-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: China CFETS Yuan Index Up 0.01% In Week of Nov 22

MNI ASIA OPEN - 10YY Tops 1.08%, Curves March Steeper

EXECUTIVE SUMMARY

- MNI INTERVIEW: Fed Model Predicts Dec Payrolls As High As +1M

- MNI BRIEF: Fed's Harker Sees Weak 1Q, Strong Bounce in 2H

- MNI BRIEF: Schumer Calls For Trump Removal With 25th Amendment

- MNI BRIEF: Bullard Says Too Soon To Talk About Taper Timing

- CHICAGO FED EVANS: "OPTIMISTIC ABOUT 2021, THE ECONOMY; LOOKING FOR GROWTH ON THE ORDER OF 4%' IN 2021," Bbg

- RICHMOND FED BARKIN: "SEES CONTINUING DISINFLATIONARY PRESSURES; EXPECT THAT SECOND HALF OF 2021 WILL BE ROBUST" Bbg

US

FED: Federal Reserve Bank of Philadelphia President Patrick Harker warned Thursday that the economy could shrink in the first three months of the year before reversing into a strong rebound in the second half and into 2022 as Covid vaccinations become widely available.

- "I'm expecting the fourth quarter of last year to show modest growth, before a significant slowing in the first quarter of this year -- possibly even negative growth," he said in remarks prepared for a Philadelphia business event. "I am optimistic that in the second half of 2021, the economy -- and frankly, life -- should begin to look much more normal. GDP growth should be strong in the second half of the year, and through 2022, before a light tapering in 2023." For more see MNI Policy Mainwire at 0801ET.

FED: U.S. employers may have added as many as 1 million jobs in December , according to a real time labor market index that has forecast official payrolls reports "reasonably well" over the pandemic, Federal Reserve Bank of St. Louis economist Max Dvorkin told MNI, though he cautioned that another version of the model predicts a much lower jobs gain.

- The bank's Coincident Employment Index, using weekly employment data from workplace software maker Ultimate Kronos Group, predicts 1,083,000 jobs were added last month despite restrictions to curb the record winter spike in coronavirus cases, far more than the median market estimate of just 73,000. For more see MNI Policy Mainwire at 0911ET.

- Evans also said the recent trend in the pandemic suggests near term economic momentum may slow, while affirming his view GDP will rise about 4% this year and unemployment will decline to around 5%.

- "I don't think it's prudent to talk about when we're going to make a decision because there's just too much uncertainty," Bullard said, despite offering an optimistic outlook for the economy in a presentation preceding the press call. It's too soon to try to pin down dates on this."

OVERNIGHT DATA

- US JOBLESS CLAIMS -3K TO 787K IN JAN 02 WK

- US PREV JOBLESS CLAIMS REVISED TO 790K IN DEC 26 WK

- US CONTINUING CLAIMS -0.126M to 5.072M IN DEC 26 WK

- US DATA: ISM Services PMI Higher in Dec

- US ISM SERVICES PMI 57.2 DEC VS 55.9 NOV

- US ISM SERVICES BUSINESS INDEX 59.4 DEC VS 58.0 NOV

- US ISM SERVICES EMPLOYMENT INDEX 48.2 DEC VS 51.5 NOV

- US ISM SERVICES NEW ORDERS 58.5 DEC VS 57.2 NOV

- US ISM SERVICES SUPPLIER DELIVERIES 62.8 DEC VS 57.0 NOV (NSA)

- The ISM Services PMI edged up 1.3pt to 57.2 following two consecutive months of decline, in contrast to markets looking for a dip to 54.5. Among the main four categories, Supplier Deliveries showed the largest gain, up 5.8pt to the highest level since May, followed by Business Activity (+1.4pt) and New Orders (+1.3pt). Employment eased by 3.3pt to the lowest level since July and below the 50-mark for the first time since August. Among all sub-indicators, Inventories saw the largest gain, rising by 8.9pt to a six-month high of 58.2 and followed by Exports which increased 6.9pt to 57.3. Meanwhile, Imports fell 3.2pt to 51.8 and Inventory Sentiment declined 2.2pt to 47.7, while Order Backlogs dropped 2.0pt to 48.7 and Prices eased 1.3pt to 64.8.

