-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Deal Is Done: Brexit, Not US Covid Bill That Is

EXECUTIVE SUMMARY:

- MNI POLICY: EU, UK Agree Post-Brexit Deal Days Before Deadline

- MNI BRIEF: EU-UK Deal To Be Reviewed In Four Years

- MNI BRIEF: Canada-Style Deal In Line With BOE, OBR Projections

- U.K.'S JOHNSON SAYS PARLIAMENT WILL VOTE ON BREXIT DEAL DEC. 30, Bbg

- However, No Unanimous Consent:

- DEMOCRATS' BID FOR $2,000 RELIEF CHECKS FAILS IN HOUSE, Bbg

EUROPE

UK/EU: The UK and the European Union have reached an agreement on a post-transition trade deal, Prime Minister Boris Johnson and European Commission Ursula von der Leyen President said in press conferences on Thursday just days before the Dec. 30 end of the Brexit transition period.

- "Its been a long and winding road, but we have a fair agreement," von der Leyen said, stressing that the UK and the EU would remain "close and trusted" partners. For more see MNI Policy MainWire at 1035ET.

UK/EU: The EU-UK trade deal will be reviewed in four years' time, European officials told reporters, adding that it also allowed for unilateral sanctions if one party diverged unfairly from agreed standards.

UK/EU: UK Prime Minister Boris Johnson described the deal with the European Union as "a Canada style deal," the formulation used by the Office for Budget Responsibility and the Bank of England in current forecasts, suggesting that the deal contains no major surprises relative to their recent projections.

US

US: House Speaker Nany Pelosi to reconvene House next week after House Republicans reject Trump-backed COVID proposal, Axios.

- "House Speaker Nancy Pelosi (D-Calif.) is bringing Congress back to the Capitol on Monday to vote on a proposal to hike coronavirus relief payments to $2,000, after Republicans rejected a move to approve the measure by unanimous consent."

OVERNIGHT DATA

The New York Fed Staff Nowcast stands at 2.0% for 2020:Q4 and 5.1% for 2021:Q1.

U.S. WEEKLY BLOOMBERG CONSUMER COMFORT INDEX AT 47 VS 48.4

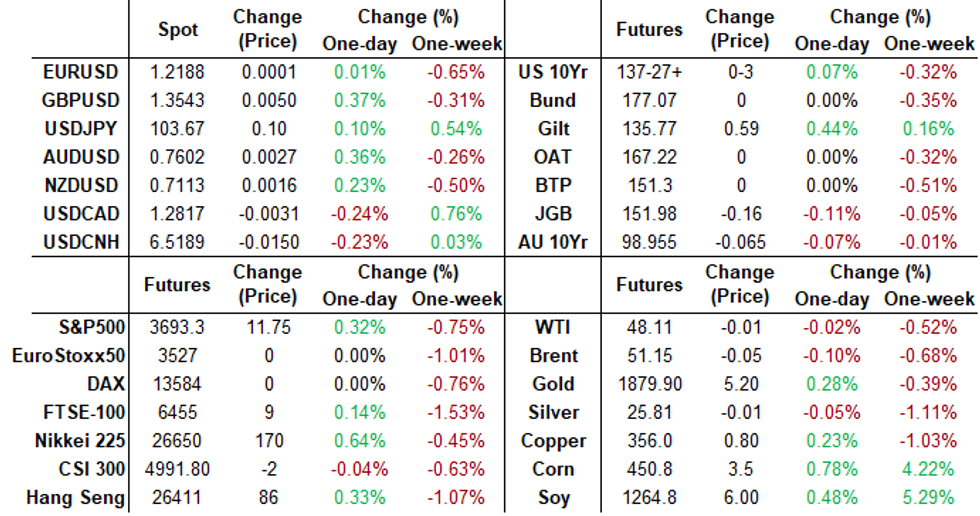

MARKETS SNAPSHOT

- DJIA up 58.13 points (0.19%) at 30154.56

- S&P E-Mini Future up 11.25 points (0.31%) at 3688

- Nasdaq up 28.1 points (0.2%) at 12785.55

- US 10-Yr yield is down 1 bps at 0.933%

- US Mar 10Y are up 3/32 at 137-27.5

- EURUSD up 0.0001 (0.01%) at 1.2188

- USDJPY up 0.1 (0.1%) at 103.65

- WTI Crude Oil (front-month) down $0.01 (-0.02%) at $48.13

- Gold is up $6.5 (0.35%) at $1879.50

- European bourses closing levels:

- EuroStoxx 50 up 4.02 points (0.11%) at 3543.28

- FTSE 100 up 6.36 points (0.1%) at 6502.11

- French CAC 40 down 5.58 points (-0.1%) at 5522.01

US TSY SUMMARY: Naughty Or Nice? UK/EU Brexit Deal, Unanimous Consent $2K Relief Bill

Tsy futures opened higher amid exceptionally light holiday volumes -- no substantive data, limited market participation alert for Brexit and/or Covid-related headline risk.

- Mixed Bag: Tsy futures see-sawed higher after $2k relief bill vote in House Blocked. "Could be voted on in a roll call vote on Dec 28, when a vote is planned to override the veto of the defense authorization bill" one desk notes. Equities holding mild gains. Incidentally -- House adjourns until Monday afternoon.

