-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI ASIA OPEN: Quarles Taps MBS-Led Taper

EXECUTIVE SUMMARY

- MNI BRIEF: Fed's Quarles Says to Consider MBS-Led Taper

- MNI: Fed's Quarles Sees Upside Risks to Inflation

- MNI INTERVIEW: Canada Revamps CPI After "Unprecedented" Shifts

- QUARLES: START TAPER TALK AT UPCOMING MEETINGS IF ECONOMY STRONG, Bbg

- U.S. TRADE CHIEF TO HOLD FIRST TALKS WITH CHINESE COUNTERPART; TAI TO SPEAK TO CHINESE OFFICIALS AS SOON AS WEDNESDAY EVENING - bbg

US

FED: Fed Vice Chair Randal Quarles said Wednesday the Federal Reserve will consider bigger reductions of MBS versus Treasuries when it decides the time has come to taper bond buys, as MNI reported exclusively last week.

- "We'll certainly be considering that as we deliberate over asset purchase policy," Quarles said during a Q&A.

- "My optimistic outlook for growth and employment places me among those who see the risks to inflation over the medium term as weighted to the upside, relative to my baseline forecast," Quarles said in prepared remarks to a Brookings Institution conference. I expect rapid growth to continue for some time before slowing to a still robust pace next year." For more see MNI Policy main wire at 1500ET.

CANADA

CANADA: An overhaul of Canada's CPI basket in July will reflect unprecedented shifts in spending patterns during the Covid-19 pandemic, though it remains unclear how much of the pickup in inflation recorded in preliminary data will feed through to the final calculations, the assistant director of Statistics Canada's consumer prices branch told MNI.

- While early figures show families spent more on housing and less on transportation during the pandemic, the July update will include richer data from Canada's provinces that may show different trends based on local shutdowns and re-openings, Chris Li said in a telephone interview. For more see MNI Policy main wire at 1137ET.

US TSY SUMMARY: Jun/Sep 30Y Roll Error Roils Long End

Hectic midday trade was book-ended by rather sedate trade through much of the first half and later in the second half Wednesday.- Tsys gradually inched higher through the first half, as did the greenback, USD index climbing back above the 90.00 and off yesterday's multi-month lows.

- No substantive data, focus was on rolling Jun/Sep quarterly Tsy futures ahead Fri's first notice when Sep takes lead, and the $61B 5Y Note auction.

- Complete debacle in 30Y roll around 1220ET saw spd gap up to 2-26 high on appr 16,300 -- since adjusted by exchange: all spds from 1-26.25 to 2-26 adjusted to 1-26.25 (new session high). While the spd looks to set around 1-19.25, there were appr nine 30k clips that traded at 1-18.25 AFTER the gap bid. Unintended consequence of fat finger: bonds extended session highs briefly after the error but quickly retraced, trading lower in last hour. It also appears more spds traded than needed rolling: % complete appr 108% according to CME site. B

- The $61B 5Y note (91282CCF6) auction traded through .7bp: high yield of 0.788% vs. 0.795% WI. Bid-to-cover highest since September 2020 at 2.49x vs. 2.33x 5 month average.

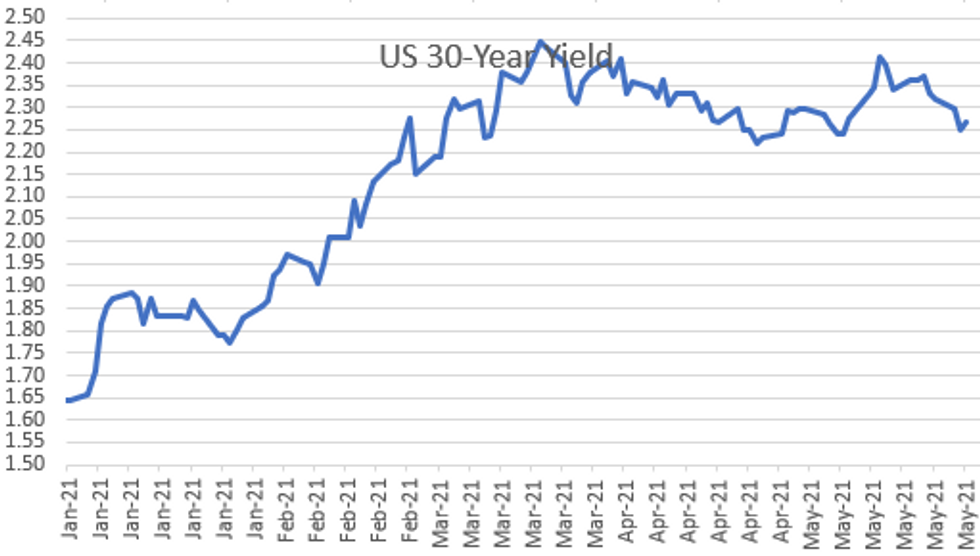

- The 2-Yr yield is up 0.5bps at 0.1466%, 5-Yr is up 0.8bps at 0.7791%, 10-Yr is up 1.9bps at 1.5774%, and 30-Yr is up 1.8bps at 2.2654%.

