-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Drains CNY33.8 Bln via OMO Wednesday

MNI BRIEF: Aussie Trimmed Mean Rises In Oct

MNI US CLOSING FI ANALYSIS: Stimulus Status-Quo

US TSY SUMMARY: Stimulus Status-Quo

Tsys continued to trade lower Wednesday, Eurodollar futures steady to marginally mixed, equities modestly higher, rates and stocks holding to an inside-range by the close. Appears markets are becoming a little more inured to stimulus-related headlines that have buffeted markets the last few sessions.

- Stimulus status-quo: while House Speaker Pelosi remains optimistic a deal can be reached before the election on Nov 3, Republicans widely pan the prospect of passing a deal even if one is agreed upon in the WH.

- Meanwhile, Covid-19 case counts continue to rise globally (new one-day jump for Italy by 15,199).

- Little to no react to another deluge of Fed speakers, VC Quarles stated late "FED EMERGENCY LOAN FACILITIES OFFER BACKSTOP IF NEEDED" a "GOOD THING THAT EMERGENCY PROGRAMS STILL HAVE FUNDS".

- Decent US Tsy $22B 20Y bond auction re-open (912810SQ2) draws high yield of 1.370% (1.213% last month) vs. 1.375% WI, on a bid/cover 2.43 (2.39 previous).

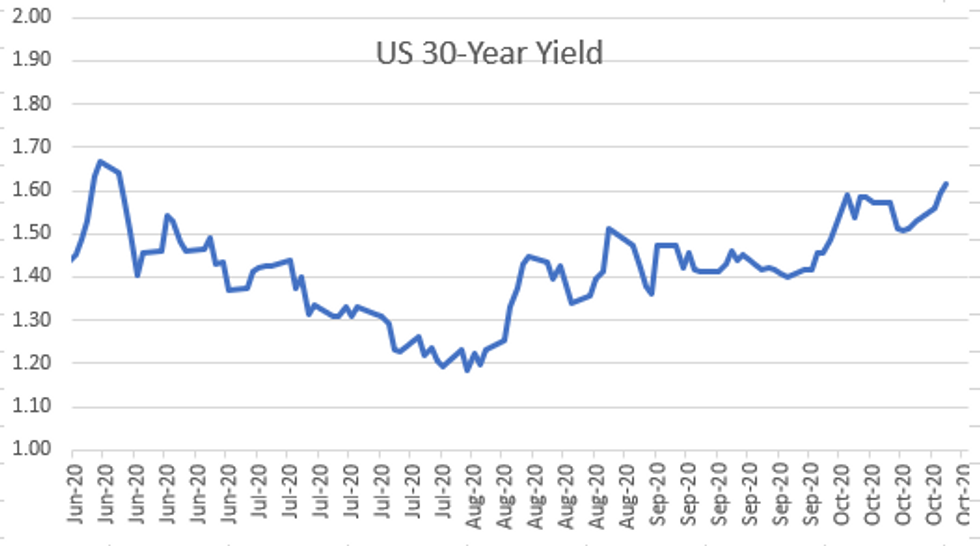

- The 2-Yr yield is up 0.4bps at 0.1472%, 5-Yr is up 1.5bps at 0.349%, 10-Yr is up 2.7bps at 0.8125%, and 30-Yr is up 3bps at 1.6216%.

