-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Fed Evans: More Persistent Infl Wouldn't Be Bad

EXECUTIVE SUMMARY

- MNI: Fed Inflation View Tested By Hot Streak, Ex-Officials Say

- MNI INTERVIEW: Signs of 'More Durable' US Inflation Pressures

- MNI REALITY CHECK: June Sales Seen Slower as Spending Cools

- FED EVANS: SLIGHTLY MORE PERSISTENT INFLATION WOULDN'T BE BAD, Bbg

- STL FED BULLARD: IT IS TIME TO END THESE EMERGENCY MEASURES, Bbg

- BIDEN TO AIM HONG KONG WARNING AT INVESTORS SHRUGGING OFF RISKS, Bbg

US

FED: A run of surprisingly strong inflation readings is increasing the danger that the Federal Reserve could allow expectations for higher price increases to become entrenched unless it alters its policy stance, former Fed officials and staffers told MNI.

- "The inflation numbers continue to come in significantly stronger than the Fed was expecting a few months ago -- stories about special factors are losing credibility," Jeffrey Lacker, former president of the Richmond Fed, said in an interview.

- Consumer prices jumped 5.4% in June, a third month of higher-than-expected readings that raised fresh inflation concerns in financial markets and among some Fed officials, even if skyrocketing used car prices likely exaggerated the spike.

- "Even though strong increases in several categories seemed to drive the headline numbers, the surge in this report is fairly broad," Lacker said. For more see MNI Policy main wire at 1007ET.

- The recovery in the owners' equivalent rent measure used to account for housing costs in the CPI could be longer lasting given the runaway strength in housing, he said, while rising food services prices reflect wage pressure in the industry that could prove durable. The six-month annualized measure of OER is back to 3%, where it was before Covid struck, while food away from home rose 8.9% annualized in June and is up 4.2% on a year-over-year basis.

- "Owners' equivalent rent has moved back up into a more 'normal' price growth range. Given its size in the retail market basket, if sustained, it will mean higher readings on core services prices," he said. "Should OER continue to climb upward, this will make it much harder to tap-dance around the inflation issue." For more see MNI Policy main wire at 1257ET.

- Overall sales growth "remains on solid footing," said Jack Kleinhenz, chief economist at the National Retail Federation, though the pace "is perhaps slowing."

- Still, business and consumer optimism was elevated through June, he said, and total sales are likely to get a slight boost from 'Amazon Prime Day' event, which took place from June 21 - 23.

OVERNIGHT DATA

- US JUL PHILADELPHIA FED MFG INDEX 21.9

- US JOBLESS CLAIMS -26K TO 360K IN JUL 10 WK

- US PREV JOBLESS CLAIMS REVISED TO 386K IN JUL 03 WK

- US CONTINUING CLAIMS -0.126M to 3.241M IN JUL 03 WK

- US JOBLESS CLAIMS -26K TO 360K IN JUL 10 WK

- US PREV JOBLESS CLAIMS REVISED TO 386K IN JUL 03 WK

- US CONTINUING CLAIMS -0.126M to 3.241M IN JUL 03 WK

- US JUN IMPORT PRICES +1.0%

- US JUN EXPORT PRICES +1.2%; NON-AG +1.1%; AGRICULTURE +1.5%

- US NY FED EMPIRE STATE MFG INDEX 43.0 JUL

- US NY FED EMPIRE MFG NEW ORDERS 33.2 JUL

- US NY FED EMPIRE MFG EMPLOYMENT INDEX 20.6 JUL

- US NY FED EMPIRE MFG PRICES PAID INDEX 76.8 JUL

- US JUN INDUSTRIAL PROD +0.4%; CAP UTIL 75.4%

- US MAY IP REV TO +0.7%; CAP UTIL REV 75.1%

- US JUN MFG OUTPUT -0.1%

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 16.06 points (0.05%) at 34908.68

- S&P E-Mini Future down 19.25 points (-0.44%) at 4343.75

- Nasdaq down 116.8 points (-0.8%) at 14511.78

- US 10-Yr yield is down 4.9 bps at 1.2972%

- US Sep 10Y are up 11/32 at 133-25.5

- EURUSD down 0.003 (-0.25%) at 1.1805

- USDJPY down 0.15 (-0.14%) at 109.85

- WTI Crude Oil (front-month) down $1.56 (-2.13%) at $71.58

- Gold is up $1.2 (0.07%) at $1828.60

European bourses closing levels:

