-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Another Shade Of Beige, Regional Weakness

EXECUTIVE SUMMARY

- MNI BRIEF: Fed Beige Book Flags Regional Weakness

- MNI EXCLUSIVE: Risk of Accidental No-Deal Brexit As Clock Ticks

- MNI INTERVIEW: Fed's Barkin Favors Tying QE To Jobs Progress

- MNI DALLAS FED: Kaplan Reiterates Cautious Stance On New Action

- MNI Pres Elect Biden: No New Trade Agreements Until Investments Made Domestically

- MNI BRIEF: Fed's Harker Sees Signs Economy is Plateauing

- MNI BRIEF: Fed's Williams: Economy Still in Deep Recession

- MNI BRIEF: Powell: Tough Near Term Outlook, Fiscal Aid Needed

- MCCONNELL SAYS MUST GET VIRUS RELIEF TO AMERICAN PEOPLE, Bbg

- GEORGIA SECRETARY OF STATE SAYS AUTHORITIES HAVE SEEN NO SUBSTANTIAL CHANGES IN SECOND RECOUNT OF PRESIDENTIAL ELECTION, Rtrs

US

FED: The Fed should pledge to continue asset purchases until the labor market has strengthened sufficiently, a scenario much easier to envision now that safe and effective Covid vaccines are ready to be deployed, Federal Reserve Bank of Richmond President Tom Barkin told MNI Wednesday. For more see MNI Policy MainWire at 1219ET.

FED: Philadelphia Federal Reserve President Patrick Harker said Wednesday there are signs economic momentum is stalling through a second wave of the pandemic and the lack of continued fiscal support for struggling families. For more see MNI Policy MainWire at 0948ET.

FED: Dallas Fed Pres Robert Kaplan in his second interview published this week (with the WSJ today, after Reuters published one Monday), reiterates that he would favour the Fed providing clarification "in the not too distant future" on its asset purchase policy. This would include guidance on conditions under which they begin to taper the program.- However, Kaplan told the WSJ he didn't see the need to make a change to the asset purchase program at the moment; if the Fed were to make changes, his preference would be to adjust the maturity of purchases, not the size.

- Kaplan is arguably the most hawkish current voter on the FOMC, particularly given his dissent at the September FOMC over the change to language on forward guidance.

FED: New York Fed President John Williams said Wednesday the U.S. economy is "still in a deep recession" and the pace of recovery next year would depend on fiscal policy and the timing of a coronavirus vaccine rollout."There's still a period of very heightened uncertainty in the near term," Williams said during a webinar.

FED: Federal Reserve Chair Jerome Powell told lawmakers Wednesday the economy faces a "challenging" near term outlook as the pandemic puts small businesses and poor households under strain that could be eased with more fiscal relief. For more see MNI Policy MainWire at 1128ET.

US: President-Elect Joe Biden, speaking to Thomas Friedman of the NYT says that "I'm not going to enter any new trade agreement with anybody until we have made major investments here at home and in our workers", potentially scuppering already-waning UK hopes of a rapid trade deal with the US in 2021.- "On China, he said he would not act immediately to remove the 25 percent tariffs" or the Phase one deal. "I'm not going to make any immediate moves, and the same applies to the tariffs," he said. "I'm not going to prejudice my options." In the interview Biden states that he wants a full strategic review of the agreement with China "so we can develop a coherent strategy."

EUROPE

EU/UK: The UK parliamentary timetable for preparing for the end-of-year Brexit deadline is becoming very tight, raising the risk of an accidental collapse in trade talks with the European Union as early as next week unless London and Brussels make a breakthrough in the coming days, legislative experts told MNI. For more see MNI Policy MainWire at 1055ET.

OVERNIGHT DATA

- ADP NOV PAYROLLS +307K (440K EXP., 404K PRIOR AFTER REVISION)

- NOV GOODS-PRODUCING PAYROLLS +31K

- NOV SERVICES-PROVIDING PAYROLLS +276K

- OCT PAYROLL CHG REVISED TO +404K (WAS +365K)

- The miss in Nov U.S. ADP employment (+307k vs +440k expected) was offset by a higher revision to the October number.

- Initial market reaction was modestly dovish (as seen in a slight uptick in Tsys) but ultimately knee-jerk and has since moved flat.

- Mixed ADP results aside, the release has not really been seen of late as a reliable predictor of Friday's much-more important nonfarm payrolls number.

