-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Stocks Under Pressure

MNI ASIA OPEN: Stocks Under Pressure

EXECUTIVE SUMMARY

- Stocks have been under pressure on the back of fresh concerns over inflation.

- Brainard Urges Patient Fed After April Jobs Report

- EU finance ministers likely to back more fiscal support at this week's Lisbon meeting

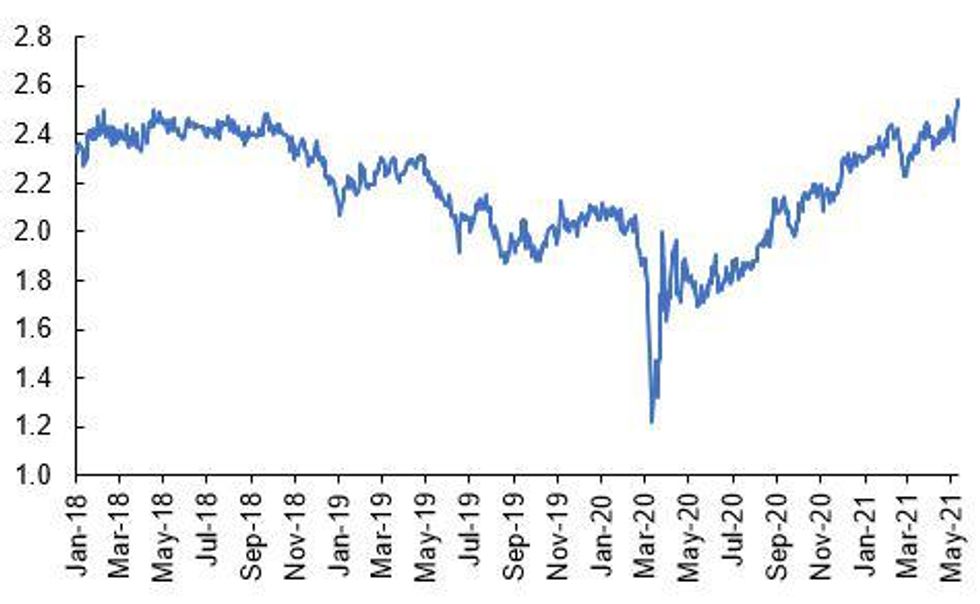

Source: MNI, Bloomberg

US

MNI Brief: Brainard Urges Patient Fed After April Jobs Report

Federal Reserve Governor Lael Brainard on Tuesday called for patience in pulling back policy support after a disappointing April jobs report, noting that while the recovery is gathering pace, the economy remains as many as 10 million jobs short of the Fed's full employment goal.

MNI Brief: Fed's Harker Says April Jobs Disappointment is Likely an Outlier

The U.S. economic outlook is improving rapidly and the emerging recovery from the Covid slump could be "long and durable," Philadelphia Fed President Patrick Harker said Tuesday.

EUROPE

MNI Brief: EU FinMins To Back More Fiscal Effort As Outlook Improves (MNI)

EU finance ministers are likely to signal fiscal policy settings will remain on full throttle when they meet in person at Lisbon later this week, despite expectations of an improved economic outlook in the European Commission Spring forecasts due Wednesday, Brussels sources told MNI.

UK

MNI INTERVIEW: UK Treasury Should Clarify QE Deal With BOE

The UK Treasury should clarify how it would meet the terms of its indemnity agreement with the Bank of England under which it promises to make good any losses on bond purchases under its quantitative easing programme should rates rise, National Institute of Economic and Social Research head Jagjit Chadha told MNI.

MNI INTERVIEW: BOE Could Sell Gilts In QE Unwind-NIESR's Chadha

The surge in the Bank of England bond buying following the Covid shock has strengthened the argument for selling gilts back to the market rather than for simply waiting for them to expire at maturity without replacement when the time comes to tighten policy, National Institute of Economic and Social Research head Jagjit Chadha told MNI.

Inflation Concerns Underpin Bear Steepening

USTs have been under pressure on the back of intensifying concerns about inflation which have unsettled equity markets and caused sovereign bond curves to bear steepen.

- UST cash yields are 1-3bp higher with the curve 1-2bp steeper. Last yields: 2-year 0.1568%, 5-year 0.7950%, 10-year 1.6182%, 30-year 2.3474%.

- TYM1 trades at 32-15+, towards the bottom end of the day's range (L: 132-12+ / H: 132-23+)

- There have been a slew of Fed speakers hitting the wires this afternoon. The San Francisco Fed's Daly stated that the modal outlook is positive, while the Atlanta Fed's Raphael Bostic stressed that the recovery still has a long way to go and that policy should remain accommodative.

- The latter was reiterated by James Bullard who stated that it was too early to discuss tapering.

EGBs-GILTS CASH CLOSE: Core FI Falls Alongside Equities

A rout in global equities (FTSE-2.5%, DAX -1.8%) did nothing to offset a big drop in core global FI, with Bunds and Gilts underperforming Treasuries amid strong bear steepening.

- The overall risk-off tone was set early with tech stocks continuing to fall; but on the bond side it appeared to be more concern on the inflation / supply side of things that roiled markets, particularly ahead of Wednesday's key US CPI release.

- Bund / Gilt yields closed near session highs, with curves on the steeps. Periphery EGBs largely contained though, with BTP spreads barely changed.

- In data, German ZEW sentiment beat expectations (21-year high). No surprises in UK Queen's Speech.

- In supply, today we got GBP4.5bn in Gilt sales, and German syndication of 30-Yr Green Bond.

