-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

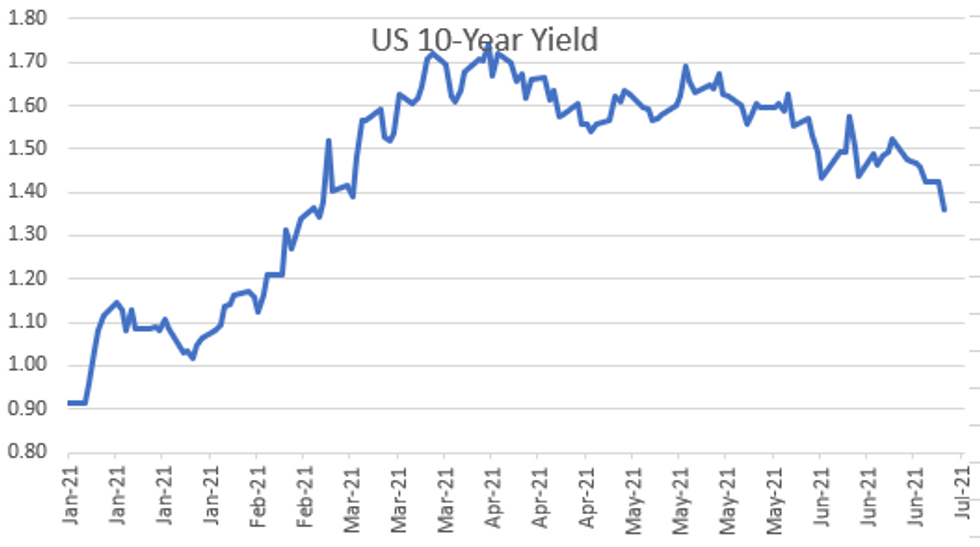

Free AccessMNI ASIA OPEN: 10YY Nears Death Cross: 50DMA Below 100DMA

EXECUTIVE SUMMARY

- MNI INTERVIEW: Fed Could Delay Taper If Jobs Lag--Adviser

- MNI INTERVIEW: Canada May Largely Close Covid Job Gap by Aug

- MNI INTERVIEW: US Service Sector Hiring In First 2021 Dip -ISM

- ISM Services PMI At 4-Month Low in Jun

- Pentagon Cancels JEDI Contract, Sets Stage For Microsoft-Amazon Rematch, Investor's Business Daily

US TSY SUMMARY: Tsy Yields in Decline

- Rates finish strong, near highs set in late morning trade, with futures trading sideways from midday through the close. Robust volumes as US markets return from 4th of July holiday, specific drivers for the rally were elusive.

- Risk-off opinion garnered some attention as Covid-19 Delta variant's resistance to vaccines contributed to the support. Others pointed to release of June FOMC minutes tomorrow for round of position squaring/current bid.

- 30Y Bond climbed to post-FOMC levels (before sharp June 21 sell-off) in early trade as 30YY dipped to 1.9712%, 10YY to 1.3498%. Desks also noted 10YY neared a "death cross" formation where 50dma (1.5552) looks to dip below 100dma (1.5511) -- potential harbinger of significantly lower Tsy yields.

- Tsys extended session highs post-data, June ISM services slips to 4M low. Tsy 10Y futures breached second resistance (133-06.5, June 11 high and bull trigger) to 133-12.5 high. Yield curves mostly flatter, 5s30s resisting move, +0.554 to 118.698.

- Bullish option flow centered around put and put spd unwinds and buying calls outright and on spd.

- The 2-Yr yield is down 1.4bps at 0.2199%, 5-Yr is down 5.3bps at 0.8045%, 10-Yr is down 6.1bps at 1.3632%, and 30-Yr is down 4.2bps at 1.9983%.

US

FED: The Federal Reserve could wait longer than investors expect to begin reducing its QE program if gains in the employment-to-population ratio fail to pick up appreciably at the end of summer, New York Fed economic adviser Sebnem Kalemli-Ozcan told MNI.

- "They are really focusing on the dual mandate here, they are really focused on the employment side and these kind of past experiences I think taught them that it's not that straightforward when you see inflation picking up a little bit that you're going to get back to full employment," Kalemli-Ozcan, an economics professor at the University of Maryland and a member of the New York Fed's economic advisory panel, said in an interview. For more see MNI Policy main wire at 1020ET.

