-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Cautious Risk-On Amid Optimistic Re-Open Heads

EXECUTIVE SUMMARY

- MNI EXCLUSIVE: Fed Faces Battle To Ease Banks' Leverage Rules

- MNI INTERVIEW: BOC Will Taper to Avoid Market Squeeze--Dodge

- Lowe's to Hire 50,000 Staff, Sets Hiring Event for May 4, Bbg

- FRANCE TO REOPEN IN PHASES FROM MAY 3: MACRON TO REGIONAL PRESS

- GERMANY WEIGHS EASING RULES FOR VACCINATED FROM MAY 28: BILD

- E BLASIO ANNOUNCES NYC TO `FULLY REOPEN' ON JULY 1 - bbg

- DE BLASIO: KIDS CAN GO BACK `FULL STRENGTH' TO SCHOOL IN SEPT. Bbg

US

FED: The Federal Reserve's forthcoming proposal to retool the supplementary leverage ratio for big banks awash in reserves is seen as a pragmatic move for Treasury market liquidity but faces an uphill political battle, according to interviews with lawmakers, former officials and industry sources.

- The Fed is expected to propose making permanent some or all of the temporary relief that expired last month, potentially with countervailing increases in the overall ratio, or lower the ratio altogether, sources said. The stakes are high with Fitch Ratings estimating USD3 trillion of deposits were added last year to the balance sheets of the largest U.S. banks in response to the Fed's stimulus actions, putting banks' SLRs on trajectory to fall close to the 5% minimum required. For more, See MNI Policy main wire at 1100ET.

US: U.S. employers added between 618,000 and 1.3 million jobs in April, according to a St. Louis Fed model using high frequency data from scheduling software companies Kronos and Homebase. That falls short of the 843,000 to 1.67 million range forecast by the regional Fed bank's model last month. Actual payroll employment rose by 916,000 in March, according to the latest jobs report from the Bureau of Labor Statistics.

- Data from Kronos, which reflects the lower end of the forecast, has been "relatively flat" over the past few weeks, likely influenced by spring break in some parts of the country, St. Louis Fed economist Max Dvorkin told MNI in an email. The data saw a "positive jump" last week, he said, though that's outside of the BLS' survey week and won't be visible in official statistics.

- Dvorkin cautioned that the Homebase data, used to calculate the forecast's upper end, "overpredicted the effective change in employment," last month by a larger margin than the Kronos data. Still, Dvorkin's coincident indices have forecast official jobs numbers from the BLS reasonably well through the pandemic.

US: U.S. weekly jobless claims slipped by 13,000 to 553,000 in the latest week, a sign of gradual improvement in the labor market as the economy bounces back from the Covid recession.

- Fed Chair Jerome Powell said the central bank needs to see a lot more job creation before it can declare the economy has made "substantial further progress" toward its goals, the Fed's criteria for tapering QE. Initial claims remain at nearly triple their pre-crisis levels.

- The strong growth reflected increases in PCE, nonresidential fixed investment, federal government spending, residential fixed investment, and state and local government spending. Partially offsetting those gains were declines in private inventory investment and exports, the BEA said.

- Increases in PCE reflected increases in purchases of goods like motor vehicles and food, the BEA said, and services like restaurant visits. Increases in federal spending were driven by PPP loans and purchases of Covid-19 vaccines.

CANADA

BOC: The Bank of Canada will keep paring back weekly government bond purchases to avoid amassing a stockpile that distorts market pricing, former Governor David Dodge told MNI, adding policy makers can manage 3% inflation through most of next year without seeking a deliberate overshoot like the Fed's.

- "They are going to be moving off, if only because you don't want to own all of that debt -- you have to have that debt out there in the market to give you the right signals," Dodge said about quantitative easing in a phone interview. For more, See MNI Policy main wire at 1415ET.

