-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Risk Parity Unwinds Meet French Lockdown

EXECUTIVE SUMMARY:

- MNI EXCLUSIVE: PBOC Acts On Yuan As Strengthening Bets Grew

- MNI INTERVIEW: US, China May Cede on Poor Nation Debt-Ortiz

- MNI EXCLUSIVE: Fiscal Stasis May Prompt Fed QE Boost

- MNI: BANK OF CANADA LEAVES KEY RATE AT 0.25%

- MACRON IMPOSES NEW NATIONWIDE LOCKDOWN IN FRANCE AS CASES SURGE, Bbg

- BREXIT TALKS MAKE PROGRESS WITH DEAL POSSIBLE BY EARLY NOVEMBER, Bbg

- MERKEL REACHES DEAL FOR ONE-MONTH PARTIAL LOCKDOWN IN GERMANY, Bbg

- GERMANY'S PARTIAL LOCKDOWN SAID TO START ON NOVEMBER 2, Bbg

US

US/CHINA: The U.S. and China are likely to give concessions ensuring a smoother refinancing of a USD200 billion pool of debt from poorer nations struggling to contain Covid-19, Mexico's former central bank chief and finance minister Guillermo Ortiz told MNI. For more see 10/28 main wire at 1147ET.

FED: Delays in approving fiscal relief for the Covid-hit U.S. economy could compel the Federal Reserve to take fresh accommodative steps via its asset purchase program in upcoming meetings despite concerns that quantitative easing provides diminishing returns when interest rates are already very low, former policymakers told MNI. For more see 10/28 main wire at 1147ET.

US: US Secretary of State Mike Pompeo has announced that the US intends to build its first Embassy in the capital of the Maldives, Male.- Usually this news would not make waves, but the Maldives has become a key strategic player in the ongoing great power struggle in the Indian Ocean, and wider South Asia region between India, China, and the US.

- The Maldives became a close ally of China under former President Abdulla Yameen, building up major debts to Beijing in the process as Chinese firms embarked on vast infrastructure projects on the island archipelago nation.

- Speaker of the Maljis (parliament) and former President Mohamed Nasheed has estimated that the Maldives could owe China as much as UD3.1bn, over half of the country's annual GDP. More conservative estimates put the debt at USD1.1-1.4bn, still a large sum for a small economy.

- In another Indian Ocean nation, Sri Lanka, the gov't was forced to cede 70% stake on a 99 year lease on a naval port to China after defaulting on its debt to Beijing.

- The US and India have significant concerns that if a similar situation were to occur in the Maldives it would provide Beijing with a second strategic foothold in the Indian Ocean, at a time when China is also seeking to expand its control of various islands in the South and East China seas.

CANADA

BOC: The Bank of Canada said Wednesday that significant slack in the economy will hold inflation below its 2% inflation target through a two-year projection horizon, among other highlights of its Monetary Policy Report:

- "The near-term slowing in the recuperation phase is likely to be more pronounced as a result of the recent increase of COVID-19."

- "There is ongoing and significant slack in the Canadian economy. The gap between the actual output and the potential output of the economy is not expected to close until 2023. The economy is progressing unevenly, with some sectors and workers disproportionately affected by the virus."

- "Ongoing slack in the economy is expected to continue to hold inflation down into 2023." For more see 10/28 main wire at 1000ET

ASIA

PBOC: A move by the People's Bank of China to ask some banks to suspend use of the counter-cyclical factor in contributions to yuan fixing came amid signs of increasing bets on appreciation but the PBOC remains determined to increase the market's role in determining the exchange rate, a former senior forex official told MNI, with a policy advisor adding that the factor could be reintroduced in the future. For more see 10/28 main wire at 1005ET.

