-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Strong Risk-Off Week Opener

EXECUTIVE SUMMARY:

- MNI EXCLUSIVE: Fed's Inclusiveness Shift to Delay Rate Hikes

- MNI INTERVIEW: Fed Average Inflation Goal Keeps Fiscal Risk Low

- MNI INTERVIEW: QE Rules Should Be Clearer-Ex-BOE's Forbes

- MNI INTERVIEW: Canada Moving Farther From Fiscal Anchor-Beatty

- MNI PREVIEW: BOC Set To Hold Rates and QE on 2nd Covid Wave

- BIDEN AIDES SAY HE'LL PUSH $2T STIMULUS PACKAGE IF ELECTED: FBN

- KUDLOW: NUMBER OF AREAS IN PELOSI PLAN THAT TRUMP CAN'T ACCEPT

- KUDLOW: ISSUES REGARDING IMMIGRATION, HEALTH CARE REMAIN

- Oxford Covid Vaccine Produces Immune Response in Elderly, Bbg

US

FED: The Fed's new framework will make policymakers reluctant to raise rates unless low-income families join the recovery, perhaps going beyond the last cycle where inflation remained weak as unemployment plumbed record lows, current and former Fed officials tell MNI. For more see 10/26 main wire at 1042ET.

FED: The Federal Reserve's new average inflation target will keep US payments on its record debt pile low even after policy interest rates rise from the zero lower bound, Kansas City Fed economist Huixin Bi told MNI. For more see 10/26 main wire at 1431ET.

CANADA

BOC: Canada is moving even further away from returning to a fiscal "anchor" that would boost business and investor confidence through the rebuild following Covid-19, Perrin Beatty, Chamber of Commerce president and a former revenue and health minister, told MNI. For more see 10/26 main wire at 1424ET.

BOC: The Bank of Canada will likely affirm Wednesday that interest rates will stay near zero for years and press ahead with QE, as the economy's transition to what policymakers had called a long recuperation is threatened by a second wave of Covid-19. For more see 10/26 main wire at 1305ET.

EUROPE

BOE: Central banks should lay down clear principles for future emergency monetary policy action of the sort seen in March, helping investors better anticipate future easing and lessening any pressure to automatically respond to falling markets, Kristin Forbes, a former Bank of England Monetary Policy Committee member and New York Fed adviser told MNI. For more see 10/26 main wire at 1310ET.

OVERNIGHT DATA

- US SEP NEW HOME SALES -3.5% TO 0.959M SAAR

- US AUG NEW HOME SALES REVISED TO 0.994M SAAR

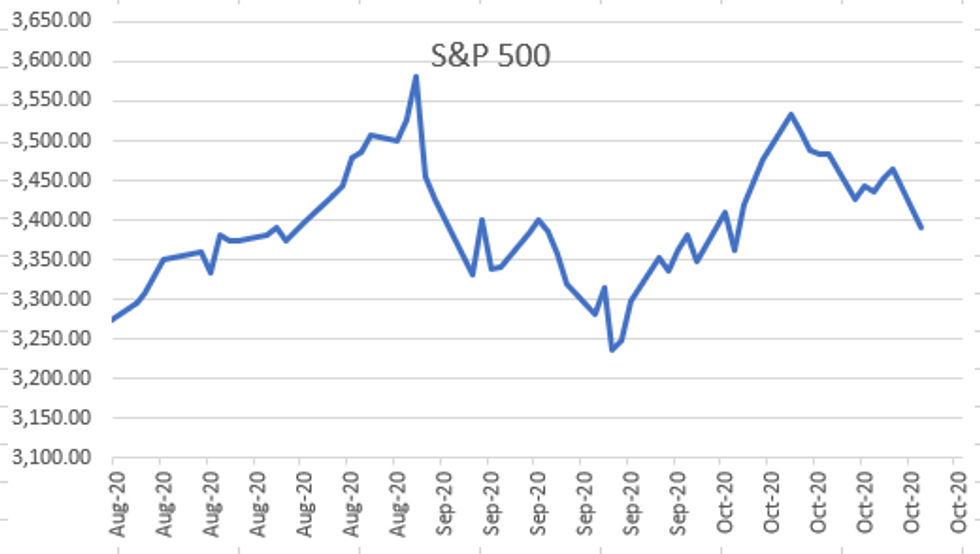

MARKET SNAPSHOT

- DJIA down 791 points (-2.79%) at 27570.66

- S&P E-Mini Future down 75.75 points (-2.19%) at 3380

- Nasdaq down 245.2 points (-2.1%) at 11322.04

- US 10-Yr yield is down 4.5 bps at 0.7977%

- US Dec 10Y are up 9.5/32 at 138-21

- EURUSD down 0.0045 (-0.38%) at 1.1813

- USDJPY up 0.14 (0.13%) at 104.85

- WTI Crude Oil (front-month) down $1.24 (-3.11%) at $38.59

- Gold is up $0.79 (0.04%) at $1903.88

- European bourses closing levels:

- EuroStoxx 50 down 93.61 points (-2.93%) at 3105.29

- FTSE 100 down 68.27 points (-1.17%) at 5791

- German DAX down 468.57 points (-3.71%) at 12183.63

- French CAC 40 down 93.52 points (-1.9%) at 4816.35

US TSY SUMMARY

Tsy futures broadly higher after the bell, strong tail-wind for rates all session with equities selling off, ESZ0 breaching 50-day EMA (50% retrace back to Sep low in second half). Limited data, Fed in media black-out through Nov 7.

- No single driver for the risk-off tone, though virus lock-down and/or vaccine efficacy concerns, election anxiety and stimulus talks all remain factors. On stimulus, WH advisor Kudlow said there were a "NUMBER OF AREAS IN PELOSI PLAN THAT TRUMP CAN'T ACCEPT" Bbg.

- Equities did recover off steep losses after midday when "BIDEN AIDES SAY HE'LL PUSH $2T STIMULUS PACKAGE IF ELECTED," FBN.

- Average volumes by the close (TYZ>1M), but pace slowed significantly in the second half, participants close to the sidelines soon after London session close.

- The 2-Yr yield is down 0.8bps at 0.1474%, 5-Yr is down 2.7bps at 0.3493%, 10-Yr is down 4.4bps at 0.7993%, and 30-Yr is down 4.9bps at 1.5923%.

US TSY FUTURES CLOSE

Broadly higher after the bell, strong tail-wind for rates all session with equities selling off, ESZ0 breaching 50-day EMA (50% retrace back to Sep low in second half). Yld curves bull flatten, update:

- 3M10Y -3.598, 71.315 (L: 69.544 / H: 73.315)

- 2Y10Y -3.551, 64.996 (L: 64.159 / H: 67.608)

- 2Y30Y -4.126, 144.223 (L: 142.931 / H: 147.446)

- 5Y30Y -2.049, 124.235 (L: 123.332 / H: 126.1)

- Current futures levels:

- Dec 2Y +0.25/32 at 110-13.3 (L: 110-13 / H: 110-13.75)

- Dec 5Y +3.25/32 at 125-21.75 (L: 125-18 / H: 125-23)

- Dec 10Y up 9/32 at 138-20.5 (L: 138-11 / H: 138-23)

- Dec 30Y up 1-1/32 at 173-20 (L: 172-22 / H: 173-30)

- Dec Ultra 30Y up 2-10/32 at 216-17 (L: 214-13 / H: 217-05)

US EURODOLLAR FUTURES CLOSE

Moderately higher across the strip, near session highs with Golds outperforming all session; lead quarterly EDZ0 holding steady since 3M LIBOR set' +0.00575 to 0.22225% (-0.00188 last wk).

- Dec 20 steady at 99.755

- Mar 21 +0.005 at 99.790

- Jun 21 steady at 99.795

- Sep 21 steady at 99.800

- Red Pack (Dec 21-Sep 22) +0.005 to +0.010

- Green Pack (Dec 22-Sep 23) +0.015 to +0.030

- Blue Pack (Dec 23-Sep 24) +0.035 to +0.045

- Gold Pack (Dec 24-Sep 25) +0.045 to +0.055

US DOLLAR LIBOR: Latest settles

- O/N -0.00075 at 0.08063% (+0.00025 last wk)

- 1 Month -0.00475 to 0.15150% (+0.00487 last wk)

- 3 Month +0.00575 to 0.22225% (-0.00188 last wk)

- 6 Month -0.00313 to 0.24625% (-0.00812 last wk)

- 1 Year -0.00463 to 0.33200% (+0.00163 last wk)

US TSYS: Short Term Rates

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.09% volume: $61B

- Daily Overnight Bank Funding Rate: 0.08%, volume: $183B

- Secured Overnight Financing Rate (SOFR): 0.08%, $915B

- Broad General Collateral Rate (BGCR): 0.06%, $334B

- Tri-Party General Collateral Rate (TGCR): 0.06%, $313B

- (rate, volume levels reflect prior session)

- Tsy 7Y-20Y, $3.601B accepted vs. $11.784B submission

- Next scheduled purchase:

- Tue 10/27 1010-1030ET: Tsy 20Y-307Y, appr $1.750B

- Wed 10/28 Next forward schedule release at 1500ET

PIPELINE: Back To The Sidelines

Expect more issuance from financial names as they exit earnings

- Date $MM Issuer (Priced *, Launch #)

- 10/?? $Benchmark Kommuninvest short 2Y TBA

- -

- $2.5B Priced late Friday; $33.35B/wk

- 10/23 $2.5B *Citigroup 4NC3 fix/FRN +48

FOREX: Equities Take Turn For Worse as Risks to Rally Mount

Equities in Europe started the session poorly and the US followed suit, with the three major indices all falling as much as 3% as a burst of equity negative news flow mounted, leaving the recent rally at risk. German software firm SAP sharply revised their outlook lower, leading their shares to trade lower by over 20%. This led tech firms lower, with China's sanction of US aerospace & defense firms adding to the downside.

