-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Weaker Data Cools Dec Hike Exp

HIGHLIGHTS

- Home-Price Growth Slowed in August -- WSJ

- Top Democrat Urges Fed Remember Workers Ahead of Expected Hike, Bbg

- PENTAGON SAYS RUSSIA NOTIFIED US ABOUT ITS GROM EXERCISES: RTRS

- 5.0 MAG. EARTHQUAKE NORTHERN CALIFORNIA :EMSC

US TSYS: Risk Appetite Gains Momentum

Tsy well bid across the board holding narrow range since midmorning after 30YY fell to 4.2216% lows, FI mkts continues to reassess rate hike expectations for year end after SF Fed Daly voiced concern over tightening monetary policy too much last Friday.

- Yields curves bull flattening (2s10s -12.933 at -39.575) despite the strong support in short end as hike expectations for Dec move closer to 50bp than last week's 75bp pricing.

- Risk appetite gains momentum as stocks trade higher for third consecutive session: SPX emini +59.0 at 3868.25 (Sep 21 levels) not far from 3923.88: 50.0% retracement of the Aug 16 - Oct 13 downleg

- Softer than expected data contributing to today's moves while Tsy held gains, little react after $42B 2Y note auction (91282CFQ9) tailed: 4.460% high yield vs. 4.447% WI; 2.59x bid-to-cover vs. 2.51x prior.

- The 2-Yr yield is down 3.2bps at 4.4728%, 5-Yr is down 11.2bps at 4.2503%, 10-Yr is down 15.7bps at 4.0854%, and 30-Yr is down 14.6bps at 4.2324%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00300 to 3.06271% (-0.001415/wk)

- 1M +0.02000 to 3.59643% (+0.01086/wk)

- 3M +0.03114 to 4.35800% (-0.00043/wk) * / **

- 6M +0.03857 to 4.91557% (+0.04057/wk)

- 12M +0.03371 to 5.39971% (-0.07586/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.35843% on 10/21/22

- Daily Effective Fed Funds Rate: 3.08% volume: $99B

- Daily Overnight Bank Funding Rate: 3.07% volume: $276B

- Secured Overnight Financing Rate (SOFR): 3.01%, $962B

- Broad General Collateral Rate (BGCR): 3.00%, $388B

- Tri-Party General Collateral Rate (TGCR): 3.00%, $376B

- (rate, volume levels reflect prior session)

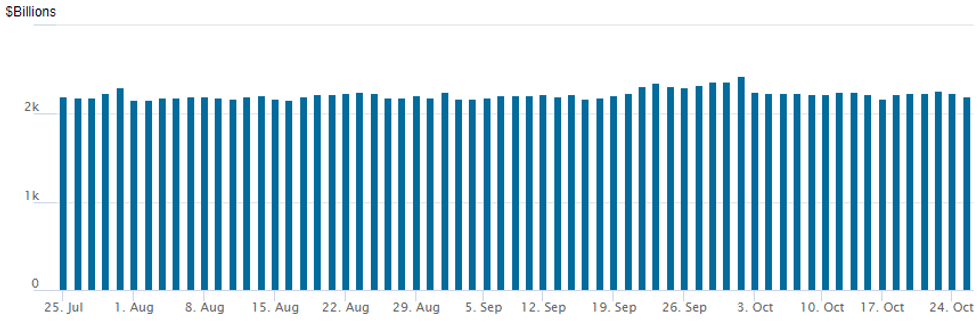

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $2,195.616B w/ 102 counterparties vs. $2,242.044B in the prior session. Prior record high stands at $2,425.910B on Friday, September 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Volumes receded in the second half but tone remained bullish amid delta call buyers, put unwinds as underlying futures held narrow range near midmorning highs through the second half - last week's 75bp hike expectations for Dec continue to cool. Salient trade:- SOFR Options:

- 8,000 SFRZ2 95.75/95.87 call spds, 0.75 - adds to appr +100k Mon from 0.75-1.0

- Block, 1,500 SFRX2 95.43/95.56 call spds 1 over Green Nov SOFR 96.75 calls

- +2,500 SFRZ2 95.37/95.50/95.56/95.68 call condors, 4.0

- 2,000 SFRZ2 96.06/96.75 1x2 call spds

- Eurodollar Options:

- 5,000 Jun 95.00/95.25/95.50 call flys

- Treasury Options:

- 2,500 TYZ 110.75/111.25 call spds, 14 ref 110-25

- +4,000 USZ 108 puts, 7 ref 120-04

- 3,000 TYZ 105 puts, 4 ref 110-27.5

- 5,000 TYZ 111 calls, 107 ref 110-25

- 2,000 USZ 111/113 put spds, 10 ref 120-11

- Over 11,000 TYZ2 114 calls, 12 ref 110-21

- +5,700 wk4 109/109.5/110 put flys, 3

- -3,000 TYZ 109.5 puts, 59 vs. 110-05

- +4,000 wk2 113/114 call spds, 6 ref 110-09.5

- -24,000 TYZ 108/110 put spds, 41 ref 110-06.5, total over 30,000, unwind after paper bought at 36 vs. 111-09 a couple weeks ago

