-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Nov Job Gains, Fed Blackout, CPI/PPI Ahead

MNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI ASIA OPEN: Vaccine Shortages, Biden Set To Take Reins

EXECUTIVE SUMMARY

- MNI EXCLUSIVE: Fed Prepared to Stick With Vague QE Guidance

- POLITICAL RISK: Various Countries Confirming Pfizer Supplies Will Fall Short

- MNI BRIEF: US Dec Industrial Production Beats Expectations

- MNI BRIEF: US Holiday Spending Up Despite Virus Shutdowns -NRF

- MNI: TRUDEAU SAYS FM MUST USE WHATEVER FISCAL FIREPOWER NEEDED

US

FED: The Federal Reserve's vague guidance on tapering asset purchases risks creating unwanted spikes in borrowing costs, but policy makers may be too far apart to refine it further, former officials told MNI.

- Investors are calling for more specificity about what policymakers mean by "substantial further progress" in the economy, their criteria for gauging an eventual reduction of the Fed's USD120 billion a month of bond buys. Officials have further muddied the waters in recent weeks by taking divergent views on the timing of such progress. For more see MNI Policy Mainwire at 1555ET.

POLITICAL RISK: Various Countries Confirming Pfizer Supplies Will Fall Short

- Following up on an earlier bullet (see 1203GMT bullet) the health ministries of a number of countries, including Germany, Norway, and Canada have released statements saying that they have been notified by Pfizer that their shipments of COVID-19 vaccines from the company will fall short of the initial order over the coming weeks.

- The disruption comes as Pfizer seeks to expand its production capacity at its plant in Puurs, Belgium.

- The Pfizer plant in the US is not set to be affected, meaning supply of vaccines there will continue uninterrupted.

US: NYC Mayor: City May Run Out Of Vaccines Next Week

- Speaking to WYNC radio, Mayor of New York City Bill de Blasio has raised fears that the city is on the brink of running out of COVID-19 vaccines, stating "We will run out of vaccines next week in New York City if there's not a very different approach from the federal government, the state government and manufacturers."

- * A number of senior politicians in various US states are also raising alarms that they are running short of vaccines. Governor Kate Brown of the state of Oregon tweeted: "Last night, I received disturbing news, confirmed to me directly by General Perna of Operation Warp Speed: States will not be receiving increased shipments of vaccines from the national stockpile next week, because there is no federal reserve of doses."

US: U.S. industrial production in December rose 1.6% when markets had expected a gain of 0.5% and November's increase was revised a tenth higher to 0.5%, signaling strength in the manufacturing sector, the Federal Reserve reported Friday. Output in December was still 3.6% lower compared to a year earlier and was 3.3% below its pre-pandemic February level.

EUROPE

RATINGS: 4x Ratings Reviews Slated

- Sovereign rating reviews of note scheduled for after hours on Friday include

- Fitch on the United Kingdom (current rating: AA-; Outlook Negative)

- Moody's on Finland (current rating: Aa1; Outlook Stable)

- S&P on Russia (current rating: BBB-; Outlook Stable)

- DBRS Morningstar on Slovenia (current rating: A (high), Stable Trend)

OVERNIGHT DATA

- US DEC FINAL DEMAND PPI +0.3%, EX FOOD, ENERGY +0.1%

- US DEC FINAL DEMAND PPI EX FOOD, ENERGY, TRADE SERVICES +0.4%

- US DEC FINAL DEMAND PPI Y/Y +0.8%, EX FOOD, ENERGY Y/Y +1.2%

- US DEC PPI: FOOD -0.1%; ENERGY +5.5%

- US DEC PPI: GOODS +1.1%; SERVICES -0.1%; TRADE SERVICES -0.8%

- US DEC RETAIL SALES & FOOD SVCS -0.7%; EX-MOTOR VEH -1.4%

- US NOV SALES REVISED -1.4%; EX-MV -1.3%

- US DEC RET SALES EX GAS & MTR VEH & PARTS DEALERS -2.1% V NOV -1.3%

- US DEC RET SALES EX MTR VEH & PARTS DEALERS -1.4% V US DEC -1.3%

- US DEC RET SALES EX AUTO, BLDG MATL & GAS -1.3% V NOV +0.6%

DATA REACT: Ugly Retail Sales Numbers Suggest End-Of-Year Weakness Perhaps surprising there wasn't more market reaction to that very weak retail sales report (indeed, Tsys have now moved lower), with control group -1.9% in December (est +0.1%, -1.1% prior - revised lower from -0.5%). That will have a direct negative bearing on Q4 GDP estimates as it is an input into national accounts.

