-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Countdown To US Presidential Election

EXECUTIVE SUMMARY

- MNI PREVIEW: Fed To Stand Pat After US Election; QE Steps Eyed

- MNI INTERVIEW: US October Job Openings Up Despite Virus Surge

- MNI EXCLUSIVE: Boeing An Early Test For EU Ties If Biden Wins

- MNI BRIEF: UK PM Johnson Says 'Intend' Dec 2 Return To Tiers

- UK'S JOHNSON: GOVERNMENT WILL DOUBLE SUPPORT FOR SELF-EMPLOYED, Bbg

- UK'S JOHNSON: SELF-EMPLOYED TO RECEIVE 80% OF TRADING PROFITS, Bbg

US

FED: The Federal Reserve is expected to hold monetary policy steady at a meeting which ends just two days after Tuesday's presidential election, but behind the scenes it will examine potential additional easing, particularly in the continued absence of more fiscal stimulus.

DATA: Employment isn't likely to drop to the record lows seen when the U.S. was battling its first wave of Covid-19 even as caseloads surged to fresh highs across the country in October, Julia Pollak, a labor economist at online job marketplace ZipRecruiter, told MNI, citing steadily rising job postings over the past weeks. For more see 11/02 main wire at 1250ET.

US/EU: The EU's dispute with the U.S. over subsidies for Boeing and Airbus will provide an early test of the bloc's willingness to work with any Joe Biden administration, a former senior U.S. diplomat told MNI, adding that substantive differences on trade would persist whoever wins Tuesday's elections. For more see 11/02 main wire at 1247ET.

EUROPE

UK: England is not going back to the full scale lockdown seen in March and April, Prime Minister Boris Johnson said Monday, whilst confirming that continued support will be in place not just for furloughed workers, but for the self-employed as well.

OVERNIGHT DATA

U.S. IHS MARKIT OCT. MANUFACTURING PMI AT 53.4 VS 53.2 PRIOR

- US SEP CONSTRUCT SPENDING +0.3%

- US SEP PRIVATE CONSTRUCT SPENDING +0.9%

- US SEP PUBLIC CONSTRUCT SPENDING -1.7%

- US DATA: ISM Oct Manufacturing PMI Higher At 59.3 vs Sep 55.4

- US ISM NEW ORDERS INDEX 67.9 OCT VS 60.2 SEP

- US ISM EMPLOYMENT INDEX 53.2 OCT VS 49.6 SEP

- US ISM PRODUCTION INDEX 63.0 OCT VS 61.0 SEP

- US ISM SUPPLIER DELIVERY INDEX 60.5 OCT VS 59.0 SEP

- US ISM INVENTORIES INDEX 51.9 OCT VS 47.1 SEP

The ISM Mfg PMI rose in Sep by 3.9pt to 59.3, which is the highest level since Sep 2018 where it hit the same level. The increase was broad-based with every major component showing a monthly uptick. Among the main five categories, New Orders (+7.7pt) saw the largest gain, followed by Inventories (+4.8pt), Employment (+3.6pt), Production (+2.0pt) and Supplier Deliveries (+1.5pt). Employment shifted back to expansion territory for the first time since Jul 2019. Among the other categories, Imports saw the largest rise to 58.1 (+4.1pt), followed by Prices which edged up to 65.5 (+2.7pt). Exports ticked up to 55.7 (+1.4pt), while Order Backlogs gained 0.5pt to 55.7. The Customer's Inventory index was the only category to reveal a decline by 1.2pt to 36.7, indicating that customers' inventory levels were considered too low.