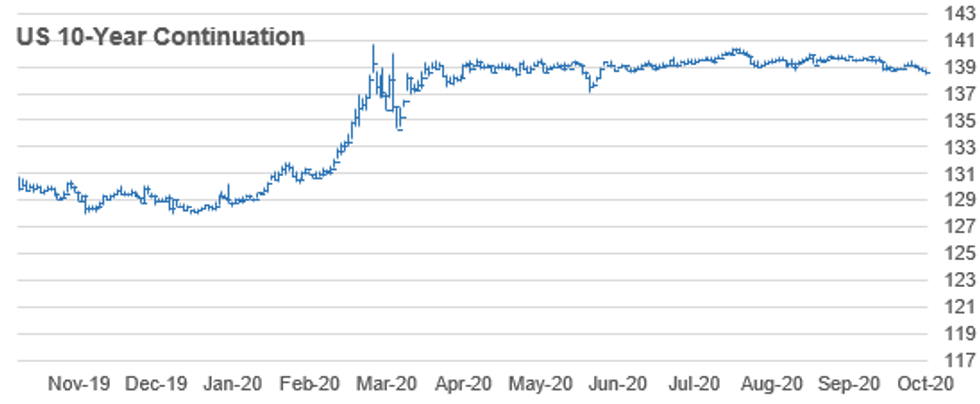

TECHNICALS:US 10YR FUTURE TECHS: (Z0) Key Support Cleared

US 10YR FUTURE TECHS: (Z0) Key Support Cleared

- RES 4: 139-25 High Oct 2

- RES 3: 139-17 76.4% retracement of Sep 29 - Oct 7 sell-off

- RES 2: 139-14 High Oct 15

- RES 1: 139-01+ High Oct 20

- PRICE: 138-20+ @16:14 BST Oct 21

- SUP 1: 138-13 Intraday low

- SUP 2: 138-12 61.8% retracement of the Jun - Aug rally (cont)

- SUP 3: 138-04+ 1.00 proj of Aug 4 - 28 decline from Sep 3 high

- SUP 4: 137-29 76.4% retracement of the Jun - Aug rally (cont)

AUSSIE 3-YR TECHS: (Z0) Looking To Clear Resistance

AUSSIE 3-YR TECHS: (Z0) Looking To Clear Resistance

- RES 3: 100.00 - Psychological round number

- RES 2: 99.886 - 3.0% Upper Bollinger Band

- RES 1: 99.845 - All time High Oct 20, 15 and the bull trigger

- PRICE: 99.830 @ 16:33 BST Oct 21

- SUP 1: 99.760 - Low Oct 1 and 2

- SUP 2: 99.705 - Low Sep 18, 21 and 22

- SUP 3: 99.675 - Low Sep 7 and key support

Aussie 3yr futures are largely unchanged and remain bullish. The price surge at the tail-end of September and early October confirmed bullish trend conditions. Recent activity is viewed as a pause in the uptrend and in pattern terms has taken on the appearance of a bull flag. This is a continuation pattern and reinforces current trend conditions. A break of 99.845, Oct 20 high and last week's high would open 99.889. Support is at 99.760.

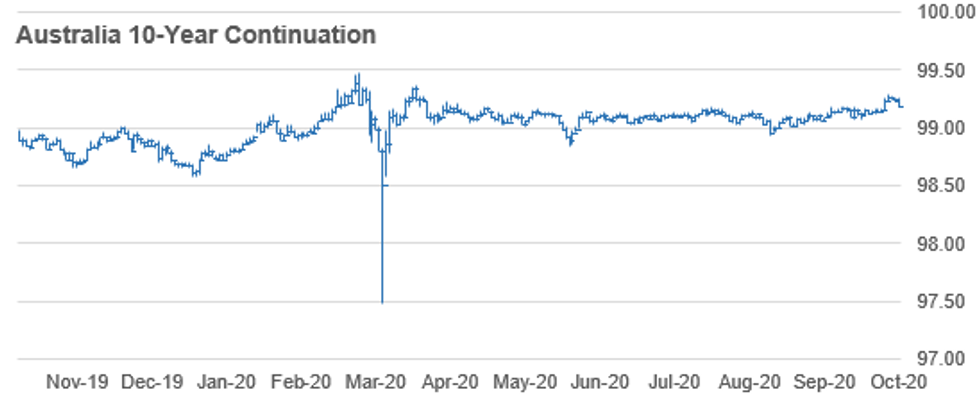

AUSSIE 10-YR TECHS: (Z0) Uptrend Remains Intact

AUSSIE 10-YR TECHS: (Z0) Uptrend Remains Intact

- RES 3: 99.480 - High Mar 10 and the all-time high

- RES 2: 99.360 - High Apr 2 (cont)

- RES 1: 99.290 - High Oct 16

- PRICE: 99.195 @ 16:39 BST Oct 21

- SUP 1: 99.075 - Low Oct and the key support

- SUP 2: 99.055 - Low Sep 18 and 21

- SUP 3: 98.970 - Low Sep 8

Aussie 10y futures remain bullish following last week's strong impulsive rally. The break above 99.180, an area of congestion reflecting highs in Sep and early October confirmed a resumption of the uptrend that started on Aug 28. Attention turns to 99.300 and 99.360. The latter is the Apr 2 high (cont). The near-term bull trigger is 99.290, Oct 16 high. On the downside, firm trend support is at 99.075, Oct 5 low.