- US CHALLENGER: DEC LAYOFF INTENTIONS 77,030 V NOV 64,797

- US CHALLENGER: DEC 2019 LAYOFF INTENTIONS WERE 32,843

- US CHALLENGER: LAYOFF INTENTIONS LED BY ENTERTAINMENT/LEISURE

- US CHALLENGER: DEC HIRING INTENTIONS 77,267 VS NOV 185,504

- US CHALLENGER: HIRING INTENTIONS LED BY TECH, HEALTH CARE

- US CHALLENGER: DEC 2019 HIRING INTENTIONS WERE 26,313

- CANADIAN NOV TRADE BALANCE -3.3 BILLION CAD

- CANADA NOV EXPORTS 46.8 BLN CAD, IMPORTS 50.1 BLN CAD

- CANADA REVISED OCT MERCHANDISE TRADE BALANCE -3.7 BLN CAD

- CANADA DEC SA IVEY PURCHASING INDEX 46.7 VS PRIOR 52.7

MARKETS SNAPSHOT

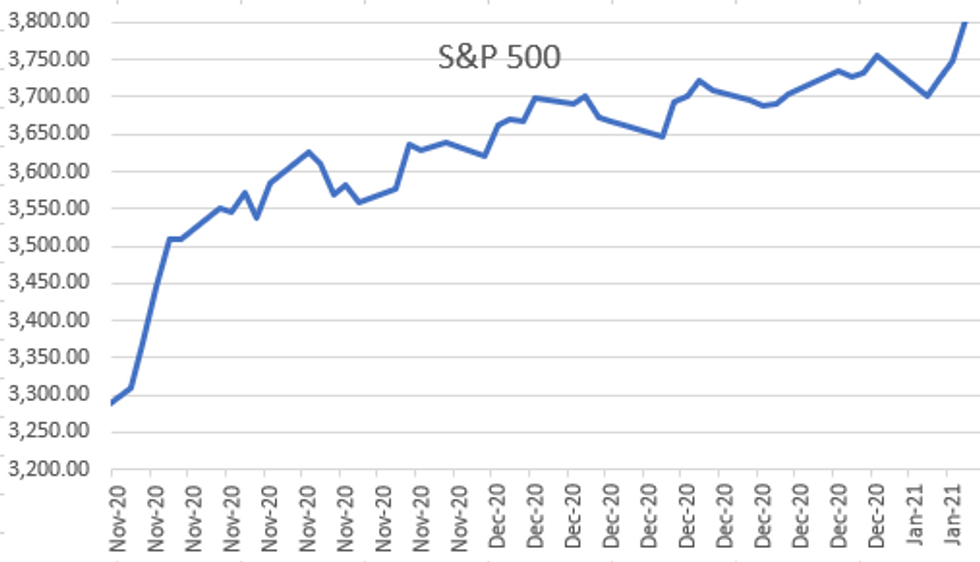

- DJIA up 227.04 points (0.74%) at 31057.44

- S&P E-Mini Future up 53 points (1.42%) at 3793.25

- Nasdaq up 299.9 points (2.4%) at 13041.61

- US 10-Yr yield is up 3.6 bps at 1.071%

- US Mar 10Y are down 8.5/32 at 136-30

- EURUSD down 0.0057 (-0.46%) at 1.227

- USDJPY up 0.79 (0.77%) at 103.82

- WTI Crude Oil (front-month) up $0.21 (0.41%) at $50.86

- Gold is down $1.16 (-0.06%) at $1917.53

- EuroStoxx 50 up 11.34 points (0.31%) at 3622.42

- FTSE 100 up 15.1 points (0.22%) at 6856.96

- German DAX up 76.27 points (0.55%) at 13968.24

- French CAC 40 up 39.25 points (0.7%) at 5669.85

US TSY SUMMARY: Fri Data Welcome Distraction

Really Decent volumes on net despite a rather quiet second half, TYH1>1.5M futures. Risk-appetite continued through the session, equities making new all-time highs (ESH1 3803.25), rate futures correspondingly weaker, 10YY tapped 1.08% while curves continued to extend 4+ year highs (5s/30s 141.202H).

- Relative calm after storm following Wed's protestor breach in the Capitol, possibly partially tied to Trump muzzled from social media platforms: Facebook, Twitch, Twitter over accusations of inciting Wed's DC Capitol riots.

- Slow stream of resignations through the day, some cabinet members (Elaine Cho, Mitch McConnel's wife) amid growing chatter of implementing the 25th amendment to remove the president less than 2 weeks before pres elect Biden takes office on Jan 20.

- Focus on Fri's Dec employ data, +50k est, curves extend bear steepening and heavy option positioning for more (Fed BULLARD: EXPECT LONGER-TERM RATES TO RISE AS ECONOMY RECOVERS, Bbg).

