-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Treasuries Surge On Bessent And Oil

MNI ASIA OPEN: Israel-Hezbollah Ceasefire Cautiously Reached

MNI ASIA OPEN: Democracy Under Siege

EXECUTIVE SUMMARY

- DC Protestors Breach Capitol, Lockdown, Electoral Count Halted

- MNI EXCLUSIVE: Fed Still Biased Toward More Bond Buying

- MNI INTERVIEW: BOE To Cut To Negative-Ex Official Aikman

- MNI BRIEF: Biden to Push for New Covid Package, OMB Pick Says

- MNI POLICY: Fed Saw Dec Guidance as Flexible, Open to More QE

- TRUMP SAYS WE WILL NEVER GIVE UP, WE WILL NEVER CONCEDE, Bbg

- BIDEN TO PICK MERRICK GARLAND FOR ATTORNEY GENERAL, AP REPORTS, Bbg

US

US: Protesters stormed the U.S. Capitol on Wednesday, temporarily suspending a vote to certify the presidential election.

- The vote accepting the victory of Joe Biden over Donald Trump, usually a formality, was expected to stretch for several hours as some Republican lawmakers mounted an effort to reject some state tallies. Republican Senate Majority Leader Mitch McConnell said at the beginning of the certification that "if this election were overturned by mere allegations from the losing side, our democracy would enter a death spiral."

- As members of militia groups and far right groups breached the Capitol, the Senate recessed, and towards 4pm there was little sign police would remove the protestors. City Mayor Muriel Bowser announced a curfew set to begin at 6pm EDT.

FED: Federal Reserve policymakers are still more likely to increase monthly bond buys in the near-term than to trim the pace of purchases, especially if the U.S. vaccine rollout remains disappointingly slow, ex-central bankers told MNI.

- While the last-minute passage of a USD900 billion fiscal stimulus has taken some pressure off the central bank, leading to some speculation about a possible tapering of bond buys, policymakers continue to lean toward doing more rather than less. For more see MNI Policy Mainwire at 0556ET.

- "As we look through a new Covid package we are thinking through how to extend unemployment insurance for the duration of the crisis," she told a webinar. "The idea that families have to worry about this every few months really makes little sense we're thinking through a long-term unemployment insurance support."

- "Some participants noted that the Committee could consider future adjustments to its asset purchases—such as increasing the pace of securities purchases or weighting purchases of Treasury securities toward those that had longer remaining maturities," the minutes said.

EUROPE

BOE: The Bank of England is likely to cut rates to negative levels, David Aikman, a former technical head of division on the financial stability wing at the Bank, told MNI.

- The BOE has been consulting with banks and building societies over how ready they are to implement negative rates but Aikman, who last year moved from the bank to become professor of finance at King's Business School, does not expect the exercise to reveal road blocks. For more see MNI Policy Mainwire at 0743ET.

OVERNIGHT DATA

DEC ADP EMPLOYMENT CHG -123K (V +75K EXP, +307K PRIOR)

US DATA: November Factory Orders Beat Expectations

- U.S. factory orders were up 1.0% in November, above expectations for a 0.7% increase, and marking the seventh consecutive month of gains, the Census Bureau reported Wednesday.

- October factory orders were revised up to 1.3% (prev +1.0%).

- Orders of transportation equipment were up 2.1% in November following a 1.5% increase in October. Orders of motor vehicle parts grew 1.8% after a 0.9% gain in October.

- Orders of nondefense aircraft and parts fell 2.8% in November, while defense aircraft orders were up 15.7% following a 71.3% gain in October.

- Excluding transportation, factory orders were up 0.8%.

- Durable goods orders were up 1.0% in November following a stronger 1.8% increase in October. Meanwhile nondurable goods orders increased 1.1% after a 0.8% gain in October.

- U.S. factory orders were up 1.0% in November, above expectations for a 0.7% increase, and marking the seventh consecutive month of gains, the Census Bureau reported Wednesday.

- October factory orders were revised up to 1.3% (prev +1.0%).

- Orders of transportation equipment were up 2.1% in November following a 1.5% increase in October. Orders of motor vehicle parts grew 1.8% after a 0.9% gain in October.

- Orders of nondefense aircraft and parts fell 2.8% in November, while defense aircraft orders were up 15.7% following a 71.3% gain in October.

- Excluding transportation, factory orders were up 0.8%.

- Durable goods orders were up 1.0% in November following a stronger 1.8% increase in October. Meanwhile nondurable goods orders increased 1.1% after a 0.8% gain in October.

