-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN - Biden Stimulus May Be Trimmed To $1T?

EXECUTIVE SUMMARY

- MNI EXCLUSIVE: Biden's Relief Plan Likely To Be Slimmed To $1T

- MNI EXCLUSIVE: Fed To Keep QE Pace Despite Bigger Fiscal Boost

- MNI BRIEF: Trump Impeachment to be Sent to Senate Mon: Schumer

- NEW COVID VARIANT MAY BE LINKED TO HIGHER MORTALITY, U.K. SAYS, Bbg

- CHINA PUSHES FOR HIGH-LEVEL MEETING TO EASE TENSION W/ U.S.: DJ

US

US: U.S. President Joe Biden's fiscal aid proposal will likely be slashed to around USD1 trillion before it stands a chance at becoming law, despite the White House's push for bipartisan support on ambitious Democratic priorities, former officials from both political parties told MNI.

- As skepticism rises among GOP moderates and Democrats gird to act quickly, a budget reconciliation process for a slimmed down package looks more viable, sources say. For more see MNI Policy Main Wire at 1407ET.

FED: The Federal Reserve will keep up its monthly USD120 bond buying for the foreseeable future despite a much-larger-than-expected fiscal stimulus plan from the Biden administration and muddled public messaging from top policy makers which has helped push up Treasury yields, current and former central bank officials told MNI.

- The Fed would have to see a significant shift in the economy's trajectory -- well beyond an expected springtime inflation spike related to year-on-year comparisons --for any tapering of QE to begin later this year or even early in 2022, they said in interviews.

- Schumer did not comment on when the trial will begin, but delivering the article triggers the start of the trial, absent a consent agreement between Schumer and Senate Minority Leader Mitch McConnell. While the transmission of the article launches the trial, the schedule ahead remains uncertain, and could potentially gum up fiscal relief negotiations and the confirmation of Biden's cabinet.

- "The Senate will conduct a trial on the impeachment of Donald Trump," Schumer said. "It will be a fair trial. But make no mistake, there will be a trial."

OVERNIGHT DATA

US FLASH JAN MFG PMI 59.1; DEC 57.1, SURVEY 56.5

US FLASH JAN SERVICES PMI 57.5; DEC 54.8, SURVEY 53.4

US FLASH JAN COMPOSITE PMI 58.0; DEC 55.3

- Annual volume of U.S. existing home sales hit the highest since 2006 as December sales surge 0.7% to 6.76 million SAAR from an upwardly revised 6.71 million in November. Markets had expected 6.56 million.

- December home sales volume jump 22.2% from a year ago

- Median sales price $309,800, up 12.9% from a year earlier; as more larger homes sold skews prices upward

- Sales of million dollar+ homes nearly double over the year

- Sales pace could reach 8 million if the market had more inventory, chief economist Lawrence Yun says

- Inventory is at an all-time low, down 23% from a year ago

- Supply at a record low 1.9 mos, down from 3.0 months a year earlier

- Biden could introduce a homebuyer tax credit, which would encourage more first time buyers

CANADA DEC FLASH RETAIL SALES -2.6%

CANADA FLASH DEC WHOLESALE SALES -1.7%

CANADIAN NOV RETAIL SALES +1.3%; SALES EX-AUTOS/PARTS +2.1%

CANADA NOV RETAIL SALES EX-AUTOS/PARTS-GASOLINE +2.6%

MARKETS SNAPSHOT

- DJIA down 122.02 points (-0.39%) at 31052.95

- S&P E-Mini Future down 7.75 points (-0.2%) at 3838

- Nasdaq up 0.8 points (0%) at 13530.93

- US 10-Yr yield is down 1.7 bps at 1.0889%

- US Mar 10Y are up 5/32 at 137-1.5

- EURUSD up 0.0007 (0.06%) at 1.2172

- USDJPY up 0.31 (0.3%) at 103.81

- WTI Crude Oil (front-month) down $0.87 (-1.64%) at $52.27

- Gold is down $12.45 (-0.67%) at $1857.51

- EuroStoxx 50 down 15.94 points (-0.44%) at 3602.41

- FTSE 100 down 20.35 points (-0.3%) at 6695.07

- German DAX down 32.7 points (-0.24%) at 13873.97

- French CAC 40 down 31.22 points (-0.56%) at 5559.57

US TSY SUMMARY: Late Bounce On

Tsy futures traded firmer into the closing bell -- catching a bid as Pres Biden talks to nation over relief plan. Note MNI story broke at same time:

