-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Bonds Sink On US CPI Shocker

US TSYS SUMMARY: Curve Sharply Steeper On Record-Breaking CPI Print

Another busy day for Treasuries saw a record-breaking (vs expectations, and in some subcomponents) April inflation print pushing yields higher across the curve with little respite through the session.

- The curve initially flattened post-release, with 5s bearing most of the brunt (presumably on Fed hike path repricing); then this reversed as 5s losses stalled and the long end sell-off resumed. 10 Year yields flirted with 1.70%, yields rising 9+bps from pre-CPI.

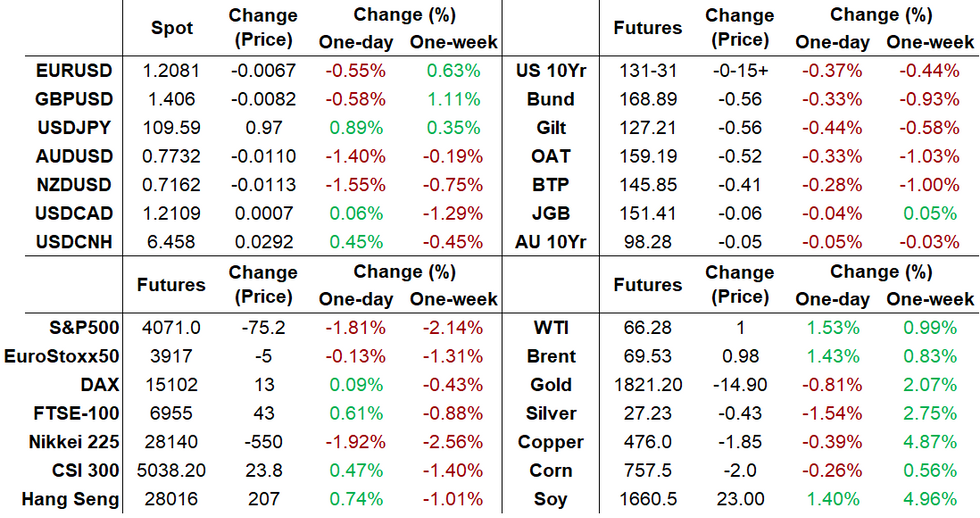

- The 2-Yr yield is up 0.6bps at 0.1648%, 5-Yr is up 5.8bps at 0.8579%, 10-Yr is up 6.6bps at 1.688%, and 30-Yr is up 6.1bps at 2.4065%.

- Jun 10-Yr futures (TY) down 15.5/32 at 131-31 (L: 131-28.5 / H: 132-18) on the highest volumes since March (>2.3mn).

- Once again, no offsetting move in equities, which sold off alongside global bonds.

- Fed VC Clarida comments shortly after the data, that the Fed "won't hesitate to act" if inflation expectations become unanchored contributed to bearish sentiment.

- 1.3bps stop-through at the 10-Yr auction (1.684% high yield vs 1.697% when-issued) and best bid to cover (2.45x) since Jan 2021 auction helped temporarily stem the bleeding in 10s.

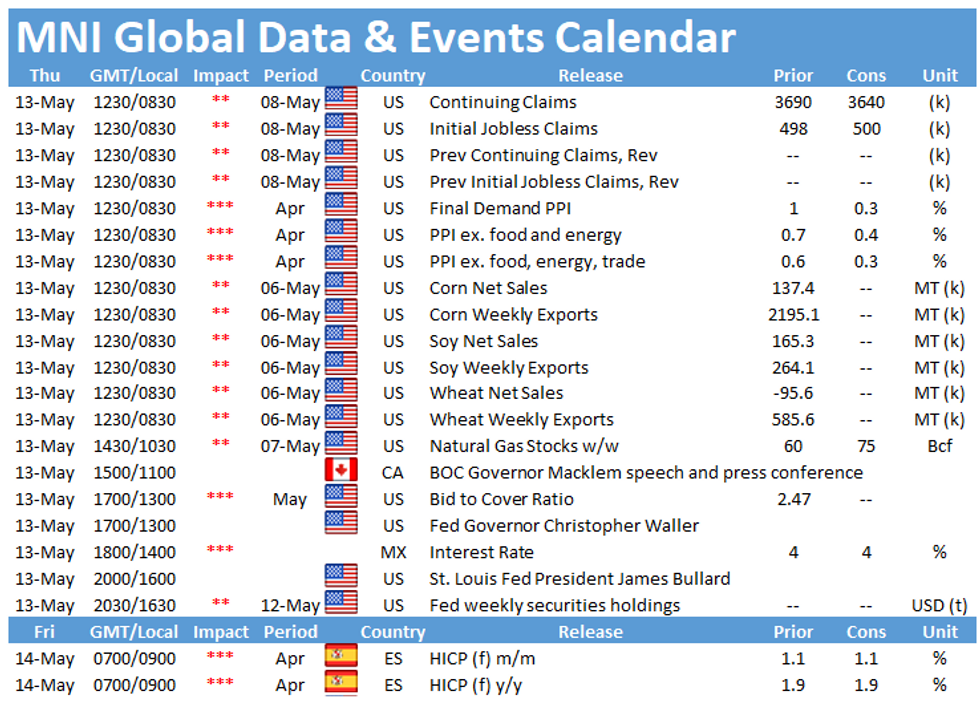

- The heavy data slate continues Thursday with weekly jobless claims and PPI.

