-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN - Lawmakers Move to Impeach South Korea President

MNI China Daily Summary: Wednesday, Dec 4

MNI ASIA OPEN: Hawkish Harker and Targeted Penalties

EXECUTIVE SUMMARY

- US Targeted Penalties for China

- MNI: Fed's Harker: Time to Think About Tapering QE

- MNI BRIEF: Inflation Picking Up, Fed's Beige Book Says

- MNI SOURCES: ECB Inflation Target Debate Focusses On Symmetry

- U.S. DELAYS DIGITAL-TAX TARIFFS TO ALLOW TIME FOR OECD-G20 DEAL, Bbg

- MEXICO SEEN CREATING 370K-570K JOBS IN 2021: BANXICO REPORT, Bbg

- U.K. LOOKS TO SEAL AUSTRALIA TRADE DEAL AFTER G7: FT

US

US/CHINA: Tsys extend duration from closing lvls after latest Bbg headlines re: China Blacklist:- BIDEN TO AMEND TRUMP'S CHINA BLACKLIST, TARGET KEY INDUSTRIES

- TREASURY WILL CREATE LIST OF COMPANIES TARGETED WITH PENALTIES

- ORDER TARGETS CHINA'S DEFENSE, SURVEILLANCE TECHNOLOGY SECTORS

FED: Federal Reserve Bank of Philadelphia President Patrick Harker on Wednesday said it's time to start discussing pulling back the Fed's asset purchases in light of a strong recovery from Covid, the latest U.S. central banker to do so in recent weeks.

- "We're planning to keep the federal funds rate low for long, but it may be time to at least think about thinking about tapering our USD120 billion in monthly Treasury bond and mortgage-backed securities purchases," he said in remarks prepared for a finance forum in Washington.

Fed Beige Book

The national economy expanded at a moderate pace from early April to late May, a somewhat faster rate than the prior reporting period. Several Districts cited the positive effects on the economy of increased vaccination rates and relaxed social distancing measures, while they also noted the adverse impacts of supply chain disruptions.- The effects of expanded vaccination rates were perhaps most notable in consumer spending in which increases in leisure travel and restaurant spending augmented ongoing strength in other spending categories. Light vehicle sales remained solid but were often constrained by tight inventories. Factory output increased further even as significant supply chain challenges continued to disrupt production.

- Manufacturers reported that widespread shortages of materials and labor along with delivery delays made it difficult to get products to customers. Similar challenges persisted in construction. Homebuilders often noted that strong demand, buoyed by low mortgage interest rates, outpaced their capacity to build, leading some to limit sales.

- Nonresidential construction increased at a moderate pace, on balance, even as contacts in several Districts said that supply chain disruptions pushed costs higher and, in some cases, delayed projects. Demand for professional and business services increased moderately, while demand for transportation services (including at ports) was exceptionally strong. Lending volumes increased modestly, with gains in both household and business loans.

- Overall, expectations changed little, with contacts optimistic that economic growth will remain solid.

EUROPE

ECB: The European Central Bank's strategy review has reached broad consensus about the need for a new symmetrical 2% price target, but officials are still arguing about whether to follow the Federal Reserve's inflation makeup strategy and some remain unsure how to incorporate climate goals into monetary policy, Eurosystem sources told MNI.

- The current inflation target, of "below, but close to, 2% over the medium term" is widely recognised as inadequate for an environment in which monetary policy may more frequently find itself close to the lower bound of interest rates, sources said. But opinions on how to define symmetry, which implies that the central bank would respond to undershooting its target with equal vigour as it would to overshooting, span a wide range, with some calling for Fed-style average-inflation targeting and others favouring much more slimline approaches, one official told MNI. For more see MNI Policy main wire at 1206ET.

US TSY SUMMARY: Fed' Harker Reiterates Taper View, Time To Talk Timing

Rather muted midweek rally in rates on light volume (TYU 815k) by the bell, 10YY slips to 1.5858% -- low end of range.- No substantive data (May Redbook store sales +13.1%; MBA REFIS -5%), Fed Beige Book underscores inflation pick-up: "Input costs have continued to increase across the board," especially in raw materials, freight, packaging, and petrochemicals, as a result of supply chain disruptions, the Beige Book said. "Strengthening demand, however, allowed some businesses, particularly manufacturers, builders, and transportation companies, to pass through much of the cost increases to their customers."