- MNI EXCLUSIVE: Biden's Relief Plan Likely To Be Slimmed To $1T

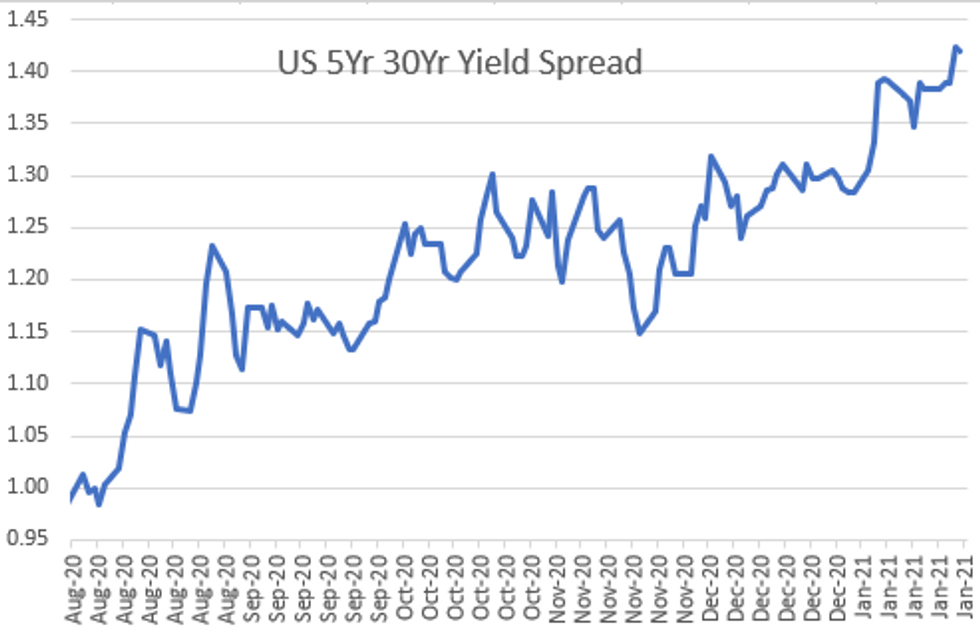

- Early session: Intermediates to long end drew quick selling after better than expected MFG (59.1 vs. 56.5 est) and Services PMI (57.5 vs. 53.4 est), equities inched off lows as risk-on tone gained slightly. Yield curves flattening after climbing to new 4+ year highs yesterday.

- That said, there were heavy Tsy steepener blocks crossed on the day in 5s30s (27,575 FVH vs. 3,000 USH) and 2s/ultra-10s (19,258 TUH vs. 5,620 UXYH) around midmorning.

- Eurodollar futures saw ongoing heavy Blocks: 10,000 2Y bundles (EDH1-EDZ2, Whites through Reds) +0.0025 from 0926-0929ET, adds to late Thu: Blocks 12,500 2Y Bundles (White+Reds or EDH1-EDZ2), +0.0075; and 7,500 White packs (EDH1-EDZ1) crossed at 0.0075. may be related to talk ICE will annc end of LIBOR date early next week.

- The 2-Yr yield is up 0.4bps at 0.123%, 5-Yr is down 1.4bps at 0.4311%, 10-Yr is down 2bps at 1.0855%, and 30-Yr is down 2.1bps at 1.8487%.

