-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Counting the Minutes

EXECUTIVE SUMMARY

MNI BRIEF: Quarles Says U.S. is Beginning Strong Recovery

MNI INTERVIEW: BOC May Adjust Guidance Over Talking Down CAD

BIDEN DELAYS REVAMP OF TRUMP'S BLACKLIST FOR CHINA INVESTMENTS, Bbg

US

FED: Fed Vice Chair for Supervision Randal Quarles said that while a strong U.S. recovery is underway and about to "enter this last stretch of the return to normal," some households and businesses are still vulnerable.

- "The COVID event is not behind us, and the vulnerabilities it exposed are not gone," said Quarles in written remarks: https://www.federalreserve.gov/newsevents/testimon... for testimony to be given to Congress Wednesday. The U.S. banking sector handled the Covid shock better than expected but Quarles called for reforms to Treasury and money markets, finalizing the post-crisis Basel III reforms and completing the transition from Libor.

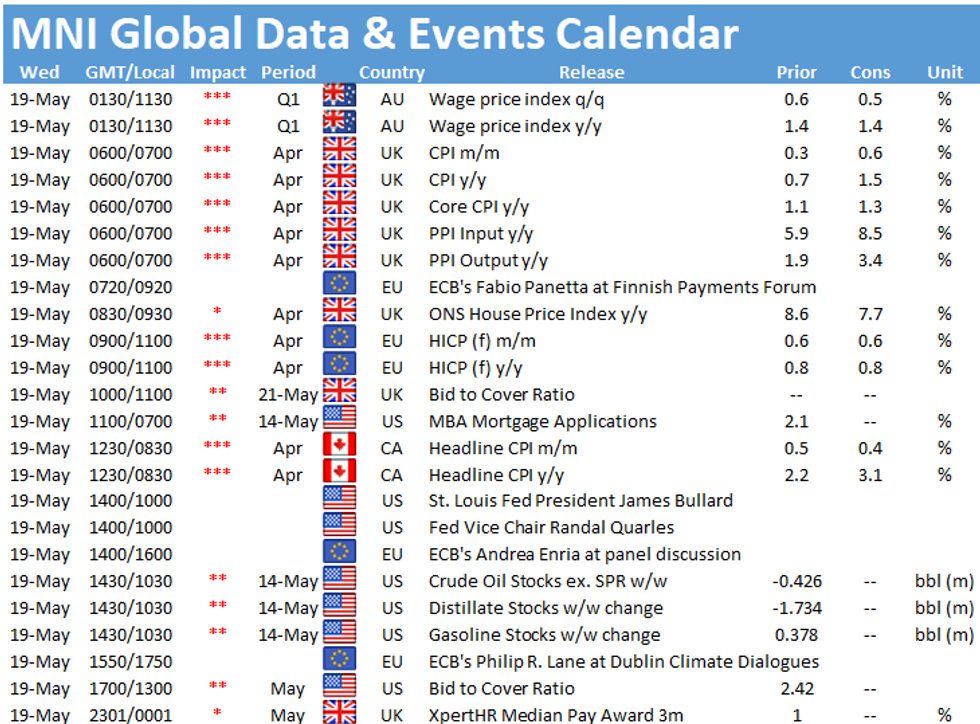

The minutes from the Apr 27-28 FOMC meeting are released at 1400ET on Wednesday. A few sell-side previews:

- Deutsche Bank characterizes the minutes as already "somewhat stale", but is still eyeing any signs of the Fed's take on the outlook: "Though the minutes ... will likely be heavily scrutinized for signs of how the Fed's economic outlook has evolved and potential implications for their asset purchase program, they are somewhat stale in light of the lackluster April jobs report and stronger-than-expected inflation data". With regard to the Fed's messaging in general, Deutsche does not expect FOMC members "to express much concern about the recent rise in inflation expectations nor alter their messaging with respect to the near-term policy trajectory".

- BMO FICC is looking to the minutes to "offer insight into the Fed's current thinking on the pace of the recovery and, of course, the risk that inflation picks up in a way that is ultimately considered 'too much' by policymakers". BMO says "the FOMC is content to be behind the curve on inflation this cycle and therefore far more comfortable characterizing consumer pricing pressures as transitory than many investors assume."