- Additionally, we note that ADP uses a VAR model and recalibrates using the official payrolls data. So there's not surprise at all that October was revised higher because payrolls came in above where ADP would have suggested last month.

MNI BRIEF: Fed Beige Book Flags Regional Weakness

The Fed's new Beige Book Wednesday shows some sign of deterioration in the outlook compared to October's reading of anecdotal reports from central bank business contacts.

- "Most Federal Reserve Districts have characterized economic expansion as modest or moderate since the prior Beige Book period," the report said.

- "However, four Districts described little or no growth, and five narratives noted that activity remained below pre-pandemic levels for at least some sectors."

US MBA: MARKET COMPOSITE -0.6% SA THRU NOV 27 WK

US MBA: REFIS -5% SA; PURCH INDEX +9% SA THRU NOV 27 WK

US MBA: UNADJ PURCHASE INDEX -28% VS YEAR-EARLIER LEVEL

US MBA: 30-YR CONFORMING MORTGAGE RATE 2.92% VS 2.92% PREV

US ISM-NY CURRENT CONDITIONS INDEX 44.2 NOV

US ISM-NY 6-MONTH OUTLOOK INDEX 48.6 NOV

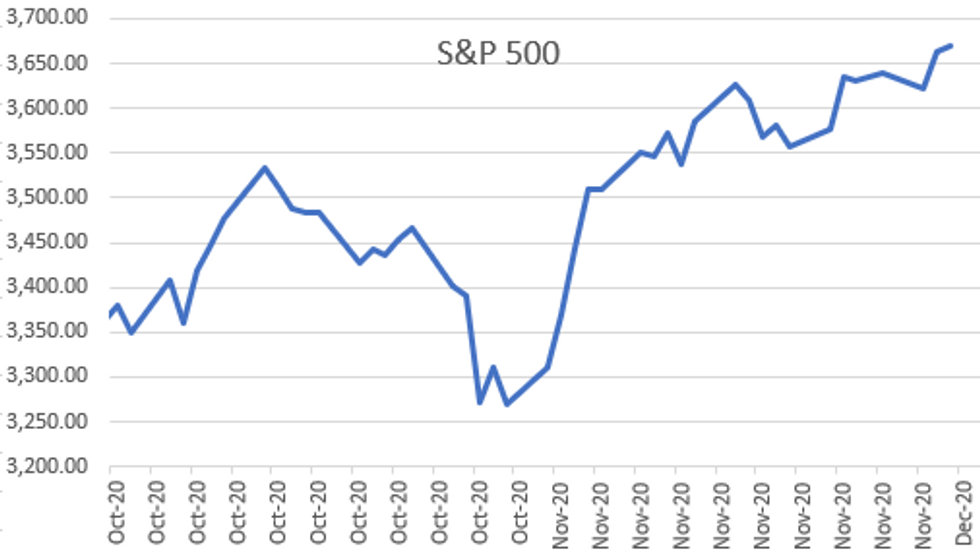

MARKETS SNAPSHOT

- DJIA up 59.87 points (0.2%) at 29877.52

- S&P E-Mini Future up 9 points (0.25%) at 3667

- Nasdaq down 5.7 points (0%) at 12348.31

- US 10-Yr yield is up 1.3 bps at 0.9393%

- US Mar 10Y are up 1/32 at 137-15

- EURUSD up 0.0046 (0.38%) at 1.2099

- USDJPY up 0.08 (0.08%) at 104.55

- WTI Crude Oil (front-month) up $0.67 (1.5%) at $45.24

- Gold is up $15.63 (0.86%) at $1829.40

- European bourses closing levels:

- EuroStoxx 50 down 3.92 points (-0.11%) at 3521.32

- FTSE 100 up 78.66 points (1.23%) at 6463.39

- German DAX down 69.06 points (-0.52%) at 13313.24

- French CAC 40 up 1.37 points (0.02%) at 5583.01

US TSY SUMMARY

Early rate support evaporated quickly Wednesday -- despite weaker than anticipated private ADP employ data: +307k vs +440k exp, offset by a higher Oct revision: +404K vs. +365K.

- Nascent risk appetite ensued at varying degrees through the session, driven again by hopes of a fiscal stimulus agreement in the near term. Building "momentum" over an $908B bipartisan relief bill apparently behind late session duration drop in Tsys, futures making new session lows/equities moving higher.

- Tsys bounced right back to prior levels, equities trimmed gains, one desk posited that "unless McConnell changes his shell, it doesn't matter what Pelosi and Schumer say they support." Deja vu.