- Combined w other poor data this week including jobless claims, suggests that economic activity at the end of the year was weaker than expected.

- Muted reaction may be on some expectation that the weak data will boost the case for a larger fiscal stimulus. Census Bureau, MN

- US DEC INDUSTRIAL PROD +1.6%; CAP UTIL 74.5%

- US NOV IP REV TO +0.5%; CAP UTIL REV 73.4%

- US DEC MFG OUTPUT +0.9%

- US NOV BUSINESS INVENTORIES +0.5%; SALES -0.1%

- US NOV RETAIL INVENTORIES +0.7%

- US NY FED EMPIRE STATE MFG INDEX 3.5 JAN

- US NY FED EMPIRE MFG NEW ORDERS 6.6 JAN

- US NY FED EMPIRE MFG EMPLOYMENT INDEX 11.2 JAN

- US NY FED EMPIRE MFG PRICES PAID INDEX 45.5 JAN

- CANADIAN DEC HOME SALES +7.2% MOM, RECORD +47.2% YOY-CREA

- CANADIAN DEC AVERAGE HOME SALES PRICE +17.1% YOY

MARKETS SNAPSHOT

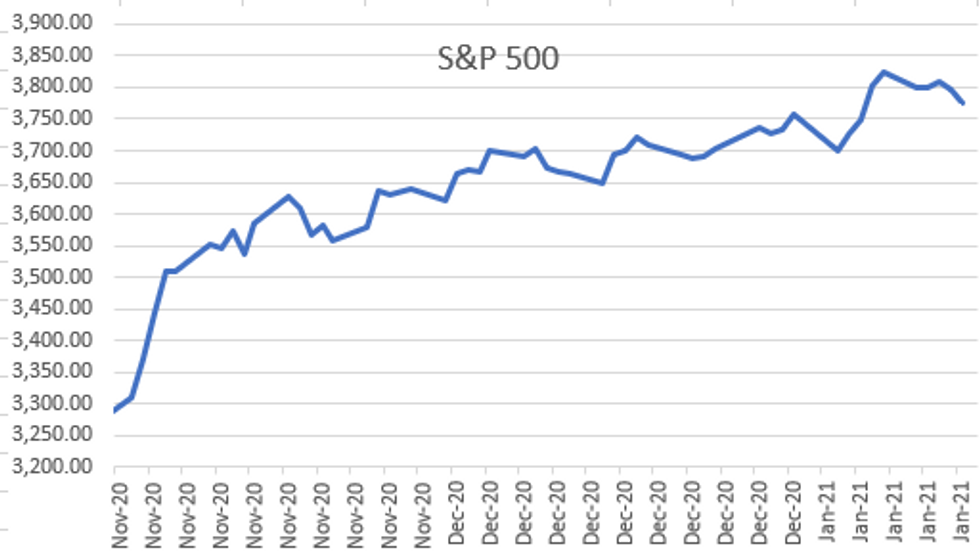

- DJIA down 89.83 points (-0.29%) at 30906.85

- S&P E-Mini Future down 20.75 points (-0.55%) at 3771

- US 10-Yr yield is down 3.4 bps at 1.0954%

- US Mar 10Y are up 9.5/32 at 136-27.5

- EURUSD down 0.0076 (-0.63%) at 1.2079

- USDJPY up 0.07 (0.07%) at 103.87

- WTI Crude Oil (front-month) down $1.23 (-2.3%) at $52.34

- Gold is down $18.69 (-1.01%) at $1827.77

- EuroStoxx 50 down 41.82 points (-1.15%) at 3599.55

- FTSE 100 down 66.25 points (-0.97%) at 6735.71

- German DAX down 200.97 points (-1.44%) at 13787.73

- French CAC 40 down 69.45 points (-1.22%) at 5611.69

US TSY SUMMARY: Risk-Off Ahead Extended Holiday Weekend

Rates firmer after the bell Friday, near the mid-session range, a mild risk-off tone with equities weaker but off lows (ESH1 -20.0).