OVERNIGHT DATA

Lone data release for day:

- US MBA: MARKET COMPOSITE -4.2% SA THRU MAY 21 WK

- US MBA: REFIS -7% SA; PURCH INDEX +2% SA THRU MAY 21 WK

- US MBA: UNADJ PURCHASE INDEX -4% VS YEAR-EARLIER LEVEL

- US MBA: 30-YR CONFORMING MORTGAGE RATE 3.18% VS 3.15% PREV

MONTH-END EXTENSIONS/PRELIM: Barclays/Bbg Extension Estimates for US

Preliminary forecast summary compared to avg increase for prior year and same time in 2020. TIPS 0.02Y. Note: fairly steady to year ago levels, while MBS extension est gains.

| Indices | Estimate | 1Y Avg Incr | Last Year |

| US Tsys | 0.12 | 0.08 | 0.11 |

| Agencies | 0.04 | 0.11 | 0.01 |

| Credit | 0.10 | 0.08 | 0.08 |

| Govt/Credit | 0.10 | 0.08 | 0.10 |

| MBS | 0.13 | 0.06 | 0.05 |

| Aggregate | 0.11 | 0.08 | 0.09 |

| Long Gov/Cr | 0.10 | 0.09 | 0.10 |

| Iterm Credit | 0.08 | 0.07 | 0.08 |

| Interm Gov | 0.09 | 0.08 | 0.08 |

| Interm Gov | 0.09 | 0.08 | 0.08 |

| High Yield | 0.1 | 0.06 | 0.04 |

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 12.6 points (0.04%) at 34319.03

- S&P E-Mini Future up 8.75 points (0.21%) at 4193.5

- Nasdaq up 89.7 points (0.7%) at 13744.21

- US 10-Yr yield is up 1.9 bps at 1.5774%

- US Jun 10Y are down 3/32 at 132-28

- EURUSD down 0.0057 (-0.47%) at 1.2193

- USDJPY up 0.37 (0.34%) at 109.15

- WTI Crude Oil (front-month) up $0.09 (0.14%) at $66.16

- Gold is down $4.25 (-0.22%) at $1894.93

European bourses closing levels:

- EuroStoxx 50 down 4.37 points (-0.11%) at 4031.67

- FTSE 100 down 2.86 points (-0.04%) at 7026.93

- German DAX down 14.37 points (-0.09%) at 15450.72

- French CAC 40 up 1.33 points (0.02%) at 6391.6

US TSY FUTURES CLOSE:

- 3M10Y +2.116, 156.47 (L: 153.422 / H: 156.639)

- 2Y10Y +1.336, 142.886 (L: 140.568 / H: 143.252)

- 2Y30Y +1.103, 211.615 (L: 209.105 / H: 212.451)

- 5Y30Y +0.818, 148.229 (L: 146.462 / H: 148.838)

- Current futures levels:

- Jun 2Y steady at at 110-13.75 (L: 110-13.5 / H: 110-14.125)

- Jun 5Y down 1/32 at 124-13 (L: 124-11.75 / H: 124-15)

- Jun 10Y down 3/32 at 132-28 (L: 132-26.5 / H: 133-02)

- Jun 30Y down 5/32 at 158-14 (L: 158-09 / H: 159-01)

- Jun Ultra 30Y down 11/32 at 187-2 (L: 186-25 / H: 188-06)

US EURODOLLAR FUTURES CLOSE

- Jun 21 +0.005 at 99.870

- Sep 21 +0.010 at 99.870

- Dec 21 +0.005 at 99.820

- Mar 22 +0.005 at 99.835

- Red Pack (Jun 22-Mar 23) -0.005 to +0.010

- Green Pack (Jun 23-Mar 24) -0.015 to steady

- Blue Pack (Jun 24-Mar 25) -0.015 to -0.01

- Gold Pack (Jun 25-Mar 26) -0.015 to -0.01

Short Term Rates

US DOLLAR LIBOR: Latest Settles

- O/N -0.00175 at 0.05888% (-0.00088/wk)

- 1 Month +0.00250 to 0.09250% (+0.00088/wk)

- 3 Month -0.00350 to 0.13500% (-0.01200/wk) ** (Record Low)

- 6 Month -0.00500 to 0.17175% (-0.00700/wk)

- 1 Year -0.00412 to 0.25188% (-0.00775/wk)

- Daily Effective Fed Funds Rate: 0.06% volume: $65B

- Daily Overnight Bank Funding Rate: 0.04% volume: $261B

- Secured Overnight Financing Rate (SOFR): 0.01%, $877B

- Broad General Collateral Rate (BGCR): 0.01%, $376B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $353B

- (rate, volume levels reflect prior session)

- Tsys 2.25Y-4.5Y, $8.401B accepted vs. $40.237B submission

- Next scheduled purchases:

- Thu 5/27 1010-1030ET: Tsy 22.5Y-30Y, appr $2.025B

- Fri 5/28 1010-1030ET: Tsy 0Y-2.25Y, appr $12.425B

PIPELINE: $3B Morgan Stanley Launched

- Date $MM Issuer (Priced *, Launch #)

- 05/26 $3B #Morgan Stanley 4NC3 fix to FRN +48

- 05/26 $2B #UniCredit 6NC5 +145a, 11NV10 +180a

EGBs-GILTS CASH CLOSE: Dovish Tone Continues

Bunds and Gilts continued to bull flatten Wednesday, largely holding onto gains made in the morning (with further ECB-speak indicating a dovish stance on PEPP, today from Panetta). Periphery spreads basically unchanged.

