-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN - Lawmakers Move to Impeach South Korea President

MNI China Daily Summary: Wednesday, Dec 4

MNI ASIA MARKETS ANALYSIS: US Inflation Metrics Ease

HIGHLIGHTS

- FED BARKIN SAYS INFLATION TOO HIGH AND FED STILL HAS WORK TO DO, Bbg

- FED HARKER: SIGNS INFLATION COOLING, SEE CORE DOWN TO 3.5% IN 2023, Bbg

- FED HARKER: NOT FORECASTING A RECESSION, EXPECT 1% 2023 GDP GROWTH, Bbg

- MNI NATO: Sweden-Finland NATO Bids In Doubt As Sweden Reject Turkish Extradition Requests

- MNI US: Biden "Documents" Case Provides Political Capital For GOP Investigations

Key links: MNI POLICY: BOJ Eyes Maturities As Yield Pressure Persists / MNI: Fed's Harker Endorses 'A Few More' 25bp Rate Hikes / MNI BRIEF: Bullard Favors Getting To Low-5% Fed Rate Quickly / MNI BRIEF: BOE Mann Sees Strong Underlying Inflation Dynamics / INVITATION: MNI Webcast With ECB's Klaas Knot On Feb 8

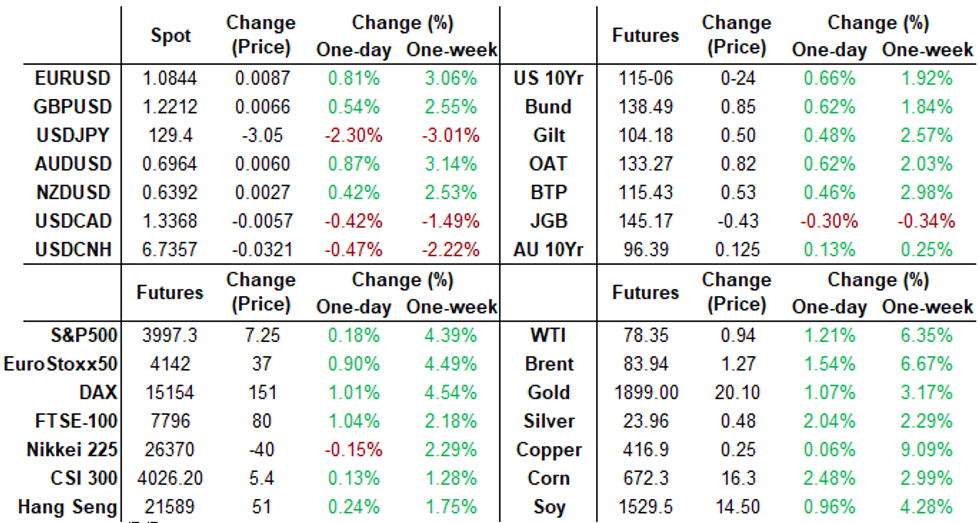

US TSYS: CPI Continues to Moderate

Tsys futures firmer across the board, trading sideways after extending session highs following decent 30Y Bond auction re-open: 2.2bp tail: 3.585% high yield vs. 3.607% WI; 2.45x bid-to-cover vs. 2.25x prior month.

- Post CPI-data volatility saw futures initially gap lower (30YY tapped 3.7201% high), reversing move nearly as quickly on in-line CPI read. U.S. price pressures continued to moderate in December as CPI fell 0.1% in the month and core CPI rose 0.3%, bringing the year-over-year rates to 6.5% and 5.7%, respectively, and matching market expectations.

- Headline CPI hit its lowest since October 2021 and should keep the Federal Reserve on track to end rate hikes early this year.

- Yield curves see-sawed off early lows but finished flatter. Fed speak: Philly Fed President Patrick Harker said Thursday that few more quarter-point increases this year should bring the Federal Reserve's benchmark overnight interest rate to a sufficiently high level to slow the economy and inflation.

- Discounting Fed Bullard: favors getting to above 5% rates as soon as possible but it may not be critical how the Fed gets rates to destination. Will need to keep rates high enough to cool prices. Fed Barkin reiterated Fed still has work to do to contain high inflation.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00015 to 4.31314% (-0.00029/wk)

- 1M +0.03557 to 4.45900% (+0.05743/wk)

- 3M +0.01471 to 4.82971% (+0.01985/wk)*/**

- 6M +0.00171 to 5.12971% (-0.06729/wk)

- 12M -0.00843 to 5.40914% (-0.14983/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.82971% on 1/12/23