- Underscoring tone: heavy first half data included ugly Dec Retail Sales (-0.7% vs. 0.0% est) combined w/ other poor data this wk including jobless claims, suggests that economic activity at the end of the year was weaker than expected.

- Moderate volumes (TYH1>1.22M) two-way with better buying from prop and real$ in belly to long end earlier. Second half much more subdued as US accts looked forward to extended three-day holiday weekend ahead next week Wednesday inauguration for President-elect Biden.

- Ongoing headline risks: threat of violent protest in state capitols across the US not just DC, Covid items: vaccine inventory concerns weighed on equities (as did bank shares after earnings started to roll).

- The 2-Yr yield is down 0.4bps at 0.135%, 5-Yr is down 3bps at 0.4533%, 10-Yr is down 3.4bps at 1.0954%, and 30-Yr is down 2.3bps at 1.8493%.

US TSY FUTURES CLOSE: Moderate Risk-Off Support

Tsy futures held firmer levels across the curve after the bell, off session highs on a rather quiet second half. Support kicked off early following ugly Dec Retail Sales (-0.7% vs. 0.0% est). Yld curves mostly flatter.

- 3M10Y -3.975, 101.085 (L: 100.235 / H: 104.466)

- 2Y10Y -3.128, 95.493 (L: 94.812 / H: 98.28)

- 2Y30Y -1.665, 171.227 (L: 169.065 / H: 172.396)

- 5Y30Y +0.924, 139.599 (L: 137.153 / H: 139.811)

- Current futures levels:

- Mar 2Y up 0.625/32 at 110-14.375 (L: 110-13.75 / H: 110-14.625)

- Mar 5Y up 4.75/32 at 125-23.25 (L: 125-18.25 / H: 125-24)

- Mar 10Y up 11/32 at 136-29 (L: 136-16.5 / H: 136-30.5)

- Mar 30Y up 21/32 at 168-28 (L: 168-03 / H: 169-05)

- Mar Ultra 30Y up 30/32 at 205-10 (L: 204-07 / H: 206-03)

US EURODOLLAR FUTURES CLOSE

Futures trade mostly higher, long end of strip outperforming, levels near session highs. Large Block: 10,000 old Green pack (EDZ2-EDU3) at +0.0075 in early trade likely swap related. Short end hold steady, 3M LIBOR settled -0.00225 to 0.22338% (-0.00100/wk). Latest levels:

- Mar 21 steady at 99.820

- Jun 21 steady at 99.825

- Sep 21 steady at 99.815

- Dec 21 +0.005 at 99.785

- Red Pack (Mar 22-Dec 22) +0.005 to +0.010

- Green Pack (Mar 23-Dec 23) +0.015 to +0.035

- Blue Pack (Mar 24-Dec 24) +0.040 to +0.055

- Gold Pack (Mar 25-Dec 25) +0.050 to +0.055

US TSY: Short Term Rates

US DOLLAR LIBOR: Latest settles:

- O/N -0.00012 at 0.08663% (-0.00012/wk)

- 1 Month +0.00062 to 0.12950% (+0.00312/wk)

- 3 Month -0.00225 to 0.22338% (-0.00100/wk)

- 6 Month -0.00312 to 0.24813% (+0.00163/wk)

- 1 Year -0.00312 to 0.32263% (-0.00700/wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.09% volume: $64B

- Daily Overnight Bank Funding Rate: 0.08%, volume: $150B

- Secured Overnight Financing Rate (SOFR): 0.08%, $887B

- Broad General Collateral Rate (BGCR): 0.05%, $340B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $321B

- (rate, volume levels reflect prior session)

- Tsy 0Y-2.25Y, $12.801B accepted vs. $36.688B submission

- Next week's scheduled purchases:

- Tue 1/19 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Wed 1/20 1010-1030ET: TIPS 1Y-7.5Y, appr $2.425B

- Thu 1/21 1010-1030ET: Tsy 7Y-20Y, appr $3.625B

- Fri 1/22 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.825B

PIPELINE: Supra-Sovs Driving US$ Issuance, Domestics Sidelined Into Earnings

$57.64B Running total issuance for week; $131.69B/month

- Date $MM Issuer (Priced *, Launch #)