- 3,000 FVZ 109 calls, 5.5 ref 106-13

- 1,750 USZ 131/132 call spds

- 1,250 USZ 112/115 put spds

- Block, 5,000 TYZ 112.25 calls, 23

- 1,500 TYZ 112 calls 1 over TYZ 107.5/109 put spds ref 109-28

EGBs-GILTS CASH CLOSE: Broad Rally As Terminal Hike Pricing Pared Further

German yields dropped sharply Tuesday in a strong bull flattening move, while periphery EGBs maintained their solid performance ahead of the ECB meeting Thursday.

- Amid continued downward repricing of Federal Reserve hike expectations and further weak US housing data, global yields fell sharply alongside a weaker USD. Long-end Bunds outperformed, while UK 10Y yields were down by double-digits.

- BoE terminal rate pricing dropped by 6bp, closing below 5% for the first time since Sept 22, with Gilt markets calming further as ex-Chancellor Sunak officially became PM.

- ECB terminal hike pricing fell by around 10bp, though expectations for this week's decision were steady (92% chance ofa 75bp hike). MNI reported the ECB is set to make changes to the terms of TLTRO loans this Thursday.

- BTPs outperformed amid a broader risk-on rally.

CLOSING YIELDS / 10-YR PERIPHERY EGB SPREADS TO GERMANY:

- Germany: The 2-Yr yield is down 4bps at 1.969%, 5-Yr is down 11.9bps at 2.03%, 10-Yr is down 16.4bps at 2.166%, and 30-Yr is down 19.8bps at 2.139%.

- UK: The 2-Yr yield is down 1.4bps at 3.414%, 5-Yr is down 7.2bps at 3.75%, 10-Yr is down 11.2bps at 3.634%, and 30-Yr is down 8.8bps at 3.668%.

- Italian BTP spread down 5.7bps at 220.2bps / Greek down 0.7bps at 251.5bps

EGB Options: Mixed Trade In Schatz, Upside In Bobl

Tuesday's Europe rates/bond options flow included:

- RXZ2 145.00 call bought for 36 in 7k, vs 137.18

- RXZ2 141.00/143.00/145.00 call ladder sold at 6 in 1.25k

- DUZ2 107.30/60 1X1.5 call spread bought for 1.75 in 2.5k

- DUZ2 105.50/105.00 put spread bought for 2.5 in 3.5k

- OEZ2 119.25/120.75/121.5/125.00 call condor (bought) vs 116.50/114.00 put spread (sold), paid 2.5 in 1.8k. 5k all day

FOREX: Greenback Slumps Following Housing Data, GBP Surges

- Data on Tuesday indicated the sharpest slowdown in US house price growth on record and the US Dollar really felt the pinch in the aftermath. The greenback weakness began to build momentum approaching the US cash equity open, with the BBG USD Index consistently under pressure through to the NY cut at 1000 ET, where the losses then consolidated for the rest of the session.

- The move has heavily favoured GBP/USD (+1.80%), with the pair sharply extending through yesterday's highs of 1.1409 and reaching a peak of 1.1499 in a potentially delayed response to the new appointment of Prime Minister Sunak and the expectation of more benign policy for markets.

- Cable has briefly pierced 1.1495, the Oct 5 high and the technical bull trigger. Above here, markets will turn their focus to 1.1590, the Sep 14 high.

- Similarly, USD/CNH staged a decent relief rally, with the pair edging off the record highs of 7.3749 printed overnight - coinciding with EUR/USD back above $0.99.

- EURUSD is extending the latest recovery, from 0.9705, the Oct 21 low and today’s price action is potentially significant. The pair is trading above an important resistance level at 0.9874 - the top of the bear channel drawn from the Feb 10 high.

- A clear break of this level would highlight a channel breakout and a stronger bullish reversal. The short-term focus now turns to 0.9999, the Oct 4 high and a reversal trigger.

- Similar strength was seen for the likes of AUD and NZD, although this mainly marked a reversal of Monday’s sharp losses associated with Chinese concerns.

- Australian CPI is due overnight before tomorrow’s main event which is the Bank of Canada rate decision. Some emphasis may also be placed on US new home sales data after the poor figures released today.

