-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK - Trump Announces Raft Of Key Nominations

BRIEF: EU-Mercosur Deal In Final Negotiations - EC

MNI BRIEF: Limited Economic Impact Of French Crisis - EC

MNI ASIA OPEN: Fed Chair Tamps Down Taper Talk

EXECUTIVE SUMMARY

- MNI: Fed's Powell Sees Jobs Progress; Still 'Long Way To Go'

- MNI: CFOs See Cost Pressures for 8-10 More Months -Fed Survey

- MNI BRIEF: Fed's Powell - MBS Not Main Fuel to Housing Prices

- MNI BRIEF: Fed's Powell Monitoring Inflation, Seen Temporary

- POWELL: FOMC TO CONTINUE BOND BUYING DEBATE IN COMING MEETINGS, Bbg

- BOC: Held rates steady at lower bound, tapered weekly bond buys from C$3B to C$2B

US

FED: Federal Reserve Chairman Jerome Powell will tell lawmakers Tuesday the economy is not yet ready for the central bank to begin paring back its USD120 billion QE program but the job market is making some headway in the strongest year for growth in decades.

- "Conditions in the labor market have continued to improve, but there is still a long way to go," Powell said in prepared remarks for two days of hearing in Congress, echoing the message of the Fed's latest Monetary Policy Report.

- "While reaching the standard of 'substantial further progress' is still a ways off, participants expect that progress will continue," he added. "We will continue these discussions in coming meetings. We will provide advance notice before announcing any decision to make changes to our purchases." For more see MNI Policy main wire at 0830ET.

- "They aren't especially important in what's happening with with housing prices," Powell told members of Congress. "They are a factor among factors, so this is one of the things that we'll be considering as we go through this process of evaluating when to taper, in what form, what will be the composition of asset purchases going forward. Those are all issues that we'll be discussing at this next meeting in a couple of weeks."

- ""We are monitoring the situation very carefully. If we were to see that inflation was remaining high and was threatening to uproot inflation expectations then we would absolutely change our policy as appropriate," he said in response to questions from lawmakers.

- About 80% of CFOs from over 300 firms surveyed by the Richmond and Atlanta Fed banks between June 21 and July 2 said their input costs have been larger than normal recently. The majority of firms anticipate the higher cost environment to persist for eight to 10 months, with a quarter of respondents expecting cost growth to persist through the end of 2022.

- Inflation on a whole has become firms' No. 2 concern, after the shortage of qualified labor. Three out of four CFOs surveyed said they have difficulty finding new employees for open positions, consistent with record high job openings figures in the BLS's JOLTS survey. For more see MNI Policy main wire at 0831ET.

OVERNIGHT DATA

- US JUN FINAL DEMAND PPI +1.0%, EX FOOD, ENERGY +1.0%

- US JUN FINAL DEMAND PPI EX FOOD, ENERGY, TRADE SERVICES +0.5%

- US JUN FINAL DEMAND PPI Y/Y +7.3%, EX FOOD, ENERGY Y/Y +5.6%

- US JUN PPI: FOOD +0.8%; ENERGY +2.1%

- US JUN PPI: GOODS +1.2%; SERVICES +0.8%; TRADE SERVICES +2.1%

- US MBA: MARKET COMPOSITE +16.0% SA THRU JUL 09 WK

- US MBA: REFIS +20% SA; PURCH INDEX +8% SA THRU JUL 9 WK

- US MBA: UNADJ PURCHASE INDEX -29% VS YEAR-EARLIER LEVEL

- US MBA: 30-YR CONFORMING MORTGAGE RATE 3.09% VS 3.15% PREV

- FED BEIGE BOOK CITES 'MODERATE TO ROBUST GROWTH'

- FED BEIGE BOOK: SUPPLY-SIDE DISRUPTIONS BECAME MORE WIDESPREAD

- FED SAYS MOST CONTACTS SEE FURTHER PRICE RISES IN COMING MTHSFED SAYS `SOME' CONTACTS SEE PRICE PRESSURES AS TRANSITORY

