-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Strong Data Spurs Early Risk Support

EXECUTIVE SUMMARY

- CHICAGO Fed EVANS: RATE HIKE LIKELY NOT NEEDED UNTIL LATE 2023, EVEN 2024

- MNI POLICY: Fed's Barkin Sees Challenging Next Few Months

- MNI DATA IMPACT: US Holiday Spending Up Over Last Year

- MNI INTERVIEW: BOC May Keep Target After Fed Struggles-Ragan

- MNI POLICY: BOC Says Financial System Resilient So Far

- Pres Elect Biden Picks Frmr Fed Chair Yellen For Tsy Sec Seat

- WHITE HOUSE WEIGHS NEW ACTION AGAINST BEIJING: DJ

US

FED: Federal Reserve Bank of Richmond President Tom Barkin said Monday the "next few months can be challenging" for the economic recovery despite promising vaccines against Covid-19.

- High savings during the pandemic will be important to back-stop households in the first half of next year with historically low employment, high caseloads and no new fiscal aid package, he said. For more see MNI Policy Main Wire at 1323ET.

US DATA: Holiday spending should grow by at least 3.6% from year-ago levels, the National Retail Federation said Monday, as strong household balance sheets, record-high savings, and sustained labor market improvement support spending through the nation's worsening Covid-19 outbreak. For more see MNI Policy Main Wire at 1350ET.

CANADA

BOC: The Bank of Canada is likely to stick with its 2% inflation target in a review due next year, despite Covid-19 and after seeing the Federal Reserve struggle to explain its new average-inflation framework, former central bank and finance department adviser Chris Ragan told MNI. For more see MNI Policy Main Wire at 0913ET.

BOC: Bank of Canada Deputy Governor Toni Gravelle said Monday the financial system has been resilient to pandemic-related strains but dangers are likely to mount as the drag on incomes and employment persists. For more see MNI Policy Main Wire at 1400ET.

OVERNIGHT DATA

US DATA: Oct Chicago Fed Nat'l Activity Beats Expectations

- The Chicago Fed National Activity Index (CFNAI) came in at +0.83 in October, vs 0.27 expected and +0.32 in Sep, suggesting that activity accelerated in the month, as opposed to the anticipated deceleration.

- Per the Chicago Fed, 3 of the 4 broad sub-indices (production, sales/orders/inventories, employment) made positive contributions in October (personal consumption/housing fell), and three of the four categories increased from September.

- From the release: " Sixty-one of the 85 individual indicators made positive contributions to the CFNAI in October, while 24 made negative contributions. Fifty-four indicators improved from September to October, 30 indicators deteriorated, and one was unchanged. Of the indicators that improved, eight made negative contributions."

- That said, the monthly readings can be volatile - the 3-month moving average, CFNAI-MA3, fell to +0.75 in Oct from +1.37 in Sep.

- Fairly limited market impact from the release.

- IHS Markit notes that November's preliminary U.S. PMI data showed the fastest overall expansion for more than 5.5 years (since March 2015), with the composite rising to 57.9 from 56.3 in October (and manufacturing and services both accelerating). The survey showed a record increase in both employment and prices.

- The record in output prices (record high in services, 25-month high in manufacturing) was due to "the improving demand environment". But the report notes that the rise in output prices (services at record high, manufacturers' highest in over 2 years) is "in part linked to a record incidence of supply chain delays" which were at a record high in the survey's 11-year history.

- Monthly employment rise was the highest since the beginning of the survey (2009), particularly among service providers.

- There was a sharp increase in new orders (fastest since Jun 2018). Total orders largely driven by domestic demand.

- Highest optimism for the year ahead since May 2014, on the back of both COVID vaccine hopes and the end of election uncertainty.

