-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI ASIA OPEN: Ylds Surge After 30Y Bond Tail

EXECUTIVE SUMMARY

- MNI INTERVIEW: Kaplan Ups PCE Outlook to 3.9%, Urges Taper Talk

- MNI INTERVIEW: 'High Probability' of 2022 Fed Hike--Ex-Staffer

- MNI INTERVIEW: Fed Model Sees 18 Months Of 2.4% Trend Inflation

- TSY SEC YELLEN: I EXPECT U.S. COMPANIES WILL PUSH FOR GLOBAL TAX DEAL; YELLEN INTENDS TO WRITE CONGRESS ON DEBT LIMIT THIS MONTH, Bbg

US

FED: Trend U.S. inflation is set to stay elevated at around 2.4% over the next year and a half, levels not seen since before the financial crisis, according to economist Tyler Atkinson of the Dallas Fed, which publishes a "trimmed mean" PCE inflation measure widely followed within the Fed system.

- While headline PCE inflation rose to an annual 3.9% in May, the trimmed mean PCE inflation rate over the 12 months through May has been 1.9%, slightly below the Fed's goal of 2%. "That's led a lot of people to conclude that high inflation will be transitory," Atkinson said in an interview. "But the fact that overall prices have increased nearly 4% over the past year does tell us something about what the trimmed mean is likely to be over the coming year." Fore more see MNI Policy main wire at 1210ET.

- "There's a high probability that we'll see rates hiked in 2022," Pennacchi, a former Cleveland Fed researcher, said in an interview.

- The first rate increase might even come early next year, he said, which would upend the Fed's desire to keep a distance between plans to taper bond buys and raise interest rates.

- "At some point they're going to have to do both, reduce bond purchases as well as raise rates. It's going to depend on just how overheated the economy is."

OVERNIGHT DATA

US JUN CPI 0.9%, CORE 0.9%; CPI Y/Y 5.4%, CORE Y/Y 4.5%

US JUN ENERGY PRICES 1.5%

US JUN OWNERS' EQUIVALENT RENT PRICES 0.3%

US REDBOOK: JUL STORE SALES +11.1% V YR AGO MO

US REDBOOK: STORE SALES +14.0% WK ENDED JUL 10 V YR AGO WK

US REDBOOK: WILL RESUME MONTH-TO-MONTH DATA COMPARISON IN FEB 2022

NFIB Small Business Optimism: 102.5 reported

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 106.65 points (-0.3%) at 34888.97

- S&P E-Mini Future down 15 points (-0.34%) at 4361.5

- Nasdaq down 37.9 points (-0.3%) at 14694.03

- US 10-Yr yield is up 4.5 bps at 1.4099%

- US Sep 10Y are down 12.5/32 at 133-0.5

- EURUSD down 0.0079 (-0.67%) at 1.1782

- USDJPY up 0.22 (0.2%) at 110.59

- WTI Crude Oil (front-month) up $1.16 (1.57%) at $75.23

- Gold is up $2.37 (0.13%) at $1808.12

- EuroStoxx 50 up 1.18 points (0.03%) at 4094.56

- FTSE 100 down 0.7 points (-0.01%) at 7124.72

- German DAX down 0.87 points (-0.01%) at 15789.64

- French CAC 40 down 0.78 points (-0.01%) at 6558.47

US TSY SUMMARY: Bond Auction Tail Reverses Post-CPI Rate Gains

Choppy session on a wide range -- rates finishing weaker -- nearly back to last week's lows. Rates and equities gapped lower following surge in June core CPI +0.9% vs. 0.4% exp.- Rising inflation more localized than systemic w/economists pointing to sharp rise in used car prices and supply-chain issues w/ semiconductors. Volume surged on post-data chop, markets posting modest gains amid two-way flow on lows lows.

