-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK ANALYSIS - Week Ahead 2-8 December

MNI POLITICAL RISK - Trump Targets BRICS w/New Tariff Threat

MNI Gilt Week Ahead: Triple issuance week?

MNI US MARKETS ANALYSIS - French Politics Undermines EUR

MNI ASIA OPEN: Multiple Factors Temper Risk Appetite

EXECUTIVE SUMMARY

- MNI EXCLUSIVE: Central Banks Mostly Deaf To Inflation Talk

- MNI POLICY: US Spending Expectations Highest In 6 Yrs- NY Fed

- US: GOP Sen Rob Portman Of Ohio Will Not Run For Re-Election In 2022

- "Germany to send naval frigate to Japan with eye on China", Nikkei

- FAUCI `WORRIED' ABOUT DELAYS TO SECOND COVID VACCINE DOSE; FAUCI: RISK IS EXISTING VACCINES MIGH NOT FIGHT FUTURE VARIANTS, Bbg

- MODERNA VACCINE RETAINS NEUTRALIZING ACTIVITY VS VARIANTS, Bbg

- MERCK SHUTS DOWN COVID-19 VACCINE PROGRAM AFTER LACKLUSTER DATA, Bbg

- ITALIAN PRIME MINISTER CONTE EXPECTED TO RESIGN TUESDAY, Bbg

US

CENTRAL BANKS: Massive global stimulus and the possibility of a sudden snap-back to growth as Covid vaccines are rolled out are prompting some investors and commentators to sharpen their focus on a pick-up – even a surge - in inflation, but extensive central bank contacts continue to tell MNI they see this as only a remote possibility.

- Some metals and agricultural commodity prices have accompanied gold higher and may portend a change in the outlook, helping push factory gate prices to a near 30-month high in MNI's December Chicago Business barometer.

- Median expected growth in household spending over the next year increased to 3% in December 2020 from 2.2% in August 2020 and 2.4% in December 2019. The increase was broad-based across education and income groups.

- Median expected changes in spending on non-essential items and essential items both reached highs going back to December 2014.

- Portman had proved a popular senator in the Buckeye state, having won election with 56.9% of the vote in 2010 before bettering his result in 2016, defeating Democratic former Ohio governor Ted Strickland with 58.0% of the vote. Had he run, expectations were that he would win re-election easily in a state that divides its US senators between Republican Portman and Democrat Sherrod Brown.

- As of 18 Jan, the Ohio US Senate seat up for election in 2022 was viewed by Cook Political Report as 'solid Republican' and 270ToWin as 'likely Republican'. With the incumbent standing down, the Democrats may have a better prospect of taking the seat.

CANADA

MNI BRIEF: Canada Consumer Confidence Highest Since Pandemic

- Canadian consumer confidence is the highest since the Covid-19 pandemic struck last March, with the Conference Board's index up 4.9 points to 90.7 in January.

- Sentiment improved about current finances as the economy gains momentum and the government extends relief payouts, according to a report Monday, with 22.8% of those polled saying it's a good time to make a major purchase.

EUROPE

MNI BRIEF: Many Finance Condition Measures in Place: ECB Lane

- Preserving favorable financing conditions "throughout the pandemic period" is the best way the European Central Bank can achieve its monetary policy aims and policymakers have a wide range of measures to gauge the current conditions, chief economist Philip Lane said Monday, as he highlighted the importance of the decline in the equilibrium real interest rate as a future challenge for monetary and fiscal policymakers.

- The impact of the Covid-19 crisis on the European banking sector has yet to be fully revealed, European Central Bank Executive Board member Frank Elderson said Monday, with non-performing loans and low profitability of key concern. Speaking for the first time since taking up the role, Elderson said it was vital banks avoid deepening the crisis by accumulating an increasing amount of bad debt, as businesses and consumers struggle with the ongoing economic shock caused by the pandemic and measures to contain it.