US TSY FUTURES CLOSE: Late Bounce, Biden Stimulus May Be Slimmed To $1T

Tsy futures traded firmer into the closing bell -- catching a bid as Pres Biden talks to nation over relief plan. Futures still holding near mid-range not only for the session but since January 14, generally quiet end to the week, yld curves mixed on moderate volumes (TYH1 just over 1.1M). Update:* 3M10Y -1.769, 100.95 (L: 100.436 / H: 103.064).

- 2Y10Y -1.314, 96.563 (L: 95.744 / H: 98.931)

- 2Y30Y -0.998, 173.148 (L: 171.024 / H: 175.425)

- 5Y30Y +0.003, 142.057 (L: 139.549 / H: 143.031)

- Current futures levels:

- Mar 2Y steady at at 110-15.25 (L: 110-15 / H: 110-15.5)

- Mar 5Y up 1.75/32 at 125-26.75 (L: 125-24.5 / H: 125-27.75)

- Mar 10Y up 5.5/32 at 137-02 (L: 136-26 / H: 137-02.5)

- Mar 30Y up 16/32 at 168-30 (L: 168-07 / H: 169-05)

- Mar Ultra 30Y up 24/32 at 205-04 (L: 203-30 / H: 205-26)

US EURODOLLAR FUTURES CLOSE:

Futures holding narrow range on net, steady in the short end to mildly higher in the latter half of the strip. Heavy Block action again: 10,000 2Y bundles (EDH1-EDZ2) adds to 12.5k Thursday as well as 7.5k Whites, ongoing chatter -- may be related to talk ICE will annc end of LIBOR/transition date early next week. Lead quarterly EDH1 steady even as 3M LIBOR inches lower: -0.00250 to 0.21525% (-0.00813/wk).

- Mar 21 steady at 99.815

- Jun 21 +0.005 at 99.830

- Sep 21 +0.010 at 99.825

- Dec 21 steady00 at 99.785

- Red Pack (Mar 22-Dec 22) steady to +0.005

- Green Pack (Mar 23-Dec 23) +0.005 to +0.015

- Blue Pack (Mar 24-Dec 24) +0.005 to +0.010

- Gold Pack (Mar 25-Dec 25) steady to +0.010

US TSY: Short Term Rates

US DOLLAR LIBOR: Latest settles:

- O/N -0.00075 at 0.08625% (-0.00038/wk)

- 1 Month -0.00525 to 0.12475% (-0.00475/wk)

- 3 Month -0.00250 to 0.21525% (-0.00813/wk)

- 6 Month +0.00150 to 0.23600% (-0.01213/wk)

- 1 Year -0.00313 to 0.31225% (-0.01038/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $74B

- Daily Overnight Bank Funding Rate: 0.08%, volume: $204B

- Secured Overnight Financing Rate (SOFR): 0.04%, $922B

- Broad General Collateral Rate (BGCR): 0.02%, $353B

- Tri-Party General Collateral Rate (TGCR): 0.02%, $324B

- (rate, volume levels reflect prior session)

- Tsy 2.25Y-4.5Y, $8.801B accepted vs. $40.551B submission

- Next scheduled purchases:

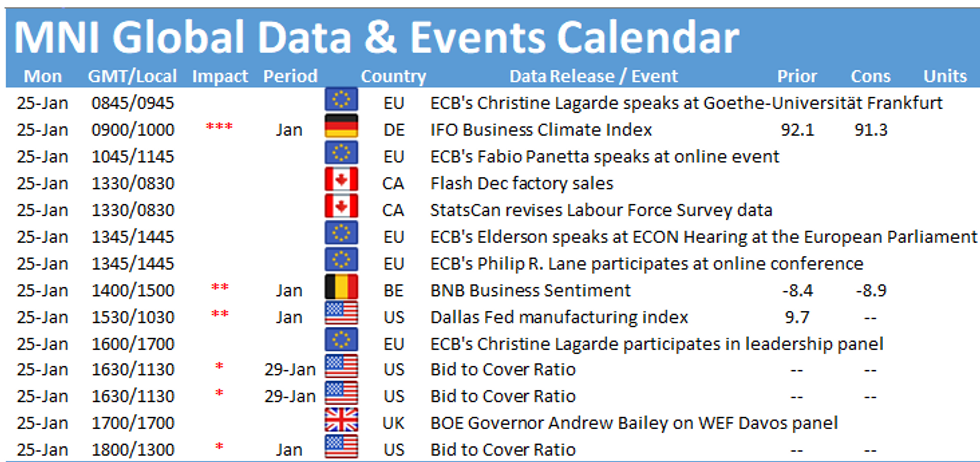

- Mon 1/25 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

- Tue 1/26 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Thu 1/28 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Fri 1/29 1010-1030ET: TIPS 7.5Y-30Y, appr $1.225B

- Fri 01/29 Next forward schedule release at 1500ET

PIPELINE: British Columbia 10Y Pushed Wk's Total Issuance To $52.96B

British Colombia 10Y Sole Friday Issuer

- Date $MM Issuer (Priced *, Launch #)

- BC 10Y Pushed Wk's Total Issuance To $52.96B

- 01/22 $1.75B *Prov British Columbia 10Y +21

- $9.5B To price Thursday, $51.96B/wk

- 01/21 $2.5B *Citigroup 6NC5 fix-FRN +68

- 01/21 $2B *European Bank for R&D (EBRD) 5Y +3

- 01/21 $1B *Kommunekredit WNG 5Y +6

- 01/21 $1.2B *Bank of NY Mellon $700M 5Y +35, $500M 10Y +55

- 01/21 $1B *Development Bank of Japan WNG 10Y +22

- 01/21 $1B *Canada Pension Plan Inv Brd (CPPIB) 10Y +24

- 01/21 $750M *Aircastle 7Y +230

FOREX: Greenback, EUR Trade Firm Into the Close

Markets welcomed the smooth inauguration of President Biden earlier this week by bidding US equity markets to new all-time highs. The sentiment faded Friday, with stocks slipping on the continent and in the US in a wave of profit-taking on the recent risk rally. This flattered the greenback, which outperformed most others in G10, while EUR also traded well.

- Notably firm EU PMIs Friday morning supported the single currency from the off, although the primary support likely remained the ECB meeting Thursday, in which the ECB President looked unconcerned over currency strength. EUR/GBP recovered the Thursday losses as UK PMIs showed persistent economic weakness.

- Focus in the coming week turns to German IFO confidence data, Australian and German regional inflation, US prelim Q4 GDP and MNI Chicago PMI. The Fed rate decision is due Wednesday.

EGBs-GILTS CASH CLOSE: Italy Pol Risk Flares Up Anew

Friday morning saw Bunds and Gilts strengthen with BTP spreads sharply wider, though the moves moderated slightly in the afternoon.

- Italian political risk flared up again, with the tone set on the open by a report by Corriere Della Sera that PM Conte may opt for early elections if he can't form a majority gov't.

- Bunds strengthened and BTP spreads hit widest levels since November.

- The Eurozone manufacturing and services flash PMI prints were a touch better than expected, with Germany largely in line, and France disappointing. The UK saw a weak PMI svcs print, but more positively, data showed that the R rate has fallen to 0.8-1.0 (i.e. no longer exponential).

- Next week highlighted by supply: E17+bn in auction supply plus EU SURE syndication (we estimate E14bn of issuance).

- Closing Levels/10-Yr Periphery Spreads to Bunds:

- Germany: The 2-Yr yield is down 0.7bps at -0.707%, 5-Yr is down 1.7bps at -0.716%, 10-Yr is down 1.6bps at -0.512%, and 30-Yr is down 1.9bps at -0.097%.

- UK: The 2-Yr yield is down 1.8bps at -0.125%, 5-Yr is down 1.8bps at -0.035%, 10-Yr is down 2.3bps at 0.308%, and 30-Yr is down 2.1bps at 0.892%.

- Italian BTP spread up 8.1bps at 126.3bps / Spanish spread up 1.3bps at 63.5bps

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.