- 01/15 $1B Nederlandse Waterschapsbank (NWB) 2Y +2

- $9B Priced Thursday

- 01/14 $3.25B *Oman $500M 2025 Tap 4.45%, $1.75B 10Y 6.25%, $1B 30Y 7.25%

- 01/14 $2.5B *Pioneer Natural $750M 3NC1 +55, $750M 5Y +65, $1B 10Y +105

- 01/14 $1.25B *Nationwide Building Society 3Y +37

- 01/14 $1B *EIB 5Y FRN SOFR+20

- 01/14 $500M *American Assets Trust 10Y +237.5

- 01/14 $500M *Public Storage WNG 5Y +43

FOREX: Haven Currencies Make Some Headway

Friday was a broadly risk-off session, with equities soft, bonds strong and haven currencies in demand. The greenback and the JPY were the firmest currencies across G10, with markets responding to reports of fractures in the Pfizer/BioNTech supply chain, poorly received earnings from some of the US' largest banks and a lower-than-expected deluge of US data.

- USD, JPY strength resulted in EUR/USD hitting new multi-week lows, just to find some support at the 1.2082 50-dma and sent AUD/JPY lower by as much as 1.3% from the day's high. Commodity tied FX traded poorly, with AUD, NZD and NOK all suffering.

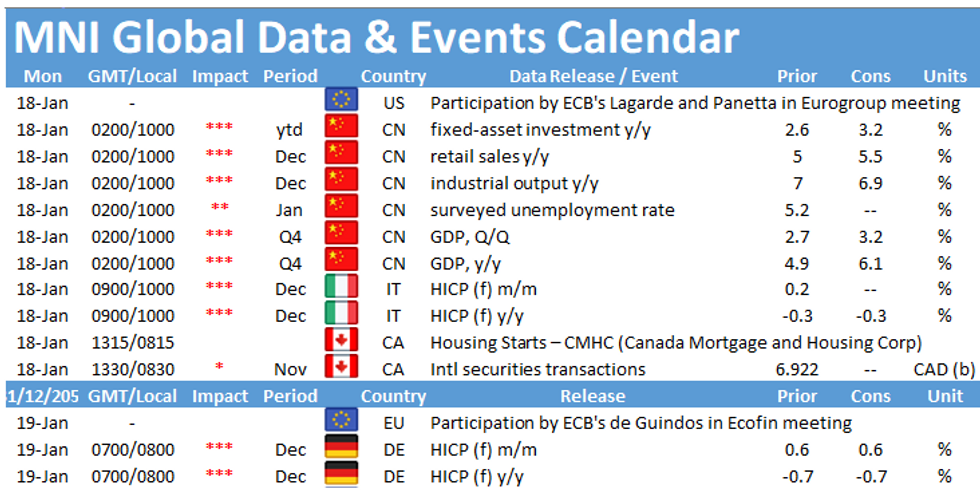

- Focus in the coming week remains on US earnings season, with reports due from some of the largest US banks as well as Netflix, UnitedHealth and IBM. The week should start slowly with a US public holiday Monday before central banks take focus. Decisions are due from the BoC, ECB and Norges Bank.

EGBs-GILTS CASH CLOSE: Attention Turns To Next Week Events

The UK and German curves steepened over the course of Friday's session, reversing initial flattening. BTP spreads reversed most of Thursday's widening, with attention on Tuesday's Senate confidence vote that could decide the fate of the Conte government.

- Stronger-than-expected UK GDP numbers added to the negative Gilt tone on the open, but apart from that there was little in the way of market-moving macro events / data / speakers.

- Ratings reviews of the UK and Finland after hours Friday of some note.

- Next week to see an estimated E21.5bln in EGB auctions, plus syndications (possibly Greece; while the EU has issued an RFP for its SURE bond).

- We also get the ECB Governing Council meeting next Thursday. Closing Cash levels:

- German 2Y Yld +0.7bps at -0.72%, 10-Yr +0.7bps at -0.543%, 30-Yr +1.3bps at -0.133%

- UK 2Y Yld -1.4bps at -0.134%, 10-Yr -0.3bps at 0.288%, 30-Yr +0.3bps at 0.868%

- Italy/German 10-Yr Spread 3.6bps tighter at 115.7bps

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.