- Reminder, Fed media blackout starts midnight Fri through June 17, say after the next FOMC policy annc. That said, Philly Fed Pres Harker took the opportunity to reiterate opinion it's time to start debate over taper timing, but "MUST ACT WITH CARE, DON'T WANT TO TRIGGER TAPER TANTRUM" Bbg.

- Focus turns to ADP private employment data and weekly claims Thursday, May NFP Friday (+653k est vs. +266k prior).

- The 2-Yr yield is down 0.2bps at 0.1446%, 5-Yr is down 0.8bps at 0.7964%, 10-Yr is down 1.5bps at 1.5909%, and 30-Yr is down 0.7bps at 2.2796%.

OVERNIGHT DATA

- US REDBOOK: MAY STORE SALES +13.1% V YR AGO MO

- US REDBOOK: STORE SALES +13.0% WK ENDED MAY 29 V YR AGO WK

- US REDBOOK: WILL RESUME MONTH-TO-MONTH DATA COMPARISON IN FEB 2022

- US MBA: REFIS -5% SA; PURCH INDEX -3% SA THRU MAY 28 WK

- US MBA: UNADJ PURCHASE INDEX -2% VS YEAR-EARLIER LEVEL

- US MBA: 30-YR CONFORMING MORTGAGE RATE 3.17% VS 3.18% PREV

- US MBA: MARKET COMPOSITE -4.0% SA THRU MAY 28 WK

MARKETS SNAPSHOT

Key late session market levels- DJIA up 23.29 points (0.07%) at 34598.92

- S&P E-Mini Future up 3 points (0.07%) at 4201.5

- Nasdaq down 13.3 points (-0.1%) at 13723.16

- US 10-Yr yield is down 1.5 bps at 1.5909%

- US Sep 10Y are up 4/32 at 131-29.5

- EURUSD down 0.0002 (-0.02%) at 1.2211

- USDJPY up 0.08 (0.07%) at 109.56

- WTI Crude Oil (front-month) up $1.1 (1.62%) at $68.82

- Gold is up $7.42 (0.39%) at $1907.80

European bourses closing levels:

- EuroStoxx 50 up 16.75 points (0.41%) at 4088.5

- FTSE 100 up 27.54 points (0.39%) at 7108

- German DAX up 35.35 points (0.23%) at 15602.71

- French CAC 40 up 32.12 points (0.5%) at 6521.52

US TSY FUTURES CLOSE:

- 3M10Y -1.957, 156.89 (L: 156.466 / H: 159.704)

- 2Y10Y -1.51, 144.257 (L: 144.113 / H: 146.934)

- 2Y30Y -0.665, 213.152 (L: 212.423 / H: 215.125)

- 5Y30Y +0.1, 148.175 (L: 147.107 / H: 148.939)

- Current futures levels:

- Sep 2Y steady at at 110-11.375 (L: 110-11.25 / H: 110-11.75)

- Sep 5Y up 1.75/32 at 123-27.25 (L: 123-24.75 / H: 123-29)

- Sep 10Y up 4.5/32 at 131-30 (L: 131-23 / H: 132-00)

- Sep 30Y up 12/32 at 156-16 (L: 155-31 / H: 156-20)

- Sep Ultra 30Y up 21/32 at 185-4 (L: 184-07 / H: 185-14)

US EURODOLLAR FUTURES CLOSE

- Jun 21 -0.010 at 99.873

- Sep 21 -0.005 at 99.875

- Dec 21 -0.005 at 99.825

- Mar 22 steady at 99.840

- Red Pack (Jun 22-Mar 23) steady to +0.010

- Green Pack (Jun 23-Mar 24) +0.020 to +0.030

- Blue Pack (Jun 24-Mar 25) +0.035 to +0.040

- Gold Pack (Jun 25-Mar 26) +0.035

Short Term Rates

US DOLLAR LIBOR: Latest Settles

- O/N -0.00075 at 0.05500% (-0.00613/wk)

- 1 Month -0.00325 to 0.08550% (-0.00038/wk)

- 3 Month +0.00550 to 0.13400% (+0.00262/wk) ** (Record Low 0.12850% on 06/01/21)

- 6 Month -0.00750 to 0.16738% (-0.00362/wk)

- 1 Year -0.00200 to 0.24488% (-0.00325/wk)

- Daily Effective Fed Funds Rate: 0.06% volume: $60B

- Daily Overnight Bank Funding Rate: 0.04% volume: $233B

- Secured Overnight Financing Rate (SOFR): 0.01%, $977B

- Broad General Collateral Rate (BGCR): 0.01%, $404B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $366B