- Across the pond: UK/EU Agree Post-Brexit Deal Days Before Deadline: "Its been a long and winding road, but we have a fair agreement," von der Leyen said, stressing that the UK and the EU would remain "close and trusted" partners.

- Reminder, January serial ops expire Thursday, earlier than usual due to Christmas holiday early close Thursday, full close Friday. Decent amount of options coming off the sheets for a serial expiry though accts have been unwinding near strikes. Options 0.5 tic ITM (0.25 tic for 5-, 2-yr opt's) auto-exercised.

- The 2-Yr yield is up 0.2bps at 0.1189%, 5-Yr is down 0.3bps at 0.367%, 10-Yr is down 1bps at 0.933%, and 30-Yr is down 1bps at 1.671%.

US TSY FUTURES CLOSE: Near Highs On Early Close

Stronger across the curve by the bell, scaling back much of Wed's move w/ yield curves off mid-2017 highs:

- 3M10Y -2.077, 83.853 (L: 83.853 / H: 86.35)

- 2Y10Y -1.62, 80.176 (L: 80.176 / H: 83.2)

- 2Y30Y -2.008, 153.594 (L: 153.527 / H: 157.488)

- 5Y30Y -1.57, 129.352 (L: 129.286 / H: 132.084)

- Current futures levels:

- Mar 2Y up 0.12/32 at 110-15.375 (L: 110-15.12 / H: 110-15.5)

- Mar 5Y up 1.25/32 at 126-2 (L: 126-00.25 / H: 126-02.75)

- Mar 10Y up 5/32 at 137-29.5 (L: 137-23.5 / H: 137-29.5)

- Mar 30Y up 26/32 at 172-28 (L: 172-02 / H: 172-28)

- Mar Ultra 30Y up 1-16/32 at 212-25 (L: 211-10 / H: 212-27)

US EURODLR FUTURES CLOSE: Mildly Higher

Futures holding near middle narrow session range by the early close, early volume surge in short end -- lead quarterly EDH1 blipped higher after 3M LIBOR largely reversed Wed's settle: -0.01087 to 0.24013% (+0.00438/wk). Current levels:

- Mar 21 +0.010 at 99.825

- Jun 21 +0.005 at 99.825

- Sep 21 +0.005 at 99.820

- Dec 21 +0.005 at 99.780

- Red Pack (Mar 22-Dec 22) +0.005

- Green Pack (Mar 23-Dec 23) +0.005 to +0.010

- Blue Pack (Mar 24-Dec 24) +0.010

- Gold Pack (Mar 25-Dec 25) +0.015 to +0.020

US TSY: Short Term Rates

US DOLLAR LIBOR: Latest settles

- O/N -0.00463 at 0.08100% (-0.00338/wk)

- 1 Month -0.00287 to 0.14513% (+0.00138/wk)

- 3 Month -0.01087 to 0.24013% (+0.00438/wk)

- 6 Month +0.00288 to 0.26663% (+0.00813/wk)

- 1 Year +0.00175 to 0.34038% (+0.00638/wk)

- Daily Effective Fed Funds Rate: 0.09% volume: $70B

- Daily Overnight Bank Funding Rate: 0.08%, volume: $157B

- Secured Overnight Financing Rate (SOFR): 0.06%, $921B

- Broad General Collateral Rate (BGCR): 0.05%, $355B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $323B

- (rate, volume levels reflect prior session)

- Mon 12/28 Forward schedule release at 1500ET

PIPELINE: Still No Issuance For Week

No new high-grade issuance since December 15; running total for month remains $52.24B

FOREX: GBP Comes Off Highs as Deal Confirmed

In typical buy the rumour, sell the fact fashion, GBP softened as UK and EU confirmed a Brexit deal had been struck between the negotiating teams, which was then signed off by both UK PM Johnson and EU's Von der Leyen. The deal now passes to a reconvening of UK parliament before the end of 2020, at which UK lawmakers are highly likely to sign off on the deal. Full coverage on the deal here:

https://roar-assets-auto.rbl.ms/documents/7741/MNI...

- GBP/USD rallied throughout the morning ahead of the formal announcement, touching 1.3619 before fading - not quite managing to hit new 2020 high, which remains in tact at Dec 17's 1.3624.

- Amid holiday-thinned trade elsewhere, equities crept higher on the continent and in the US morning, helping keep a lid on haven currencies. The JPY and CHF were among the poorest performers.

- The Turkish central bank hiked rates by a larger margin than expected, boosting the one-week repo rate by 200bps to 17.00% vs. Exp. 16.50%. TRY rallied in sympathy, pressuring USD/TRY back toward the mid-November lows of 7.5140.

UP TODAY

US, European markets closed for Christmas holiday Friday, December 25.

- US Data/Speaker Calendar (prior, estimate)

- 28-Dec 1030 Dallas Fed Manf. Activity (12.0, 10.2)

- 28-Dec 1130 US Tsy $51B 26W-Bill auction (912796B40)

- 28-Dec 1130 US Tsy $58B 2Y-Note auction (91282CBD2)

- 28-Dec 1300 US Tsy $54B 13W-Bill auction (9127964P1)

- 28-Dec 1300 US Tsy $59B 5Y-Note auction (91282CBC4)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.