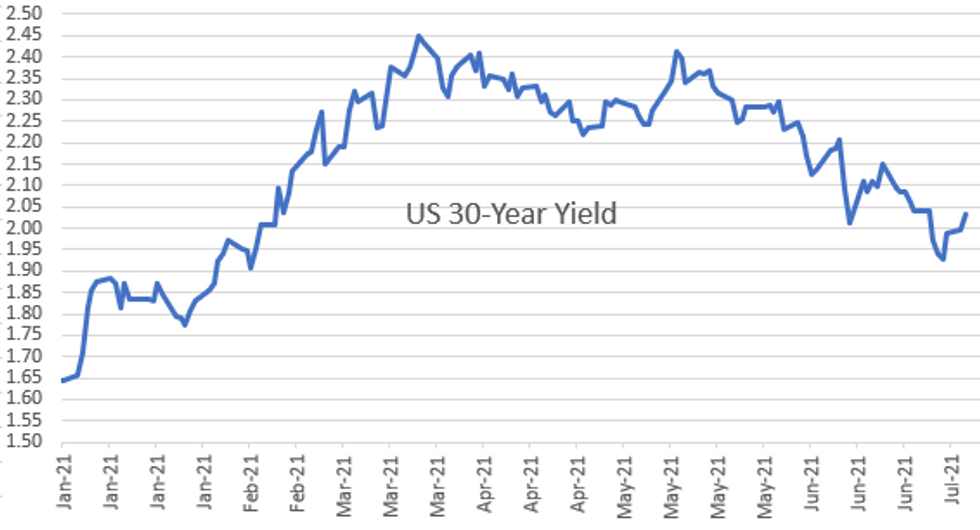

- Rates gradually climbed into midday but an unexpected Bond auction tail shook things up: Tsys gapped lower after $24B 30Y Bond auction re-open (912810SX7) tails 2.3Bp: 2.000% high yield vs. 1.977% WI; 2.19x bid-to-cover off 2.29x 5 auction avg.

- 30YY climbed to 2.0537% post auction highs amid heavy volume. Sell stops contributed to the move. Equities traded weaker as well, but drawing some dip buy support ahead more bank earnings Wednesday.

- SF Fed Pres Daly sees inflation as temporary, but positioned to taper late '21 - early '22.

- The 2-Yr yield is up 2.8bps at 0.2548%, 5-Yr is up 5bps at 0.8444%, 10-Yr is up 4.5bps at 1.4099%, and 30-Yr is up 3.3bps at 2.0308%.

US TSY FUTURES CLOSE

- 3M10Y +4.542, 135.919 (L: 128.767 / H: 136.595)

- 2Y10Y +2.127, 115.707 (L: 108.809 / H: 116.014)

- 2Y30Y +1.519, 178.337 (L: 170.11 / H: 179.617)

- 5Y30Y -0.563, 119.503 (L: 113.728 / H: 120.779)

- Current futures levels:

- Sep 2Y down 1.5/32 at 110-5.125 (L: 110-04.25 / H: 110-07.125)

- Sep 5Y down 8/32 at 123-20.25 (L: 123-17.75 / H: 123-30.75)

- Sep 10Y down 12/32 at 133-1 (L: 132-31 / H: 133-18)

- Sep 30Y down 31/32 at 161-17 (L: 161-06 / H: 163-04)

- Sep Ultra 30Y down 1-20/32 at 193-30 (L: 193-06 / H: 196-31)

US EURODOLLAR FUTURES CLOSE

- Sep 21 steady at 99.870

- Dec 21 -0.005 at 99.80

- Mar 22 -0.010 at 99.80

- Jun 22 -0.020 at 99.725

- Red Pack (Sep 22-Jun 23) -0.075 to -0.035

- Green Pack (Sep 23-Jun 24) -0.075 to -0.07

- Blue Pack (Sep 24-Jun 25) -0.065 to -0.055

- Gold Pack (Sep 25-Jun 26) -0.055 to -0.05

SHORT TERM RATES

US DOLLAR LIBOR: Latest Settles

- O/N -0.00112 at 0.08563% (-0.00100/wk)

- 1 Month -0.00262 to 0.09313% (-0.00700/wk)