- (rate, volume levels reflect prior session)

- TIPS 7.5Y-30Y, $1.201B accepted vs. $2.828B submission

- Next scheduled purchases:

- Thu 6/03 1100-1120ET: Tsy 22.5Y-30Y, appr $2.025B

- Fri 6/04 1010-1030ET: Tsy 7Y-10Y, appr $3.225B

PIPELINE: $5.5B ADP Priced

- Date $MM Issuer (Priced *, Launch #)

- 06/02 $5.5B *ADB $4B 3Y -3, $1.5B 7Y +10

- 06/02 $3B #Indonesia $1.25B 5Y 1.5%, $1B 10Y +2.55%, $ 750M 30Y 3.55% Sukuk

- 06/02 $2.5B #Societe Generale $1.25B each: 6NC5 +100, 11NC10 +130

- 06/02 $1.5B #Petrobras 30Y 5.75%

- 06/02 $Benchmark Citigroup 6NC5 +65a, 6NC5 FRN SOFR

- 06/02 $Benchmark NY Life Ins 5Y +40a, 5Y FRN SOFR

- Expected later in week:

- 06/03 $Benchmark IADB 10Y FRN SOFR

- 06/03 $500M Council of Europe Development Bank (CoE) 3Y -2a

EGBs-GILTS CASH CLOSE: Positive Session

Wednesday was a constructive if quiet session for the space, with yields falling steadily over the course of the day amid light news / trade flow, and Eurex futures roll proceeding apace.

- Germany had yet another weak auction, this time for Bobl; UK 10-/25Y Gilt auctions decent.

- Data was 2nd tier (German retail sales and Spanish unemp disappointed; UK mortgage approvals higher than expected; Eurozone PPI in line).

- Heavy issuance ahead Thursday, with Spain selling up to E6.25bln in nominal + linkers, and France selling up to E11bln in OAT (incl Green OAT).

- Spain and Italy Services PMIs are Thursday's data highlights (the rest are Finals). BOE's Bailey the only scheduled speaker.

Closing German/UK Yields And 10-Yr Spreads To Germany

- Germany: The 2-Yr yield is down 0.4bps at -0.663%, 5-Yr is down 1.5bps at -0.579%, 10-Yr is down 2bps at -0.198%, and 30-Yr is down 1.9bps at 0.363%.

- UK: The 2-Yr yield is down 1bps at 0.06%, 5-Yr is down 2.2bps at 0.337%, 10-Yr is down 2.7bps at 0.799%, and 30-Yr is down 1.7bps at 1.328%.

- Italian BTP spread down 0.3bps at 107.6bps / Spanish spread up 0.5bps at 65.2bps

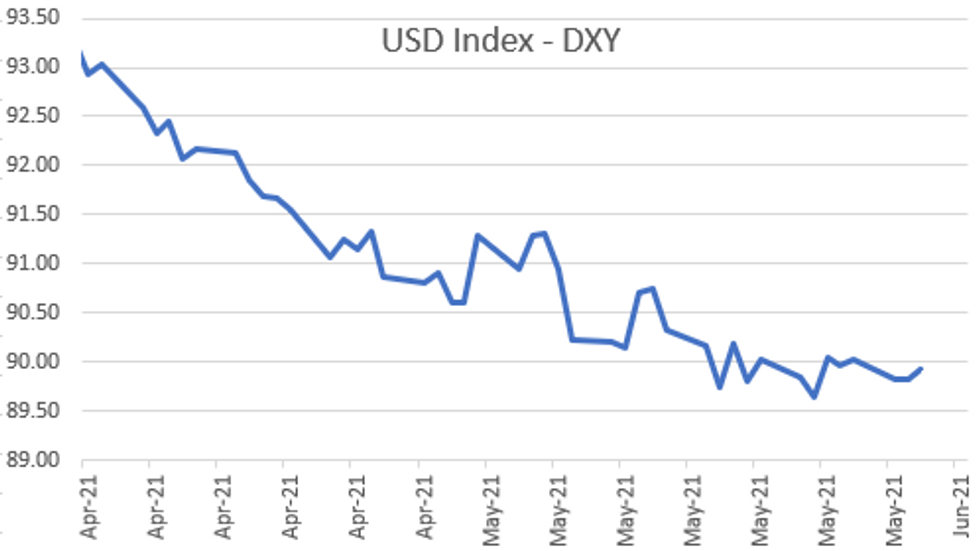

FOREX: USD Gains Short-Lived, DXY Hovers Above Multi-Month Low

- The USD started the Wednesday session particularly well, rallying against all others pushing the USD Index firmly back above the 90.00 handle. The gains were short-lived however, as NY traders responded with waves of USD sales against the rest of DM and GBP in particular.