MARKETS SNAPSHOT

- DJIA up 415.2 points (1.37%) at 30824

- S&P E-Mini Future up 23.5 points (0.63%) at 3747.5

- Nasdaq down 63.8 points (-0.5%) at 12776.51

- US 10-Yr yield is up 7.6 bps at 1.0304%

- US Mar 10Y are down 18.5/32 at 137-8.5

- EURUSD up 0.0028 (0.23%) at 1.2337

- USDJPY up 0.27 (0.26%) at 102.96

- WTI Crude Oil (front-month) up $0.35 (0.7%) at $49.73

- Gold is down $28.59 (-1.47%) at $1924.01

- European bourses closing levels:

- EuroStoxx 50 up 63.23 points (1.78%) at 3611.08

- FTSE 100 up 229.61 points (3.47%) at 6841.86

- German DAX up 240.75 points (1.76%) at 13891.97

- French CAC 40 up 66 points (1.19%) at 5630.6

US TSY SUMMARY

Not how you would expect markets to finish: risk-appetite evaporating as DC protestors breach the Capitol, Congress that had been in process of counting electoral votes in recess, DC Mayor orders 1800ET curfew. Heavy volumes (TYH>2.4M) as yields surged (10YY tapped 1.0524%).

- Tsys opened weaker along with equities after GA special run-off election points toward Democrats gaining one if not two Senate seats.

- Shrugging Off Big ADP Employment Data Miss: Tsy futures headed back toward late overnight lows after bouncing in lead-up to Dec ADP data: Huge miss: -123k bs. +75k est (+307k in Nov). Very heavy volumes early as yield curves bear steepen to 4+ year highs.

- Tsys made new session lows as equities bounced lows (still inside overnight range w/ESH1 +4.0 at moment). Decent full day volumes just over hour after NY open: TYH1>1.3M. Sources reported real$ and bank portfolio selling across the curve, prop and fast$ two-way in short end, deal-tied selling getting lost in the mix, curve steepeners.

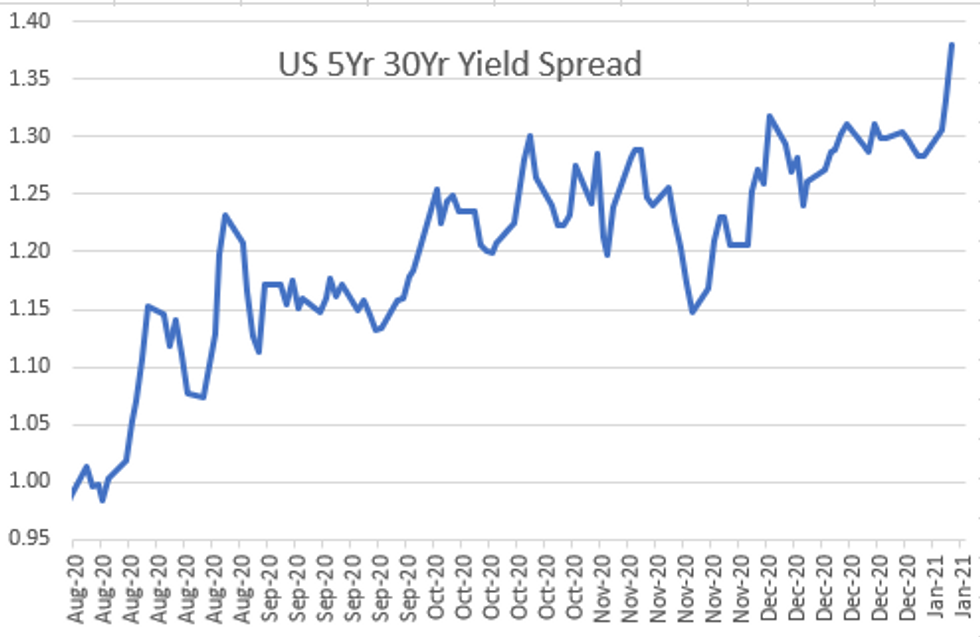

- The 2-Yr yield is up 2bps at 0.1408%, 5-Yr is up 5.1bps at 0.4274%, 10-Yr is up 8.1bps at 1.0355%, and 30-Yr is up 10.2bps at 1.8099%.

US TSY FUTURES CLOSE: Broadly Weaker/Off Lows

Futures broadly lower all day, rebound slightly as DC protestors actually breach the Capitol, necessitating Congress to halt electoral vote count. Tsys shrugged off weaker than expected ADP -123k vs. +75k est. Yield curves bear steepen to 4+ year highs.