- TD Focused On "Substantial" Timing: TD expects the focus for the April minutes to be on "when officials might see "substantial" enough progress for QE tapering. We don't expect any more specificity than on the day the meeting ended, but that means a dovish tone. In the chair's words, 'it is likely to take some time for substantial further progress to be achieved.' TD also notes that "Fedspeak has remained dovish since the meeting, even after the April CPI report."

- ING says we could see signals that a few FOMC members weren't quite as dovish as the overall meeting message implied, though they shouldn't do "too much damage" market-wise: "Perhaps the key takeaway from Powell's press conference that day were the words 'now is not the time to talk tapering'. With that in mind, we expect the markets to absorb in their stride any suggestions that a 'few participants' were a little less dovish."

- ANZ sees the minutes as "likely to be dated given the [respective] downside and upside shocks on jobs and inflation. The key question is how this news might impact the timing of tapering talk."

CANADA

BOC: The Bank of Canada would likely react to any unwelcome further strength in the dollar by scaling back economic projections or tweaking other guidance rather than seeking to directly talk it down, Dominique Lapointe, a former economist in the finance department's forecasting branch, told MNI.

- Canada's dollar could strengthen a bit further based on fundamentals such as higher prices for exported metals, minerals and lumber, he said. The chance of a major further rally is hemmed in by rising energy prices and potential Fed tightening signals, said Lapointe, now senior economist at Montreal-based Laurentian Bank Securities. For more see MNI Policy main wire at 1530ET.

OVERNIGHT DATA

US APR HOUSING STARTS 1.569M; PERMITS 1.760M

US MAR STARTS REVISED TO 1.733M; PERMITS 1.755M

US APR HOUSING COMPLETIONS 1.449M; MAR 1.515M (REV)

US REDBOOK: MAY STORE SALES +13.0% V YR AGO MO

US REDBOOK: STORE SALES +12.6% WK ENDED MAY 15 V YR AGO WK

US REDBOOK: WILL RESUME MONTH-TO-MONTH DATA COMPARISON IN FEB 2022

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 108.01 points (-0.31%) at 34216.81

- S&P E-Mini Future down 14.5 points (-0.35%) at 4142.75

- Nasdaq down 5.2 points (0%) at 13373.74

- US 10-Yr yield is down 0.9 bps at 1.6403%

- US Jun 10Y are up 1.5/32 at 132-12.5

- EURUSD up 0.0077 (0.63%) at 1.2229

- USDJPY down 0.33 (-0.3%) at 108.88

- WTI Crude Oil (front-month) down $0.78 (-1.18%) at $65.46

- Gold is up $2.02 (0.11%) at $1868.90

European bourses closing levels:

- EuroStoxx 50 down 1.5 points (-0.04%) at 4005.34

- FTSE 100 up 1.39 points (0.02%) at 7034.24

- German DAX down 10.04 points (-0.07%) at 15386.58

- French CAC 40 down 13.68 points (-0.21%) at 6353.67

US TSY SUMMARY: Narrow Range Ahead April FOMC Minutes

With the exception of early morning chop, alternately rallying after the open to session highs after weaker than anticipated April housing starts (1.569M vs. 1.702M est). Tsys sold off soon after to extend session lows -- levels moderated by 10am, trading mixed on narrow range through the close, yield curves steeper after a flatter start. Though dated, focus remains on Apr FOMC minutes out Wednesday.- Light overall volumes even with the pick-up in 5- and 10Y June/Sep rolls, TYM1 breaking 880k after the bell. FVM/FVH trades 79,800 from 18.75-19.25, 19.0 last; TYM/TYU 66,100 from 27.5 to 28.5, 28.0 last.

- Another decent session for corporate issuance at just over $12B, $30.6b since Monday. June quarterly options expire this Friday, generating some two-way hedging flows as accts squared up positions.

