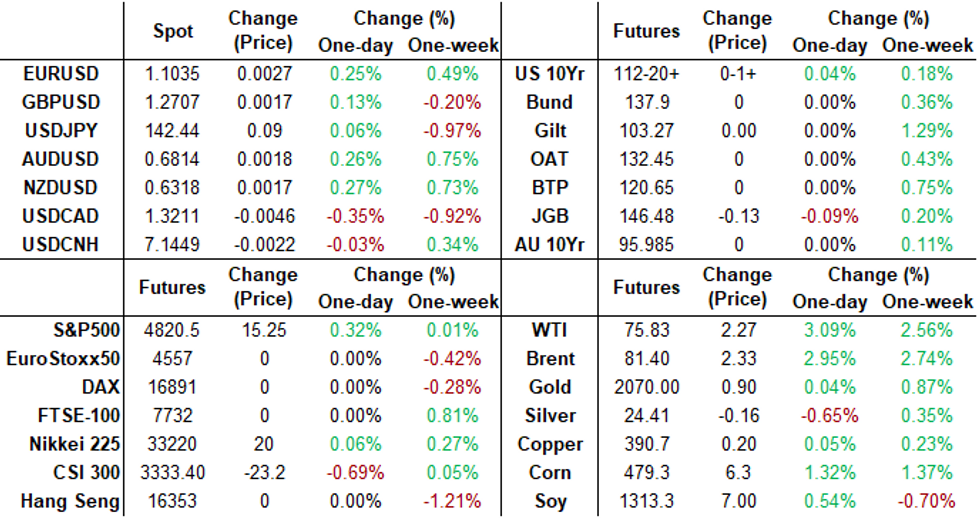

- EURUSD up 0.0035 (0.32%) at 1.1044

- USDJPY up 0.09 (0.06%) at 142.46

Late Equities Roundup: Extending Highs, Utilities Displace IT Shares

- Stocks gradually extending highs in late Monday trade, S&P eminis closing in on last Wednesday's high of 4830.75, Energy and Utility sectors outperforming. At the moment: DJIA trades up 178.79 points (0.48%) at 37565, S&P E-Mini futures up 20.25 points (0.42%) at 4826, Nasdaq up 78.1 points (0.5%) at 15071.66.

- Leading gainers: Energy and Utility sector shares, the latter outpacing Information Technology stocks in the second half. Equipment and services shares continue to support the Energy sector: Baker Hughes +1.96%, Schlumberger and Haliburton both +1.67%. Independent power stocks buoyed the Utility sector: Edison Int +3.01%, Constellation Energy +2.06%, NRG Energy +1.95%.

- Incidentally, semiconductor stocks still buoyed IT: Intel +4.78%, Monolithic Power +3.31%, AMD +2.27%, while shares of Apple continued to recede after ITC supports ban of Apple watch ban.

- Laggers: Communication Services and Health Care stocks led laggers in late trade, media and entertainment weighing on the former: Take Two -0.32%, Electronic Arts -0.26%, Comcast -0.15%. Pharmaceutical and biotech shares weighing on the former: Bristol-Myers Squibb -1.53% after announcing $4.1B to purchase radiopharmaceutical therapeutics company RayzeBio (RYZB) earlier in the day.

E-MINI S&P TECHS: (H4) Trend Direction Remains Up

- RES 4: 4915.11 1.236 proj of Nov 10 - Dec 1 - 7 price swing

- RES 3: 4900.00 Round number resistance

- RES 2: 4854.75 1.00 proj of Nov 10 - Dec 1 - 7 price swing

- RES 1: 4830.75 High Dec 20

- PRICE: 4826.00 @ 1520 ET Dec 26

- SUP 1: 4743.25 Low Dec 20

- SUP 2: 4692.70 20-day EMA

- SUP 3: 4594.00 Low Nov 30

- SUP 4: 4591.56 50-day EMA

A bullish theme in S&P e-minis remains intact and Wednesday’s abrupt sell-off appears to be a correction. This week’s fresh trend highs, confirm once again a resumption of the uptrend that started Oct 27. The contract has recently cleared resistance at 4738.50, the Jul 27 high, reinforcing current positive trend conditions. Sights are on 4854.75 next, a Fibonacci projection. On the downside, initial firm support lies at 4692.70, the 20-day EMA.

COMMODITIES

- WTI Crude Oil (front-month) up $1.9 (2.58%) at $75.47

- Gold is up $10.74 (0.52%) at $2061.95

WEDNESDAY DATA CALENDAR

- US Data/Speaker Calendar (prior, estimate)

- Dec-27 1000 Richmond Fed Mfg Index (-5, --)

- Dec-27 1000 Richmond Fed Business Conditions (-9, --)

- Dec-27 1030 Dallas Fed Services Activity (-11.6, --)

- Dec-27 1130 US Tsy 17W Bill and $70B 42D CMB Bill auctions

- Dec-27 1300 US Tsy $26B 2Y FRN Note and $58B 5Y Note auctions

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.