OVERNIGHT DATA

December reading of the Chicago Fed National Activity Index is 0.52 vs. 0.10 exp

STATSCAN REVISES DEC JOBLESS RATE TO 8.8% FROM 8.6%

STATSCAN REVISES DEC JOBS TO -52.7K FROM -62.6K

- "The increase reflects widespread growth, particularly in the wood products and transportation equipment industries," Statistics Canada said Monday

- Response rate of 62% vs 12m average of 90%

MARKET SNAPSHOT

Key Market Levels in Late Session Trade:- DJIA down 103.29 points (-0.33%) at 30893.23

- S&P E-Mini Future up 5.75 points (0.15%) at 3839.75

- Nasdaq up 64.2 points (0.5%) at 13606.51

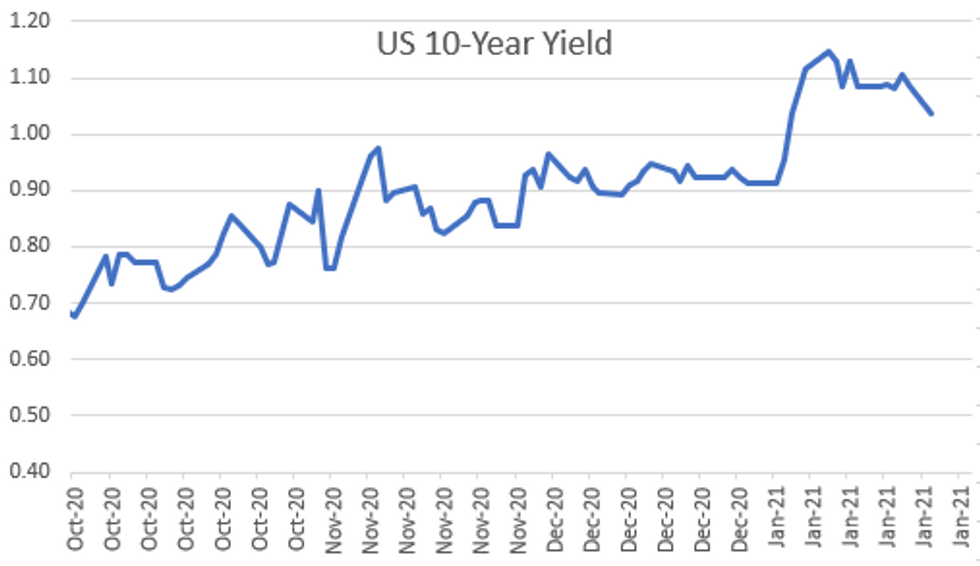

- US 10-Yr yield is down 5.1 bps at 1.0346%

- US Mar 10Y are up 12/32 at 137-13

- EURUSD down 0.0033 (-0.27%) at 1.2138

- USDJPY down 0 (0%) at 103.78

- WTI Crude Oil (front-month) up $0.48 (0.92%) at $52.74

- Gold is up $0.12 (0.01%) at $1855.67

European bourses closing levels:

- EuroStoxx 50 down 49.27 points (-1.37%) at 3553.14

- FTSE 100 down 56.22 points (-0.84%) at 6638.85

- German DAX down 230.02 points (-1.66%) at 13643.95

- French CAC 40 down 87.21 points (-1.57%) at 5472.36

MONTH-END EXTENSIONS: Prelim Barclays/Bbg Extension Estimates

Forecast summary compared to the avg increase for prior year and the same time in 2020. TIPS -0.16Y; Govt inflation-linked, 0.23.

| Estimate | 1Y Avg Incr | Last Year | |

| US Tsys | 0.08 | 0.09 | 0.07 |

| Agencies | 0.12 | 0.06 | -0.03 |

| Credit | 0.07 | 0.09 | 0.09 |

| Govt/Credit | 0.08 | 0.09 | 0.07 |

| MBS | 0.06 | 0.06 | 0.07 |

| Aggregate | 0.08 | 0.08 | 0.08 |

| Long Gov/Cr | 0.08 | 0.09 | 0.05 |

| Iterm Credit | 0.08 | 0.08 | 0.09 |

| Interm Gov | 0.09 | 0.08 | 0.07 |

| Interm Gov/Cr | 0.08 | 0.08 | 0.08 |

| High Yield | 0.07 | 0.08 | 0.09 |

US TSY SUMMARY: Tsys Extend Duration, Heavy Volumes As Eq Rally Falters

Monday was a choppy day all around -- rates and equities well bid on the open, the latter gapping lower ahead midday. No One Driver:

- Desks cited multiple headlines for rate bid that started well before NY open:

- German Navy sending ship to Japan (keep eye on activity in the South China Sea), pharmaceutical co Merck canceled their Covid vaccine efforts after poor results. Rates continued to extend duration while equities gapped lower, desks pointed to several headlines: Sen majority leader Schumer saying stimulus

- Rates continued to extend duration while equities gapped lower, desks pointed to several headlines: Sen majority leader Schumer saying stimulus effort to pass in next 4-6 weeks, Rep Sen Portman will not run for re-election (makes Trump imp conviction more likely ?), German Dax also hit as equities reversed gains, stops triggered.