USD LIBOR FIX - 12-05-2021

O/N 0.06000 (-0.00063)

1W 0.07250 (0.00125)

1M 0.09813 (0.00438)

2M 0.12850 (0.00137)

3M 0.15413 (-0.00612)

6M 0.19013 (-0.00087)

12M 0.26438 (-0.00075)

SOFR, Other Repo Rates Steady

| REPO REFERENCE RATES (rate, change from prev. day, volume): |

| * Secured Overnight Financing Rate (SOFR): 0.01%, no change, $865B |

| * Broad General Collateral Rate (BGCR): 0.01%, no change, $383B |

| * Tri-Party General Collateral Rate (TGCR): 0.01%, no change, $359B |

Fed Funds, OBFR Steady

| New York Fed EFFR for prior session (rate, chg from prev day): |

| * Daily Effective Fed Funds Rate: 0.06%, no change, volume: $66B |

| * Daily Overnight Bank Funding Rate: 0.05%, no change, volume: $271B |

NY Fed Operational Purchases

Accepts $1.735bn of 20-30Y Tsys, Total Submitted $5.384bn

- Next up is tomorrow's 1500ET Update of the Operational Purchase Schedule. Could be interesting if they make a technical "adjustment" incl to the pace of 20-Year / TIPS as previously flagged.

US OPTIONS SUMMARY: Largely Bearish On The ED Strip

Wednesday's Tsy/Eurodollar options flow included:

- EDH2 98.8125p, traded at half in 8k

- EDM1/EDU2 99.8125 put spread, bought for 1.5 in 6k

- EDN1 99.75/99.81cs 1x3 traded flat in 2k

- 2EM1 99.12p traded 1 in 10k

- 2EM1 99.43/99.31/99.15p fly traded 2.5 in 1.5k

- 3EN1 98.62/98.87cs 1x3, traded 14 in 3.1k

- 2EM1 99.25^, sold at 20.5 in 1k

- 0EH2 99.25p, sold at 7.5 in 2.5k

- 0EU1 99.68^ sold at 11.5 in 2k

- 3EM1 98.87c, bought for 3.5 in 2k

- 0EZ1 99.12p, bought for 3 in 10k

- 3EK1 98.50/98.37/98.25, sold at half in 15k

- 3EN1 98.37/98.00ps, traded 8.5 in 11k (blocked)

- 0EQ1 9918/9931/9956 p-fly bought for 1.5 in 2.5k

- EDH2 9981/9987/9993 c-fly pays 1.5 on 5k

- 3EU 82/80 ps vs 87/90 cs, sells the c/s at 0.25 on legs in 5k (ref 49.5/50)

- TYM1 133.00 calls bought for 4 in 40k

EGBs-GILTS CASH CLOSE: US CPI Sends Bund Ylds To 2-Yr Highs

A very busy Wednesday for the European FI space: Bunds and Gilts initially traded firmer, but then the biggest upside surprise in US inflation data history hammered global core FI in the afternoon.

- Curves bear steepened sharply, with Bund yields breaking the 2020 high of -0.1398% to levels not seen since 2019 (Gilts not far from the mid-March 2021 high just below 0.91%).

- Risk appetite recovered from early lows, with equities bouncing strongly, and periphery EGB spreads flat on the session.

- Earlier, UK GDP data surprised to the upside. Portugal sold E1.5bn of OTs.

- Thursday sees a quiet data schedule (some final CPIs); but busy on issuance, with E9.25bln of BTPs on offer, as well as Ireland selling E1.0-1.5bn of IGB. BOE's Bailey and Cunliffe, and ECB's Centeno appear.

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is up 1.2bps at -0.656%, 5-Yr is up 3.1bps at -0.518%, 10-Yr is up 3.8bps at -0.123%, and 30-Yr is up 3.8bps at 0.446%.

- UK: The 2-Yr yield is up 4.1bps at 0.105%, 5-Yr is up 4.7bps at 0.402%, 10-Yr is up 5.3bps at 0.886%, and 30-Yr is up 3.7bps at 1.425%.