- 3 Month -0.00675 to 0.12613% (-0.00250/wk) ** (Record Low: 0.11800% on 6/14)

- 6 Month -0.00288 to 0.15150% (+0.00050/wk)

- 1 Year -0.00125 to 0.24325% (+0.00438/wk)

- Daily Effective Fed Funds Rate: 0.10% volume: $75B

- Daily Overnight Bank Funding Rate: 0.08% volume: $256B

- Secured Overnight Financing Rate (SOFR): 0.05%, $855B

- Broad General Collateral Rate (BGCR): 0.05%, $359B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $331B

- (rate, volume levels reflect prior session)

- Tsy 4.5Y-7Y, $5.999B accepted vs. $17.024B submission

- Next scheduled purchases:

- Wed 7/14 1010-1030ET: Tsy 10Y-22.5Y, appr $1.425B

- Wed 7/14 1500ET Update NY Fed Operational Purchase Schedule

FED: Reverse Repo Operations

NY Fed reverse repo usage climbs to $798.267B from 73 counterparties vs. $776.472B on Monday. Remains well off June 30 record high of $991.939B.

PIPELINE: $3B IADB, $2.5B British Columbia Priced

- Date $MM Issuer (Priced *, Launch #)

- 07/13 $3B *IADB 7Y sustainable development bond +7

- 07/13 $2.5B *Province of British Columbia 5Y +4

- 07/13 $600M #MassMutual 5Y +40

- 07/13 $Benchmark Interchile investor calls

EGBs-GILTS CASH CLOSE: Shrugging Off U.S. Inflation Surprise

Tuesday saw mixed results for Bunds and Gilts, with periphery EGB spreads continuing to tighten throughout the session.

- The biggest catalyst of the day - by some distance - was the much-higher-than-expected June inflation reading from the US, which caused global core FI yields to spike to session highs.

- But 10Y Bund and Gilt yields then fell to session lows as the figure was seen as transitory. Gilts maintained their gains, while Bunds faded.

- The data overshadowed massive supply in Europe: >E30bln in eurozone (Germany, Italy, Netherlands, EU syndication) and GBP7bln Gilt (Jan-39 syndication).