OVERNIGHT DATA

- U.S. SEPT. GOODS-TRADE GAP NARROWS TO $79.4B; EST. $84.5B

- U.S. ADVANCE RETAIL INVENTORIES ROSE 1.6 % IN SEPT

- U.S. ADVANCE WHOLESALE INVENTORIES FELL 0.1 % IN SEPT

- US MBA: MARKET COMPOSITE +1.7% SA THRU OCT 23 WK

- US MBA: REFIS +3% SA; PURCH INDEX +0.2% SA THRU OCT 23 WK

- US MBA: UNADJ PURCHASE INDEX +24% VS YEAR-EARLIER LEVEL

- US MBA: 30-YR CONFORMING MORTGAGE RATE 3.00% VS 3.02% PREV

SNAPSHOT

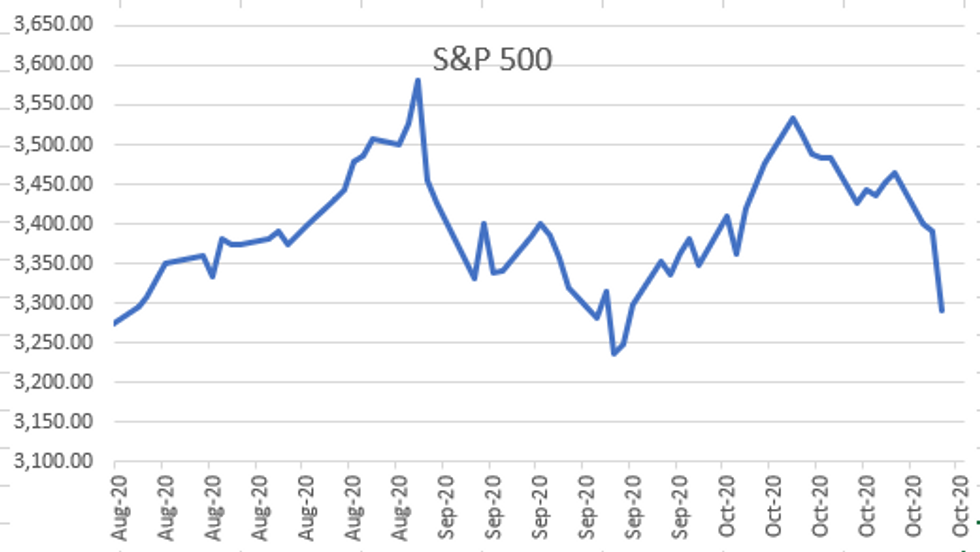

- DJIA down 942.22 points (-3.43%) at 26670.35

- S&P E-Mini Future down 118.25 points (-3.5%) at 3283.5

- Nasdaq down 426.5 points (-3.7%) at 11079.29

- US 10-Yr yield is up 0.5 bps at 0.7727%

- US Dec 10Y are down 0.5/32 at 138-26.5

- EURUSD down 0.0051 (-0.43%) at 1.1758

- USDJPY down 0.07 (-0.07%) at 104.3

- WTI Crude Oil (front-month) down $2.22 (-5.61%) at $37.40

- Gold is down $31.37 (-1.64%) at $1878.51

- European bourses closing levels:

- EuroStoxx 50 down 107.06 points (-3.49%) at 2963.54

- FTSE 100 down 146.19 points (-2.55%) at 5582.8

- German DAX down 503.06 points (-4.17%) at 11560.51

- French CAC 40 down 159.54 points (-3.37%) at 4571.12

US TSY SUMMARY: Risk-Parity Unwind Stymie Stock Rout?

Tsy futures opened well bid in reaction to steep losses in equities through London into New York trade (ESZ0 -105.0 in late trade). Tsy support was not consistent, however.

- The reluctance of Tsys to hold onto strong bids across the curve in the face of sharp sell-off in equities spurred a lot of questions. It was evident early on that German DAX lead S&P futures rout, selling ebbed briefly after details of German shutdown aired).

- Varied desks pointed to likely position unwinds by Risk-Parity funds from midmorning on as Tsys continued to scale back deep support into the close.

- Delayed react to late headlines that France PM Macron calling for a nationwide lockdown to contain the spread of COVID-19 (will reevaluate in 15 days), helped Tsys bounce off lows while equities continued to fall (ESZ0 -120.0)

- The 2-Yr yield is up 0.1bps at 0.1466%, 5-Yr is unchanged at 0.3301%, 10-Yr is up 0.5bps at 0.7727%, and 30-Yr is up 0.4bps at 1.5571%.

US TSY FUTURES CLOSE: Well Off Early Highs Despite Eq Rout

Well off early session highs, Tsy futures trading mixed after the bell, 10s-30s weaker, even as equities retain steep losses (ESZ0 -86.0). Decent volumes (TYZ0 over 1.38M); yield curves mildly steeper after flattening last four sessions. Update:

- 3M10Y +1.006, 68.106 (L: 64.075 / H: 68.441)

- 2Y10Y +0.694, 62.716 (L: 59.936 / H: 63.08)

- 2Y30Y +0.903, 141.467 (L: 138.223 / H: 142.347)

- 5Y30Y +1.051, 123.187 (L: 121.134 / H: 124.067)

- Current futures levels:

- Dec 2Y up 0.12/32 at 110-13.62 (L: 110-13.3 / H: 110-13.8)

- Dec 5Y up 0.25/32 at 125-24.5 (L: 125-24 / H: 125-27.25)

- Dec 10Y down 1/32 at 138-26 (L: 138-24.5 / H: 139-03)

- Dec 30Y steady at at 174-3 (L: 173-30 / H: 174-29)

- Dec Ultra 30Y up 7/32 at 217-25 (L: 217-13 / H: 219-14)

US EURODLR FUTURES CLOSE: Follow Tsy Futures Lead

Steady to mixed in the short end, mildly weaker out the strip; lead quarterly EDZ0 back to steady since 3M LIBOR set' +0.00113 to 0.21438% (-0.00212/wk).