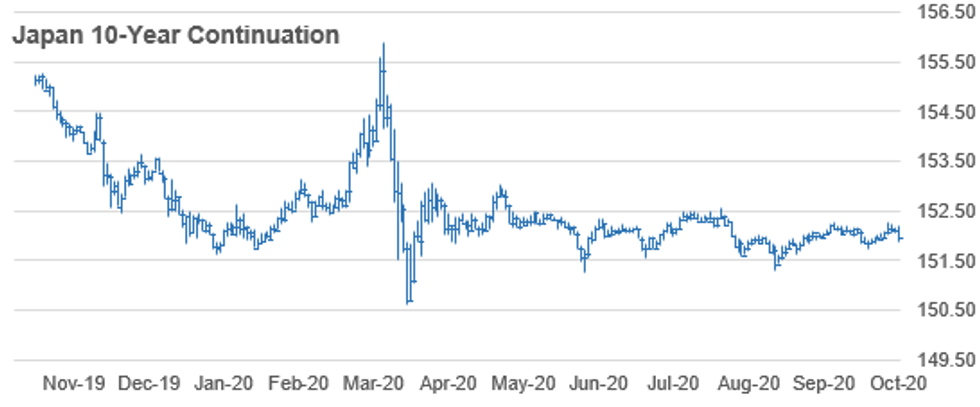

JGB TECHS: (Z0) Bullish Focus

JGB TECHS: (Z0) Bullish Focus

- RES 3: 152.55 - High Aug 5 (cont)

- RES 2: 152.36- 3.0% Upper Bollinger Band

- RES 1: 152.29 - High Sep 24 and the bull trigger

- PRICE: 152.02 @ 16:40 BST Oct 21

- SUP 1: 151.75 - Low Oct 08 and trend support

- SUP 2: 151.54 - Low Sep 7

- SUP 3: 151.43 - Low Sep 1

JGBs remain firmer following the recent recovery that has resulted in a move above 152.00. While prices showed below the handle briefly Wednesday, prices swiftly recovered to keep attention turns on 152.29, Sep 4 high, a key resistance and the bull trigger. A break of this level would confirm a resumption of the uptrend and open 152.36, a Bollinger band objective and 152.55, Aug 5 high (cont). On the downside, key trend support has been defined at 151.75, Oct 8 low.

US TSY FUTURES CLOSE: Yld Curves Continue Bear Steepening

Weaker after the bell, near middle of session range with level receding late. Yld curves continue to bear steepen, update:

- 3M10Y +3.443, 71.363 (L: 68.583 / H: 72.523)

- 2Y10Y +2.274, 66.329 (L: 64.654 / H: 68.104)

- 2Y30Y +2.465, 147.102 (L: 144.573 / H: 149.733)

- 5Y30Y +1.494, 126.964 (L: 124.799 / H: 128.49)

- Current futures levels:

- Dec 2Y down 0.125/32 at 110-13.5 (L: 110-13 / H: 110-13.875)

- Dec 5Y down 1.5/32 at 125-21.5 (L: 125-19 / H: 125-23.75)

- Dec 10Y down 4/32 at 138-18.5 (L: 138-13 / H: 138-24.5)

- Dec 30Y down 12/32 at 173-4 (L: 172-17 / H: 173-24)

- Dec Ultra 30Y down 18/32 at 215-8 (L: 213-27 / H: 216-09)

US EURODLR FUTURES CLOSE: EDZ0 Dips Despite 3M LIBOR Decline

Steady/mixed in the short end, Reds-Greens posting marginal gains while long end of strip inched off lows. After holding steady much of the session the lead quarterly EDZ0 is mildly weaker despite 3M LIBOR drop of -0.00662 to 0.20913% (-0.00925/wk).

- Dec 20 -0.005 at 99.760

- Mar 21 steady at 99.795

- Jun 21 steady at 99.805

- Sep 21 +0.005 at 99.810

- Red Pack (Dec 21-Sep 22) +0.005 to +0.010

- Green Pack (Dec 22-Sep 23) +0.005

- Blue Pack (Dec 23-Sep 24) steady

- Gold Pack (Dec 24-Sep 25) -0.01 to -0.005

US DOLLAR LIBOR: Latest settles

- O/N +0.00025 at 0.08063% (-0.00050/wk)

- 1 Month +0.00213 to 0.14788% (-0.00350/wk)