- Italian BTP spread unchanged at 114.7bps/ Spanish spread up 0.3bps at 68.5bps

EUROPE OPTIONS SUMMARY: Lots Of Afternoon Euribor Structures

Wednesday's options flow included:

- RXM1 168/167ps, bought for 6 in 4.5k

- RXM1 169/168ps, bought for 20 in 3k

- RXN1 171/169ps 1x2, bought for 28.5/29 in 1.5k

- 2RH2 100.25^ bought up to 28.5 (v 100.23, 16d) in 1.5k

- 2RU1 100.375/100.50 1x2 call spread sold at 2.5 in 10k

- 0RZ1 100.625/100.50 1x2 put spread bought for 0.75 in 10k

- 3RZ1 100.375/99.50 combo (v 100.125) bought for 0.5 in 20k (+p, -call)

- 0LH2 99.50^ bought for 31.5 in 2.75k

FOREX: US CPI Sparks Dollar Volatility, Weak Equities Prompt NZD & AUD Slump

- The huge beat in US CPI, rising 0.8% m/m, prompted immediate strength in the greenback as US 10-year yields soared back above 1.65%.

- Despite the initial bout of strength for the Dollar Index, in the region of 0.4%, a full retracement and sharp selling pressure actually led the DXY to make new lows on the session, with EURUSD firming from 1.2072 to fresh highs at 1.2152.

- As the dust settled following the data, the greenback gradually inched back higher throughout the session, to eventually make new highs once again, supported by continued pressure on global equity indices and higher US yields.

- The poor risk sentiment caused an extension of weakness for Aussie and Kiwi, currencies that were firmly in the red following the overnight Asia session. Additional dollar strength throughout US hours prompted losses in the region of 1.5% for AUDUSD and NZDUSD Wednesday.

- CAD remains the clear outlier and outperformer. Roughly unchanged on the day in the face of equity weakness and a surging greenback indicates the strong trend in play following the recent testing of multi-year highs. USDCAD briefly dipped below a major support level to new lows of 1.2046, representing the lowest level for the pair since 2015. The 1.2062 pivot support level will potentially either reinforce the current medium-term bear leg if breached or lead to a reversal if the support manages to contain CAD strength.

FX OPTIONS: Expiries for May13 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1865(E2.4bln), $1.1900-05(E1.4bln), $1.1950-55(E2.2bln-EUR puts), $1.1964-75(E2.0bln-EUR puts), $1.1995-00(E535mln), $1.2040-50(E538mln), $1.2100(E1.3bln-EUR puts), $1.2115-30(E850mln), $1.2150(E821mln), $1.2170-80(E2.5bln-EUR puts), $1.2235-50(E1.9bln)

- USD/JPY: Y107.00($1.1bln), Y107.20-30($910mln), Y108.30-40($678mln), Y108.90-109.00($1.6bln-USD puts), Y109.15-20($505mln), Y110.40-50($648mln)

- GBP/USD: $1.4200-04(GBP806mln-GBP puts)

- USD/CHF: Chf0.9085-95($1.3bln-USD puts)

- EUR/CHF: Chf1.1040(E1.1bln-EUR puts), Chf1.1150(E1.35bln-EUR puts)

- AUD/USD: $0.7690-00(A$656mln), $0.7760-65(A$1.0bln), $0.7780-95(A$1.7bln)

- USD/CAD: C$1.2090-10($503mln)

EQUITIES: Stocks Slip as Inflation Fears Realized

- Equities markets fell sharply on the back of the largest surprise relative to expectations on record for the US CPI print, which rose 0.8% m/m and 0.9% for the core reading, realizing the market's concern that there will be a material spike in near-term inflation metrics.

- As such, the heavily sold sectors earlier in the week came under fire again, with consumer discretionary and tech firms the hardest hit. At the other end of the table, banks and financials had a firmer session, with the likes of Citi and Wells Fargo higher by 1%, enjoying the steeper US yield curve.

- Stock markets remained under pressure after the London close, with the e-mini S&P narrowing the gap with the 50-dma support of 4047.72. This level was last crossed on March 25th, but hasn't closed below since the early March stock weakness.- Consumer discretionary and tech names leading the decline, while bank stocks are holding up well.

COMMODITIES: Gold Sees Little Post-CPI Support as Firmer Greenback Weighs

- Oil benchmarks remained firm Wednesday as markets continued to lack any clarity of the resumption of capacity through the hacking-hit Colonial Pipeline, which kept gas prices elevated across the Southern US states, prompting further sporadic reports of panic buying and stockpiling of energy products.

- WTI crude futures rallied to touch $66.63, just shy of the May highs. A break and hold above that level of $66.76 would open the early March cycle highs and resume the multi-month uptrend.

- Gold faltered under the weight of a rallying greenback Wednesday, shrugging off any support that may have stemmed from the surging inflation rate in the US. Prices managed to hold above the week's low of $1818.13, however, which remains the first key support.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.