- Daily Effective Fed Funds Rate: 4.33% volume: $110B

- Daily Overnight Bank Funding Rate: 4.32% volume: $291B

- Secured Overnight Financing Rate (SOFR): 4.30%, $1.142T

- Broad General Collateral Rate (BGCR): 4.27%, $448B

- Tri-Party General Collateral Rate (TGCR): 4.27%, $413B

- (rate, volume levels reflect prior session)

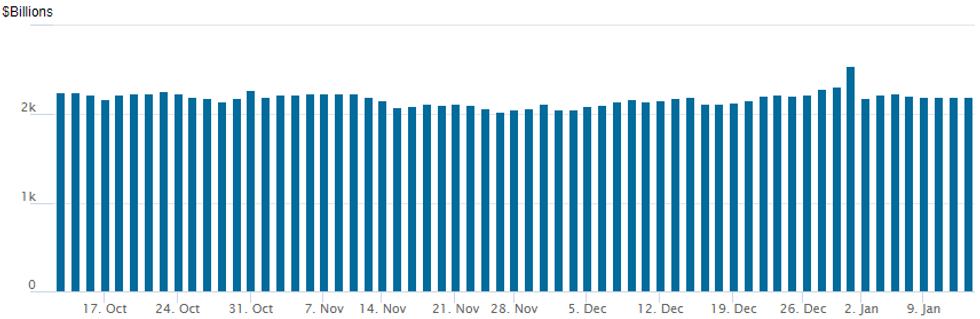

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,202.989B w/ 101 counterparties vs. prior session's $2.199.170B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Robust volumes on mixed trade Thursday - fading the eventual post-CPI rally, put volumes gained in the second half. Note: Wed's heavy call spd buying appear to be all new/openers: +100,000 SFRZ3 98.00/98.50 call spds, 1.5 ref 95.63; 6,239 SFRG3 95.18/95.43 4x5 call spds, 13.0 vs. 95.115/100%; +30k+ SFRF3 95.12/95.18/95.25 call flys, 1.75-2.0. Large 45k SFRZ3 futures block sees OI gain 57k.- SOFR Options:

- Block, total 20,000 SFRM3 94.93/95.31 2x1 put spds, 15.5

- 5,000 SFRH3 95.37/95.50/95.62 call trees ref 95.15

- Block, 2,500 SFRG3 95.06/95.18/95.25 broken put flys, 0.5 ref 95.15

- Block, 10,000 OQH3 95.50/95.75 put spds, 3.5 vs. 96.235/0.10%

- +5,000 SFRH3 95.18/95.31/95.43 call flys, 3

- +5,000 SFRM3 94.81/95.06/95.31 call flys, 7

- Block, 4,000 SFRZ3 96.25/96.75 call spds, 9.5 vs. 95.745/0.12%

- 2,500 SFRU 95.00/95.50/96.00 call flys, ref 95.27

- 10,000 SFRH3 95.12/95.18/95.25/95.37 call condors ref 95.12

- 6,700 SFRF3 95.18 calls, 1.75 ref 95.12 -.115

- 4,500 SFRM3 94.50/94.62 put spds ref 95.085

- 8,000 SFRG3 94.87/95.00 put spds, ref 95.12

- 4,000 SFRK3 94.93 puts, ref 95.08

- 1,200 SFRG3/SFRH3 95.12 straddle spd

- 5,250 SFRG3 95.00/95.12 put spds, ref 95.12

- Block, 6,000 SFRK3 94.81/94.93/95.06 put flys, 2.75

- Block, 14,000 SFRK3 94.81/94.93/95.06 put flys 0.5-.75 over 95.62 calls

- 5,000 SFRH3 95.25/95.31/95.37 call trees ref 95.12

- Block, 10,000 SFRU3 94.75/94.87/95.00 put flys, 1.5 vs. 95.255/0.05%

- 4,000 SFRH3 95.18/95.25 call spds, ref 95.115

- Treasury Options:

- 48,300 Wk2 TY 114 puts 1 ref 115-09.5 (expire Friday)

- Block, 7,500 TYG3 115/116 1x3 call spds, 8 net. 3leg over ref 114-31.5

- 9,500 TYG3 116 calls, 13, total volume>20.8k ref 114-28

- 2,000 FVG 108/108.5 put spds, 6.5 ref 109-25.5

- Block, 40,000 FVH 110.5/111 call spds, 8.5 ref 109-16.75 to -17

- 2,500 TYG3 114.25/115.25/116.25 call flys

- 4,000 TYG3 111.75/113 put spds, 9 ref 114-17.5

- 3,800 TYH3 116.5/117.5 call spds, 10 ref 114-17

- 3,300 FVH3 106 puts, 4

- 3,000 TUH3 103.12/103.37 call spds, ref 102-27.75

- 10,000 TYG3 111 puts, 2 ref 114-16.5

EGBs-GILTS CASH CLOSE: Post-US CPI Gains Fade

Bunds and Gilts pared gains made immediately after the highly-anticipated US CPI report came exactly in line with expectations, though finished stronger on the session, with curve bellies outperforming.