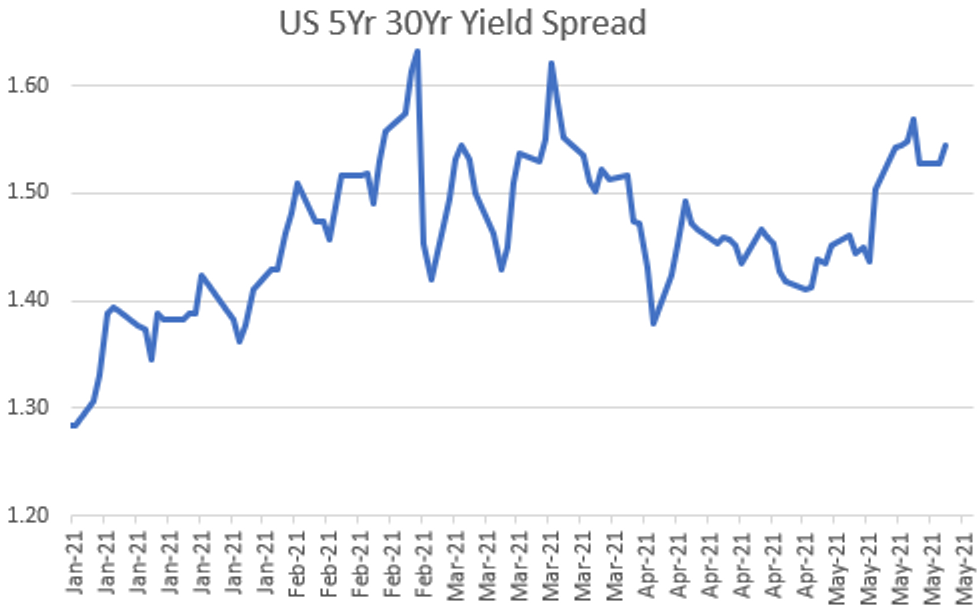

- The 2-Yr yield is down 0.4bps at 0.1491%, 5-Yr is down 1.8bps at 0.8178%, 10-Yr is down 0.9bps at 1.6403%, and 30-Yr is up 0.1bps at 2.3633%.

US TSY FUTURES CLOSE:

- 3M10Y -0.935, 162.681 (L: 161.402 / H: 164.552)

- 2Y10Y -0.083, 149.091 (L: 147.327 / H: 150.113)

- 2Y30Y +0.963, 221.512 (L: 218.911 / H: 222.553)

- 5Y30Y +1.978, 154.521 (L: 152.088 / H: 154.724)

- Current futures levels:

- Jun 2Y up 0.375/32 at 110-13.125 (L: 110-12.625 / H: 110-13.125)

- Jun 5Y up 1.5/32 at 124-6 (L: 124-03.25 / H: 124-06.75)

- Jun 10Y up 1/32 at 132-12 (L: 132-07.5 / H: 132-14.5)

- Jun 30Y down 4/32 at 156-21 (L: 156-11 / H: 157-00)

- Jun Ultra 30Y down 13/32 at 183-20 (L: 183-03 / H: 184-10)

US EURODOLLAR FUTURES CLOSE

- Jun 21 steady at 99.848

- Sep 21 +0.005 at 99.845

- Dec 21 +0.005 at 99.80

- Mar 22 +0.005 at 99.815

- Red Pack (Jun 22-Mar 23) steady to +0.005

- Green Pack (Jun 23-Mar 24) steady to +0.005

- Blue Pack (Jun 24-Mar 25) -0.005 to steady

- Gold Pack (Jun 25-Mar 26) -0.005 to steady

Short Term Rates

US DOLLAR LIBOR: Latest Settles

- O/N +0.00050 at 0.06288% (+0.00088/wk)

- 1 Month +0.00175 to 0.09925% (+0.00175/wk)

- 3 Month +0.00562 to 0.15525% (+0.00012/wk) ** (NEW Record Low 0.14963% on 5/17)

- 6 Month -0.00275 to 0.18375% (-0.00388/wk)

- 1 Year -0.00175 to 0.26275% (-0.00312/wk)