- Polling continues to suggest Trump's paths to a second term are dwindling, with Monday's broad-based move lower in stocks a possible sign that equities are pricing in a straightforward Blue Wave at next week's election. Despite the range in stocks, currencies were rangebound, but the over-arching risk-off tone fed into USD strength.

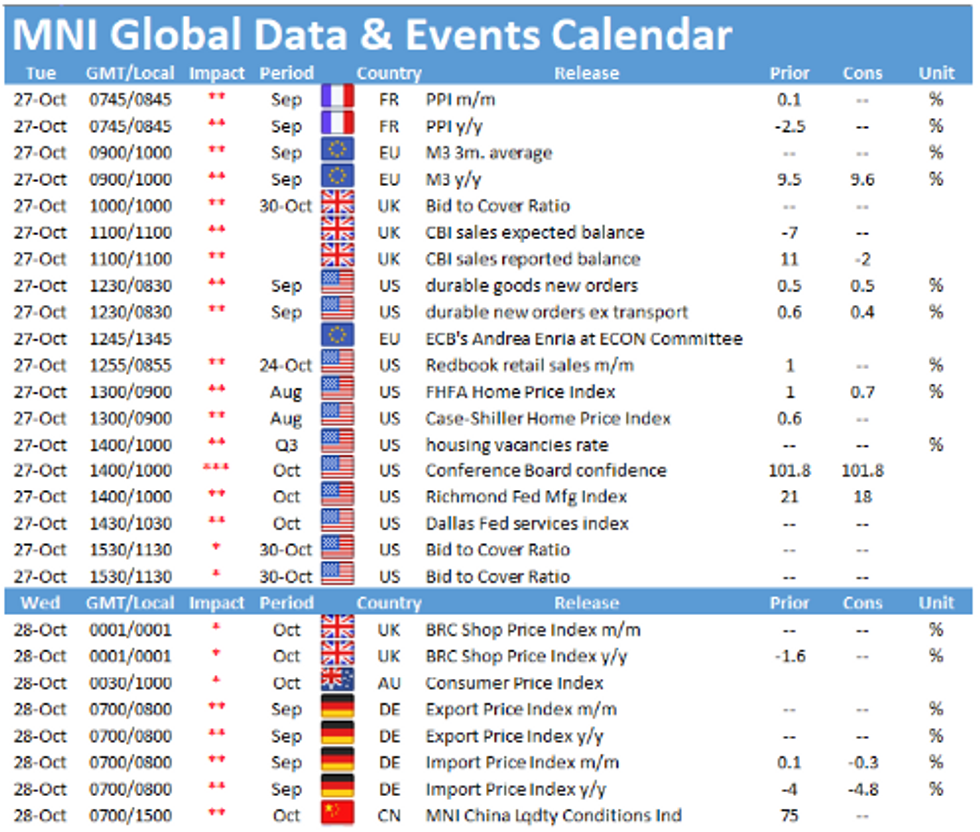

- Focus Tuesday turns to September durable goods orders and consumer confidence data from the US. RBA's Debelle & Bullock and ECB's de Cos are due to speak.

EGBs-GILTS CASH CLOSE: Not Quite Risk-Off

Despite a major equity correction (DAX off 3.7%), Bunds and Gilts had a mixed day, with an initial fall in yields giving way to afternoon weakness.

- Italian short-end yields briefly hit new lows, but the rally didn't last. 10-Yr spreads retraced 6bps wider from the lows but still finished slightly tighter, after getting a ratings + outlook reprieve from S&P on Fri. Closing Levels / 10-Yr Periphery EGB Spreads:

- Germany: The 2-Yr yield is up 0.1bps at -0.757%, 5-Yr is unchanged at -0.773%, 10-Yr is down 0.6bps at -0.58%, and 30-Yr is down 0.8bps at -0.162%.

- UK: The 2-Yr yield is down 0.1bps at -0.034%, 5-Yr is unchanged at -0.031%, 10-Yr is down 0.5bps at 0.275%, and 30-Yr is up 0.3bps at 0.851%.

- Italian BTP spread down 1.3bps at 131.9bps

- Spanish bond spread down 0.3bps at 76.6bps

- Portuguese PGB spread down 0.8bps at 74bps

- Greek bond spread up 0.3bps at 150.1bps

UP Today

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.