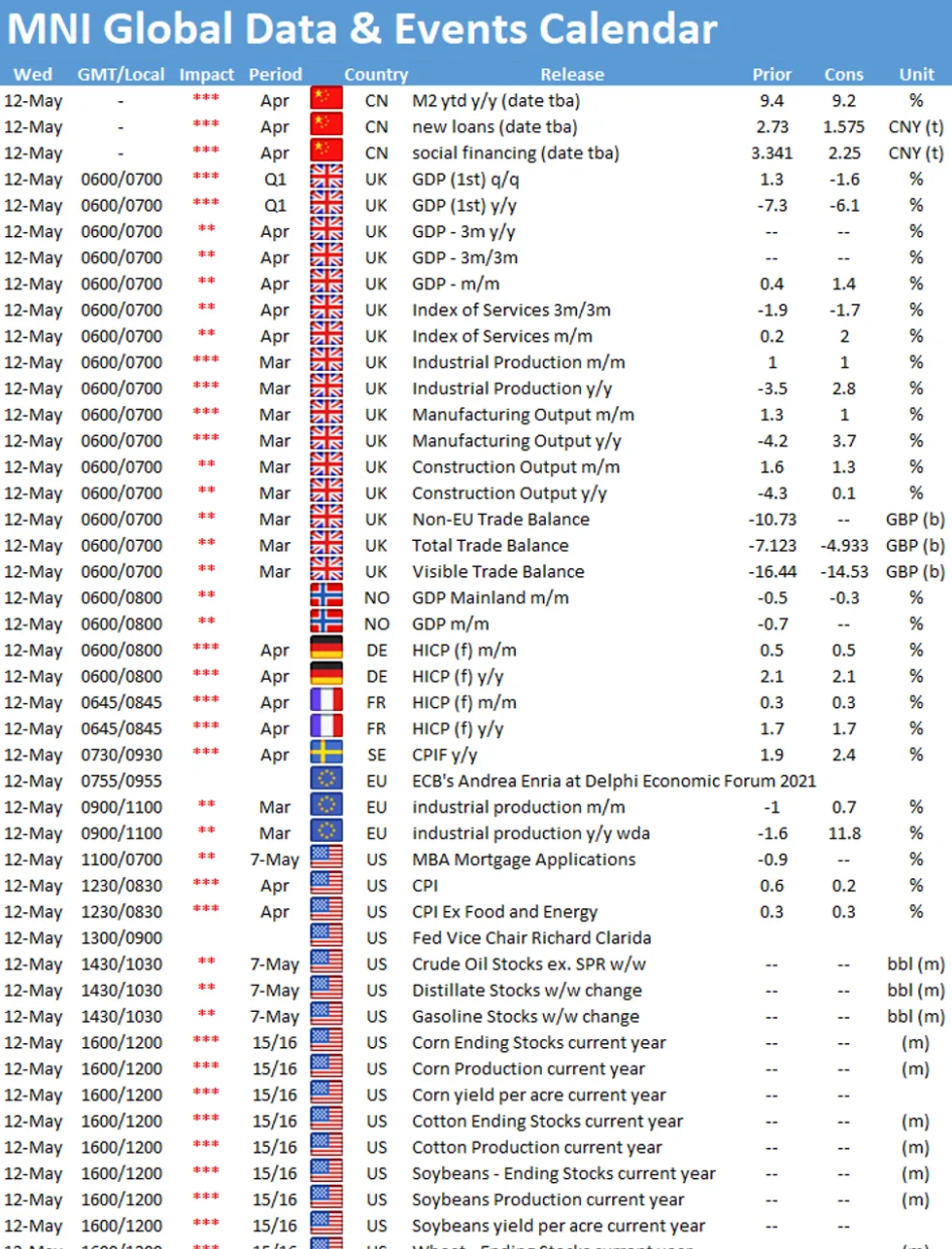

- Wednesday sees a Portugal OT auction, UK GDP, and some EZ Final CPI data.

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is up 1.8bps at -0.668%, 5-Yr is up 4.2bps at -0.549%, 10-Yr is up 5.1bps at -0.161%, and 30-Yr is up 4.9bps at 0.408%.

- UK: The 2-Yr yield is up 2.6bps at 0.064%, 5-Yr is up 3.4bps at 0.355%, 10-Yr is up 4.5bps at 0.833%, and 30-Yr is up 5.9bps at 1.388%.

- Italian BTP spread up 0.7bps at 114.7bps / Spanish spread up 0.3bps at 68.2bps

FOREX: Currencies Calm Despite Equity Market Rout

- Currency markets were a relative calm Tuesday, despite the continued volatility in equity markets, which spread beyond the tech sector to draw the Dow Jones Industrial Average lower by near 1.5%.

- The USD's weakness on Monday carried through for much of the Tuesday session, with the likes of EUR/USD and GBP/USD hovering just below the week's highs. After an uneventful European morning, JPY and EUR shook to the top of the G10 pile, while CHF and NZD traded poorly.

- Inflation concerns remain a primary driver, with underlying gyrations in stocks to value from growth sectors prompting some appetite for haven currencies.

- Focus Wednesday rests on the US CPI release for April, with the Y/Y headline CPI release seen lurching higher to 3.6% from 2.6% previously. Other key releases include UK GDP and Eurozone industrial production numbers.

- Fedspeak remains key for the market outlook, with speeches scheduled from Fed's Clarida, Rosengren, Bostic and Harker. BoE's Bailey is also on the docket.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.