- Daily Effective Fed Funds Rate: 0.06% volume: $63B

- Daily Overnight Bank Funding Rate: 0.05% volume: $267B

- Secured Overnight Financing Rate (SOFR): 0.01%, $902B

- Broad General Collateral Rate (BGCR): 0.01%, $363B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $346B

- (rate, volume levels reflect prior session)

- TIPS 7.5Y-30Y, $1.199B accepted vs. $2.550B submission

- Next scheduled purchases:

- Wed 5/19 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

- Thu 5/20 1010-1030ET: Tsy 22.5Y-30Y, appr $2.025B

- Fri 5/21 1010-1030ET: Tsy 7Y-10Y, appr $3.225B

PIPELINE: Charter Communications Launched, Outpaces World Bank

- Date $MM Issuer (Priced *, Launch #)

- 05/18 $2.8B #Charter Communications $1.4B 30Y +177, $1.4B 40Y +202

- 05/18 $2.5B *World Bank 5Y +2

- 05/18 $1.5B #Cox Communications $800M 10Y +100, $700M 30Y +125

- 05/18 $1.25B #Federation des Caisses Desjardins du Quebec (CCDJ) $750M 3Y +38, $500M 3Y FRN SOFR+43

- 05/18 $1B *Caisse de depot et placement du Québec (CDPQ) 5Y +10

- 05/18 $1B #Societe Generale PNC5 4.75%

- 05/18 $1B #Microchip WNG 3Y +65

- 05/18 $1B #DNB Bank 6NC5 +72

- 05/18 $Benchmark Caisse d'Amortissement de la Dette Sociale (CADES) 3Y +4

EGBs-GILTS CASH CLOSE: Reprieve For Peripheries

Periphery EGB spreads narrowed Tuesday, reversing widening earlier in the session (though BTPs underperformed once again). Bunds and Gilts closed weaker with some bear steepening.

- UK sold GBP5.5bln of Gilts; Germany allotted E4.8bln of Schatz (lowest bid-to-cover since Mar 2020); EU syndicated E14.1bln of 8Yr/25Yr SURE.

- U.K. labour market data came in better than expected, while Eurozone 1Q flash GDP confirmed the prelim reading. BOE's Bailey said QE unwind should be operated "automatically".

- Looking ahead to Wednesday, data includes UK Apr inflation. In supply, UK sells GBP2.5bln of Gilt, Germany E4bln of Bund, and EFSF E1bln. Speakers include ECB's Panetta, Rehn, de Cos, and Lane, while ECB also publishes its Financial Stability Review.

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is up 1.1bps at -0.644%, 5-Yr is up 0.5bps at -0.505%, 10-Yr is up 1.2bps at -0.103%, and 30-Yr is up 1.8bps at 0.464%.

- UK: The 2-Yr yield is up 0.4bps at 0.088%, 5-Yr is down 0.1bps at 0.385%, 10-Yr is up 0.3bps at 0.868%, and 30-Yr is up 1.6bps at 1.417%.

- Italian BTP spread down 0.9bps at 121.1bps / Spanish spread down 2.5bps at 70.5bps

FOREX SUMMARY: USD Weakness Prevails Despite Commodities Turnaround

- A softer greenback had largely been attributed to further commodity strength and positive risk sentiment early on Tuesday, particularly benefitting the antipodeans, rallying close to 1%.

- A notable reversal in the commodity complex, led by a sharp move lower in oil prices, halted the momentum of dollar depreciation.

- However, tight ranges during the US session in G10 FX has meant the Dollar Index (DXY) is set to close at its lowest level since early January this year, down 0.42% on the day.

- As expected with its large weighting in the index, EUR joins Aussie and Kiwi as the largest beneficiaries with EURUSD (+0.63%) pressing on towards the February highs of 1.2243.

- In a continuation of recent technical breakouts, GBPUSD breached 1.42 and is within touching distance of the year's high at 1.4237. USDCAD also reached the lowest level since May 2015. Fresh lows of 1.2013 were posted before the oil move brought the pair back to ~1.2050.

- UK and Canadian inflation data headline Wednesday's docket before markets turn their attention to the FOMC minutes later in the session.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.