-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Ylds Higher Friday, Focus on FOMC

HIGHLIGHTS

- US MIDTERMS: Early Voting Data Suggests Trends Which May Favour GOP

- US-CHINA: Foreign Min-US Shouldn't Try To Deal w/China From Position Of Strength

- MNI: Canada To Issue 5Y Ukraine Sovereignty Bonds

US TSYS: Tsy Yields Grind Higher, Focus on Next Week's COMC

Tsys remain weaker after the bell - near early session lows after some choppy first half trade. Tsys bounced after latest Employment Cost Index came out in-line w/ estimates at 1.2% (1.3% prior) but with a relatively larger moderation in private sector wages within, PCE in-line as well at +0.4%. (down-revision to core PCE weaker than expected but was all rounding).

- Futures reverse course, extend lows following 10Y Block sale at 0836:03: -8,700 TYZ2 111-05.5, sell through 111-07 post-time bid.

- Protracted round of support followed, yields fell from 4.1681% high to 4.0791% low in lead-up to U-Mich sentiment (1Y inflation exp up to 5% from 4.7% prior) while Much weaker than expected pending home sales in Sept (-10% M/M vs cons -4.0%), suggesting the slide in existing home sales isn't done yet.

- Tsy gradually retreated from midmorning highs through the second half with no obvious headline driver as 30YY climbed back around 4.1287%, yield curves bear flattening (2s10s -5.893 at -42.050).

- Deferred Eurodollar calendar spds extend inversion to new cycle lows this morning: indicating a larger ease in current hikes over the latter half of 2023: Mar'23/Jun'23 -0.095; Dec'22/Red Dec'23 at -0.415, Mar'23/Red Mar'24 at -0.725, Jun'23/Red Jun'24 at -0.815.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00057 to 3.06386% (-0.01786/wk)

- 1M +0.01385 to 3.76771% (+0.18214/wk)

- 3M +0.02486 to 4.43957% (+0.08114/wk) * / **

- 6M +0.00257 to 4.93086% (+0.05586/wk)

- 12M -0.00343 to 5.36900% (-0.10657/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.43957% on 10/28/22

- Daily Effective Fed Funds Rate: 3.08% volume: $103B

- Daily Overnight Bank Funding Rate: 3.07% volume: $286B

- Secured Overnight Financing Rate (SOFR): 3.04%, $973B

- Broad General Collateral Rate (BGCR): 3.00%, $406B

- Tri-Party General Collateral Rate (TGCR): 3.00%, $387B

- (rate, volume levels reflect prior session)

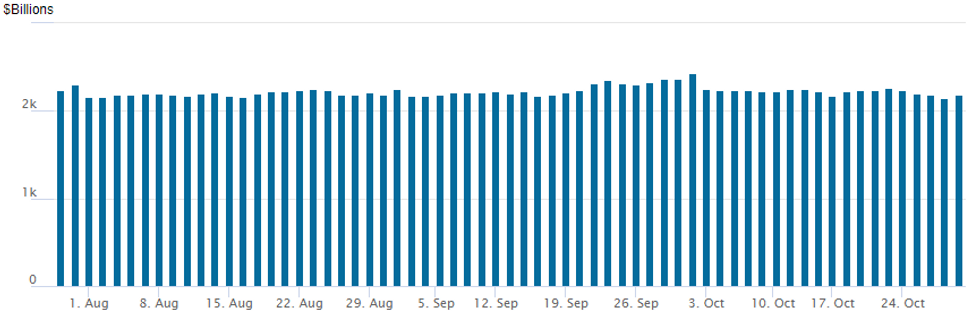

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage rebounds to $2,183.290B w/ 99 counterparties vs. $2,152.485B in the prior session. Prior record high stands at $2,425.910B on Friday, September 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Decent volume on sporadic trade Friday, call trade two-way while puts structures saw better buying as underlying rates sold off ahead next Wednesday's FOMC policy annc.- SOFR Options:

- Block, +15,000 SFRM2 94.50/94.75/95.25/95.50 put condors, 8.5

- March SOFR spd block posted at 1123:42ET, Put spd sold 8.5 over call spd ref 95.15