- GBP/USD's near 80 pip rally off the day's lows was aided by continued confidence from UK PM Johnson that the UK remains on course for a full economic reopening in just over 2 weeks. While UK COVID figures were unable to maintain the streak of 0 daily fatalities, the continued stability in hospital admissions is giving cause for confidence.

- CAD, GBP and NOK were the session's best performers, while JPY, NZD and AUD all traded weaker.

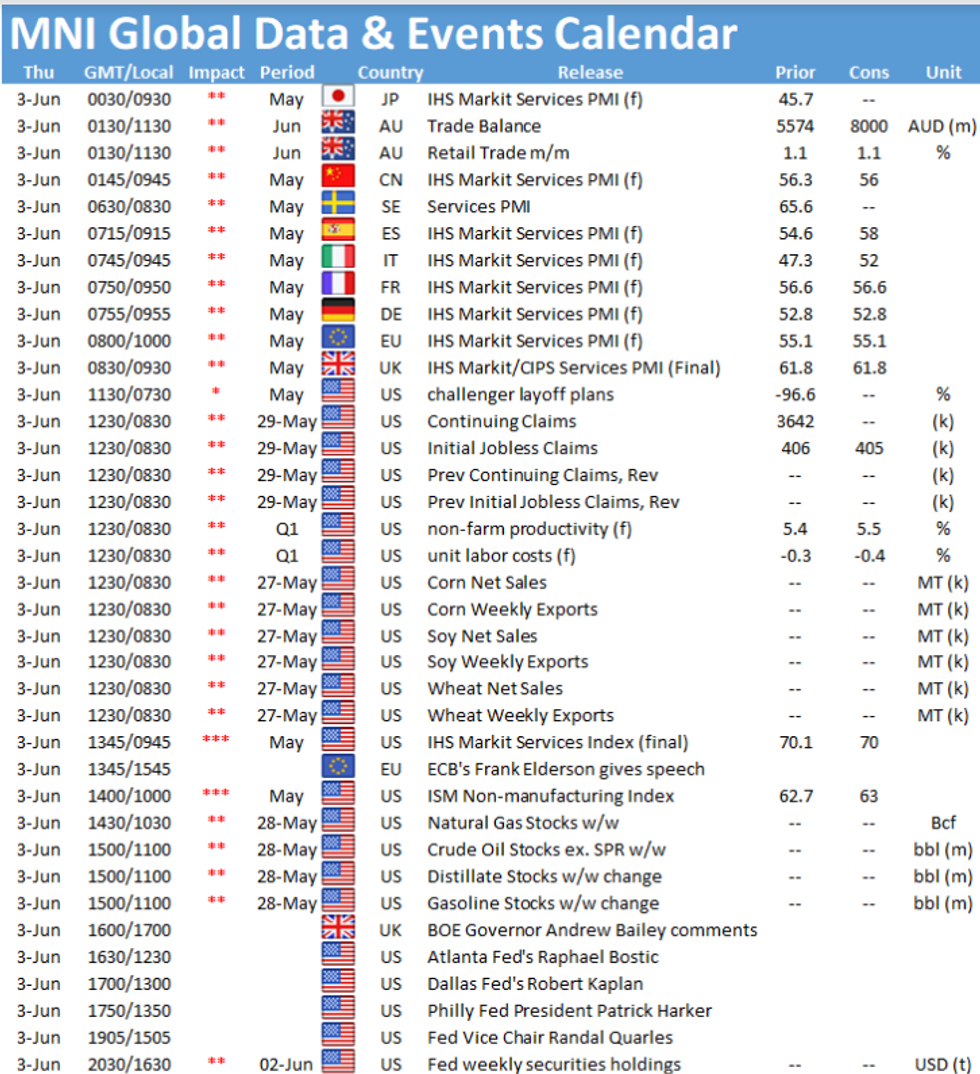

- Markets watch the release of ADP employment change, weekly jobless claims and ISM services data on Thursday. The manufacturing ISM earlier this week showed a sharp slowdown in the employment subcomponent, raising focus for Friday's nonfarm payrolls release, in which markets see net gains of around 650k jobs.

- China's Caixin services and composite PMIs are due as well as speeches from BoE's Bailey, Fed's Bostic, Kaplan, Harker and Quarles.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.