- CANADIAN MAY MANUFACTURING SALES -0.6% MOM

- CANADA MAY FACTORY INVENTORIES +0.7%; INVENTORY-SALES RATIO 1.56

MARKETS SNAPSHOT

Key late session market levels

- DJIA up 75.8 points (0.22%) at 34960.1

- S&P E-Mini Future up 13.25 points (0.3%) at 4374.25

- Nasdaq up 12.7 points (0.1%) at 14691.59

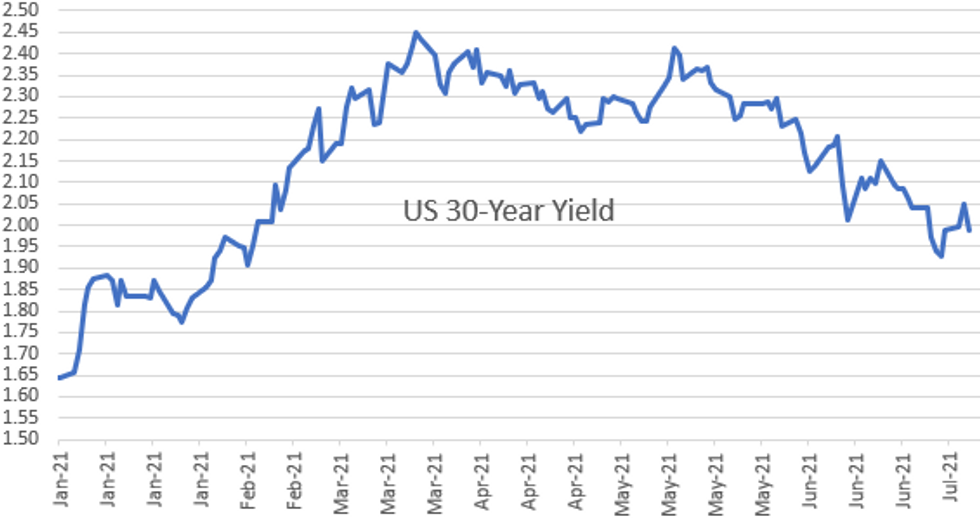

- US 10-Yr yield is down 6.2 bps at 1.3543%

- US Sep 10Y are up 15/32 at 133-14.5

- EURUSD up 0.0055 (0.47%) at 1.1831

- USDJPY down 0.62 (-0.56%) at 110.01

- WTI Crude Oil (front-month) down $2.39 (-3.18%) at $72.83

- Gold is up $18.17 (1.01%) at $1826.07

- EuroStoxx 50 up 4.94 points (0.12%) at 4099.5

- FTSE 100 down 33.53 points (-0.47%) at 7091.19

- German DAX down 0.66 points (0%) at 15788.98

US TSY SUMMARY: Dovish Cues

Tsy futures finished strong Wednesday, near late session highs after the bell, long end leading on moderate volumes (TYU >1.3M), curves bull flattening.- Rates took early dovish cues from prepared text of Fed Chairman Powell's testimony to the House Committee on Financial Services. Cooling the chances of tapering in July after Chairman Powell noted the need for continued discussions "in coming meetings".

- JUN FINAL DEMAND PPI (+1.0%, EX FOOD, ENERGY +1.0%) largely ignored. Sources reported real- and fast$ buying in intermediates, dealer buying in long end in early trade. Rates continued to drift back into Mon-Tues range as Chairman Powell's Q&A portion got underway.

- Large Eurodollar flow: +50,000 EDM2 99.755 (+0.035) 99.76 last, lent further support for lead into Red packs (EDU2-EDM3) as tighter policy expectations cooled slightly.

- Bonds climbed higher following US/CHINA geopolitical risk headline: U.S. TO EXTEND TRUMP-ERA HALT TO ECONOMIC DIALOGUE WITH CHINA, Bbg, Excerpt: "While Yellen's team, and those of other departments, are in touch with Chinese counterparts, the expectation for now is not to restart formal high-level talks, according to people familiar with the situation" Bbg.

- The 2-Yr yield is down 2.6bps at 0.227%, 5-Yr is down 4.8bps at 0.7977%, 10-Yr is down 6.2bps at 1.3543%, and 30-Yr is down 5.8bps at 1.9889%.