- -20,000 SFRH3 95.00/95.25 put spds 12.0 vs. SFRH3 95.37/95.50 call spd, 3.5

- Block, 10,000 SFRH3 95.5/95.75/96.00 call flys, 2.5 vs. 95.18/0.05%

- Block, total 20,000 SFRH3 94.75/95.50 put spds, 35.5 ref 95-18

- Block, 2,000 Green Nov 96.75/96.87 call spds, 1.0 vs. 96.235/0.05%

- Block, 2,500 SFRH3 94.12/94.62 put spds, 5.0 vs. 95.165/0.14%

- 1,500 SFRJ 94.25/94.50/95.00 put flys

- Block total 9,000 SFRH3 95.50/95.62 put spds, 9.25 on splits

- Eurodollar Options: Deep put spds

- 10,000 Dec 97.00/98.87 put spds ref 94.94

- 17,500 Dec 97.00/97.62 put spds ref 94.94

- Block, 20,000 Mar 94.50/95.25 put spds, 38.25/splits

- Treasury Options:

- 5,800 TYZ 109 puts, 29 ref 110-30.5

- Block/screen, 20,000 TYZ2 109.25 puts, 31-32

- Block, -10,000 TYZ2 113.5 calls, 17 ref 110-28.5

- 5,000 FVZ2 106.75/107.75/108.5 broken put flys

- Block, 2,000 TUZ2 102.75/103/103.25 call flys, 2 vs. 102-18/0.05%

- 2,000 TYZ 108/108.25/109.5 put fly vs. TYZ 112.25/112.75 call spd

FOREX: EURGBP Continues Bearish Grind Lower, JPY Consolidates Losses

- Despite the more optimistic price action across equity markets on Friday, the greenback has held onto gains with the USD index (+0.25%) extending on the prior day’s recovery. 111.135 resistance has held for now and the index has moderated a little ahead of the close.

- The Bank of Japan rate decision came and went with little surprise, with Governor Kuroda doubling down on policy by stating that markets should not expect rate hikes or an exit from easy policy anytime soon. The JPY was the weakest G10 currency on Friday, helping put USD/JPY back around Y147.50, where price action consolidated for much of the US session.

- GBP has outperformed its major counterparts as markets continue to factor in a more benign political/fiscal backdrop in the UK under a Sunak government. GBP most notable in the crosses with GBPJPY advancing 1.22% as well as EURGBP continuing its grind lower throughout the week.

- A short-term bear threat remains present for EURGBP following the strong reversal from 0.9266, Sep 26 high, resulting in the break of a number of key short-term support levels and this suggests scope for an extension lower near-term with sights on 0.8559 next, a Fibonacci retracement. Key short-term resistance has been defined at 0.8867.

- Worth noting the daylight-saving time shift for the Uk and Europe over the weekend which will affect the time difference for US data and especially the Fed decision on Wednesday. The November FOMC meeting appears mainly about the message the Fed wants to send about its plans for December.

- Other central bank decisions for Australia and the UK underpin a busy week that culminates in the release of October US non-farm payrolls.

FX: Expiries for Oct31 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9750(E1.4bln), $1.0000(E2.4bln)

- EUR/JPY: Y140.00($825mln)

- USD/CAD: C$1.3900($630mln)

Late Equity Roundup: New 1M Highs, Tech Lead

Stocks continue to power higher in late trade - new highs for the week and back to mid-September levels. Strong rebound in Information Technology shares underpinning SPX eminis currently trading +88.75 (2.32%) at 3908.75; DJIA +821.54 (2.56%) at 32857.77; Nasdaq +292.3 (2.7%) at 11086.36.

- SPX leading/lagging sectors: IT (+4.49%) lead by strong performance for hardware makers (Intel +9.65%, Apple (APPL) +7.61%, AMD +5.41%); Communication Services (+2.80%) and Utilities (+2.36%) follow. Laggers: Consumer discretionary (-0.63%) as on-line retailers underperform: Amazon (AMZN) -7.52%, Etsy (-3.82%), Ebay (-0.06%). Energy (+0.62%) and Materials (+1.03%) follow.

- Dow Industrials Leaders/Laggers: Apple (APPL) +10.88 at 155.68, United Health (UNH) +10.59 at 552.39, McDonalds (MCD) +8.30 at 273.41. Laggers: Dow Inc +0.09 at 47.71, JP Morgan +0.99 at 125.59, Chevron (CVX) +1.14 at 179.04.