- The 2-Yr yield is unchanged at 0.1369%, 5-Yr is up 2.9bps at 0.4545%, 10-Yr is up 3.6bps at 1.071%, and 30-Yr is up 3.2bps at 1.8456%

US TSY FUTURES CLOSE: 10YY Tops 1.08%

Tsys futures trading weaker after the bell but off late morning lows even as equities hold near all-time highs (ESH1 3803.25). Yld curves continue to extend multi-year steepening while 10YY tops 1.08% in earlier trade.

- 3M10Y +4.398, 98.82 (L: 93.495 / H: 100.006)

- 2Y10Y +3.888, 93.357 (L: 88.993 / H: 94.543)

- 2Y30Y +3.366, 170.691 (L: 166.674 / H: 172.883)

- 5Y30Y +0.342, 139.01 (L: 137.851 / H: 141.202)

- Current futures levels:

- Mar 2Y up 0.5/32 at 110-14.125 (L: 110-13.62 / H: 110-14.25)

- Mar 5Y down 3/32 at 125-22.25 (L: 125-21.5 / H: 125-27)

- Mar 10Y down 9.5/32 at 136-29 (L: 136-27 / H: 137-09.5)

- Mar 30Y down 19/32 at 169-4 (L: 168-21 / H: 169-31)

- Mar Ultra 30Y down 1-3/32 at 205-11 (L: 204-13 / H: 207-00)

EURODOLLAR FUTURES CLOSE: Mirroring Tsy Curve Steepening

Eurodollar futures trade steady/mixed in the short end to broadly weaker in the long end of the strip. Lead quarterly EDH1 held bid since 3M LIBOR set -0.00925 to 0.22475% (-0.01368/wk). Massive early second half buying in Red Mar'22: over 150,000 bought from 99.795 to .805, pushed total volume over 270,000.

- Mar 21 +0.010 at 99.825

- Jun 21 +0.005 at 99.825

- Sep 21 steady00 at 99.815

- Dec 21 -0.005 at 99.775

- Red Pack (Mar 22-Dec 22) -0.015 to steadysteady0

- Green Pack (Mar 23-Dec 23) -0.045 to -0.02

- Blue Pack (Mar 24-Dec 24) -0.065 to -0.055

- Gold Pack (Mar 25-Dec 25) -0.08 to -0.075

US TSY: Short Term Rates

US DOLLAR LIBOR: Latest settles:

- O/N +0.00025 at 0.08675% (+0.00912/wk)

- 1 Month +0.00063 to 0.13263 (-0.01125/wk)

- 3 Month -0.00925 to 0.22475% (-0.01368/wk)

- 6 Month -0.00113 to 0.25125% (-0.00638/wk)

- 1 Year -0.00313 to 0.32925% (-0.01263/wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.09% volume: $56B

- Daily Overnight Bank Funding Rate: 0.08%, volume: $139B

- Secured Overnight Financing Rate (SOFR): 0.10%, $978B

- Broad General Collateral Rate (BGCR): 0.08%, $361B

- Tri-Party General Collateral Rate (TGCR): 0.08%, $335B

- (rate, volume levels reflect prior session)

FED: NY Fed Operational Purchases

- Tsy 20Y-30Y, $1.734B accepted vs. $4.851B submission

- Next scheduled purchase:

- Fri 1/08 1100-1120ET: Tsy 0Y-2.25Y, appr $12.825B

PIPELINE: Over $75B High Grade Debt Issued First Wk 2021

- * Date $MM Issuer (Priced *, Launch #)

- * 01/07 $3.5B #World Bank (IRBD) $2.35B 2Y FRN SOFR+13, $1.15B 2027 Tap SOFR+34

- * 01/07 $3B #Standard Chartered $1.5B 4NC3 +89, $1.5B 6NC5 +100

- * $12.9B Priced Wednesday; $66.8B/wk

- * 01/06 $4B *ADB 10Y +15

- * 01/06 $3B *Toyota Motor Cr $1B 3Y +25, $750M 3Y FRN SOFR+33, $700M 5Y +40,

- $550M 10Y +62.5

- * 01/06 $2.25B *BNP Paribas 6NC5 +90

- * 01/06 $2B *Kommunalbanken 5Y +9

- * 01/06 $1B *AerCap Ireland 5Y +155

- * 01/06 $650M *Ares Capital +5Y +180

FOREX: Dollar Stages Tepid Bounce Off Multi-Yr Low

After hitting a new multi-year low yesterday, the dollar bounced slightly Thursday, prompting a minor uptick in the USD index to the best levels since late December. The bounce, so far, has been insufficient to prompt any sort of trend reversal, but the greenback did see some stiff support as US equity markets once again hit alltime highs. Confirmation from US President Trump that he will oversee an orderly handover of power on January 20th followed the final hurdle being removed from President-Elect Biden also helped support the greenback.