- In supply, Germany held a very weak (technically uncovered, 0.73x bid-to-cover) 15-Yr Bund auction, allotting E1.73bln; Italy sold E4.75bln of BTPei and short-term BTP.

- Not much in data, though French May confidence indices beat expectations.

- Ex-Gov't aide Cummings' testimony in Parliament on the govt's handling of the pandemic made for dramatic headlines, but little market impact.

- Thursday sees several speakers (ECB's de Guindos/Schnabel/Weidmann, BOE's Vlieghe) and Italian and German confidence data but no bond issuance.

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is down 0.3bps at -0.666%, 5-Yr is down 2.4bps at -0.577%, 10-Yr is down 3.9bps at -0.206%, and 30-Yr is down 4.7bps at 0.349%.

- UK: The 2-Yr yield is up 0.7bps at 0.023%, 5-Yr is down 1.9bps at 0.302%, 10-Yr is down 3.4bps at 0.752%, and 30-Yr is down 3.8bps at 1.282%.

- Italian BTP spread up 0.1bps at 112.7bps / Spanish spread down 0.2bps at 65.8bps

FOREX: USD Regains Lustre, Markets Suspect Month-End Flow

- The greenback initially traded steady-to-lower Wednesday, with EUR/USD holding close to recent highs ahead of NY hours. Markets changed tack into the WMR fix, however, with the USD index climbing back above the 90.00 and off yesterday's multi-month lows.

- Most sell-side month-end models pointed toward USD demand into the May close, and with May's final fix falling on a UK bank holiday, markets suspect some of this flow may be brought forward into the final few sessions of this week.

- NZD held its place among the day's best performers, although markets drifted off the multi-month highs printed at 0.7316 post-RBNZ decision. NOK and SEK were among the day's worst performers.

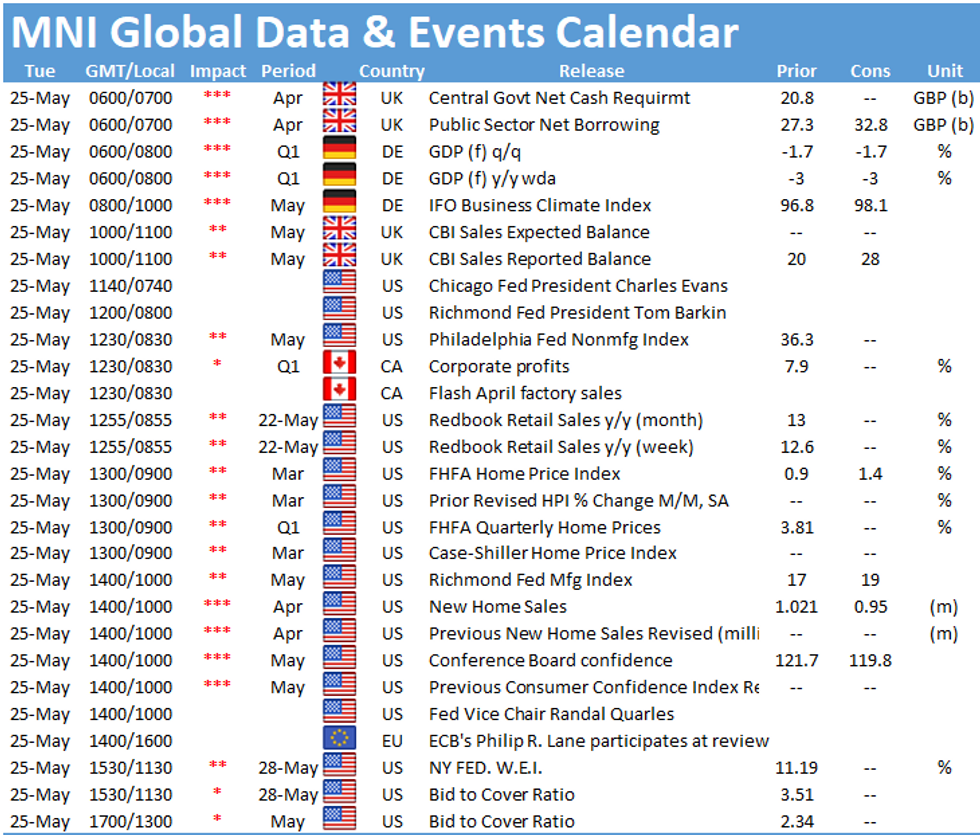

- Notable data releases pick up Thursday, with Italian consumer confidence, weekly US jobless claims and prelim April durable goods orders on the docket. Pending home sales data also crosses which may be worth watching given the sizeable miss in new home sales earlier in the week.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.