OVERNIGHT DATA

US JOBLESS CLAIMS -13K TO 553K IN APR 24 WK

US PREV JOBLESS CLAIMS REVISED TO 566K IN APR 17 WK

US CONTINUING CLAIMS +0.009M to 3.660M IN APR 17 WK

US Q1 GDP +6.4%

US NAR MAR PENDING HOME SALES INDEX 111.3 V 109.2 IN FEB

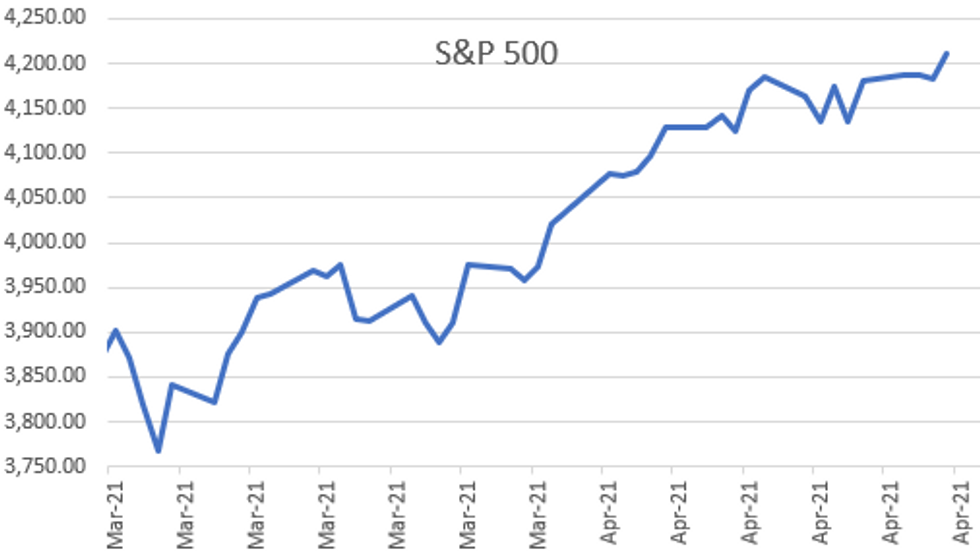

MARKETS SNAPSHOT

Key late session market levels

- DJIA up 236.33 points (0.7%) at 34037.08

- S&P E-Mini Future up 30 points (0.72%) at 4203.25

- Nasdaq up 49.6 points (0.4%) at 14092.75

- US 10-Yr yield is up 2.9 bps at 1.6379%

- US Jun 10Y are down 3.5/32 at 131-31.5

- EURUSD down 0 (0%) at 1.2126

- USDJPY up 0.28 (0.26%) at 108.87

- WTI Crude Oil (front-month) up $1.2 (1.88%) at $65.06

- Gold is down $8.53 (-0.48%) at $1773.55

European bourses closing levels:

- EuroStoxx 50 down 18.13 points (-0.45%) at 3996.9

- FTSE 100 down 2.19 points (-0.03%) at 6961.48

- German DAX down 137.98 points (-0.9%) at 15154.2

- French CAC 40 down 4.41 points (-0.07%) at 6302.57

US TSY SUMMARY: General Risk-On, May the Fourth Be With You!

Generally a risk-on trade Thursday, rates/equities weaker/stronger but off lower/higher bounds by the bell. In other words, markets fairly subdued in the session after the FOMC left rates and bond buying steady (if I had a dollar for every time I heard "no time to taper" I could go to the movies).

- Speaking of the movies, in another hopeful sign the pandemic is loosening it's grip: Lowe's to Hire 50,000 Staff, Sets Hiring Event for May 4, Bbg. Elsewhere, France hopes to reopen in phases starting May 3, Germany looking to ease restrictions for the vaccinated, while NY Mayor De Blasio marked July 1 on calendar for NY reopening (NY schools at 100% in the fall).

- Rates hit session lows around 1000ET, S&P eminis made new all-time highs (4210.0). From that point through the Tsy close, Tsys weaker but at top end of session range, markets scaled back respective moves, eminis just over 4200.0.

- Despite decent overall volumes (TYM1 >1.4M) desks did not report much conviction in the second half reversal, some repositioning, month-end flow, muted deal-tied hedging. Note, next Tsy quarterly refunding annc next week Wed at 0830ET -- expected to remain on par w/prior quarter likely due to uncertainty over large-scale infrastructure spending and whether the debt ceiling will be reinstated July 31.

- The 2-Yr yield is unchanged at 0.1641%, 5-Yr is up 1.4bps at 0.8652%, 10-Yr is up 2.9bps at 1.6379%, and 30-Yr is up 1.9bps at 2.3082%.

MONTH-END EXTENSION ESTS: UPDATED Barclays/Bbg Extension Estimates for US

Updated Forecast summary compared to avg increase for prior year and same time in 2020. TIPS 0.16Y; Govt inflation-linked, 0.17. Note broad decline in Govt/Credit and Intermediate credit from year ago levels, while MBS extension est surges.

| Estimate | 1Y Avg Incr | Last Year | |

| US Tsys | 0.08 | 0.08 | 0.13 |

| Agencies | 0.05 | 0.04 | 0.03 |

| Credit | 0.06 | 0.1 | 0.2 |

| Govt/Credit | 0.08 | 0.09 | 0.17 |

| MBS | 0.25 | 0.06 | 0.05 |

| Aggregate | 0.12 | 0.08 | 0.08 |

| Long Gov/Cr | 0.06 | 0.09 | 0.06 |

| Iterm Credit | 0.08 | 0.08 | 0.2 |

| Interm Gov | 0.09 | 0.08 | 0.1 |

| Interm Gov/Cr | 0.09 | 0.08 | 0.15 |

| High Yield | 0.1 | 0.11 | 0.08 |

US TSY FUTURES CLOSE:

- 3M10Y +3.437, 162.599 (L: 160.696 / H: 167.59)

- 2Y10Y +2.677, 147.003 (L: 145.527 / H: 151.227)

- 2Y30Y +1.852, 214.131 (L: 213.081 / H: 217.817)

- 5Y30Y +0.569, 144.222 (L: 142.533 / H: 144.902)

- Current futures levels:

- Jun 2Y steady at at 110-12.125 (L: 110-11.375 / H: 110-12.125)

- Jun 5Y down 0.5/32 at 123-29 (L: 123-22.25 / H: 123-30.75)

- Jun 10Y down 3/32 at 132-0 (L: 131-18.5 / H: 132-05.5)

- Jun 30Y down 11/32 at 157-5 (L: 156-06 / H: 157-20)

- Jun Ultra 30Y down 12/32 at 185-20 (L: 184-02 / H: 186-08)

US EURODOLLAR FUTURES CLOSE

- Jun 21 -0.005 at 99.815

- Sep 21 -0.005 at 99.80

- Dec 21 +0.005 at 99.745

- Mar 22 +0.005 at 99.775

- Red Pack (Jun 22-Mar 23) +0.005

- Green Pack (Jun 23-Mar 24) steady to +0.010

- Blue Pack (Jun 24-Mar 25) -0.01 to steady

- Gold Pack (Jun 25-Mar 26) -0.015 to -0.01

Short Term Rates

US DOLLAR LIBOR: Latest settles

- O/N -0.00038 at 0.07275% (-0.00062/wk)

- 1 Month -0.00312 to 0.11013% (-0.00088/wk)

- 3 Month -0.00987 to 0.17563% (-0.00575/wk) ** (Record Low 0.17288% on 4/22/21)

- 6 Month +0.00038 to 0.20638% (+0.00225/wk)

- 1 Year -0.00237 to 0.28138% (+0.00050/wk)

- Daily Effective Fed Funds Rate: 0.07% volume: $67B

- Daily Overnight Bank Funding Rate: 0.05%, volume: $259B

- Secured Overnight Financing Rate (SOFR): 0.01%, $847B

- Broad General Collateral Rate (BGCR): 0.01%, $375B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $354B

- (rate, volume levels reflect prior session)

- Tsy 20Y-30Y, $1.734B accepted vs. $5.197B submission

- Next scheduled purchases:

- Fri 4/30 1100-1120ET: Tsy 0Y-2.25Y, appr $12.825B

PIPELINE: Development Bank of Kazakhstan Dual Tranche Launched

- Date $MM Issuer (Priced *, Launch #)

- 04/29 $2B CSC Holdings $1.5B 10.5NC5.5, $00M 10.

- 04/29 $500M #Development Bank of Kazakhstan 10Y 3.0% (US$ leg also launched with KZT100B 5Y at 11% yld)

- 04/?? $2.96B Allied Universal 7NC3 fix/FRN, 8NC3 sometime next week

- 04/?? $Benchmark Abu Dhabi Ports 10Y

FOREX: CAD Continues to Pressure New Cycle Highs

- CAD continued to press higher Thursday, putting USD/CAD at new cycle lows for a second consecutive session. The break of 1.2365, Mar 18 low confirms a resumption of the underlying downtrend that has been in place since March 2020. MA studies remain in a bear mode reinforcing current trend conditions, with firmer oil prices also lending a hand.

- Having tested the level on several occasions Thursday, USD/JPY finally managed to show above the week's best levels of 109.08 before a turnaround in equity market sentiment undermined the bullish argument and dragged the pair back below Y109 ahead of the US close.

- CAD, USD were the strongest Thursday, with AUD, SEK and NOK among the poorest performers.