- 3 Month -0.00662 to 0.20913% (-0.00925/wk)

- 6 Month -0.00588 to 0.24600% (-0.01150/wk)

- 1 Year -0.00225 to 0.33488% (-0.00012/wk)

US TSY: Short-Term Rates, Purchase Operations

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.09% volume: $54B

- Daily Overnight Bank Funding Rate: 0.08%, volume: $155B

- Secured Overnight Financing Rate (SOFR): 0.08%, $918B

- Broad General Collateral Rate (BGCR): 0.06%, $347B

- Tri-Party General Collateral Rate (TGCR): 0.06%, $323B

- (rate, volume levels reflect prior session)

- TIPS 7.5Y-30Y, $1.201B accepted vs. $1.980B submission

- Next scheduled purchase:

- Thu 10/22 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

OUTLOOK: Look Ahead To Thursday

- US Data/Speaker Calendar (prior, estimate)

- 22-Oct 0830 17-Oct initial jobless claims (898k, 870k)

- 22-Oct 0830 17-Oct continuing claims (10.018M, 9.625M)

- 22-Oct 1000 Sep existing home sales (6.00M, 6.30M)

- 22-Oct 1030 16-Oct natural gas stocks w/w

- 22-Oct 1100 Oct Kansas City Fed Mfg Index

- 22-Oct 1130 TBA 4W-Bill 20-Oct

- 22-Oct 1130 TBA 8W-Bill 20-Oct

- 22-Oct 1300 US Tsy $17B 5Y-TIPS auction (91282CAQ4)

- 22-Oct 1310 Richmond Fed Barkin & SF Fed Daly on economy

- 22-Oct 1630 21-Oct Fed weekly securities holdings

- 22-Oct 1800 Dal Fed Pres Kaplan, national/global economic issues w/ John B. Taylor, Mary and Robert Raymond Professor of Economics, Stanford and George P. Shultz Senior Fellow, Hoover Inst

PIPELINE: RBC Launched Late

- Date $MM Issuer (Priced *, Launch #)

- 10/21 $6B *World Bank (IBRD) 5Y +10

- 10/21 $2.25B #RBC $1.25B 3Y +33, $1B 3Y FRN SOFR+45

- 10/21 $2B #Sultanate of Oman $1.25B 7Y 6.75%, $750M 12Y 7.375%

- 10/21 $1B *FHLBanks 2Y global +4

- 10/21 $Benchmark Meituan 5Y +180, 10Y +225

- 10/21 $750M Arab National Bank 10NC5 Sukuk +290

- 10/21 $750M *Qatar Islamic Bank 5Y Sukuk +155

- 10/21 $600M *Inv Corp Dubai (ICD) +5.5Y +275

EURODOLLAR/TREASURY OPTIONS

Eurodollar Options:

- +2,000 Mar 100/100.12 call spds, 0.5

- +6,000 Mar 96/97 2x1 put spds, 2.0

- +2,500 Blue Mar 91/93 put spds, 6.75 legged

- Overnight trade

- 5,000 Blue Dec 96 puts

Tsy Options:

- +5,000 TYX 139 calls, 3/64 vs. 138-20/0.17%

- -5,000 TYZ 138/139/140 iron flys, 47/64

- +2,000 TYZ 136.5/137/138 broken put fly 8 over TYZ 140.5/141.5 call spds

- scale seller -3,700 USZ 169/177 put over risk reversals, 12- to 5/64

- +1,300 TYZ 137/138/138.5/139.5 put condors19/64

- 11,100 TYX 138.5 puts, 10/64

- 5,000 TYZ 137/138 2x1 put spds, 1, total near 10k from 2-1

- 1,400 TYZ 134 puts, 2

- 1,300 USZ 179/180 put spds, 6/64

- Overnight trade (reminder Nov options expire Friday)

- 11,500 TYX 139 calls, 2/64 last

- 12,200 TYX 138 puts, 2/64 last

- Block +20k TYZ 138/139 put spds vs. -10k TYF 138 puts, 0.0 net (another 15k on screen soon after and 5k TYZ 138/139 put spds outright)

- 1,500 TYZ 137/138 2x1 put spds

- 1,500 TYF 137/138/139 put trees (>+85k TYZ 137.5/138/139 put trees bought Tue 3-6)

- 5,300 FVX 125.5 puts, 1.5

- Decent flurry of trade in Nov and Dec 30Y calls/puts

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.