- 3M10Y +7.387, 94.256 (L: 85.7 / H: 96.617)

- 2Y10Y +5.639, 88.795 (L: 82.017 / H: 91.354)

- 2Y30Y +7.901, 166.209 (L: 156.679 / H: 169.623)

- 5Y30Y +4.878, 137.87 (L: 131.957 / H: 140.699)

- Current futures levels:

- Mar 2Y down 1.25/32 at 110-14 (L: 110-13.25 / H: 110-15.37)

- Mar 5Y down 7.75/32 at 125-26.75 (L: 125-23.75 / H: 126-04)

- Mar 10Y down 17.5/32 at 137-9.5 (L: 137-03 / H: 137-29.5)

- Mar 30Y down 2-0/32 at 170-0 (L: 169-13 / H: 172-10)

- Mar Ultra 30Y down 4-1/32 at 207-02 (L: 205-27 / H: 211-23)

EURODOLLAR FUTURES CLOSE:

Broadly weaker across the strip on heavy volumes, short end outperforming since 3M LIBOR settled -0.00288 to 0.23400% (-0.00438/wk).

- Mar 21 -0.010 at 99.820

- Jun 21 -0.015 at 99.825

- Sep 21 -0.020 at 99.815

- Dec 21 -0.015 at 99.780

- Red Pack (Mar 22-Dec 22) -0.025 to -0.015

- Green Pack (Mar 23-Dec 23) -0.055 to -0.03

- Blue Pack (Mar 24-Dec 24) -0.075 to -0.06

- Gold Pack (Mar 25-Dec 25) -0.085 to -0.075

US TSY: Short Term Rates

US DOLLAR LIBOR: Latest settles:

- O/N +0.00012 at 0.08650% (+0.00887/wk)

- 1 Month +0.00112 to 0.13200 (-0.01188/wk)

- 3 Month -0.00288 to 0.23400% (-0.00438/wk)

- 6 Month -0.00150 to 0.25238% (-0.00525/wk)

- 1 Year +0.00263 to 0.33238% (-0.00950/wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.09% volume: $55B

- Daily Overnight Bank Funding Rate: 0.08%, volume: $140B

- Secured Overnight Financing Rate (SOFR): 0.11%, $986B

- Broad General Collateral Rate (BGCR): 0.08%, $358B

- Tri-Party General Collateral Rate (TGCR): 0.08%, $336B

- (rate, volume levels reflect prior session)

FED: NY Fed Operational Purchases

- TIPS 7.5Y-30Y, $1.201B accepted vs. $2.367B submission

- Next scheduled purchase:

- Thu 1/07 1100-1120ET: Tsy 20Y-30Y, appr $1.750B

- Fri 1/08 1100-1120ET: Tsy 0Y-2.25Y, appr $12.825B

PIPELINE: $12.9B High-Grade Debt To Price Wednesday

- Date $MM Issuer (Priced *, Launch #)

- 01/06 $4B *ADB 10Y +15

- 01/06 $3B #Toyota Motor Cr $1B 3Y +25, $750M 3Y FRN SOFR+33, $700M 5Y +40, $550M 10Y +62.5

- 01/06 $2.25B #BNP Paribas 6NC5 +90

- 01/06 $2B *Kommunalbanken 5Y +9

- 01/06 $1B *AerCap Ireland 5Y +155

- 01/06 $650M #Ares Capital +5Y +180

- On tap for Thursday

- 01/07 $Benchmark World Bank (IRBD) 2Y FRN SOFR+14, 2027 Tap SOFR+35a

FOREX: USD Chop, Risk-On Prevails Despite Protests

With US TSY Futures under pressure, an initial rally in the USD was quickly reversed as Equities remained firm and risk-on theme dominated the markets.

- EURUSD had a wild ride today after testing 1.2350 during the first half of the session. A rebound in the USD saw us take out the lows of the day through 1.2275 to a low of 1.2266. Short term positioning likely caused a round of stops to be triggered before late USD selling took us back above 1.2330.

- Cross JPY remained bid throughout the day with the clearest barometer for risk, AUDJPY, up 0.75% on the day. EURJPY also benefitting +0.55% with USDJPY also heading into the close, up 0.3% at 103.02, despite a late pullback amid the scenes at the Capitol.

- GBPUSD was heavy amid the usd buying, combined with an MNI story regarding potential negative rates in the UK. Lows were made at 1.3540, however, the pair also rebounded healthily back above the 1.36 handle.

- In EM, USDMXN was a notable mover down 1.2% with a notable technical break of 19.70 and the Peso benefitting from the rally in risk.

- The Dollar Index finds itself exactly in the middle of its 60 tik range at 89.50.