FX: Expiries for Oct26 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9700(E1.3bln), $0.9850(E740mln), $0.9890-00(E1.7bln), $0.9910-20(E1.3bln), $0.9950(E624mln), $1.0000(E1.1bln)

- USD/JPY: Y148.00-15($835mln)

- GBP/USD: $1.1500(Gbp773mln)

- EUR/GBP: Gbp0.8400(E500mln)

- AUD/USD: $0.6200(A$802mln), $0.6300(A$656mln)

- NZD/USD: $0.5720-35(N$912mln)

- USD/CNY: Cny7.1500-10($2.3bln)

Late Equity Roundup, Property Inv, Auto Makers Strong

Stocks extending late session highs after the FI close, the third consecutive session of higher trade w/Real Estate sector leading SPX eminis: currently trading +42 (1.1%) at 3850.5; DJIA +210.54 (0.67%) at 31712.2; Nasdaq +181.3 (1.7%) at 11133.07.

- SPX leading/lagging sectors: Real Estate (+3.50%) supported by property investment shares (Ventas, American Tower, Welltower all +4.75-5.5%) followed by Consumer Discretionary (+2.30%) lead by autos (Tesla +5.07%, GM +3.93% after Q3 earnings beat: $2.25 vs. $1.893 est;) Materials (+2.30%). Laggers: Energy (-0.46%), Health Care (+0.70%) followed by Financials and Industrials (both +1.10).

- Note, recent Elon Musk headlines he plans to close Twitter deal Friday sees TWTR climb to session high of 52.82; TSLA +10.97 at 222.22.

- Dow Industrials Leaders/Laggers: Home Depot (HD) +6.84 at 290.10, American Express (AXP) +4.94 at 146.56, Salesforce.com (CRM) +4.17 at 164.82. Laggers: United Health (UNH) -3.24 at 538.26 (ironically, UNH issuing 7pt jumbo debt spanning 2-40Y today), Travelers (TRV) -3.79 at 176.00, Amgen (AMGN) -1.47 at 259.85.

E-MINI S&P (Z2): Clears Key Resistance

- RES 4: 4023.44 61.8% retracement of the Aug 16 - Oct 13 downleg

- RES 3: 3981.25 High Sep 14

- RES 2: 3923.88 50.0% retracement of the Aug 16 - Oct 13 downleg

- RES 1: 3874.25 Intraday high

- PRICE: 3839.50 @ 15:05 BST Oct 25

- SUP 1: 3729.44/3641.50 20-day EMA / Low Oct 21

- SUP 2: 3590.50/3502.00 Low Oct 17 / 13 and the bear trigger

- SUP 3: 3491.13 50.0% retracement of the 2020 - 2022 bull cycle

- SUP 4: 3453.78 1.618 proj of the Aug 16 - Sep 7 - 13 price swing

S&P E-Minis maintains a bullish tone and the contract has traded higher today. This has resulted in a break of the 3820.00 hurdle, the Oct 5 high. Furthermore, price is trading above the 50-day EMA, at 3829.80. The break higher today strengthens the short-term bullish condition and signals scope for a climb towards 3923.88, a Fibonacci retracement. On the downside, key short-term support has been defined at 3641.50.

COMMODITIES: Another Mixed Session For Oil, Little Changed On Week To Date

- Crude oil has again seen a mixed session, with WTI eking out gains but Brent slightly lower on the day.

- Saudi Arabia’s oil minister defended the OPEC+ decision to cut production and criticised the release of emergency inventories, Valero’s CEO sees global oil demand growing even through recession, said a proposed fuel export ban wouldn’t have the aimed effect and the company would take more SPR barrels if released, whilst Rosneft has issued a tender to sell six cargoes of Sokol crude for loading in Nov to early Dec in a sign that output from the Sakhalin-1 project may be recovering.

- WTI is +0.5% at $84.97 having kept within technical ranges with resistance at $87.14 (Oct 20 high) and support at $81.30 (Oct 18 low).

- Brent is -0.2% at $93.05, with resistance seen at $95.17 (Oct 12 high) and support at $91.00 (Oct 21 low).

- Gold is +0.25% at $1653.91, off support at $1670.5 (Oct 24 high) whilst support remains the bear trigger of $1615 (Sep 28 low).

Wednesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 26/10/2022 | 0030/1130 | *** |  | AU | CPI inflation |

| 26/10/2022 | 0600/1400 | ** |  | CN | MNI China Liquidity Suvey |

| 26/10/2022 | 0645/0845 | ** |  | FR | Consumer Sentiment |

| 26/10/2022 | 0800/1000 | ** |  | EU | M3 |

| 26/10/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 26/10/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 26/10/2022 | 1230/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 26/10/2022 | 1400/1000 | *** |  | CA | Bank of Canada Policy Decision |

| 26/10/2022 | 1400/1000 |  | CA | BOC Monetary Policy Report | |

| 26/10/2022 | 1400/1000 | *** |  | US | New Home Sales |

| 26/10/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 26/10/2022 | 1500/1100 |  | CA | BOC Governor Press Conference | |

| 26/10/2022 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 26/10/2022 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.