-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Appetite for Risk Cools

EXECUTIVE SUMMARY

- MNI EXCLUSIVE: Fed Edges Closer to 'Substantial Progress' Mark

- MNI BRIEF: Congress Debates Directing Fed to Target Disparities

- MNI SOURCES: France, Spain Want Faster EU Aid Plan Approval

- TOKYO HAS DECIDED TO SEEK VIRUS STATE OF EMERGENCY: MAINICHI, Bbg

US TSY SUMMARY: Risk-Appetite Cools

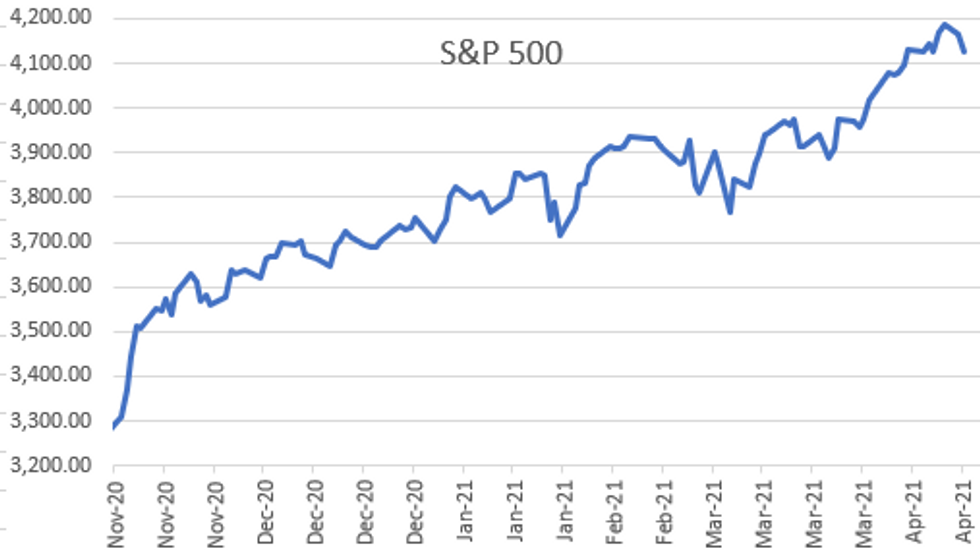

Risk appetite cooled Tuesday, 30Y bonds staging an early rally with stocks broadly weaker: SPUs followed weaker global stocks: Estoxx as the index fell blow Friday's lows, Japan's NIKKEI settled down a whopping 584.99 pts or -1.97% at 29100.38.- While some sources cited ongoing pandemic related concerns (Japan looking to call a state of emergency earlier, growing concerns in India w/PM Modi addressing the nation) and growing US/Russia tensions over troop build-up near Ukraine border -- others simply cited various technicals: sellers emerge every time SPUs climb 16% over 200DMA; or following a pattern of better selling in the second half of the month, every month since the beginning of the year.

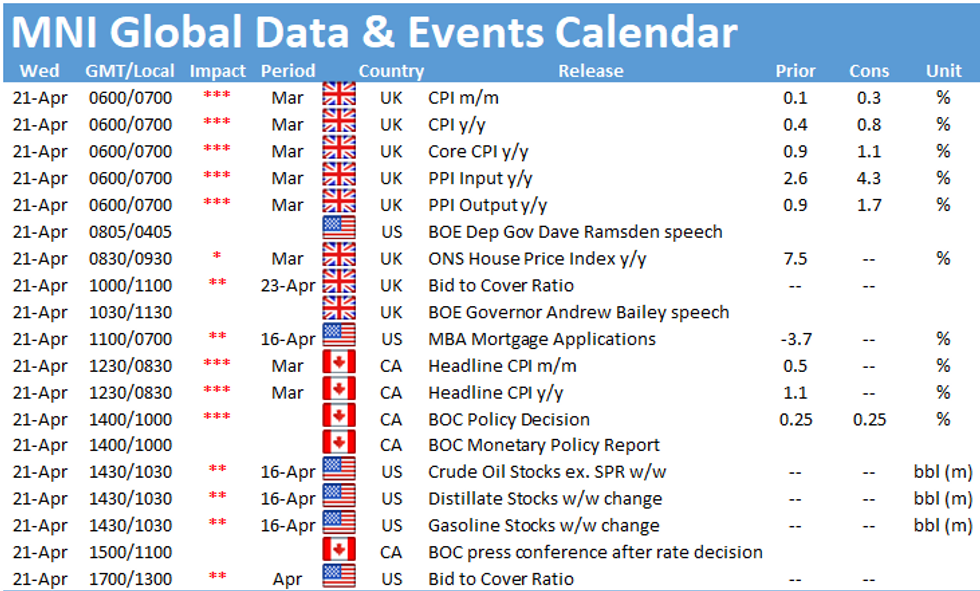

- Whatever the reason, US markets had another day of no economic data to trade off of -- and more of the same Wednesday. Data resumes Thursday w/weekly claims. Otherwise, focus is on Bank of Canada policy announcement Wednesday (includes Monetary Policy Report) and ECB decision Thursday.