E-MINI S&P (Z2): Short-Term Trend Needle Still Points North

- RES 4: 4023.44 61.8% retracement of the Aug 16 - Oct 13 downleg

- RES 3: 3981.25 High Sep 14

- RES 2: 3923.88 50.0% retracement of the Aug 16 - Oct 13 downleg

- RES 1: 3874.50 High Oct 26

- PRICE: 3846.75 @ 14:41 BST Oct 28

- SUP 1: 3758.61/3641.50 20-day EMA / Low Oct 21

- SUP 2: 3590.50/3502.00 Low Oct 17 / 13 and the bear trigger

- SUP 3: 3491.13 50.0% retracement of the 2020 - 2022 bull cycle

- SUP 4: 3453.78 1.618 proj of the Aug 16 - Sep 7 - 13 price swing

S&P E-Minis maintains a bullish tone and the contract is holding the bulk of its recent gains. The latest pullback is considered corrective. This week’s climb resulted in a break of the 3820.00 hurdle, Oct 5 high. Furthermore, price has traded above the 50-day EMA, at 3831.28. A resumption of gains would signal scope for a climb towards 3923.88, a Fibonacci retracement. On the downside, key short-term support has been defined at 3641.50.

COMMODITIES: Oil Chips Away At Week's Gains and Pemex Lags International Peers

- Crude oil falls back after gains in the last two days that set it up for a small increase on the week.

- Pemex posted a surprise quarterly loss as a depreciating peso and higher cost of importing fuel weigh, in contrast to profits reported by its major international peers, one of which being Exxon which has been chided by Biden for its investor payouts.

- WTI is -1.2% at $88.01, remaining below resistance at $89.79 (Oct 27 high) but equally not testing support at $85.62 (20-day EMA) with a low of $87.08.

- Brent is -1.2% at $95.82, remaining below key near-term resistance at $98.75 (Oct 10 high) but above support at the 20-day EMA of $93.00.

- Gold is -1.3% at $1641.4, suffering from a firmer dollar plus a rebound in US yields. It came close to testing support at $1638.4 (Oct 25 low) with the bear trigger of $1615.0 (Sep 28 low) below that.

- Weekly moves: WTI +3.5%, Brent +2.5%, Gold -1.0%, US nat gas +15%, EU TTF nat gas 0%, the latter after EU gas storage neared 94% according to GIE data, helped by gas use dropping 14% in August compared to the 5y average and hitting the targeted 15% reduction in September.

Monday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 30/10/2022 | - |  | BR | Brazil Second-Round Runoff Election | |

| 31/10/2022 | 0030/1130 | ** |  | AU | Retail Trade |

| 31/10/2022 | 0130/0930 | *** |  | CN | CFLP Manufacturing PMI |

| 31/10/2022 | 0130/0930 | ** |  | CN | CFLP Non-Manufacturing PMI |

| 31/10/2022 | 0700/0800 | ** |  | DE | Retail Sales |

| 31/10/2022 | 0730/0830 | ** |  | CH | retail sales |

| 31/10/2022 | 0800/0900 |  | ES | Retail Sales | |

| 31/10/2022 | 0900/1000 | *** |  | IT | GDP (p) |

| 31/10/2022 | 0930/0930 | ** |  | UK | BOE Lending to Individuals |

| 31/10/2022 | 0930/0930 | ** |  | UK | BOE M4 |

| 31/10/2022 | 1000/1100 | *** |  | EU | HICP (p) |

| 31/10/2022 | 1000/1100 | *** |  | EU | EMU Preliminary Flash GDP Q/Q |

| 31/10/2022 | 1000/1100 | *** |  | EU | EMU Preliminary Flash GDP Y/Y |

| 31/10/2022 | 1345/0945 | ** |  | US | MNI Chicago PMI |

| 31/10/2022 | 1430/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 31/10/2022 | 1500/1600 |  | EU | ECB Lane Speech at Danmarks Nationalbank Conference | |

| 31/10/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 31/10/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 31/10/2022 | 1900/1500 |  | US | Treasury Financing Estimates | |

| 01/11/2022 | 2200/0900 | ** |  | AU | IHS Markit Manufacturing PMI (f) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.