-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Risk Appetite Cools As Stimulus Odds Drop

EXECUTIVE SUMMARY:

- MNI EXCLUSIVE:US Permanent Joblessness to Eclipse Hiring Burst

- MNI INTERVIEW: GDP Won't Recover 1Y From Now- Chicago Fed Econ

- MNI SOURCES: EU Covid Loans Snub A Headache For ECB

- PELOSI: STIMULUS CAN BE PASSED BEFORE NOV. 3 IF TRUMP BACKS IT, Bbg

- MNUCHIN: PELOSI HAS `DUG IN,' STILL `SIGNIFICANT DIFFERENCES' -bbg

- TRUMP: DOES NOT WANT COVID-19 AID DEAL TO BAIL OUT DEMOCRATIC STATES - Reuters

- OIL PRICES DROP WITH LIBYA BOOSTING PRODUCTION IN COMING WEEKS, Bbg

- ITALY REPORTS JUMP IN NEW DAILY VIRUS CASES TO RECORD 19,143, Bbg

US

PAYROLLS: U.S. layoffs will more likely be permanent in the months ahead with the surge of re-hiring after the first wave of Covid-19 now fading away, current and former officials told MNI.

- Still-high unemployment and consumers holding back on spending are weighing on economic growth, weakening the prospect of more re-hiring, said Heidi Shierholz, former chief economist to the Secretary of Labor under President Barack Obama. For more see 10/23 main wire at 1417ET.

- The economy grew at a 30.8% annualized pace between July and September and the fourth quarter will come in at 5.2%, according to a new near-term projection model Brave created using 107 indicators. GDP fell at a record 31.4% pace in the second quarter and official third quarter figures come out Oct. 29. For more see 10/23 main wire at 1131ET.

EUROPE

- EU: The decision by some eurozone countries to snub European Covid emergency loans in favor of their own borrowing backed up by the European Central Bank's pandemic emergency purchase program could put unwelcome pressure on the ECB to extend monetary easing, eurosystem and Brussels sources told MNI. For more see 10/23 main wire at 0853ET.

OVERNIGHT DATA

- U.S. IHS MARKIT OCT. MANUFACTURING PMI AT 53.3 VS 53.2 PRIOR

- U.S. IHS MARKIT OCT. COMPOSITE PMI AT 55.5 VS 54.3 PRIOR

- U.S. IHS MARKIT OCT. SERVICES PMI AT 56 VS 54.6 LAST MONTH

- The New York Fed Staff Nowcast stands at 13.7% for 2020:Q3 and 3.5% for 2020:Q4

MARKET SNAPSHOT

- DJIA down 69.86 points (-0.25%) at 28289.96

- S&P E-Mini Future down 0.25 points (-0.01%) at 3448.75

- Nasdaq up 1.9 points (0%) at 11505.77

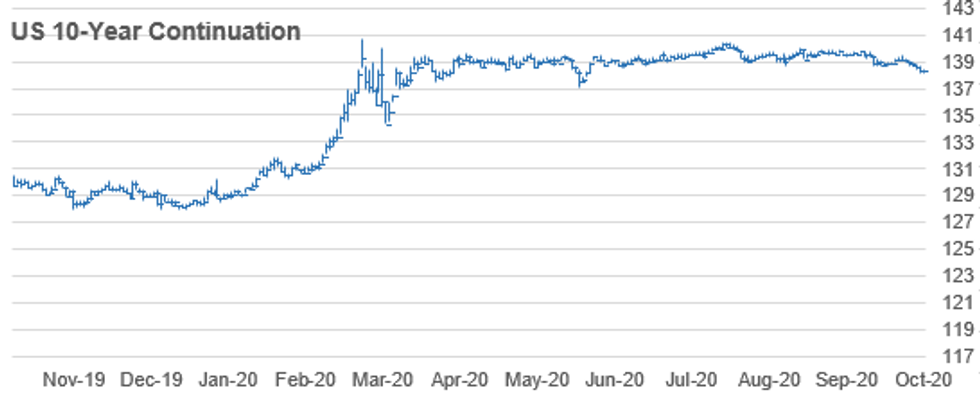

- US 10-Yr yield is down 1.7 bps at 0.8396%

- US Dec 10Y are up 1.5/32 at 138-12

- EURUSD up 0.0043 (0.36%) at 1.1861

- USDJPY down 0.15 (-0.14%) at 104.71

- WTI Crude Oil (front-month) down $0.81 (-1.99%) at $39.82

- Gold is up $0.03 (0%) at $1904.28

- European bourses closing levels:

- EuroStoxx 50 up 27.45 points (0.87%) at 3198.86

- FTSE 100 up 74.63 points (1.29%) at 5860.28

- German DAX up 102.69 points (0.82%) at 12645.75

- French CAC 40 up 58.26 points (1.2%) at 4909.64

US TSY SUMMARY:

Tsy futures were modestly higher across the curve, near session highs after trading weaker in the first half. A modest early risk-on unwound later in the session as Trump admin officials telegraphed chances of stimulus deal before election is evaporating. Really decent volumes by midmorning (TYZ>625k by 1030ET) dried up in the second half w/ TYZ just over 1.06M after the bell.

- Chances of a reaching a stimulus deal before the election evaporated precipitously in the second half. Though House Speaker Nancy Pelosi held hopes of reaching a deal "if Trump backs it", headlines quoting Tsy Sec Mnuchin that Pelosi has "dug in" with "significant differences" while Trump not wanting to "bail out Democratic states" weighed on risk appetite ahead the weekend.

- Otherwise trade action was relatively subdued the day after the final Presidential debate (no fireworks) with little data to trade off of (IHS MARKIT PMI's), while Fed-speak disappeared ahead of the blackout that kicks off at midnight tonight through Nov 7.

- The 2-Yr yield is up 0bps at 0.1534%, 5-Yr is down 0.6bps at 0.3685%, 10-Yr is down 1.8bps at 0.8379%, and 30-Yr is down 3.5bps at 1.641%.

US TSY FUTURES CLOSE: Near Late Day Highs

Modestly higher across the curve, near session highs after trading weaker in the first half. Really decent volumes by midmorning (TYZ>625k by 1030ET) dried up in the second half w/ TYZ just over 1.06M after the bell. Yld curves flatter, update:

- 3M10Y -1.75, 74.745 (L: 73.569 / H: 77.609)

- 2Y10Y -1.509, 68.582 (L: 68.014 / H: 71.243)

- 2Y30Y -2.784, 149.243 (L: 148.747 / H: 153.144)

- 5Y30Y -2.379, 127.549 (L: 127.295 / H: 130.493)

- Current futures levels:

- Dec 2Y up 0.12/32 at 110-13.12 (L: 110-12.8/H: 110-13.6)

- Dec 5Y up 0.25/32 at 125-18.5 (L: 125-16.5 / H: 125-20.5)

- Dec 10Y up 1/32 at 138-11.5 (L: 138-05.5 / H: 138-15)

- Dec 30Y up 8/32 at 172-19 (L: 171-22 / H: 172-25)

- Dec Ultra 30Y up 14/32 at 214-5 (L: 212-12 / H: 214-20)

US EURODLR FUTURES CLOSE: Reds-Golds Mildly Higher

Steady/mixed in the short end to mildly higher out the strip; lead quarterly EDZ0 slips late after holding steady since 3M LIBOR set' +0.00175 to 0.21650% (-0.00188/wk).

- Dec 20 -0.005 at 99.755

- Mar 21 -0.005 at 99.785

- Jun 21 steady at 99.80

- Sep 21 +0.005 at 99.805

- Red Pack (Dec 21-Sep 22) +0.005 to +0.010

- Green Pack (Dec 22-Sep 23) +0.010

- Blue Pack (Dec 23-Sep 24) +0.010

- Gold Pack (Dec 24-Sep 25) +0.010

US DOLLAR LIBOR: Latest settles

- O/N -0.00275 at 0.08138% (+0.00025/wk)

- 1 Month +0.00700 to 0.15625% (+0.00487/wk)

- 3 Month +0.00175 to 0.21650% (-0.00188/wk)

- 6 Month +0.00338 to 0.24938% (-0.00812/wk)

- 1 Year +0.00150 to 0.33663% (+0.00163/wk)