US TSY FUTURES CLOSE

- 3M10Y -6.153, 130.188 (L: 130.02 / H: 136.848)

- 2Y10Y -3.822, 112.361 (L: 112.194 / H: 116.89)

- 2Y30Y -3.752, 175.46 (L: 175.46 / H: 179.546)

- 5Y30Y -1.349, 118.585 (L: 117.519 / H: 120.181)

- Current futures levels:

- Sep 2Y up 1.875/32 at 110-6.875 (L: 110-04.875 / H: 110-07.375)

- Sep 5Y up 8.25/32 at 123-27.75 (L: 123-18.75 / H: 123-28)

- Sep 10Y up 16.5/32 at 133-16 (L: 132-30 / H: 133-16)

- Sep 30Y up 1-6/32 at 162-20 (L: 161-08 / H: 162-21)

- Sep Ultra 30Y up 2-0/32 at 195-29 (L: 193-15 / H: 195-29)

US EURODOLLAR FUTURES CLOSE

- Sep 21 +0.005 at 99.875

- Dec 21 +0.010 at 99.810

- Mar 22 +0.020 at 99.820

- Jun 22 +0.025 at 99.750

- Red Pack (Sep 22-Jun 23) +0.040 to +0.045

- Green Pack (Sep 23-Jun 24) +0.045

- Blue Pack (Sep 24-Jun 25) +0.050 to +0.060

- Gold Pack (Sep 25-Jun 26) +0.065 to +0.080

SHORT TERM RATES

US DOLLAR LIBOR: Latest Settles

- O/N -0.00025 at 0.08538% (-0.00125/wk)

- 1 Month -0.00200 to 0.09113% (-0.00900/wk)

- 3 Month +0.00025 to 0.12638% (-0.00225/wk) ** (Record Low: 0.11800% on 6/14)

- 6 Month -0.00075 to 0.15075% (-0.00025/wk)

- 1 Year -0.00025 to 0.24300% (+0.00413/wk)

- Daily Effective Fed Funds Rate: 0.10% volume: $74B

- Daily Overnight Bank Funding Rate: 0.08% volume: $249B

- Secured Overnight Financing Rate (SOFR): 0.05%, $875B

- Broad General Collateral Rate (BGCR): 0.05%, $361B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $331B

- (rate, volume levels reflect prior session)

- Tsy 10Y-22.5Y, $1.401B accepted vs. $3.774B submission

- Next scheduled purchases

- Thu 7/15 1010-1030ET: Tsy 0Y-2.25Y, appr $12.425B

- Fri 7/16 1010-1030ET: Tsy 7Y-10Y, appr $3.225B

FED: Reverse Repo Operations

NY Fed reverse repo usage climbs to $859.975B from 75 counterparties vs. $798.267B on Tuesday. Remains well off June 30 record high of $991.939B.

PIPELINE: $5.5B Goldman Sachs 2Pt Lauched

- Date $MM Issuer (Priced *, Launch #)

- 07/14 $5.5B #Goldman Sachs $4B 11NC10 +103, $1.5B 21NC20 +100

- 07/14 $Benchmark New Development Bank 3Y +15a

- Rolled to Thursday:

- 07/15 $Benchmark African Development Bank (AFDB) 5Y +3a

EGBs-GILTS CASH CLOSE: The Long End Comes Back

Bunds and Gilts bull flattened Wednesday after early weakness, following the lead of Treasuries which strengthened on dovish-leaning Congressional testimony by Fed Chair Powell.

- Gilts had sold off early on strong UK June inflation data out in the morning. Eurozone industrial production data disappointed, but that was considered stale (May).

- Periphery spreads widened slightly, with 10Y BTPs failing to break the 100bps mark.

- Supply came from Germany (Bund, EUR3.392bn allotted) and Portugal (OTs, EUR914mn).

- Thursday sees UK labor market data, and Spanish and French bond supply, plus comments from BOE's Saunders.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 0.6bps at -0.678%, 5-Yr is down 1.9bps at -0.618%, 10-Yr is down 2.5bps at -0.319%, and 30-Yr is down 3.4bps at 0.177%.

- UK: The 2-Yr yield is down 1.1bps at 0.082%, 5-Yr is up 0.2bps at 0.297%, 10-Yr is down 0.5bps at 0.627%, and 30-Yr is down 2.2bps at 1.103%.

- Italian BTP spread up 2bps at 102.9bps / Spanish up 1.6bps at 63.2bps

FOREX: Softer Greenback Helps Kiwi Extend Gains

- Federal Reserve Chair Jerome Powell reiterated that the central bank would continue its accommodative monetary policy despite a spike in CPI data. He described the U.S. job market as "still a ways off" from the progress the Fed wants to see before reducing stimulus.

- The dollar had been weaker in the lead up to the event and extended losses in the aftermath, in a fairly gradual and contained manner. The dollar index is 0.38% lower.

- USDCAD had a very brief spell of volatility following the BOC decision, where they left rates unchanged and tapered weekly buying to C$2B as expected. After a brief slip to 1.2428, USDCAD aggressively reversed, rising to 1.2521 as little indication was provided that these strong inflation readings are forcing the bank to re-evaluate their monetary policy.