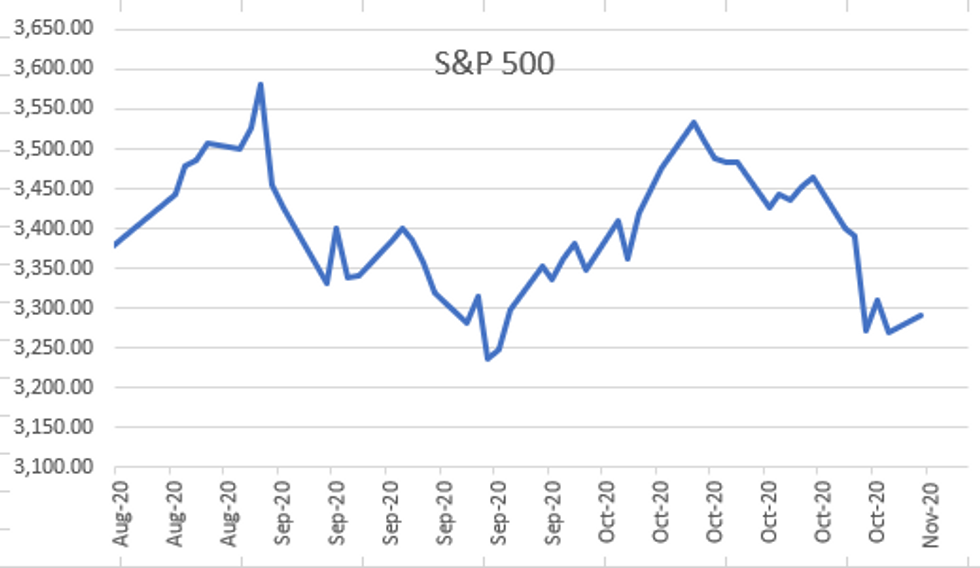

MARKETS SNAPSHOT

- DJIA up 381.44 points (1.44%) at 26883.27

- S&P E-Mini Future up 33 points (1.01%) at 3292.5

- Nasdaq up 34.3 points (0.3%) at 10894.17

- US 10-Yr yield is down 2 bps at 0.8535%

- US Dec 10Y are up 1/32 at 138-8

- EURUSD down 0.0009 (-0.08%) at 1.1631

- USDJPY up 0.13 (0.12%) at 104.85

- WTI Crude Oil (front-month) up $1.3 (3.63%) at $37.00

- Gold is up $16.56 (0.88%) at $1894.12

- European bourses closing levels:

- EuroStoxx 50 up 61.33 points (2.07%) at 3019.54

- FTSE 100 up 77.7 points (1.39%) at 5654.97

- German DAX up 231.8 points (2.01%) at 11788.28

- French CAC 40 up 96.9 points (2.11%) at 4691.14

US TSY SUMMARY:

Tsys were nearly back to where they started the session -- steady to mixed, long end bid but well off late morning highs with a block sale in Dec 30Y ultra-bonds (WNZ0) after the closing bell weighing (only -2k at 215-11, well through the 215-16 bid at the time).

- Curves were flatter but off midday levels as the long end scaled back long end support. Overall volumes were well off last Fri's month end trade (TYZ 1.1M vs. 2.1M) with trade more tentative ahead Tuesday's presidential election and swing states results.

- Of course there's a lot of other event and data risk this week: FOMC policy announcement on Wednesday, October employment data on Friday (+600k est job gains vs. +661k last month), and ongoing covid-19 spread concerns.

- Trade two-way, mostly position squaring/paring, option related hedging, no deal-related flow, some swap-tied selling in the short end.

- The 2-Yr yield is up 0.4bps at 0.1564%, 5-Yr is down 1.1bps at 0.3733%, 10-Yr is down 2.7bps at 0.8468%, and 30-Yr is down 3.8bps at 1.6218%.

US TSY FUTURES CLOSE: Off Late Morning Highs

Trading steady to mixed after the bell, off late morning highs amid much lighter volume compared to last Fri's month end trade (TYZ 1.1M vs. 2.1M), yield curves flatter with long end outperforming. Update:

- 3M10Y -2.358, 75.864 (L: 73.229 / H: 77.805)

- 2Y10Y -2.559, 69.175 (L: 67.406 / H: 71.764)

- 2Y30Y -3.309, 146.961 (L: 145.107 / H: 151.507)

- 5Y30Y -2.322, 124.992 (L: 123.773 / H: 128.898)

- Current futures levels:

- Dec 2Y -0.37/32 at 110-13.12 (L: 110-13 / H: 110-13.75)

- Dec 5Y steady at 125-19.25 (L: 125-18.75 / H: 125-22.5)

- Dec 10Y up 2/32 at 138-9 (L: 138-04.5 / H: 138-15.5)

- Dec 30Y up 5/32 at 172-20 (L: 171-31 / H: 173-06)

- Dec Ultra 30Y up 17/32 at 215-17 (L: 213-20 / H: 216-11)

US EURODOLLAR FUTURES CLOSE: Mirroring Tsy Futures Curve

Futures trading steady/weaker in the short end to modestly firmer out the strip, little off session highs. Lead quarterly holding steady since 3M LIBOR set +0.00438 to 0.22013% (-0.00075 last wk). Currently:

- Dec 20 steady at 99.755

- Mar 21 -0.005 at 99.790

- Jun 21 steady at 99.800

- Sep 21 -0.005 at 99.800

- Red Pack (Dec 21-Sep 22) +0.005 to +0.015

- Green Pack (Dec 22-Sep 23) +0.015 to +0.025

- Blue Pack (Dec 23-Sep 24) +0.025 to +0.030

- Gold Pack (Dec 24-Sep 25) +0.030 to +0.035

US DOLLAR LIBOR

Latest settles

- O/N -0.00025 at 0.08113% (+0.00000 net last wk)

- 1 Month +0.00025 to 0.14050% (-0.01513 net last wk)

- 3 Month +0.00438 to 0.22013% (-0.00075 last wk)

- 6 Month +0.00387 to 0.24600% (-0.00725 net last wk)

- 1 Year +0.00225 to 0.33238% (-0.00650 net last wk)

US TSY: Short Term Rates

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.09% volume: $56B

- Daily Overnight Bank Funding Rate: 0.08%, volume: $147B

- Secured Overnight Financing Rate (SOFR): 0.09%, $873B

- Broad General Collateral Rate (BGCR): 0.07%, $332B

- Tri-Party General Collateral Rate (TGCR): 0.07%, $305B

- (rate, volume levels reflect prior session)

- Tsy 20Y-30Y, $1.734B accepted vs. $5.508B submission

- Next scheduled purchases:

- Tue 11/03 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

- Fri 11/06 1100-1120ET: Tsy 0Y-2.25Y, appr $12.825B

PIPELINE

Issuers sidelined ahead US presidential election; $111.65B total high-grade debt issued in October.

FOREX: Recovering Oil Price Bolsters CAD

A negative start for WTI and Brent crude oil on Monday got commodity-tied FX to a bad start, but this swiftly reversed ahead of the close, with CAD, AUD and others outperforming the rest of G10 as WTI and Brent crude futures swung from losses of as much as 5% to positive territory ahead of the NY close. The moves followed wires reports that the Russian energy minister had met with domestic energy firms to discuss the option of delaying a planned easing of OPEC output curbs - effectively restricting supply for a longer period of time. Brent crude futures rose to just shy of $39/bbl after trading as low as $35.75 earlier in the day.

- The USD index traded slightly higher, showing above the 100-dma at 94.262 for the first time May ahead of polling. Markets clearly remain fretful, with the VIX index holding close to multi-month highs one day out from voting.

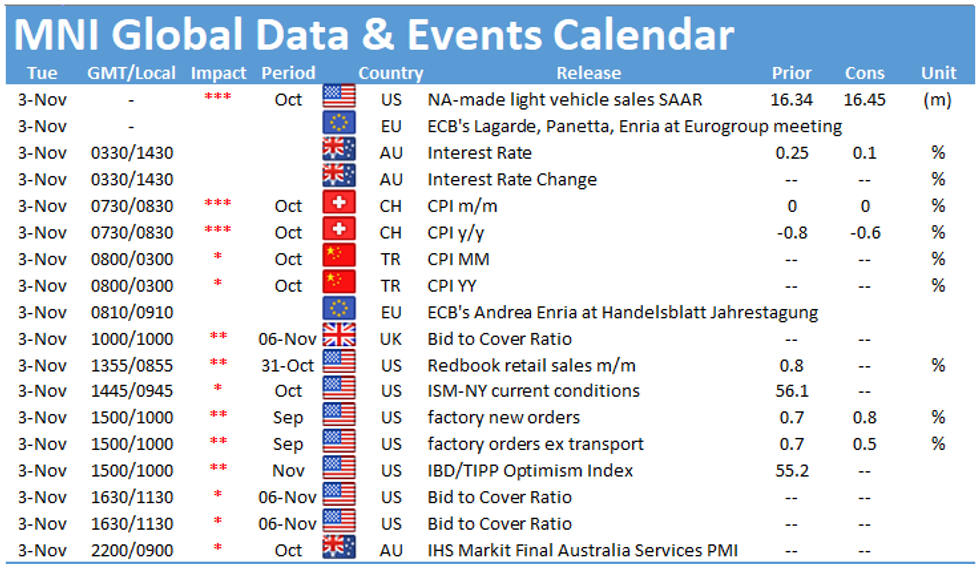

- Focus Tuesday remains on the US Presidential election, with all attention paid to the early results and swing states. The RBA rate decision is also due where the bank are expected to trim the cash rate target by 15bps.

UP TODAY

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.