-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Risk Cools As Stim Debate Stalls

EXECUTIVE SUMMARY

- MNI POLICY: EU, China Agree Wording On Forced Labour-Official

- "TORY ERG CAUCUS OF LAWMAKERS BACKS JOHNSON'S BREXIT DEAL," Bbg

- "EU MEMBER STATES APPROVE TRADE DEAL WITH U.K," DJ

- "McConnell suggests he'll tie bigger stimulus checks to Internet, voting issues," DJ

- "MCCONNELL BLOCKS SCHUMER MOVE TO QUICKLY PASS $2,OOO CHECKS" Bbg

EUROPE

EU/CHINA: China has committed to standards and strong wording on forced labour which should allow EU leaders to agree in principle the EU-China investment agreement on Wednesday, an EU official said today.

- The official said that the commitment to ratify ILO conventions on forced labour was the same as those included in EU trade agreements with third countries. For more see MNI Policy Mainwire at 0855ET.

OVERNIGHT DATA

- US OCT CASE-SHILLER SEAS ADJ HOME PRICE INDEX +1.6% M/M

- US OCT CASE-SHILLER UNADJ HOME INDEX +1.3% M/M; +7.9% Y/Y

- US OCT CASE-SHILLER NATIONAL IDX +1.7% SA, +1.4% NSA, +8.4% Y/Y

- US REDBOOK: DEC STORE SALES +0.4% V NOV THROUGH DEC 26 WK

- US REDBOOK: DEC STORE SALES +5.0% V YR AGO MO

- US REDBOOK: STORE SALES +8.9% WK ENDED DEC 26 V YR AGO WK

- US TREASURY GENERAL ACCOUNT $1.612T DEC 28 VS $1.576T PRIOR DAY

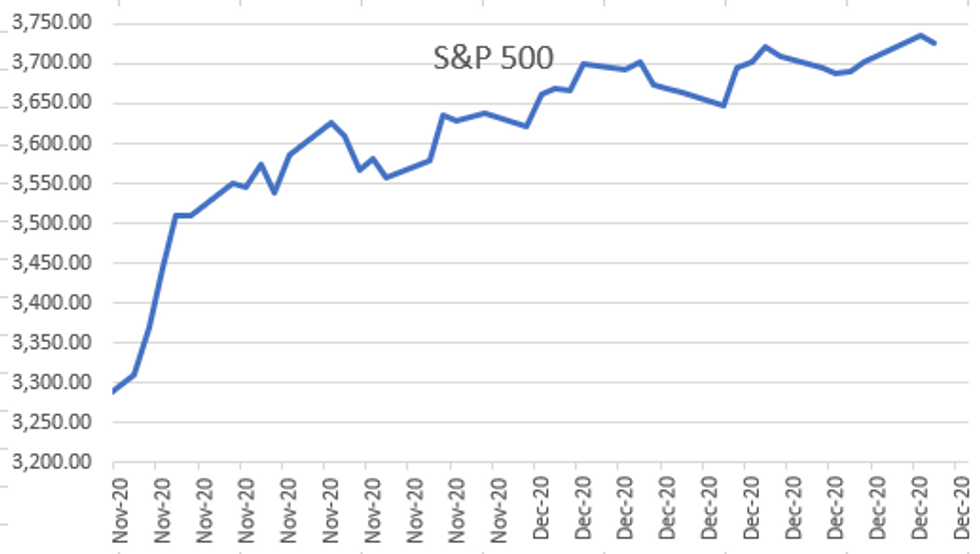

MARKETS SNAPSHOT: Key Market Levels In Late Trade

- DJIA down 86.56 points (-0.28%) at 30403.97

- S&P E-Mini Future down 9 points (-0.24%) at 3741

- Nasdaq down 59.3 points (-0.5%) at 12899.42

- US 10-Yr yield is up 1 bps at 0.9331%

- US Mar 10Y are down 0.5/32 at 137-29

- EURUSD up 0.0042 (0.34%) at 1.2253

- USDJPY down 0.29 (-0.28%) at 103.73

- WTI Crude Oil (front-month) up $0.34 (0.71%) at $48.17

- Gold is up $4.62 (0.25%) at $1879.14

European bourses closing levels:

- EuroStoxx 50 up 5.96 points (0.17%) at 3590.46

- FTSE 100 up 100.54 points (1.55%) at 6637.49

- German DAX down 28.91 points (-0.21%) at 13825.52

- French CAC 40 up 23.41 points (0.42%) at 5615.99

US TSY SUMMARY: Risk Sours

Treasury futures trade steady/mixed after the bell, well off early session lows as risk appetite cooled by midmorning. Overall volumes remain muted due to limited holiday participation.