- EuroStoxx 50 down 43.11 points (-1.05%) at 4056.39

- FTSE 100 down 79.17 points (-1.12%) at 7012.02

- German DAX down 159.32 points (-1.01%) at 15629.66

- French CAC 40 down 65.02 points (-0.99%) at 6493.36

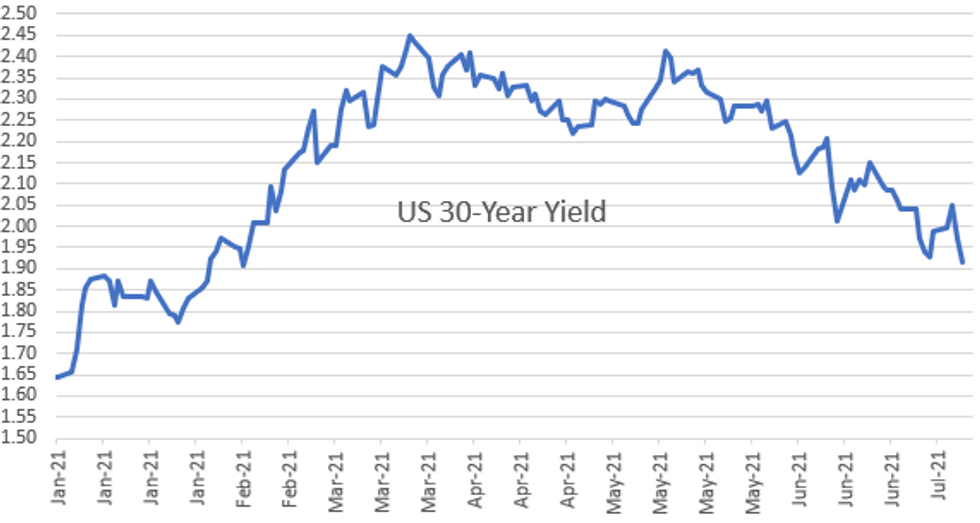

US TSY SUMMARY: No Hawks To Temper Tsy Rally, 30YY Sub-1.92%

Overnight support for US rates carried through Thursday's session, 30Y Bonds lead the charge all day, finishing just off highs, yield curves flatter. Intermediates lagged slightly, 10Y futures tested first resistance of 133-26.5 several times before settling back around -25 to -25.5.

- Support for Tsys picked up early in the second half (30YY slips to 1.9160% low) as Chicago Fed Pres Evans headlines make the rounds:

- "The upside potential for inflation isn't quite as strong and sustainable as I would like," adding "SLIGHTLY MORE PERSISTENT INFLATION WOULDN'T BE BAD" while "I don't think you can get 2.5% to 3% year after year on the basis of these relative price increases".

- Tsy Sec Yellen also spoke on NPR later in day but didn't saying anything new, or particularly market moving: expecting inflation to fade over the mid-term.

- Fed Chair Powell's semiannual mon-pol report to the Senate failed to illicit much of a market reaction either.

- Bonds maintain strong bid after flurry of data, weekly claims little higher than exp at 360k vs. 350k est while continuing claims inch lower again: -126k to 3.241M vs. 3.3M est.

- The 2-Yr yield is up 0bps at 0.2231%, 5-Yr is down 2.1bps at 0.7736%, 10-Yr is down 4.9bps at 1.2972%, and 30-Yr is down 5.1bps at 1.9199%.

US TSY FUTURES CLOSE

- 3M10Y -4.69, 124.573 (L: 124.239 / H: 129.677)

- 2Y10Y -5.01, 107.08 (L: 106.746 / H: 112.037)

- 2Y30Y -4.986, 169.554 (L: 169.158 / H: 174.471)

- 5Y30Y -3.08, 114.345 (L: 114.185 / H: 117.812)

- Current futures levels:

- Sep 2Y up 0.25/32 at 110-7.125 (L: 110-06.625 / H: 110-07.625)

- Sep 5Y up 3/32 at 123-30 (L: 123-25 / H: 124-00)

- Sep 10Y up 11.5/32 at 133-26 (L: 133-14 / H: 133-28)

- Sep 30Y up 1-11/32 at 163-30 (L: 162-25 / H: 164-00)

- Sep Ultra 30Y up 2-17/32 at 198-10 (L: 196-08 / H: 198-14)

US EURODOLLAR FUTURES CLOSE

- Sep 21 steady at 99.870

- Dec 21 +0.005 at 99.815

- Mar 22 +0.010 at 99.825

- Jun 22 +0.010 at 99.765

- Red Pack (Sep 22-Jun 23) +0.010

- Green Pack (Sep 23-Jun 24) +0.010 to +0.035

- Blue Pack (Sep 24-Jun 25) +0.045 to +0.060

- Gold Pack (Sep 25-Jun 26) +0.065 to +0.085

SHORT TERM RATES

US DOLLAR LIBOR: Latest Settles

- O/N +0.00025 at 0.08563% (-0.00100/wk)