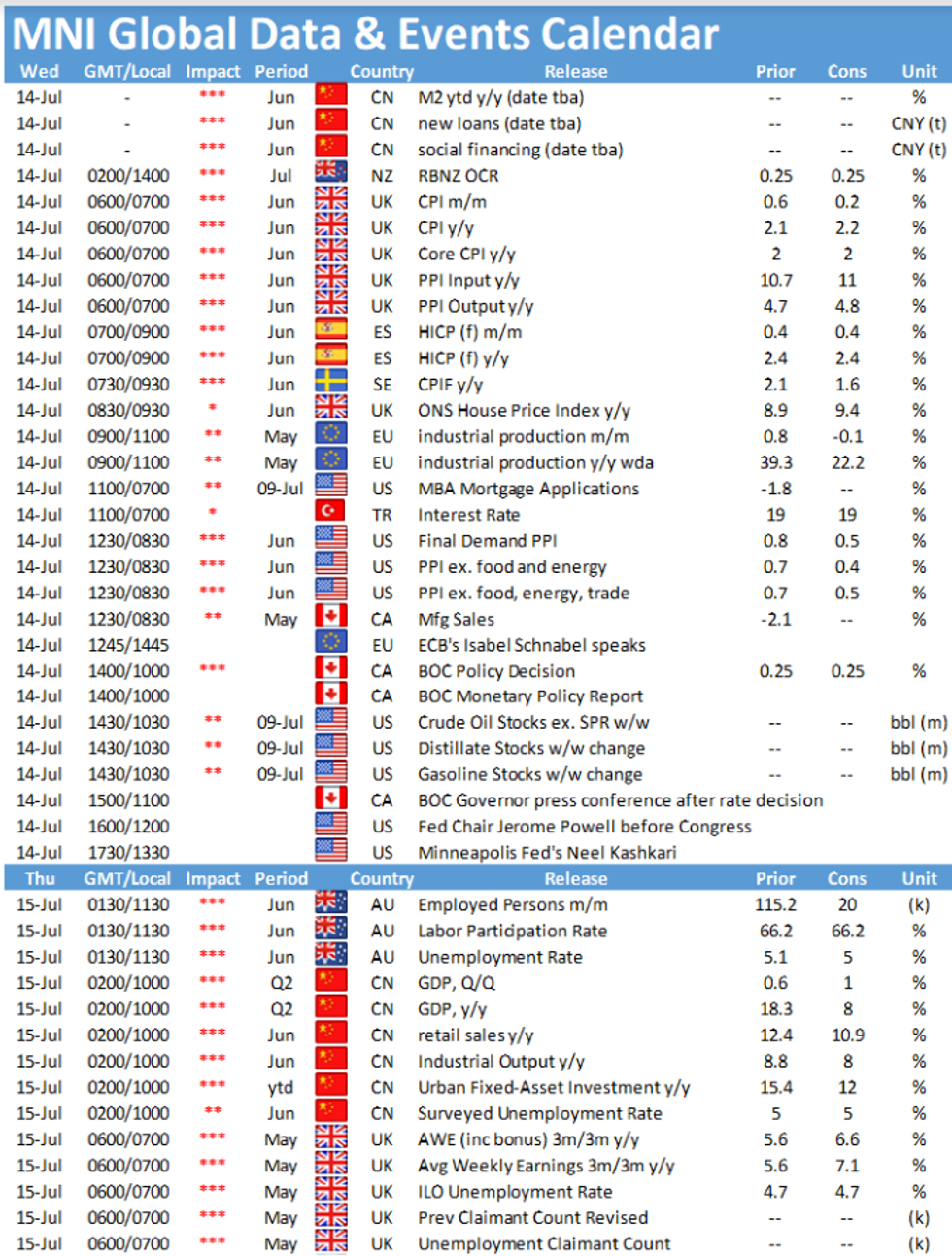

- A rather quieter supply day Weds: Germany sells E4bln of Aug-31 Bund, while Portugal sells up to E1bln of OT. We also get UK inflation data and appearances by ECB's Schnabel and BOE's Ramsden.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is unchanged at -0.672%, 5-Yr is down 0.1bps at -0.599%, 10-Yr is up 0.1bps at -0.294%, and 30-Yr is up 0.6bps at 0.211%.

- UK: The 2-Yr yield is down 0.1bps at 0.093%, 5-Yr is down 0.1bps at 0.295%, 10-Yr is down 1.9bps at 0.632%, and 30-Yr is down 3.3bps at 1.125%.

- Italian BTP spread down 2.4bps at 100.9bps / Spanish down 2bps at 61.6bps

FOREX: Greenback Strength Prevails Following US Inflation Beat

- The dollar index recovered from weakness over the past few sessions, slowly approaching last week's highs and the best levels seen since April, up half a percent on the day.

- Despite another big set of beats in the US CPI release, an initial spike in the dollar was faded with a fairly muted immediate reaction seen in currencies.

- However, as the session developed, with most pairs unable to trade back to pre-release levels, the USD gradually firmed across the board, extending on session highs late on Tuesday, in line with higher treasury yields. Particular weakness was seen in EURUSD (-0.62%), matching the July 7 low at 1.1982.

- With the technical outlook remaining bearish, a sustained break of 1.1795, the Apr 6 low may expose key support at 1.1704, Mar 31 low.

- Other pairs tracked the dollar index with GBP, AUD, NZD and CAD all losing just shy of 0.5%.

- Notable moves in the EM space included weakness in MXN (-0.95%) and another substantial retreat for the South Africa Rand (-2.15%) amid escalating levels of domestic violence and looting.

- Central bank decisions from the RBNZ and the BOC tomorrow, along with UK CPI and US PPI data.

- Additionally, Fed's Powell is due to testify on the Semi-Annual Monetary Policy Report before the House Financial Services Committee, in Washington DC.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.