- The risk-on theme elsewhere was reinforced by the Japanese Ministry of Finance stating they would work with the central bank in order to prevent disorderly strengthening of the JPY - leading the Japanese currency to be the weakest performer in G10 Thursday.

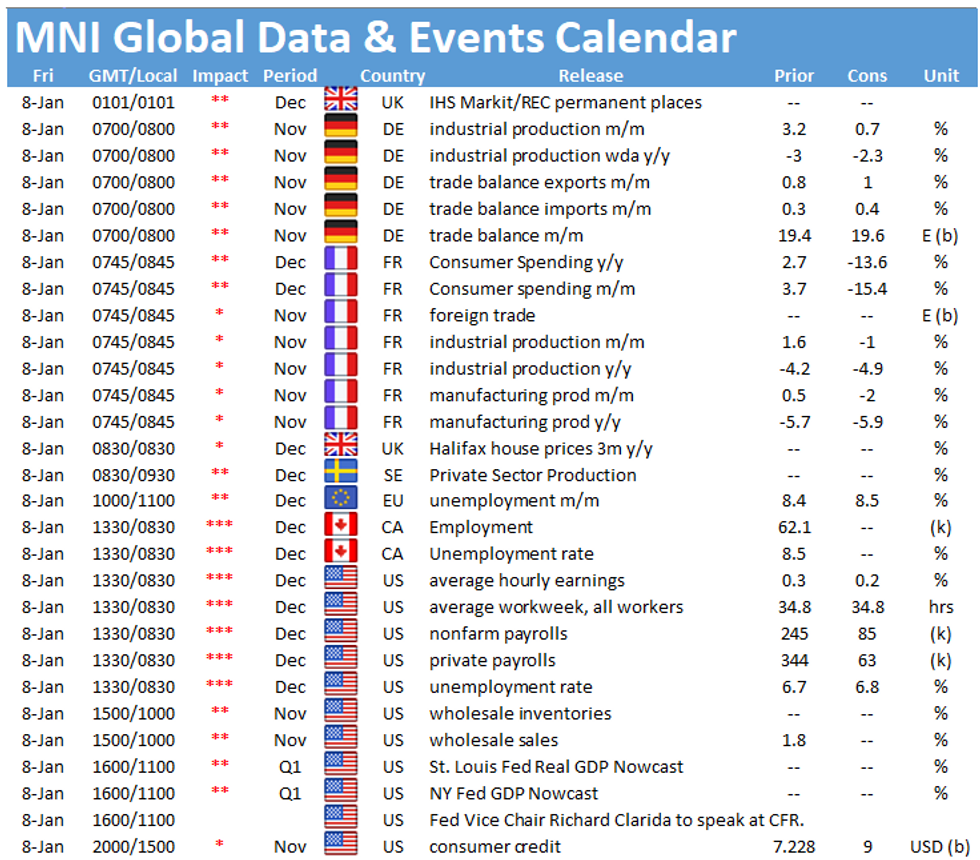

- Focus Friday turns to the US jobs report, with the US seen adding around 50k jobs in the month of December - the lowest since COVID crisis struck in early 2019. Canadian jobs data also crosses.

EGBs-GILTS CASH CLOSE: Gilts Weaker, Bunds Weaker On Supply

Thursday saw weakness in Gilts with bear steepening in the curve, though fairly directionless trade in Bunds, with a generally risk-on tone prevailing.

- Another day of large supply weighed on EGBs in the morning with France and Spain selling a combined EUR17bn of bonds/linkers at auction. Periphery spreads little changed.

- Strong German factory data this morning, with Eurozone/Italy inflation largely in line. Friday sees Eurozone industrial production data. Closing Levels / 10-Yr Periphery EGB Spreads:

- Germany: The 2-Yr yield is down 0.2bps at -0.704%, 5-Yr is down 0.5bps at -0.734%, 10-Yr is down 0.2bps at -0.522%, and 30-Yr is up 0.6bps at -0.131%.

UK: The 2-Yr yield is down 0.1bps at -0.135%, 5-Yr is up 2.2bps at -0.056%, - UK: The 2-Yr yield is down 0.1bps at -0.135%, 5-Yr is up 2.2bps at -0.056%, 10-Yr is up 4.1bps at 0.284%, and 30-Yr is up 5bps at 0.873%.

- Italian BTP spread down 0.7bps at 108bps

- Spanish bond spread unchanged at 56.6bps

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.