- Difficulties in hiring is "absolutely" weighing on the service sector's ability to recover fully from Covid-19 shutdowns, Nieves said, and even though businesses like restaurants are able to open at full capacity in many areas for the first time since last March, a shortage of available workers is inhibiting their ability to do so. For more see MNI Policy main wire at 1322ET.

CANADA

CANADA: Elevated job postings amid a quickening vaccine rollout suggest solid gains for Canada's June and July employment reports, crucial milestones of the labor market recovery for policy makers, Brendon Bernard, senior economist at Indeed Hiring Lab and a former federal finance department researcher, told MNI.

- Hiring was strong following the last major lockdown, including a combined jump of 562,000 jobs in February and March, and there is potential for a similar leap this time, Bernard said. Statistics Canada reports June job numbers Friday at 8:30am EST and market economists predict a gain of around 200,000 positions. Two months of those kind of increases would make up a majority of the 750,000 jobs the central bank says have been lost or not created since the pandemic struck. For more see MNI Policy main wire at 1200ET.

OVERNIGHT DATA

- U.S. IHS MARKIT JUNE COMPOSITE PMI AT 63.7 VS 68.7 PRIOR

- U.S. IHS MARKIT JUNE SERVICES PMI AT 64.6 VS 70.4 LAST MONTH

- US JUN ISM SERVICES PMI 60.1 VS 64.0 MAY

- US ISM SERVICES BUSINESS INDEX 60.4 JUN VS 66.2 MAY

- US ISM SERVICES EMPLOYMENT INDEX 49.3 JUN VS 55.3 MAY

- US ISM SERVICES NEW ORDERS 62.1 JUN VS 63.9 MAY

- US ISM SERVICES SUPPLIER DELIVERIES 68.5 JUN VS 70.4 MAY (NSA)

- The ISM Services PMI declined 3.9pt to 60.1 in Jun, coming in weaker than markets expected (BBG: 63.4) and marking the lowest level since Feb 2021.

- Jun's downtick was broad-based with every major category posting a decline, led by Employment which fell 6pt to 49.3, its first reading below the 50-ma since Dec 2020.

- The Business Activity index declined 5.8pt in Jun, while New Orders and Supplier Deliveries fell 1.8pt and 1.9pt, respectively.

- Among the other categories, Exports showed the largest decline, down 9.3pt 50.7, its lowest level since Jan. While Inventory Sentiment ticked down 3.3pt to 37.2, Inventories eased 1.6p to 49.9 and Prices edged down 1.1pt to 79.5, which is still a very high level. Imports jumped 7.8pt to 58.2 in Jun, posting the highest level since Apr 2013, while Order Backlogs rose 4.7pt to a record high of 65.8.

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 252.79 points (-0.73%) at 34786.35

- S&P E-Mini Future down 15 points (-0.35%) at 4341.25

- Nasdaq down 3.6 points (0%) at 14639.33

- US 10-Yr yield is down 6.1 bps at 1.3632%

- US Sep 10Y are up 19/32 at 133-8.5

- EURUSD down 0.0038 (-0.32%) at 1.1845

- USDJPY down 0.36 (-0.32%) at 110.75

- WTI Crude Oil (front-month) down $1.83 (-2.43%) at $76.42

- Gold is up $4.49 (0.25%) at $1808.27

European bourses closing levels:

- EuroStoxx 50 down 34.7 points (-0.85%) at 4077.26

- FTSE 100 down 64.03 points (-0.89%) at 7158.35

- German DAX down 150.59 points (-0.96%) at 15607.22

- French CAC 40 down 60.06 points (-0.91%) at 6551.02

US TSY FUTURES CLOSE

- 3M10Y -5.387, 131.925 (L: 130.162 / H: 139.503)

- 2Y10Y -4.524, 114.299 (L: 112.562 / H: 120.878)

- 2Y30Y -2.967, 177.512 (L: 174.604 / H: 183.033)

- 5Y30Y +0.631, 118.775 (L: 115.778 / H: 119.993)

- Current futures levels:

- Sep 2Y up 1.25/32 at 110-7.125 (L: 110-05.625 / H: 110-07.5)

- Sep 5Y up 9/32 at 123-25 (L: 123-14.5 / H: 123-28.5)

- Sep 10Y up 18.5/32 at 133-8 (L: 132-18.5 / H: 133-12.5)

- Sep 30Y up 1-8/32 at 162-5 (L: 160-19 / H: 162-22)

- Sep Ultra 30Y up 2-0/32 at 195-10 (L: 192-19 / H: 196-11)

US EURODOLLAR FUTURES CLOSE

- Sep 21 +0.005 at 99.865

- Dec 21 +0.005 at 99.805

- Mar 22 +0.010 at 99.820

- Jun 22 +0.015 at 99.760

- Red Pack (Sep 22-Jun 23) +0.020 to +0.045

- Green Pack (Sep 23-Jun 24) +0.055 to +0.085

- Blue Pack (Sep 24-Jun 25) +0.090 to +0.10

- Gold Pack (Sep 25-Jun 26) +0.10

SHORT TERM RATES

US DOLLAR LIBOR: Latest Settles

- O/N +0.00113 at 0.08163% (+0.00113/wk)

- 1 Month -0.00200 to 0.10213% (-0.00075/wk)

- 3 Month -0.00312 to 0.13488% (-0.00300/wk) ** (Record Low: 0.11800% on 6/14)

- 6 Month +0.00388 to 0.16638% (+0.00338/wk)

- 1 Year +0.00100 to 0.24225% (-0.00225/wk)

- Daily Effective Fed Funds Rate: 0.10% volume: $81B

- Daily Overnight Bank Funding Rate: 0.08% volume: $242B

- Secured Overnight Financing Rate (SOFR): 0.05%, $910B

- Broad General Collateral Rate (BGCR): 0.05%, $352B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $315B

- (rate, volume levels reflect prior session)

- Tsy 0Y-2.25Y, $12.401B accepted vs. $40.051B submission

- Next scheduled purchases:

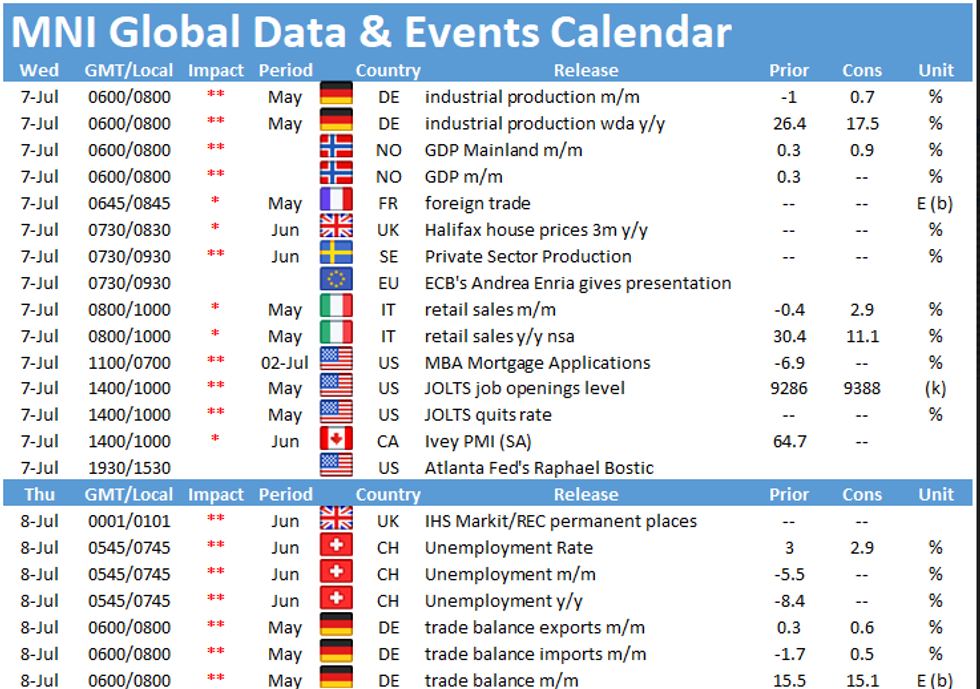

- Wed 7/7 1010-1030ET: Tsy 10Y-22.5Y, appr $1.425B

- Thu 7/8 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.425B

- Fri 7/9 1010-1030ET: Tsy 22.5Y-30Y, appr $2.025B

FED: Repo and Reverse Repo Operations

Well off last Wednesday's record high of $991.939B, NY Fed reverse repo usage climbs to $772.581B from 66 counterparties Tuesday vs. $731.504B on Friday.