- Heavy surge in volumes, TYH more than doubled in the first hour of trade. Large Blocks an hour later: 1021:04ET: 11,190 TUH 110-15.62 buy through 110-15.5 offer; 22,900 TYH 137-10.5 buy through 137-09 offer; 12,467 UXYH 154-13 buy through 154-11.5 offer. Bbg breakdown: 2s7s10s cash fly; DV01 $460k/$2M/$1.8M.

- Record $60B 2Y note auction stopped through: drew 0.125% (0.137% last month) vs. 0.127% WI, bid/cover 2.67 vs. 2.45 previous.

- The 2-Yr yield is down 0.2bps at 0.1189%, 5-Yr is down 2.4bps at 0.4071%, 10-Yr is down 4.9bps at 1.0363%, and 30-Yr is down 5bps at 1.7962%.

US TSY FUTURES CLOSE: Yld Curves Bull Flatten For Once

Tsy futures took several legs higher Monday, early risk-off triggers well ahead the NY open appeared to be: German Navy sending ship to Japan (keep eye on activity in the South China Sea), pharmaceutical co Merck canceled their Covid vaccine efforts after poor results. Yld curves bull flattened, latest levels:

- 3M10Y -4.497, 96.449 (L: 90.892 / H: 101.808)

- 2Y10Y -4.345, 91.707 (L: 91.199 / H: 97.591)

- 2Y30Y -4.288, 167.801 (L: 166.689 / H: 173.858)

- 5Y30Y -2.449, 138.869 (L: 138.056 / H: 142.3)

- Current futures levels:

- Mar 2Y steady at at 110-15.375 (L: 110-15.125 / H: 110-15.625)

- Mar 5Y up 3.75/32 at 125-30.75 (L: 125-26.25 / H: 126-00)

- Mar 10Y up 11/32 at 137-12 (L: 136-30 / H: 137-13.5)

- Mar 30Y up 1-1/32 at 169-29 (L: 168-19 / H: 170-05)

- Mar Ultra 30Y up 2-11/32 at 207-9 (L: 204-18 / H: 207-24)

US EURODOLLAR FUTURES CLOSE

Futures trade steady/mixed in the short end, progressively higher out the strip. Lead quarterly EDH1 mildly weaker even after 3M LIBOR settled -0.00237 to 0.21288% (-0.00813 net last wk).

- Mar 21 -0.005 at 99.815

- Jun 21 steady at 99.830

- Sep 21 steady at 99.820

- Dec 21 steady at 99.790

- Red Pack (Mar 22-Dec 22) -0.005 to +0.005

- Green Pack (Mar 23-Dec 23) +0.015 to +0.025

- Blue Pack (Mar 24-Dec 24) +0.030 to +0.035

- Gold Pack (Mar 25-Dec 25) +0.040 to +0.045

US TSY: Short Term Rates

US DOLLAR LIBOR: Latest settles:

- O/N -0.00162 at 0.08463% (-0.00038 net last wk)

- 1 Month +0.00275 to 0.12750% (-0.00475 net last wk)

- 3 Month -0.00237 to 0.21288% (-0.00813 net last wk)

- 6 Month -0.00300 to 0.23300% (-0.01213 net last wk)

- 1 Year +0.00000 to 0.31225% (-0.01038 net last wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $70B

- Daily Overnight Bank Funding Rate: 0.08%, volume: $193B

- Secured Overnight Financing Rate (SOFR): 0.05%, $906B

- Broad General Collateral Rate (BGCR): 0.04%, $360B

- Tri-Party General Collateral Rate (TGCR): 0.04%, $326B

- (rate, volume levels reflect prior session)

- Tsy 4.5Y-7Y, $6.001B accepted vs. $23.580B submission

- Next scheduled purchases:

- Tue 1/26 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Thu 1/28 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Fri 1/29 1010-1030ET: TIPS 7.5Y-30Y, appr $1.225B

- Fri 01/29 Next forward schedule release at 1500ET

PIPELINE: $11B 7-Eleven Multi Tranche Tues

- Date $MM Issuer (Priced *, Launch #)

- 01/25 $600M #United Airlines 5Y 4.875%

- 01/25 $550M *Woori Bank 5Y +45

- 01/25 $Benchmark Armenia investor call

- On tap for Tuesday: 7-Eleven to lead w/ multi trance jumbo

- 01/26 $11B est 7-Eleven

- 01/25 Oesterreichische Kontrollbank (OKB) 5Y +8

FOREX: Single Currency Lags - IFO, Italy To Blame

Risk appetite took a considerable hit shortly after the Wall Street opening bell, with US futures shedding around 60 points inside 15 minutes. The sell-off translated to some support for JPY in currency markets, with the USD also faring well. Growth proxy currencies, however, saw no material downside, with the NZD actually the best performer across G10.