- After rising to new all-time highs in early trade, equities reversed, near session lows in late trade. Trading desks citing various factors including asset re-allocation out of stocks into Tsys ahead month/yr end, headline risk associated w/stimulus relief vote in Senate, weakness in Apple shares after making new highs also noted.

- Midday selling after Sen Majority leader Mitch McConnell "BLOCKS SCHUMER MOVE TO QUICKLY PASS $2,OOO CHECKS" Bbg. Dow Jones reported soon after that "McConnell suggests he'll tie bigger stimulus checks to Internet, voting issues."

- No significant react to Case Shiller Home Index (+1.7%) nor the third consecutive weak note auction of the week: US Tsy $59B 7Y Note auction (91282CBB6) draws high yield 0.662% rate (0.653% last month) vs. 0.660% WI; 2.31 bid/cover vs. 2.37 prior.

- The 2-Yr yield is up 0.8bps at 0.127%, 5-Yr is up 2.2bps at 0.3766%, 10-Yr is up 1bps at 0.9331%, and 30-Yr is up 1.2bps at 1.671%.

MONTH-END EXTENSIONS: Updated Bloomberg-Barclays US Extension Estimates

Forecast summary compared to the avg increase for prior year and the same time in 2019. TIPS -0.03Y; Govt inflation-linked, -0.04. Note MBS extension climbs to 0.14Y from 0.09 in preliminary.

| Estimate | 1Y Avg Incr | Last Year | |

| US Tsys | 0.08 | 0.09 | 0.07 |

| Agencies | 0.08 | 0.06 | 0.09 |

| Credit | 0.07 | 0.09 | 0.07 |

| Govt/Credit | 0.07 | 0.09 | 0.07 |

| MBS | 0.14 | 0.05 | 0.09 |

| Aggregate | 0.08 | 0.08 | 0.06 |

| Long Gov/Cr | 0.07 | 0.09 | 0.06 |

| Iterm Credit | 0.05 | 0.08 | 0.06 |

| Interm Gov | 0.09 | 0.08 | 0.07 |

| Interm Gov/Cr | 0.08 | 0.08 | 0.06 |

| High Yield | 0.08 | 0.08 | 0.09 |

US TSY FUTURES CLOSE

Tsy futures trading steady to mixed after the bell, well off early session lows as upsized stimulus debate in house gets mired, equities reversed early gains, trade weaker. Overall volumes remain light due to thin holiday participation. Latest levels:

- 3M10Y +0.667, 83.848 (L: 82.92 / H: 85.339)

- 2Y10Y +0.471, 80.279 (L: 79.888 / H: 82.14)

- 2Y30Y +0.54, 153.931 (L: 153.473 / H: 156.756)

- 5Y30Y -1.028, 129.127 (L: 128.744 / H: 131.431)

- Current futures levels:

- Mar 2Y up 0.125/32 at 110-15.375 (L: 110-15.125 / H: 110-15.5)

- Mar 5Y up 0.5/32 at 126-3 (L: 126-01.25 / H: 126-03.75)

- Mar 10Y up 1/32 at 137-30.5 (L: 137-25.5 / H: 137-31)

- Mar 30Y steady at at 172-24 (L: 172-05 / H: 172-28)

- Mar Ultra 30Y down 2/32 at 212-16 (L: 211-10 / H: 212-29)

US EURODOLLAR FUTURES CLOSE

Futures at/near top end of narrow range after the bell, short end anchored after LIBOR resumed settlement following extended London holiday. The 3N benchmark rate surged +0.01375 to 0.25388% (+0.00438 net last wk).

- Mar 21 -0.005 at 99.825

- Jun 21 +0.005 at 99.830

- Sep 21 steady at 99.815

- Dec 21 +0.005 at 99.780

- Red Pack (Mar 22-Dec 22) +0.005

- Green Pack (Mar 23-Dec 23) +0.005 to +0.010

- Blue Pack (Mar 24-Dec 24) +0.005

- Gold Pack (Mar 25-Dec 25) steady to +0.005

US TSY: Short Term Rates

US DOLLAR LIBOR: Latest settles:

- O/N +0.00638 at 0.08738% (-0.00338 net last wk)

- 1 Month +0.00162 to 0.14675% (+0.00138 net last wk)

- 3 Month +0.01375 to 0.25388% (+0.00438 net last wk)

- 6 Month -0.00950 to 0.25713% (+0.00813 net last wk)

- 1 Year +0.00087 to 0.34125% (+0.00638 net last wk)