- Fed's latest Beige Book shows some sign of deterioration in outlook compared to October's reading of anecdotal reports from central bank business contacts.

- Little if any market reaction to multiple Fed speakers on the day. The 2-Yr yield is down 0.4bps at 0.1623%, 5-Yr is up 0.5bps at 0.4209%, 10-Yr is up 2bps at 0.9459%, and 30-Yr is up 3.3bps at 1.7011%.

US TSY FUTURES CLOSE: Late Bounce

Nascent risk appetite ensued at varying degrees through the session, driven again by hopes of a fiscal stimulus agreement in the near term. Tsys bounced late, one desk posited that "unless McConnell changes his shell, it doesn't matter what Pelosi and Schumer say they support." Deja vu. Yld curves still steeper:

- 3M10Y +2.172, 85.65 (L: 81.574 / H: 88.3)

- 2Y10Y +1.938, 77.529 (L: 74.498 / H: 79.589)

- 2Y30Y +3.393, 152.936 (L: 148.328 / H: 155.457)

- 5Y30Y +2.505, 127.554 (L: 123.706 / H: 128.785)

- Current futures levels:

- Mar 2Y up 0.62/32 at 110-12.12 (L: 110-11.62 / H: 110-12.5)

- Mar 5Y up 2.25/32 at 125-24 (L: 125-20.5 / H: 125-25.5)

- Mar 10Y up 1.5/32 at 137-15.5 (L: 137-08.5 / H: 137-21)

- Mar 30Y down 12/32 at 172-9 (L: 171-22 / H: 173-06)

- Mar Ultra 30Y down 23/32 at 211-0 (L: 209-23 / H: 212-27)

US EURODOLLAR FUTURES CLOSE: Reds-Greens Rebound

Mixed after the bell, short end through Greens steady to higher, Blues-Golds weaker --near middle session range. Lead quarterly EDZ0 gained/held bid since 3M LIBOR set' -0.00150 to 0.23050% (+0.00512/wk). Decent two-way volume in Greens-Blues earlier, opinion tied and LIBOR retirement re-positioning again. Latest levels:

- Dec 20 +0.005 at 99.755

- Mar 21 +0.005 at 99.795

- Jun 21 steady at 99.795

- Sep 21 steady at 99.785

- Red Pack (Dec 21-Sep 22) steady to +0.010

- Green Pack (Dec 22-Sep 23) -0.01 to +0.010

- Blue Pack (Dec 23-Sep 24) -0.01 to -0.005

- Gold Pack (Dec 24-Sep 25) -0.015 to -0.01

US TSY: Short Term Rates

US DOLLAR LIBOR: Latest settles

- O/N +0.00100 at 0.08150% (+0.00125/wk)

- 1 Month +0.00450 to 0.15213% (-0.00262/wk)

- 3 Month -0.00150 to 0.23050% (+0.00512/wk)

- 6 Month -0.00050 to 0.25825% (+0.00087/wk)

- 1 Year +0.00125 to 0.33438% (+0.00400/wk)

- Daily Effective Fed Funds Rate: 0.09% volume: $56B

- Daily Overnight Bank Funding Rate: 0.08%, volume: $168B

- Secured Overnight Financing Rate (SOFR): 0.08%, $972B

- Broad General Collateral Rate (BGCR): 0.06%, $362B

- Tri-Party General Collateral Rate (TGCR): 0.06%, $336B

- (rate, volume levels reflect prior session)

- TIPS 7.5Y-30Y, $1.199B accepted vs. $1.577B submission

- Next scheduled purchases:

- Thu 12/03 1100-1120ET: Tsy 20Y-30Y, appr $1.750B

- Fri 12/04 1100-1120ET: Tsy 2.25Y-4.5Y, appr $8.825B

PIPELINE: Brazil Priced Late

- Date $MM Issuer (Priced *, Launch #)

- 12/02 $2.75B #Philippines $1.25B 10.5Y +70, $1.5B 25Y 2.65%

- 12/02 $2.5B *Brazil R/O $500M 5Y 2.2%, $1.25B 10Y 3.45%, $750M 30Y 4.5%

- 12/02 $1.5B #Credit Suisse PerpNC 10Y 4.5%

- 12/02 $1B Calpine 10.5NC5.25 3.75%a

FOREX: Sterling Dragged Off Perch as Deal Drags

GBP fell against all others Wednesday, with reports of a cautious warning from Brexit negotiator Barnier weighing from the off. This pulled GBP/USD off the week's multi-month high of 1.3441, with implied vols running suitably higher also with a deal still making little progress.