MARKET SNAPSHOT

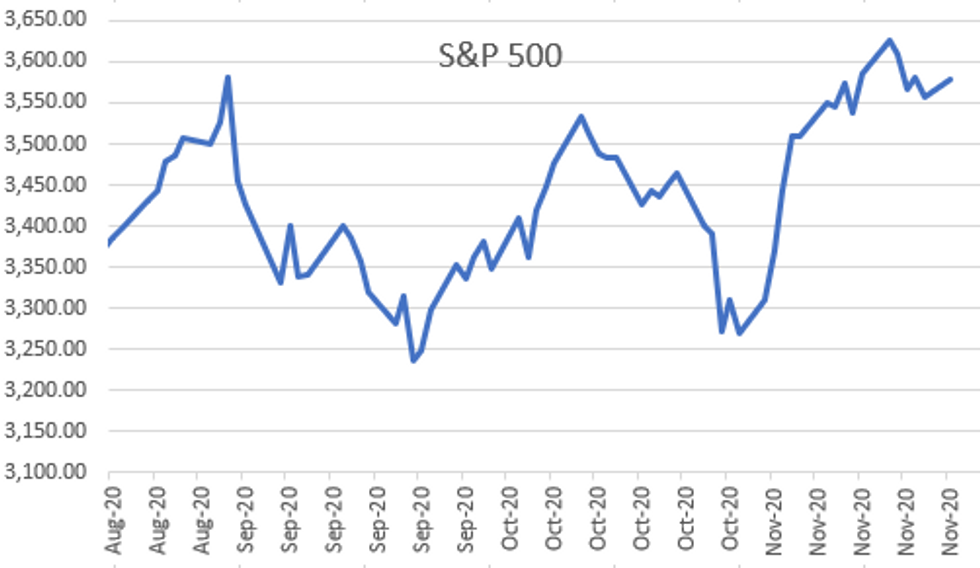

- DJIA up 357.59 points (1.22%) at 29624.51

- S&P E-Mini Future up 24.25 points (0.68%) at 3577.75

- Nasdaq up 45 points (0.4%) at 11901.79

- US 10-Yr yield is up 3.3 bps at 0.857%

- US Dec 10Y are down 5.5/32 at 138-10.5

- EURUSD down 0.0012 (-0.1%) at 1.1844

- USDJPY up 0.61 (0.59%) at 104.49

- WTI Crude Oil (front-month) up $0.59 (1.39%) at $42.99

- Gold is down $30.58 (-1.63%) at $1838.51

- European bourses closing levels:

- EuroStoxx 50 down 4.56 points (-0.13%) at 3480.37

- FTSE 100 down 17.61 points (-0.28%) at 6342.43

- German DAX down 10.28 points (-0.08%) at 13200.56

- French CAC 40 down 3.74 points (-0.07%) at 5515.21

US TSY SUMMARY: Risk-On, Strong Markit PMI, US$ Surge

Tsys traded weaker on an inside range day after selling off during London morning hours Monday. Mild early chop: Tsys bounced off lows but quickly retraced following early headlines US mulling new "action against Beijing" DJ reported. Equities pared gains briefly but bounced after IHS Markit Nov prelim US PMI showed fastest overall expnsn in over 5.5 yrs, composite 57.9 from 56.3 in Oct. US$ Bounced to multi-yr high.

- Heavy volumes tied to lead quarterly roll, not the headlines for once, FV and TY saw over 1M rolls before the closing bell.

- Mixed auctions: US Tsy 2Y Auction Stopped Out: US Tsy $56B 2Y Note (91282CAX9) draws 0.165% (0.151% last month) vs. 0.167% WI, bid/cover 2.71 vs. 2.41 previous. US Tsy $57B 5Y Note auction (91282CAZ4) tailed .7bp , drawing high yld of 0.397% (0.330% last month) vs. 0.390% WI; 2.38 bid/cover vs. 2.38 prior.

- Light option volumes while supra-sovereign drove US$ debt issuance, Peru issuing $4B over 3 tranches longest of which out to 100Y.

- Tsy 2-Yr yield is up 0.6bps at 0.1635%, 5-Yr is up 1.5bps at 0.386%, 10-Yr is up 3.1bps at 0.8553%, and 30-Yr is up 3.9bps at 1.5589%.

US TSY FUTURES CLOSE

Weaker but off lows after the bell, yld curves bear steepening mildly on the week opener. Risk-on tone carried on through the session, impetus from stronger equities after better than expected Markit PMI, composite rising to 57.9 from 56.3 in October (manufacturing and services both accelerating). Mixed Tsy auctions w/2Y stopping out slightly, 5Y tailing near full bp.