- Daily Effective Fed Funds Rate: 0.09% volume: $73B

- Daily Overnight Bank Funding Rate: 0.08%, volume: $161B

- Secured Overnight Financing Rate (SOFR): 0.09%, $946B

- Broad General Collateral Rate (BGCR): 0.07%, $354B

- Tri-Party General Collateral Rate (TGCR): 0.07%, $323B

- (rate, volume levels reflect prior session)

Updated NY Fed operational purchase schedule, $40.2B from 1/04-1/14

- Mon 1/04 1100-1120ET: Tsy 2.25Y-4.5Y, appr $8.825B

- Tue 1/05 1100-1120ET: Tsy 20Y-30Y, appr $1.750B

- Wed 1/06 1010-1030ET: TIPS 7.5Y-30Y, appr $1.225B

- Thu 1/07 1100-1120ET: Tsy 20Y-30Y, appr $1.750B

- Fri 1/08 1100-1120ET: Tsy 0Y-2.25Y, appr $12.825B

- Mon 1/11 1010-1030ET: TIPS 1Y-7.5Y, appr $2.425B

- Tue 1/12 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

- Wed 1/13 1010-1030ET: Tsy 7Y-20Y, appr $3.625B

- Thu 1/14 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Thu 01/14 Next forward schedule release at 1500ET

PIPELINE

No new high-grade issuance since December 15; running total for month remains $52.24B.

FOREX: Summary

Further USD selling continuation during the US morning session.

- EURUSD tested MNI tech resistance at 1.2273 High Dec 17 and the bull trigger, printed 1.2275 high.

- The pair has since faded back lower with better USD buying emerging, after Equities fell from their high of the session.

- AUDUSD extended gains, through high of the session.

- US stimulus and Brexit, is benefiting riskier and risk tied assets.

- While AUD trades on the front foot on the weaker Dollar, it is trading through the lowest levels versus the NZD since the 17th of Dec.

- Looking ahead, expect to see more Month End related price action as liquidity dissipates.

- Citi FX: Dec month-end points to moderate USD sales into the final month-end fix of the year

- Barcap FX: The passive rebalancing model points to strong USD selling versus majors at month-end. The signal is moderate against the EUR

EGBs-GILTS: Covid Concerns Continue, Focus On Equivalence

EGB and gilt markets have clearly been suffering from a holiday hangover. EGBs have remained within yesterday's ranges. Gilts rallied at the open to catch up with yesterday's moves and have pushed on a little higher but on little new news today.

- The market debate has focused on the final deal the EU and UK will strike on financial services, with the Brexit deal agreed before Christmas not specifically mentioning equivalence so some uncertainty still remains.

There has also been some focus on Covid-19 numbers across the region, as - There has also been some focus on Covid-19 numbers across the region, as concerns about the new strain first identified in the UK which spreads more easily has led to vigilance on the numbers of cases across the Eurozone.

Furthermore, media reports that it may take until the end of January for the - Furthermore, media reports that it may take until the end of January for the EU to sign off use of the AZ/Oxford vaccine has helped peripheral spreads widen on the day, led by Italy with 10-year spreads widening 2.3bp at writing.

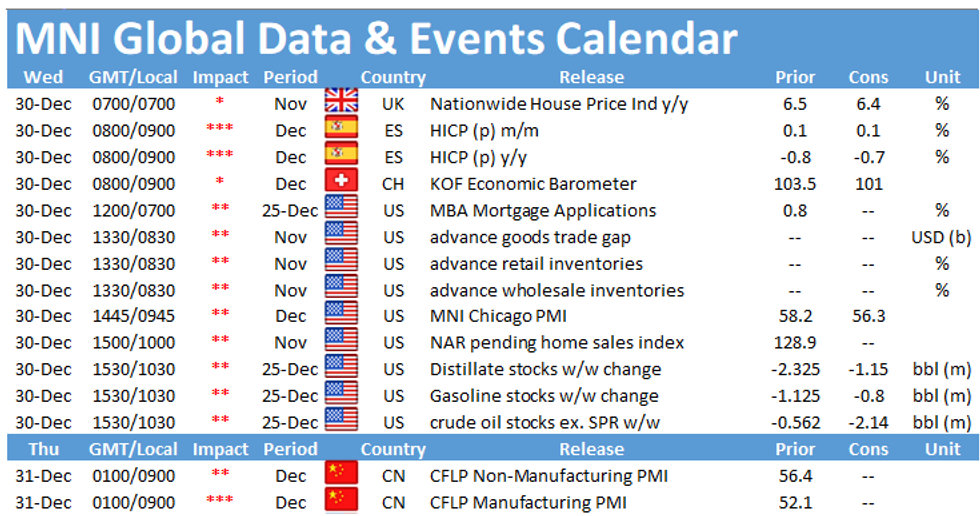

UP TODAY

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.