- Another decent round of corporate issuance, near $17B generated hedging flow; FI markets a little gun-shy ahead Wednesday's $24B 20Y Bill auction re-open that has managed to push markets around last two auctions as performance varied.

- The 2-Yr yield is down 0.6bps at 0.1512%, 5-Yr is down 3.4bps at 0.7952%, 10-Yr is down 4.4bps at 1.5607%, and 30-Yr is down 3.9bps at 2.2573%.

US

FED: The Federal Reserve is likely to define "substantial further progress" toward its maximum employment goal, part of its criteria for tapering QE, as just over halfway between where the labor market stood in December and policymakers' judgement of full employment, former officials tell MNI.

- "The implicit (jobless rate) target is under 4% so you judge it accordingly -- if Powell's adjusted unemployment rate makes up half of that, I think he's entitled to say substantial progress," former Richmond Fed President Jeffrey Lacker said in an interview.

- How quickly the central bank is able to claim it has crossed the threshold depends on forecasts for how fast the job market will rebound, and these have become increasingly bullish, both former and current officials acknowledged. For more see MNI Policy main wire at 1148ET.

- House Financial Services Committee Chairwoman Maxine Waters (D-CA) said her legislation would set no numerical targets or rules-based process for the Fed but it would give it a duty to reduce and eliminate racial economic disparities to the "greatest extent possible." Democrats cited comments from Atlanta Fed President Raphael Bostic last summer when he wrote in an essay that the Fed "can play an important role in helping to reduce racial inequities and bring about a more inclusive economy." The bill would need to be passed by the full House and Senate to become law.

EUROPE

EUROPE: Countries including France, Spain and Portugal are pushing the European Commission to speed up approval of national recovery plans setting out reforms and investments required to access money from the EUR750 billion Next Generation EU aid package, officials told MNI.

- The Commission has said it will need two months to approve NRPs once submitted and EU finance ministers will only provide the final green light a month later. This delay could threaten the official timeline for NextGenEU borrowing to start in July, particularly now that some countries, such as the Netherlands and Finland, have already said they will not meet the end-of-April 'soft deadline' for submitting plans.

- "There is a level of impatience that is growing in some countries. There are countries that depend much more on Next Generation EU funds than others," said one official. For more see MNI Policy main wire at 1100ET.

OVERNIGHT DATA

No significant data Monday through Wednesday after the Fed entered media blackout regarding monetary policy through Apr-29 late Friday, Bill auctions and NY Fed Buy-backs on tap.

MARKETS SNAPSHOT

Key late session market levels

- DJIA down 311.54 points (-0.91%) at 33743.47

- S&P E-Mini Future down 34.75 points (-0.84%) at 4119

- Nasdaq down 155.9 points (-1.1%) at 13753.35

- US 10-Yr yield is down 4.4 bps at 1.5607%

- US Jun 10Y are up 10.5/32 at 132-18

- EURUSD down 0.0003 (-0.02%) at 1.2031

- USDJPY down 0.09 (-0.08%) at 108.1

- WTI Crude Oil (front-month) down $0.94 (-1.48%) at $62.44

- Gold is up $7.12 (0.4%) at $1778.33

European bourses closing levels:

- EuroStoxx 50 down 79.45 points (-1.98%) at 3940.46

- FTSE 100 down 140.21 points (-2%) at 6859.87

- German DAX down 238.88 points (-1.55%) at 15129.51

- French CAC 40 down 131.58 points (-2.09%) at 6165.11

US TSY FUTURES CLOSE

- 3M10Y -4.3, 154.316 (L: 153.182 / H: 160.294)

- 2Y10Y -3.271, 141.075 (L: 140.019 / H: 146.832)

- 2Y30Y -2.77, 210.742 (L: 209.904 / H: 216.214)

- 5Y30Y -0.298, 146.258 (L: 145.215 / H: 147.715)

- Current futures levels:

- Jun 2Y up 0.625/32 at 110-12.5 (L: 110-11.625 / H: 110-12.625)

- Jun 5Y up 4.75/32 at 124-3.25 (L: 123-27 / H: 124-04.5)

- Jun 10Y up 9.5/32 at 132-17 (L: 131-31.5 / H: 132-19.5)

- Jun 30Y up 18/32 at 158-2 (L: 156-27 / H: 158-10)

- Jun Ultra 30Y up 28/32 at 187-9 (L: 185-05 / H: 187-22)