- Dec 20 steady at 99.755

- Mar 21 +0.005 at 99.790

- Jun 21 +0.005 at 99.800

- Sep 21 steady at 99.800

- Red Pack (Dec 21-Sep 22) -0.005 to steady

- Green Pack (Dec 22-Sep 23) -0.01 to -0.005

- Blue Pack (Dec 23-Sep 24) -0.01 to -0.005

- Gold Pack (Dec 24-Sep 25) -0.015 to -0.010

US DOLLAR LIBOR: Latest settles

- O/N -0.00138 at 0.08025% (-0.00113/wk)

- 1 Month +0.00312 to 0.14775% (-0.00850/wk)

- 3 Month +0.00113 to 0.21438% (-0.00212/wk)

- 6 Month -0.00237 to 0.24413% (-0.00525/wk)

- 1 Year -0.00412 to 0.32763% (-0.00900/wk)

US TSYS: Short Term Rates

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.09% volume: $60B

- Daily Overnight Bank Funding Rate: 0.08%, volume: $177B

- Secured Overnight Financing Rate (SOFR): 0.09%, $931B

- Broad General Collateral Rate (BGCR): 0.06%, $331B

- Tri-Party General Collateral Rate (TGCR): 0.06%, $309B

- (rate, volume levels reflect prior session)

- Thu 10/29 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Fri 10/30 1100-1120ET: TIPS 7.5Y-30Y, appr $1.225B

- Mon 11/02 1100-1120ET: Tsy 20Y-30Y, appr $1.750B

- Tue 11/03 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

- Fri 11/06 1100-1120ET: Tsy 0Y-2.25Y, appr $12.825B

- Mon 11/09 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Tue 11/10 1010-1030ET: TIPS 1Y-7.5Y, appr $2.425B

- Thu 11/12 1010-1030ET: Tsys 7Y-20Y, appr $3.625B

- Fri 11/13 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.825B

- Fri 11/13 Next forward schedule release at 1500ET

PIPELINE

Waiting On Lenovo

- Date $MM Issuer (Priced *, Launch #)

- 10/28 $1B #Lenovo 10Y +265

- 10/28 $750M #Kommunalbanken 2Y +3

- 10/28 $500M *World Bank (IADB) +4Y SOFR+25

- 10/28 $500M *Kookmin 10NCL covid bond, +175

- 10/?? $500M Swedish Export Credit Corporation (SEK) 2Y +6a

FOREX: Equities Extend Slide, Fuelling Fearsome USD Rally

Markets sought havens throughout the Wednesday session as equities slipped further. European equities shed a further 3% or so. with US stocks following suit. With stocks falling sharply, JPY and USD rose against all others in G10, boosting the USD index to the best levels in two weeks and back above the 50-dma.

- GBP saw a little reprieve ahead of the London close as Bloomberg reported that a Brexit deal could be in the offing in early November as good progress has been made between negotiating teams this week.

- Commodity markets were similarly roiled by the threat of further lockdowns across continental Europe, leading WTI and Brent crude futures to shed over 5% and anchor the likes of NOK & CAD.