- After the CPI release, 10Y Bund yields dipped below 2.10% with Gilts dropping below 3.30%, both reaching those levels for the first time since mid Dec.

- 10Y BTP spreads hit the tightest vs Bunds (177.3bp) since April 2022, 5+bp narrower at one point, before reversing course and finishing slightly wider.

- While US rate hike expectations faded, ECB pricing remained resilient and even ticked higher post-CPI, with some attributing the move to a media report citing sources saying growth resilience favours hawkish policy.

- Conversely, Gilts outperformed as under 100bp of further BoE hikes are now expected over the course of the cycle - no particular catalyst Thursday.

- Friday morning begins with UK GDP data.

ECB Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 2.9bps at 2.559%, 5-Yr is down 4.3bps at 2.179%, 10-Yr is down 4.5bps at 2.159%, and 30-Yr is down 3bps at 2.109%.

- UK: The 2-Yr yield is down 9.2bps at 3.438%, 5-Yr is down 9.6bps at 3.239%, 10-Yr is down 7.5bps at 3.334%, and 30-Yr is down 6.2bps at 3.694%.

- Italian BTP spread up 1bps at 184.1bps / Spanish up 0.2bps at 98.6bps

EGB Options: Mixed Trade, Mostly Pre-US CPI

Thursday's Europe rates / bond options flow included:

- RXG3 132/131ps bought for 2 in 10k total

- RXG3 136.5/134.5/133 broken put fly bought for 28/28.5 in 4k

- RXH3 134/131ps 1x2, bought for average of 16.5 up to 17.5 in 12k

- RXH3 127.00p, bought for 5 in 6k

- ERG3 96.87/97.00/97.12c fly 1x2x3, bought for 1.5 in 7.5k

FOREX: Greenback Resumes Downtrend Post CPI, JPY Surges

- US inflation data came alongside expectations and despite a predictably volatile trading session the USD index is ending with 0.85% losses for the day as the confirmation of disinflation on the month has given USD bears the green light to resume selling pressure.

- Gains across the rest of G10 have been broad based but the focus has been on the significant strength for the Japanese Yen. Hawkish rhetoric had prompted a substantial move lower for USDJPY (-2.40%) before the US data release, however, the pair then resumed its sharp downward trajectory, breaking multiple support levels through Thursday’s trading session.

- Price has now traded through the bear trigger at 129.52 and printed a fresh low of 128.87 in late US hours. Markets will be paying close attention for a daily close below the bear trigger to confirm a possible head and shoulders pattern drawn from early June 2022.

- Additionally, moving average patterns could add further weight, with the 50- and 200-dmas on the cusp of forming a bearish death cross. Support seen scant until 128.44, the 1.236 proj of the Oct 31 - Nov 15 - 21 price swing.

- Elsewhere, both EUR and AUD are showing gains of around 1%, with the single currency continuing to trade in buoyant fashion, extending trend highs above key short-term resistance and the 1.08 mark in tandem. The break higher reinforces the bull trend condition and next targets 1.0913, the 2.764 projection of the Sep 28 - Oct 4 - Oct 13 price swing.

- A much quieter docket on Friday with UK growth data, Eurozone IP and US Uni of Michigan sentiment figures the main highlights approaching the week’s close.

FX: Expiries for Jan13 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0500(E1.5bln), $1.0600(E1.8bln), $1.0645-60(E2.0bln), $1.0670-80(E2.6bln), $1.0685-00(E2.3bln), $1.0750(E2.4bln), $1.0770-75(E1.2bln), $1.0800(E1.5bln), $1.0820-25(E740mln), $1.0850(E1.5bln)

- GBP/USD: $1.2000(Gbp1.1bln)

- EUR/GBP: Gbp0.8900(E791mln)

- USD/JPY: Y131.00($597mln), Y131.95-00($776mln), Y133.85-00($1.0bln), Y134.40($542mln)

- AUD/USD: $0.6950(A$1.5bln), $0.7000(A$1.3bln), $0.7125(A$1.9bln)

- USD/CAD: C$1.3295-05($560mln)

Late Equity Roundup: Near Highs, Energy, Comm Services Outperform

Major indexes look to finish Thursday on positive footing, near top end rather narrow range after some post CPI-data volatility. Energy and Communication Services sectors outperforming weaker Consumer Staples and Health Care names. SPX eminis currently trades +21.25 (0.53%) at 4011.25; DJIA +268.78 (0.79%) at 34235.67; Nasdaq +75.4 (0.7%) at 11005.18.