US EURODOLLAR FUTURES CLOSE

- Jun 21 steady at 99.810

- Sep 21 +0.005 at 99.805

- Dec 21 steady at 99.740

- Mar 22 +0.005 at 99.780

- Red Pack (Jun 22-Mar 23) +0.005 to +0.015

- Green Pack (Jun 23-Mar 24) +0.015 to +0.030

- Blue Pack (Jun 24-Mar 25) +0.030 to +0.035

- Gold Pack (Jun 25-Mar 26) +0.030 to +0.035

Short Term Rates

US DOLLAR LIBOR: Latest settles

- O/N +0.00013 at 0.07288% (+0.00013/wk)

- 1 Month -0.00625 to 0.10750% (-0.00838/wk)

- 3 Month -0.00225 to 0.18375% (-0.00450/wk) (Record Low of 0.17525% on 2/19/21)

- 6 Month +0.00088 to 0.22263% (-0.00100/wk)

- 1 Year +0.00025 to 0.28700% (-0.00538/wk)

- Daily Effective Fed Funds Rate: 0.07% volume: $65B

- Daily Overnight Bank Funding Rate: 0.06%, volume: $248B

- Secured Overnight Financing Rate (SOFR): 0.01%, $919B

- Broad General Collateral Rate (BGCR): 0.01%, $380B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $351B

- (rate, volume levels reflect prior session)

- Tsy 20Y-30Y, appr $1.732B accepted vs. $4.793B submission

- Next scheduled purchases:

- Wed 4/21 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

- Thu 4/22 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Fri 4/23 1010-1030ET: TIPS 1Y-7.5Y, appr $2.425B

PIPELINE: $16.88B To Price Tuesday

- Date $MM Issuer (Priced *, Launch #)

- 04/20 $4B *EIB 3Y -3

- 04/20 $3.5B #Taiwan Semiconductor Mfg (TSMC) $1.1B 5Y +50, $900M 7Y +55, $1.5B 10Y +70

- 04/20 $1.75B #FedEx $1B 10Y +87.5, $750M 20Y +112.5

- 04/20 $1.5B #New Development Bank (NDB) 5Y +25

- 04/20 $1.5B #Abu Dhabi National Energy (TAQA) 7Y +80, 30Y 3.4%

- 04/20 $580M *Japan Int Cooperation Agcy 10Y +30

- 04/20 $500M *Korea Hydro & Nuclear Power 5Y +57.5

- 04/20 $1B #PNC Financial 11NC10 +75

- 04/20 $1.75B #FedEx $1B 10Y +87.5, $750M 20Y +112.5

- 04/20 $800M #New York Life $400M each: 3Y +25, 3Y FRN SOFR+31

- Expected over next few days:

- 04/21 $1B Kommunivest (Koomins) 3Y +2a

- 04/21 $Benchmark Kommunalbanken Norway (KBN) 2Y SOFR

- 04/21 $Benchmark International Development Assn (IDA) 5Y +5a

- 04/26 $Benchmark Tokyo Metropolitan, investor calls re: 3-10Y

FOREX: USD Spared Another Day of Losses Despite Further Curve Flattening

- Somewhat bucking the recent trend, the USD Index was spared further losses Tuesday as profit-taking and position squaring in the likes of EUR/USD and GBP/USD worked in favour of the index. This came despite persistent flattening the US yield curve, having taken the lead from a pullback in the US stock market.

- Further support for the greenback came as the latest polling in Germany suggested Merkel's CDU/CSU bloc has fallen behind the Greens. The headline prompted some selling pressure in the single currency, pressuring EUR/USD to the day's lowest levels, although support at the 1.20 remained intact.

- Lastly, commodity-tied currencies had the wind taken from their sails Tuesday, with a sharp drop in oil prices knocking both NOK and CAD into the close. The advancement of a bill in the Judiciary Committee that would open OPEC to lawsuit pressure from US lawmakers weighed on sentiment.

- Focus Wednesday turns to Australian retail sales, UK inflation data for March, Canadian CPI and the Bank of Canada rate decision. There are a number of BoE speakers on tap, with BoE's Bailey and Ramsden due to speak.

EGB/Gilt Summary: Underpinned during the afternoon session

Core Govies remain supported this afternoon, after taking their cue from the Risk Off price action.

- Move in Equities was seen as corrective, rather than any new news impact. German stays bull flatter, but well within April's ranges.

- In options space, downside structure play continue to dominate ahead of the awaited ECB meeting on Thursday

- Semi core have under performed somewhat, translating in wider peripheral spreads.

- Greece and Portugal trades at 1.7bp and 1.3bps wider respectively against the German 10yr

- Bund futures are up 0.07 today at 170.55 with 10y Bund yields down -0.6bp at -0.241%

- Schatz yields down -0.5bp at -0.692%

- BTP futures are down -0.07 today at 147.83 with 10y yields up 0.2bp at 0.792% and 2y yields up 0.1bp at -0.348%.

- OAT futures are up 0.03 today at 161.23 with 10y yields down -0.5bp at 0.096% and 2y yields up 0.3bp at -0.653%..

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.