- A softer-than-expected IFO release and continued wrangling in Italian politics led the single currency lower from the off. EUR/USD was sold to lows of 1.2116 before the pair bounced, trimming the day's losses to around 30 pips by the London close.

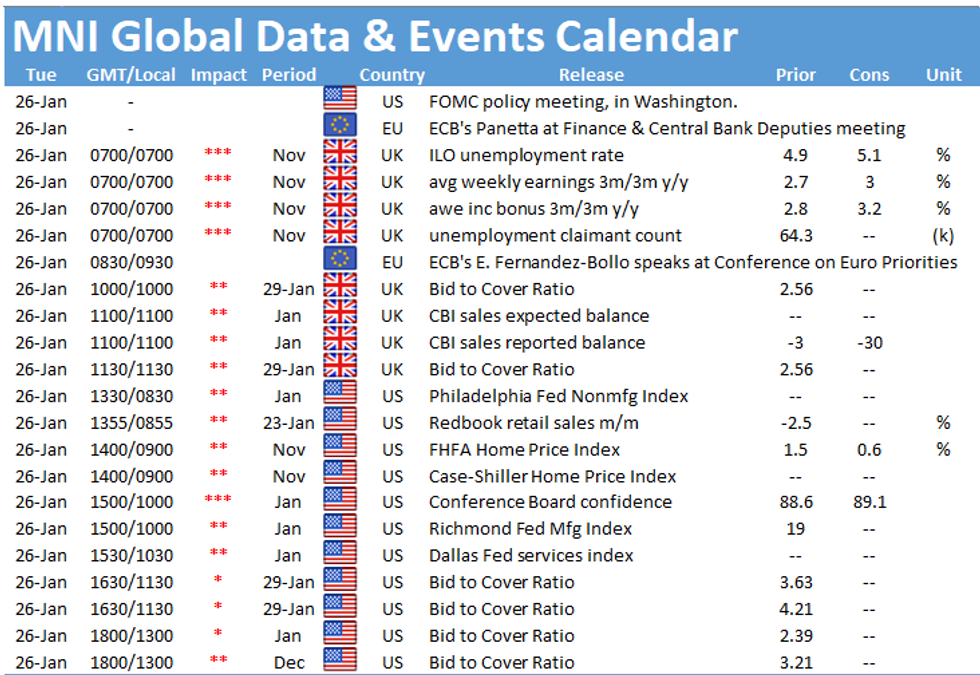

- Focus Tuesday turns to UK jobs data for December and US consumer confidence numbers for January. Speeches are due from ECB's Centeno and de Cos. US earnings season continues with Johnson & Johnson, Microsoft and Verizon Communications all due to report.

EGBs-GILTS CASH CLOSE: Awaiting Conte

Bonds gained all afternoon with weaker equities. Interest in Italian politics grew after the cash close, with reports that PM Conte would resign Tuesday morning in a bid to gain a mandate from President Mattarella to form a new government with broader backing. Italian spreads dropped in the cash session, while BTP futures regained lost ground following the Conte headlines in the post-cash session. Closing levels:

- Germany: The 2-Yr yield is down 2bps at -0.727%, 5-Yr is down 2.8bps at -0.744%, 10-Yr is down 3.8bps at -0.55%, and 30-Yr is down 3.9bps at -0.136%.

- UK: The 2-Yr yield is down 0.8bps at -0.133%, 5-Yr is down 2.7bps at -0.062%, 10-Yr is down 4.6bps at 0.262%, and 30-Yr is down 5.8bps at 0.834%.

- Italian BTP spread down 3.5bps at 122.8bps

- Spanish bond spread down 1.2bps at 62.3bps

- Portuguese PGB spread down 1.1bps at 57.2bps

- Greek bond spread up 1.8bps at 123.4bps

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.