- 3M10Y +2.431, 77.765 (L: 74.645 / H: 78.927)

- 2Y10Y +2.528, 68.823 (L: 65.157 / H: 69.719)

- 2Y30Y +3.005, 138.758 (L: 136.187 / H: 140.322)

- 5Y30Y +2.123, 116.705 (L: 114.702 / H: 117.841)

- Current futures levels:

- Dec 2Y -0.12/32 at 110-12.375 (L: 110-12.25 / H: 110-12.75)

- Dec 5Y -1.25/32 at 125-18 (L: 125-16.5 / H: 125-20)

- Dec 10Y -5/32 at 138-11 (L: 138-08.5 / H: 138-17.5)

- Dec 30Y -16/32 at 173-18 (L: 173-09 / H: 174-08)

- Dec Ultra 30Y -26/32 at 218-18 (L: 217-26 / H: 219-28)

US TSY FUTURES: Late Session Roll Update, 5Y, 10Y Over 1M

Heavy start to shortened week. Position holders scrambling to roll from Dec to Mar with shortened Thanksgiving holiday workweek ahead Nov 30 "first notice". Dec futures won't expire until mid-late December: 10s, 30s and Ultras on 12/21; 2s & 5s 12/31.

- TUZ/TUH appr 778,000 0.125 last; 35% complete

- FVZ/FVH appr 1,127,900 -10.25 last; 39% complete

- TYZ/TYH appr 1,022,900 12.50 last; 27% complete

- UXYZ/UXYH appr 320,348, 18.75 last; 388% complete

- USZ/USH appr 417,700, -1-11.25 last; 34% complete

- WNZ/WNH appr 263,800, 1-21 last; 41% complete

US EURODOLLAR FUTURES CLOSE

Mostly weaker, mixed in the short end to modestly weaker out the strip, Blues-Golds near lows. Lead quarterly EDZ0 holds bid despite 3M LIBOR bounce +0.00162 off last Fri's all-time low of 0.20488% to 0.20650% (-0.01712/wk).

- Dec 20 +0.005 at 99.758

- Mar 21 steady at 99.785

- Jun 21 -0.005 at 99.790

- Sep 21 -0.005 at 99.785

- Red Pack (Dec 21-Sep 22) -0.005 to +0.005

- Green Pack (Dec 22-Sep 23) -0.01 to -0.005

- Blue Pack (Dec 23-Sep 24) -0.015 to -0.01

- Gold Pack (Dec 24-Sep 25) -0.03 to -0.02

US TSY: Short Term Rates

US DOLLAR LIBOR: Latest settles

- O/N -0.00063 at 0.08200% (-0.00062/wk)

- 1 Month +0.00000 to 0.15013% (+0.01375/wk)

- 3 Month +0.00162 to 0.20650% (-0.01712/wk)

- 6 Month +0.00500 to 0.25375% (+0.00275/wk)

- 1 Year -0.00087 to 0.33563% (-0.00288/wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.08% volume: $64B

- Daily Overnight Bank Funding Rate: 0.08%, volume: $196B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.05%, $920B

- Broad General Collateral Rate (BGCR): 0.04%, $345B

- Tri-Party General Collateral Rate (TGCR): 0.04%, $316B

- (rate, volume levels reflect prior session)

FED: NY Fed operational purchase:

- Tsy 20Y-30Y, $1.734B accepted vs. $7.084B submission

- Next scheduled purchases:

- Tue 11/24 1010-1030ET: TIPS 1Y-7.5Y, appr $2.425B

PIPELINE: Republic of Peru 3Pt Launched

- Date $MM Issuer (Priced *, Launch #)

- 11/23 $4B #Peru $1B 12Y +100, $2B 40Y +125a, $1B 100Y +170

- 11/23 $1.2B *Rep of Serbia, 10Y +2.35%

- 11/23 $500M *Sultanate of Oman 6Y 6.3%, $300M 11Y 6.9%

FOREX: Dollar Soars on Multi-Year High PMI

Stellar PMI data saved an underperforming greenback Monday. The USD was lower against most others in G10 the majority of European hours, but a multi-year high turnout in the November PMI numbers propped up the greenback, with follow through steepening in the US curve also lending some support. While it's unlikely a higher than expected PMI will swing the needle at the Fed in December, it could point to further strength in the PCE, Michigan, and Chicago PMI releases later in the week.

The JPY was the poorest performer in G10, sold alongside the uptick in the greenback and equity markets, with AstraZeneca's addition of another vaccine candidate helping bolster sentiment.

GBP outperformed as negotiators meet in an attempt to finalise any Brexit deal this week - reports on both sides of the channel appear encouraging on this front.