- SPX leading/lagging sectors: Energy sector outperformed (+2.22%) w/ crude prices stronger (WTI +1.15), energy equipment and services names leading O&G refiners (HAL +3.05%; VLO +0.99%). Communication Services a distant second (+1.05%) w/ media/entertainment names gaining (WBD +4.84%, DIS +4.05%, NFLX +1.18%).

- Laggers: Second consecutive session of weaker trade (but off lows), Consumer Staples (-0.44%) and Health Care (-0.27%) sectors. Pharmaceuticals and biotech shares underperforming (TECH -4.20%, ILMN -4.69%).

- Dow Industrials Leaders/Laggers: In-line with energy equipment/servicer gains, Caterpillar (CAT) +5.38 to 256.11, Boeing (BA) +5.90 at 213.93, Honeywell (HON) +4.18 at 216.48. Laggers: Amgen (AMGN) continued to trade weaker, -2.11 at 270.80, McDonalds (MCD) -1.30 at 267.51, Walmart (WMT) -0.91 at 145.22.

E-MINI S&P (H3): Bullish Focus

- RES 4: 4194.25 High Sep 13

- RES 3: 4180.00 High Dec 13 and the bull trigger

- RES 2: 4043.00 High Dec 15

- RES 1: 4021.50 Round number resistance

- PRICE: 3985.75 @ 14:35 GMT Jan 12

- SUP 1: 3891.50 Low Jan 10

- SUP 2: 3788.50/78.45 Low Dec 22 / 61.8% of Oct 13-Dec 13 uptrend

- SUP 3: 3735.00 Low Nov 3

- SUP 4: 3670.00 76.4% retracement of the Oct 13 - Dec 13 uptrend

S&P E-Minis have traded higher again today although price is off earlier highs. The contract has cleared resistance at the 50-day EMA and this has strengthened the short-term bullish condition. Price has also traded above the 4000.00 handle to open 4043.00, the Dec 15 high. Key support and the bear trigger has been defined at 3788.50, the Dec 22 low. A reversal lower and a break of this level would resume bearish activity.

COMMODITIES: WTI Opens Bull Trigger and Gold May 2022 Levels

- Crude oil ends higher for its six straight session, buoyed by continued signs of China demand recovering and with a later helping hand by perceived growing likelihood of a downshift to a 25bp hike from the Fed on Feb 1 after an inline CPI print.

- Biden is said to not be ruling out further SPR releases whilst the House has voted to ban SPR oil sales to China.

- WTI is +1.2% at $78.37, off earlier highs of $79.10 having opened next resistance at the bull trigger of $81.50 (Jan 3 high).

- Brent is +1.6% at $83.97 off highs of $84.60 that cleared the 50-day EMA of $83.64 and open key resistance at $87.00 (Jan 3 high).

- Gold benefits from lower Treasury yields and dollar weakness, rising +1.1% at $1896.25, having failed to hold a brief trip above $1900 with a high of $1901.49, opening resistance at $1909.8 (May 5, 2022 high).

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 13/01/2023 | 0700/0700 | ** |  | UK | UK Monthly GDP |

| 13/01/2023 | 0700/0700 | ** |  | UK | Index of Services |

| 13/01/2023 | 0700/0700 | *** |  | UK | Index of Production |

| 13/01/2023 | 0700/0700 | ** |  | UK | Output in the Construction Industry |

| 13/01/2023 | 0700/0700 | ** |  | UK | Trade Balance |

| 13/01/2023 | 0700/0800 | *** |  | SE | Inflation report |

| 13/01/2023 | 0745/0845 | *** |  | FR | HICP (f) |

| 13/01/2023 | 0800/0900 | *** |  | ES | HICP (f) |

| 13/01/2023 | 0900/1000 | * |  | IT | Industrial Production |

| 13/01/2023 | 0900/1000 |  | DE | GDP 2022 | |

| 13/01/2023 | 1000/1100 | ** |  | EU | Industrial Production |

| 13/01/2023 | 1000/1100 | * |  | EU | Trade Balance |

| 13/01/2023 | - | *** |  | CN | Trade |

| 13/01/2023 | 1330/0830 | ** |  | US | Import/Export Price Index |

| 13/01/2023 | 1500/1000 | *** |  | US | University of Michigan Sentiment Index (p) |

| 13/01/2023 | 1500/1000 |  | US | Minneapolis Fed's Neel Kashkari | |

| 13/01/2023 | 1520/1020 |  | US | Philadelphia Fed's Patrick Harker |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.