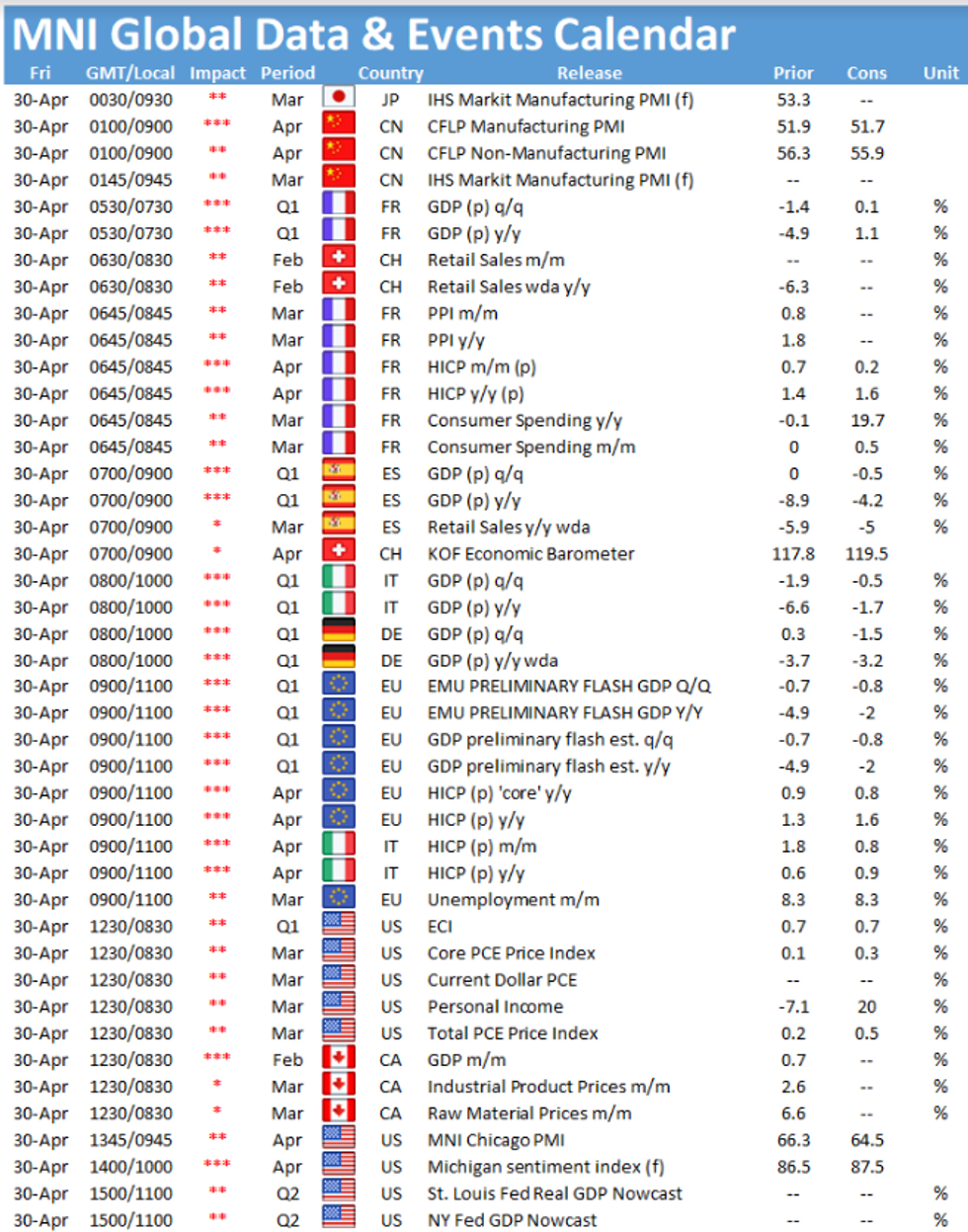

- Focus Friday turns to Japanese industrial production, Chinese PMI data for April and prelim GDPs from Germany, Italy and the Eurozone. In the US, March PCE, the MNI Chicago Business Barometer and Canadian GDP data crosses. Speakers include Fed's Kaplan.

EGBs-GILTS CASH CLOSE: Weaker In Reflationary Move

Bunds and Gilts traded weaker for most of the session alongside a broader bear steepening move in core global FI, while periphery spreads were mixed.

- There wasn't a clear driver of this move, though a broader "reflation trade" theme seemed to be in play in the afternoon in the US which helped drive UK and German yields higher.

- Flash April inflation data for Germany and Spain came in above expectations. Italy sold E8.5bn of BTP/CCTeu. ECB's Lane said in an interview that he sees the EZ economy at an "inflection point".

- Reuters reported Greece plans at least 2 more bond issues this year, to raise up to E4bln.

- Friday sees a busy data calendar, including prelim Q1 GDP and Apr inflation for multiple countries.

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is up 0.7bps at -0.678%, 5-Yr is up 2.2bps at -0.562%, 10-Yr is up 3.8bps at -0.193%, and 30-Yr is up 4.9bps at 0.36%.

- UK: The 2-Yr yield is up 1.9bps at 0.078%, 5-Yr is up 3.1bps at 0.387%, 10-Yr is up 4.6bps at 0.843%, and 30-Yr is up 3.6bps at 1.347%.

- Italian BTP spread up 0.4bps at 110.6bps / Spanish up 0.4bps at 66.8bps

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.