- The single currency outperformed, with EUR/USD breaking above 1.21 for the first time since mid-2018. Short-end EUR vols also traded at multi-week high as the contracts begin to look ahead to next week's ECB decision.

- Trade in haven currencies was inconsistent, with JPY slipping against most others while CHF gained. CHF/JPY rallied sharply for a second sessions, clearing the October high to trade at the best level since September.

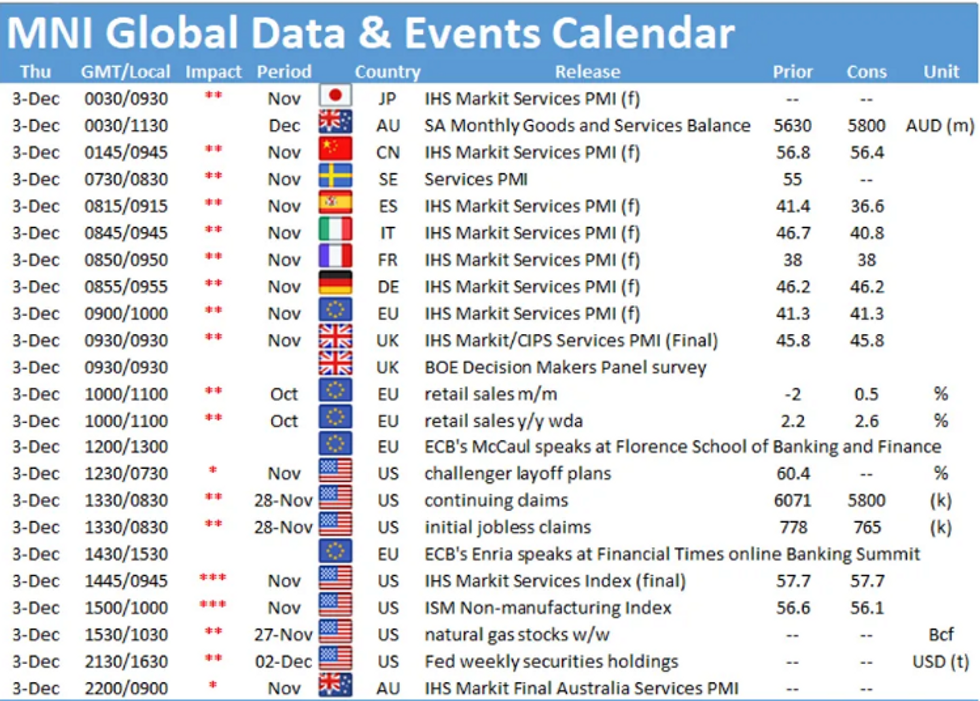

- Focus Thursday turns to Australian trade balance, final global PMI revisions for November, Eurozone retail sales and ISM services & weekly jobless claims data from the US. BoE's Saunders & Tenreyro and Fed's Bowman & Kashkari are scheduled to speak.

EGBs-GILTS CASH CLOSE: Strength In Gilt Short End And BTPs

Wednesday saw Bund and Gilt curves steepening and in BTPs which reversed most of Tuesday's yield rise. Gilt yields climbed this afternoon despite this morning's news that a Brexit deal didn't seem to be as close as Tuesday's "tunnel negotiations" headlines implied. Fishing still a key difference w Brussels. Optimism this morning over the UK beginning COVID vaccinations in coming days largely looked priced in.

- EU looking to press ahead on a short-term solution on the COVID recovery fund w/o Hungary and Poland.

- Light schedule Thurs: France L-T OAT supply and Spain/Italy services PMI (finals elsewhere in Europe). Closing Levels / 10-Yr Periphery EGB Spreads:

- Germany: The 2-Yr yield is up 0.2bps at -0.716%, 5-Yr is up 0.3bps at -0.715%, 10-Yr is up 0.9bps at -0.519%, and 30-Yr is up 1.2bps at -0.105%.

- UK: The 2-Yr yield is down 1.4bps at -0.026%, 5-Yr is down 1bps at 0.025%, 10-Yr is up 0.7bps at 0.354%, and 30-Yr is up 1.2bps at 0.919%.

- Italian BTP spread down 5.1bps at 115.1bps

- Spanish bond spread down 2.5bps at 62.2bps

- Portuguese PGB spread down 1.9bps at 58.5bps

- Greek bond spread up 2.9bps at 121.4bps

UP TODAY

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.