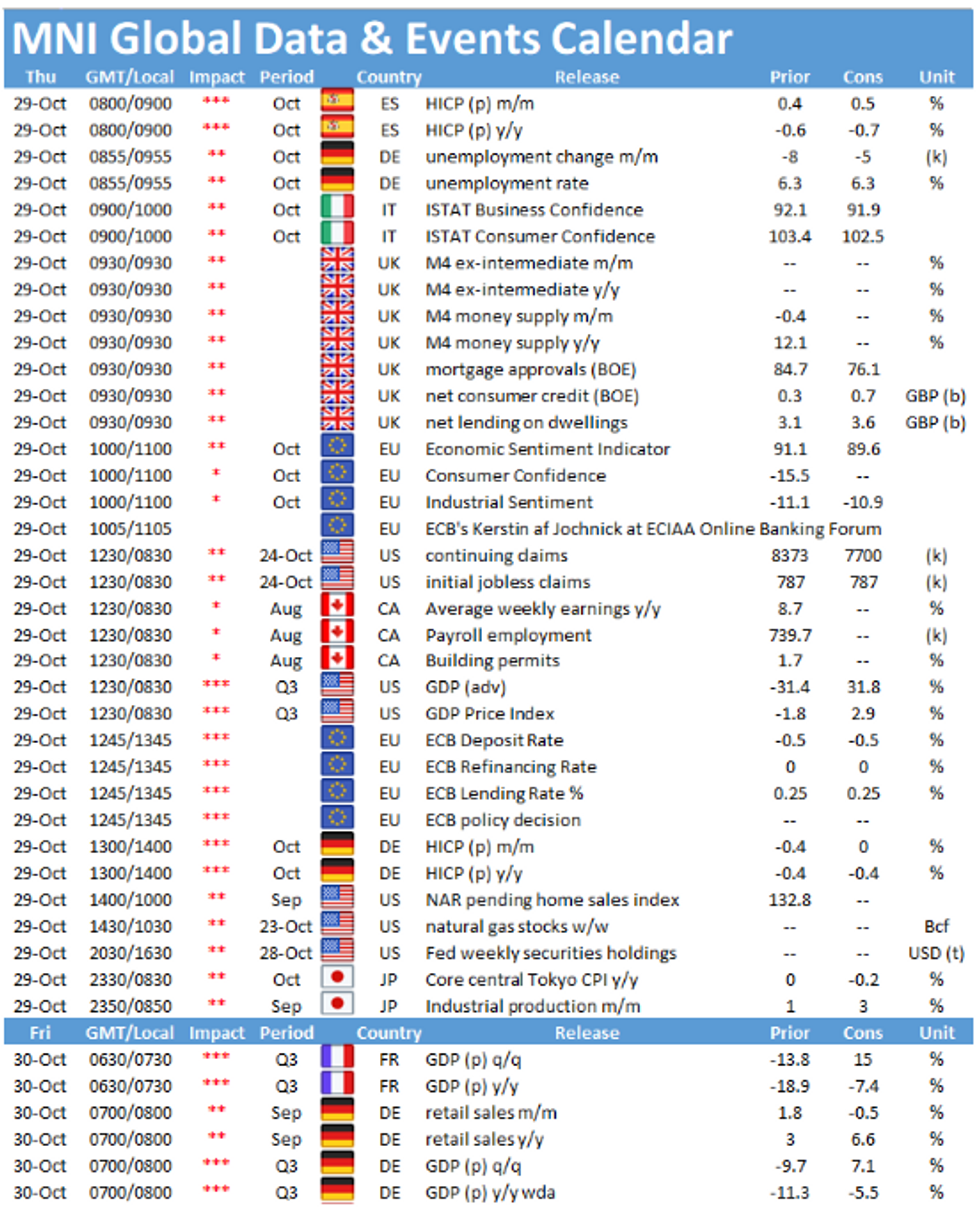

- Thursday brings weekly US jobless claims and advance Q3 GDP, regional German CPIs and pending home sales. Rate decisions from the ECB and BoJ are due. Neither bank are expected to make any material change to policy, although pressure is clearly ratcheting higher on both bank's committees as their inflation outlooks continue to deteriorate.

EGBs-GILTS CASH CLOSE: Peripheries Bear Brunt Of Risk Aversion

Bunds and Gilts are modestly stronger on the day but yields came off lows even as equities dropped hard on renewed European COVID lockdown fears. Germany's Merkel announced a month-long lockdown and France's Macron is expected to announce similar this evening.

- UK/German curves flattened but closed well off flattest levels of the session. A clearer reflection of global risk-off was in periphery yields: Greek 10-Yr spreads blew out nearly 15bps.

- ECB meeting will be the focal point Thursday. Closing Levels / 10-Yr Periphery EGB Spreads:

- Germany: The 2-Yr yield is down 1.5bps at -0.789%, 5-Yr is down 1.1bps at -0.813%, 10-Yr is down 1bps at -0.625%, and 30-Yr is down 1.9bps at -0.215%.

- UK: The 2-Yr yield is down 1.3bps at -0.062%, 5-Yr is down 1.8bps at -0.072%, 10-Yr is down 1.9bps at 0.213%, and 30-Yr is down 2.6bps at 0.754%.

- Italian BTP spread up 7.5bps at 139bps

- Spanish bond spread up 3bps at 80.3bps

- Portuguese PGB spread up 2.9bps at 77.5bps

- Greek bond spread up 14.9bps at 169.6bps

UP TODAY

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.