PIPELINE: Banks Kick-Off July Issuance

July kicks off with $8B high-grade issuance

- Date $MM Issuer (Priced *, Launch #)

- 07/06 $3.25B #Nomura $1.25B 5Y +85, $1B 7Y +105, $1B 10Y +125

- 07/06 $1.75B #Mizuho Fncl Grp $1.1B 6Y +75, $11Y +100a

- 07/06 $1.7B #Bank of Montreal $1.15B 3Y +27, $550M 3Y FRN/SOFR+32

- 07/06 $800M *Korea Gas $450M 5Y +37.5, $350M 10Y +65

- 07/06 $500M *Hongkong Land Co 10Y +90

- 07/06 $Benchmark Beijing Capital Development investor call

- 07/06 $Benchmark Mitsubishi 5Y investor call

- Expected second half of week:

- 07/07 $500M EIB 7Y FRN/SOFR+25a

- 07/07 $Benchmark KFW 3Y -1a

EGBs-GILTS CASH CLOSE: Long End Rallies Hard

Core European FI rallied strongly Tuesday, taking their cue from US Treasuries. Risk appetite faded in the European afternoon, with equities slipping but periphery spreads holding in.

- UK and German 30 Yrs rallied 7+bps. Multiple catalysts for the safe-haven strength: multi-year highs in oil reversed sharply, the dollar strengthened, and data was on the soft side.

- German factory orders unexpectedly contracted sharply in May and ZEW expectations dipped more than expected, while the US Services ISM missed expectations.

- Supply today was UK (Gilts, GBP4.25bn), Germany (ILBs,EUR475mn allotted), France (E5bln of syndicated LT OAT).

- Wednesday sees German IP and Italy retail sales data; UK sells GBP0.6bln of linkers and Germany sells E5bln of Bobl.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is down 1.8bps at -0.678%, 5-Yr is down 3.7bps at -0.621%, 10-Yr is down 5.8bps at -0.268%, and 30-Yr is down 7.4bps at 0.224%.

- UK: The 2-Yr yield is down 0.6bps at 0.051%, 5-Yr is down 3.6bps at 0.278%, 10-Yr is down 8bps at 0.634%, and 30-Yr is down 7.1bps at 1.165%.

- Italian BTP spread down 0.3bps at 101.2bps/ Spanish up 0.4bps at 61.2bps

FOREX: Risk Off Prompts Flight To Safety

- Weakness across all three major US equity indices follows increased concern over the more transmissible delta COVID variant, bolstering the US dollar as US market participants returned from a National Holiday.

- Initial overnight greenback weakness was firmly reversed as oil markets began to turnaround with signs of stress following the OPEC+ deal falling through. Additionally, softer US ISM services data further soured sentiment, sparking another leg higher in the dollar and particular weakness in some emerging market FX.

- In the G10 space, NOK and CAD are the biggest laggards, on the back of the oil move. USDNOK resides 1.45% higher.

- USDCAD rose to the best levels since late April, posting a high just shy of the 1.25 mark, which coincides with a Fibonacci retracement. A break would open 1.2653, Apr 21 high and an important resistance. Initial firm support lies at 1.2253, Jun 23 low.

- Elsewhere, EURUSD and GBPUSD had strong reversals lower from their highs and are down 0.35%. EURUSD printed a fresh 1-pip low from Friday, reversing the entire move following the release of US non-farm payrolls last week.

- AUD and NZD, after being the biggest beneficiaries during the Asia session, also significantly retreated, dropping in the region of 1.5%. BRL had the largest move in EM, where the external and domestic environment amplified losses of 1.85%.

- Undoubtedly, Wednesday's focus will be on the release of the FOMC minutes.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.