- RBNZ inspired gains were extended in the Kiwi, the best G10 performer, rising 1.2% on Wednesday.

- EURUSD crept back above 1.18 and continued to slowly unwind yesterday's retreat to highs of 1.1836. Initial firm resistance is at 1.1881, the July 9 high.

- USDCNH had a flurry lower ahead of Powell's text release as lows from July 6th, 7th and 13th were all broken and the pair traded to the lowest level for a month. CNH held on to the majority of gains despite late negative headlines from the white house concerning US-China economic dialogue.

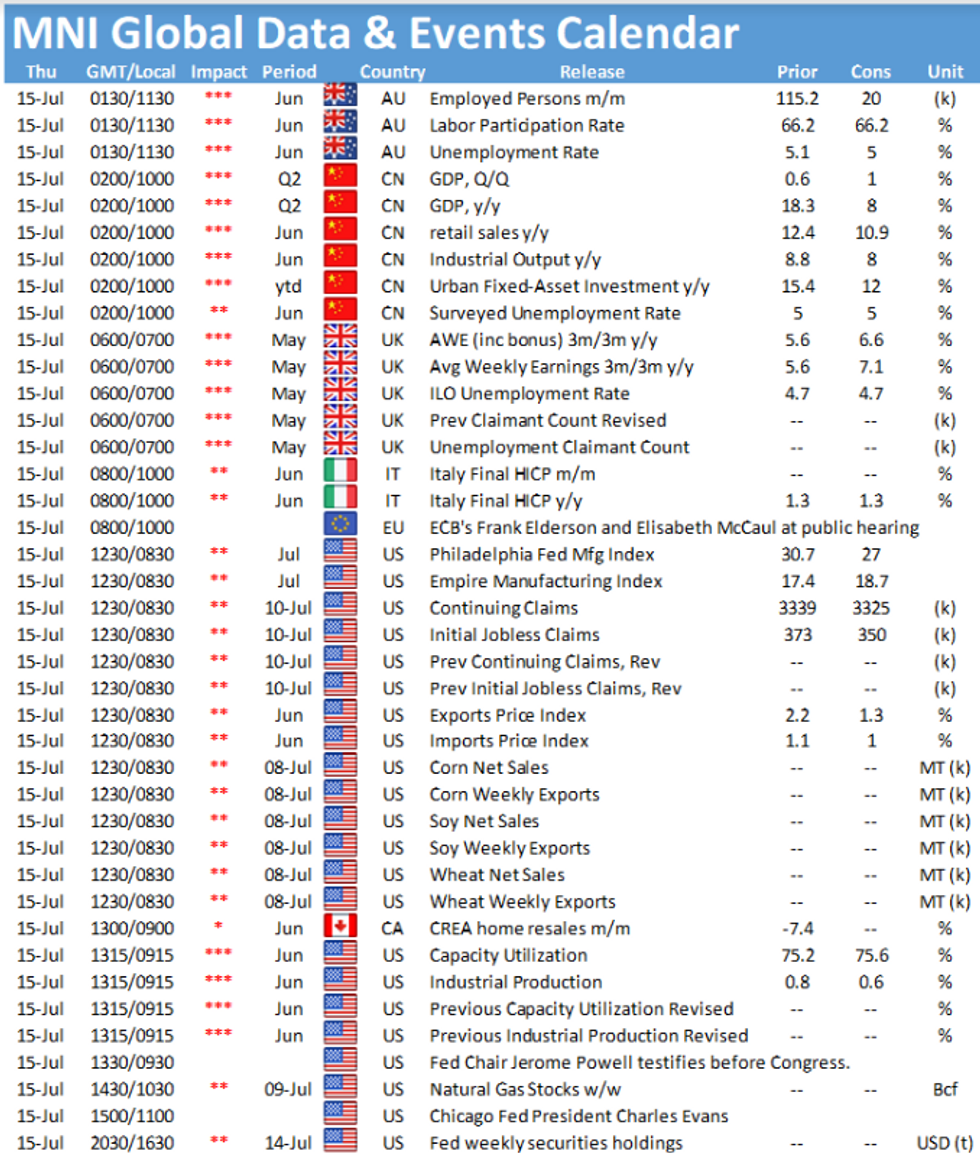

- Australian Employment data and Chinese GDP overnight before the UK also publish their employment figures on Thursday.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.