US TSY: Short Term Rates

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.09% volume: $61B

- Daily Overnight Bank Funding Rate: 0.08%, volume: $183B

- Secured Overnight Financing Rate (SOFR): 0.07%, $943B

- Broad General Collateral Rate (BGCR): 0.05%, $347B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $321B

- (rate, volume levels reflect prior session)

- Tsy 2.25Y-4.5Y, $8.801B accepted vs. $24.161B submission

- Next week's scheduled purchases:

- Tue 10/27 1010-1030ET: Tsy 7Y-20Y, appr $3.625B

- Wed 10/28 1010-1030ET: Tsy 20Y-307Y, appr $1.750B

PIPELINE: Citigroup Priced Late

Expect more issuance from financial names as they exit earnings

- Date $MM Issuer (Priced *, Launch #)

- 10/23 $2.5B *Citigroup 4NC3 fix/FRN +58

- -

- No New Issuance Thursday

- 10/22 $Benchmark Galaxy Pipeline multi-tranche investor call

FOREX: Fisheries Optimism Not Enough to Prop Up Pound

Hopes of progress for one of the last few sticking points for a Brexit deal were raised Friday, but GBP failed to sustain the rally into the close. The currency held its place as the poorest performer in G10.

- Reports citing a French fishing industry source suggested the French government were preparing domestic industry groups for more restricted access to British fishing waters - signs that the EU could be open to making concessions to secure a deal.

- The EUR outperformed, with the move starting in earnest after better-than-expected PMI data - manufacturing continues to outstrip services, which helped tip the Eurozone composite just above expectations. JPY rose alongside the greenback as US equities turned lower. Sticking points clearly remain between the White House Admin and House Speaker Pelosi, leading markets to knock back the chances of a stimulus package pre-election.

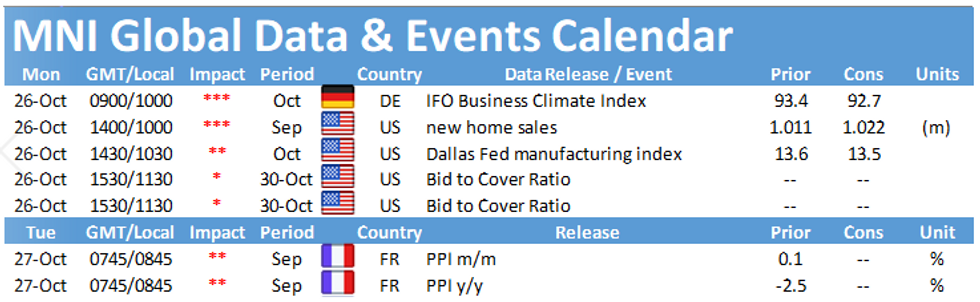

- Focus in the coming week turns to the ECB, BoJ & BoC rate decisions, Australian inflation and French, German & Canadian GDP. Earnings season in the US continues with the busiest week of the quarter. 46% of the S&P500 by market cap are due to report.

EGBs-GILTS CASH CLOSE: Bear Steepening Fades

Early bear steepening in Bunds and - especially - Gilts faded in the afternoon as a bit of risk was taken off ahead of the weekend with equities coming off highs. Gilts hit session lows around 1330BST after a Reuters sources piece suggesting France was set to give ground on fishing in the Brexit negotiations, but gained steadily thereafter.

- This wasn't fully a risk-off bid though, with BTP spreads remaining pinned down ahead of tonight's S&P credit ratings review. Closing Levels / 10-Yr Periphery EGB Spreads:

- Germany: The 2-Yr yield is up 0.7bps at -0.758%, 5-Yr is unchanged at -0.773%, 10-Yr is down 0.8bps at -0.574%, and 30-Yr is down 0.9bps at -0.154%.

- UK: The 2-Yr yield is down 0.6bps at -0.033%, 5-Yr is down 0.6bps at -0.031%, 10-Yr is down 0.4bps at 0.28%, and 30-Yr is down 0.5bps at 0.848%.

- Italian BTP spread down 3.7bps at 133.2bps

- Spanish bond spread down 2bps at 76.9bps

- Portuguese PGB spread down 1.9bps at 74.8bps

- Greek bond spread down 0.4bps at 149.8bps

UP TODAY

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.