- There was little to no movement in the FX space on the release of the FOMC minutes before ongoing social unrest at the Capitol Building caused equities to pare gains and TSY futures to turn off the lows which prompted a small retracement in JPY.

EGBs-GILTS CASH CLOSE: Bear Steepening Post-US Senate Elections

Bunds and Gilts bear steepened Wednesday, with periphery spreads tightening, largely on greater anticipation of US fiscal expansion following the Georgia Senate elections.

- Broadly disappointing Dec services PMI helped core FI recover some lost ground in the morning.

- We saw a rally in Gilts to session highs and buying throughout the Short Sterling strip, following our MNI BoE exclusive on Negative rates just before 1400GMT.

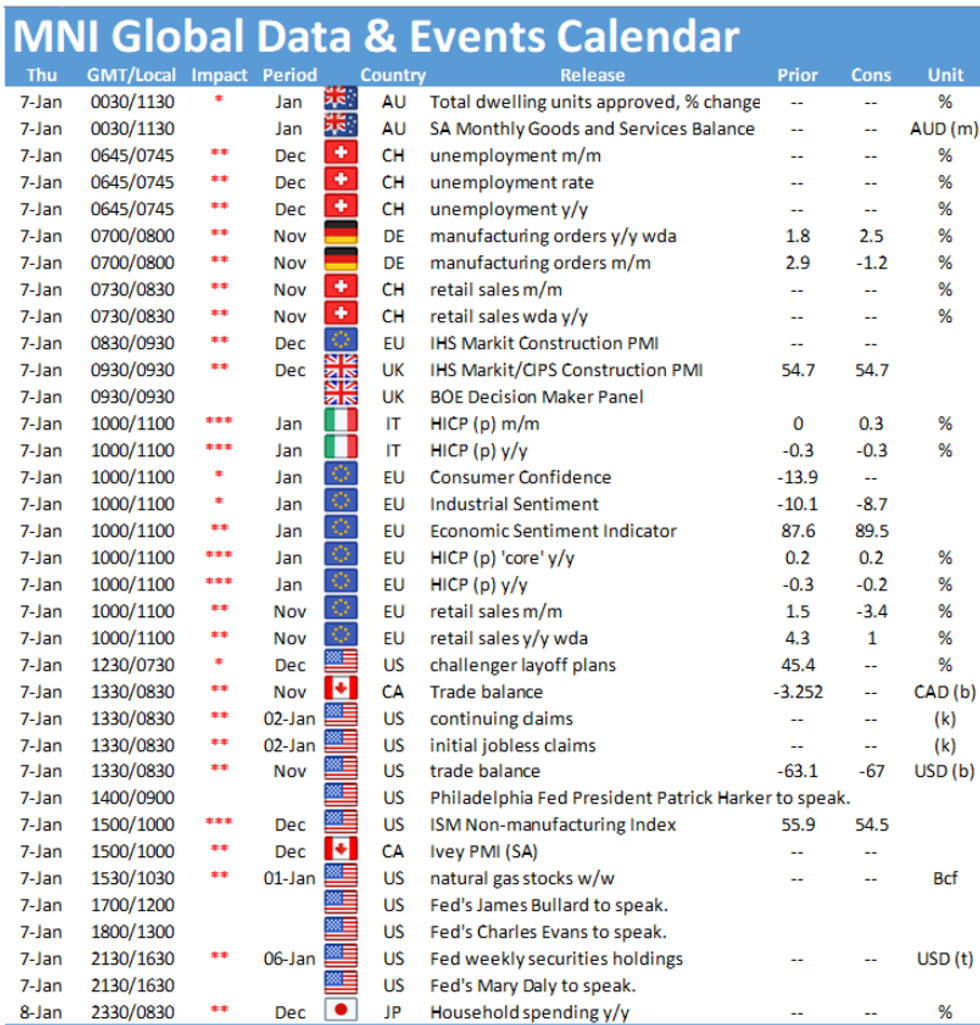

- Thursday sees French and Spanish bond auctions, German factory orders and Italy+Eurozone Dec flash inflation data. Closing Levels / 10-Yr Periphery EGB Spreads:

- Germany: The 2-Yr yield is up 1.4bps at -0.702%, 5-Yr is up 1.8bps at -0.729%, 10-Yr is up 5.7bps at -0.52%, and 30-Yr is up 2.9bps at -0.137%.

- UK: The 2-Yr yield is up 0.9bps at -0.134%, 5-Yr is up 1.4bps at -0.078%, 10-Yr is up 3.4bps at 0.243%, and 30-Yr is up 4.4bps at 0.823%.

- Italian BTP spread down 5.6bps at 108.7bps / Spanish down 4.6bps at 56.6bps

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.