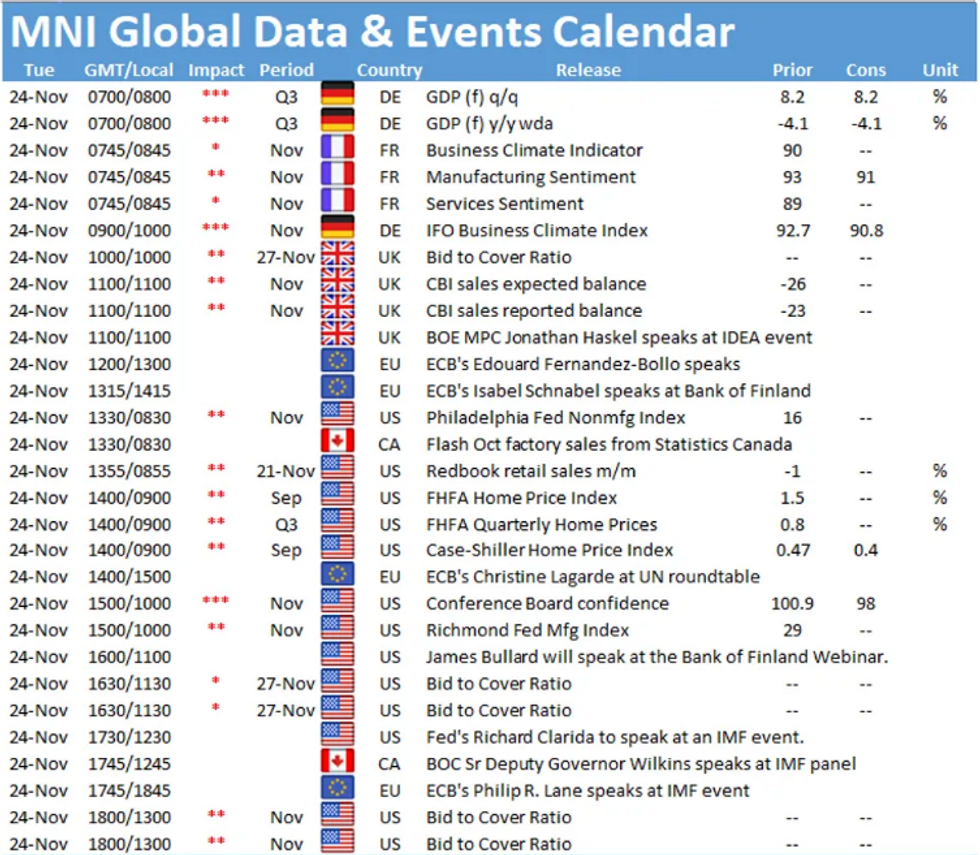

Focus Tuesday turns to November German IFO and US consumer confidence data. The speaker schedule includes RBA's Debelle, ECB's Lagarde & Lane, BoE's Haskel, BoC's Wilkins and Bullard & Williams of the Fed also speak.

EGBs-GILTS CASH CLOSE: Shrugging Off Dollar Surge/Equity Drop

The European bond space largely ignored a strong move higher in the US dollar and equities falling to session lows in the afternoon.

- Gilt yields maintained their sharp rise at the open amid a panoply of headlines/data (incl very strong PMIs in both the UK and US, and optimism on AZN vaccine and Brexit talks), largely shrugging off BoE TSC. Bund yields moved in similar fashion, while Italian spreads widened late in the day from the lows.

- Confidence indicators highlight Tuesday's data docket (incl German IFO), while in supply we get Dutch and UK supply. ECB's Lagarde and BoE's Haskel speak.

- Closing Levels / 10-Yr Periphery EGB Spreads:

- Germany: The 2-Yr yield is down 0.2bps at -0.753%, 5-Yr is down 0.1bps at -0.762%, 10-Yr is up 0.2bps at -0.581%, and 30-Yr is up 1.1bps at -0.165%.

- UK: The 2-Yr yield is up 1.3bps at -0.029%, 5-Yr is up 1.6bps at 0.009%, 10-Yr is up 1.6bps at 0.318%, and 30-Yr is up 1.3bps at 0.902%.

- Italian BTP spread down 1.1bps at 120.5bps

- Spanish bond spread up 0.4bps at 65.2bps

- Portuguese PGB spread unchanged at 60.6bps

- Greek bond spread down 2.7bps at 125.1bps

UP TODAY

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.