-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Focus on November Jobs Ahead Fed Blackout

MNI ASIA MARKETS ANALYSIS: Consolidation Ahead Nov Jobs Report

MNI ASIA MARKETS ANALYSIS - USD Index Climbs to Fresh 2021 High

HIGHLIGHTS:

- Post-CPI moves extend, pressing EUR/USD to fresh 2021 lows

- Equities recover off lows, Europe outperforms to prompt new all time highs in German stocks

- Focus turns to Indian inflation, Prelim UMich Sentiment

EGBs-GILTS CASH CLOSE: Gilts Recover Some Losses

Gilts retraced some of the prior session's steep losses, while the Bund curve weakened in mixed fashion Thursday. This was a much quieter session compared with those of the prior week, with the US cash Treasury holiday sapping liquidity.

- UK GDP was the session's major data point, disappointing on the initial Q3 reading, and arguably helping underpin the short end of the curve.

- Periphery spreads widened slightly, led by Greece (10Y out 4bp vs Germany).

- While there were multiple central bank speakers today, none made much market impact.

- Following Ireland and Italy's auctions today, no supply Friday.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 0.7bps at -0.693%, 5-Yr is up 2bps at -0.516%, 10-Yr is up 1.6bps at -0.231%, and 30-Yr is up 1.4bps at 0.073%.

- UK: The 2-Yr yield is down 1.1bps at 0.565%, 5-Yr is down 1bps at 0.705%, 10-Yr is down 0.5bps at 0.92%, and 30-Yr is up 0.6bps at 1.06%.

- Italian BTP spread up 1bps at 119.3bps / Greek up 4bps at 143.8bps

US OPTION FLOW SUMMARY: Downside Prevalent In Thin Thursday Trade

Thursday's US ED / Bond options flow included:

- EDJ2 99.37/99.12ps, bought for 3.25 and 3.75 in 15k (target April 2022 hike)

- 0EX1 99.00 puts bought for 1 in 15k (overnight)

- USA week3 161.5/160/158.5p fly, bought for 15 and 16 in 8.5k (short-term downside play)

EGB OPTION FLOW SUMMARY: Mostly Downside Plays, Once Again

Thursday's Europe rates / bonds options flow included:

- DUG2 112.00/111.80ps, bought for 4.75 in 10k

- DUG2 112.10/112.00/111.90/111.80p condor, bought for 2 in 5k

- DUG2 112.00/111.70ps, bought for 6.5 in 4k

- RXF2 171.5/173/174.5c fly, bought for 30.5 in 1k

- RXZ1 169.5/168.5ps, bought for 19 in 2.15k

- RXZ1 169.50p, bought for 33 in 4k

- OEZ1 135.50/135.75cs, bought for 2.5 in 2k

- OEG2 132.75/132.25ps, bought for 11.5 in 10k

- OEZ1 135.25/135.75 1x2 call spread sold at 5 in 5k

FOREX: US Dollar Maintains Upward Trajectory, CAD Underperforms

- Following yesterday's strong CPI-fuelled rally, the greenback maintained its ascent on Veteran's day Thursday. The dollar index (DXY) broke above 95.00 for the first time since July 2020, rising 0.32% as of writing.

- The buoyant dollar solidified the EURUSD break of 1.15 and confirming the resumption of the downtrend. Moving average studies remain in bear mode, reinforcing current trend conditions and the focus now turns to 1.1375, a Fibonacci projection.

- AUD and NZD continued to suffer, both dropping roughly 0.5% and extending their losing streaks to three sessions. AUDUSD extends the current short-term bear cycle where the continued weakness suggests scope for a deeper pullback, opening 0.7261 next, a Fibonacci retracement. A firm support lies just below, at 0.7241, the base of a bull channel drawn from the Aug 20 low.

- The Canadian dollar was the worst performer on Thursday after breaking back above 1.2500 for the first time since October 8. Despite a firmer commodity complex, the broad dollar strength and continued unwind for CAD since the October central bank statement continue to underpin the price action.

- After breaking the Oct/Nov highs, USDCAD traded consistently higher to just shy of 1.2600. Resistance has been breached above 1.2562 which is considered technically constructive.

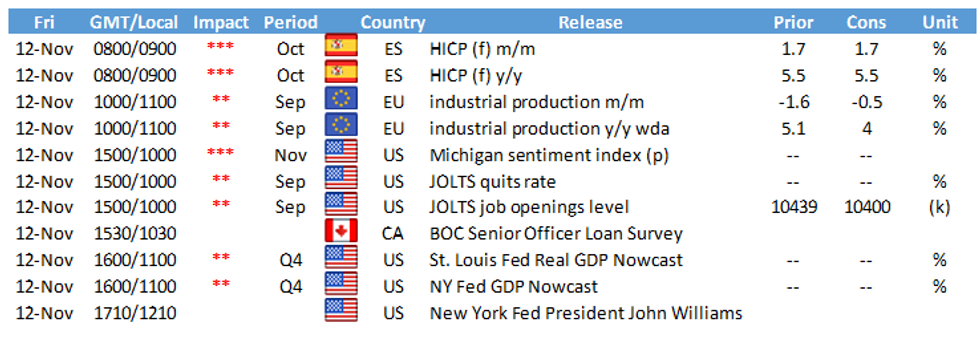

- A quiet data calendar on Friday with Eurozone Industrial production followed by US Jolts Job openings and UoMichigan Sentiment data to wrap up the week. The US Treasury are also scheduled to release their bi-annual currency report.

FX OPTIONS: Expiries for Nov12 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1320-25(E934mln), $1.1460(E1.2bln), $1.1485-00(E1.0bln), $1.1540-50(E2.0bln)

- USD/JPY: Y112.95-00($750mln), Y113.90-00($2.2bln)

- GBP/USD: $1.3320(Gbp690mln)

- AUD/USD: $0.7370-85(A$1.4bln)

- NZD/USD: $0.6780(N$1.1bln)

- USD/CAD: C$1.2450-65($1.2bln), C$1.2490($1.3bln), C$1.2510-15($1.1bln), C$1.2620-25($507mln)

EQUITIES: Markets Mixed Amid Holiday-Thinned Trade

- Wall Street traded mixed amid light newsflow and volumes as liquidity was thinned by the Veteran's Day holidays. The S&P 500 inched higher thanks to a solid showing from materials and energy names. Utilities and healthcare were the laggards, but losses were muted.

- Gold miners led the way higher thanks to post-inflation strength in the yellow metal. The moves put Freeport-McMoRan higher by as much as 10%, while Disney countered at the other end of the table as Disney+ subscriber numbers missed forecast. The 6% drop in Disney shares provided a solid headwind for the Dow Jones, which slipped 100 points or so.

COMMODITIES: Market Looks Through Lukashenko Threats

- European gas prices saw some support halfway through the trading session as Belarus' Lukashenko threatened to shutter one of the key pipelines running gas from Russia into Europe. Lukashenko's threat came amid continued unrest along the Polish border as contested migrant flow raises tensions between the European Union and Belarus. Much of the effect faded into the close as Belarusian opposition politicians flagged how unlikely it is that the threat would be carried out.

- Contrasting with US energy markets, precious metals are advancing as gold's status as an inflation hedge comes back into view following yesterday's multi-decade high in CPI.

- The move higher resulted in a clear break of resistance at $1834.0, Sep 3 high.

- The breach of this hurdle reinforces current bullish conditions and paves the way for further upside. Note too that the yellow metal has also breached $1863.3, 76.4% of the Jun -Aug sell-off. The focus is on $1877.7 next, Jun 14 high.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.