- 1 Month -0.00200 to 0.08913% (-0.01100/wk)

- 3 Month +0.00750 to 0.13388% (+0.00525/wk) ** (Record Low: 0.11800% on 6/14)

- 6 Month +0.00250 to 0.15325% (+0.00225/wk)

- 1 Year -0.00200 to 0.24100% (+0.00213/wk)

- Daily Effective Fed Funds Rate: 0.10% volume: $72B

- Daily Overnight Bank Funding Rate: 0.08% volume: $246B

- Secured Overnight Financing Rate (SOFR): 0.05%, $908B

- Broad General Collateral Rate (BGCR): 0.05%, $361B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $329B

- (rate, volume levels reflect prior session)

- Tsy 0Y-2.25Y, $12.401B accepted vs. $48.705B submission

- Next scheduled purchase

- Fri 7/16 1010-1030ET: Tsy 7Y-10Y, appr $3.225B

FED: Reverse Repo Operations

NY Fed reverse repo usage slips to $776.261B from 69 counterparties vs. $859.975B on Wednesday. Remains well off June 30 record high of $991.939B.

PIPELINE: $7.75B BoA 3Pt Launched

- Date $MM Issuer (Priced *, Launch #)

- 07/15 $8.5B #Morgan Stanley $2B 3.5NC2.5 +57, $3B 6NC5 +75, $3.5B 11NC10 +95

- 07/15 $7.75B #Bank of America $2B 6NC5 tap +77, $3.75B 11NC10 +100, $2B31NC30 +103

- 07/15 $2.75B *African Development Bank (AFDB) 5Y +1

- 07/15 $2.25B *New Development Bank (NDB) 3Y +14

- 07/15 $1.3B #Royalty Pharma $600M 10Y +105, $700M 30Y +155

- 07/15 $1B ADT Security 8Y 4%a

- 07/15 $Benchmark Cibanco 10Y +325a

- 07/?? $1.2B Xiaomi $800M 10Y, $400M 30Y Green bond

EGBs-GILTS CASH CLOSE: Hawkish Saunders Sinks Gilts

Gilts underperformed Thursday after the BoE's Saunders suggested that it may soon be appropriate to withdraw pandemic stimulus. The Gilt move also weakened Bunds (and Treasuries), with bear steepening in the curves and periphery spreads widening.

- Prior to Saunders' comments at 1100BST, it was shaping up as a constructive morning for core FI, with some bull flattening resuming from Wednesday.

- By comparison, data didn't really have much impact (UK jobs data basically in line with expectations). It was a fairly heavy supply day, with E10.5bln in French OATS and E1.7bln in linkers, and Spain selling E3.5bln - but again, no discernable impact.

- Friday sees no tier-1 data (Eurozone inflation figures are finals), no bond supply, and no scheduled ECB / BoE speakers.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is up 0.1bps at -0.677%, 5-Yr is down 0.6bps at -0.624%, 10-Yr is down 1.5bps at -0.334%, and 30-Yr is down 2.5bps at 0.152%.

- UK: The 2-Yr yield is up 6.5bps at 0.147%, 5-Yr is up 6.1bps at 0.358%, 10-Yr is up 3.5bps at 0.662%, and 30-Yr is up 4.2bps at 1.145%.

- Italian BTP spread up 2.5bps at 105.4bps/ Spanish up 0.9bps at 64.1bps

FOREX: US Dollar Regains Poise As Equities Drift Lower

- The Greenback spent the latter half of Thursday reversing the prior day's losses. Dollar indices are roughly 0.3% above yesterday's closing marks.

- Significantly weak sessions for Aussie and Kiwi, retreating the best part of 1%, amid the decline in global equity indices and an extension lower in crude futures.

- Similar declines seen in the Canadian dollar, adding to negative price action following yesterday's BOC statement. Following a recent resumption of the uptrend in USDCAD that started Jun 1, a bullish price sequence of higher highs and higher lows has been established. Additionally, moving average studies are in a bull mode. July 8th highs have been breached through 1.2590, with stronger resistance noted at 1.2653, Apr 21 high.

- More contained price action in EURUSD, edging gradually back below the 1.18 handle and USDJPY appearing content around the 110 mark.

- The move lower in oil put pressure on the Norwegian Krone. EURNOK continued its most recent upward trajectory, briefly reaching the highest levels seen since March 1st in the pair at 10.4359.

- New Zealand inflation data due later this evening, before the Bank of Japan will release their monetary policy statement and hold a press conference.

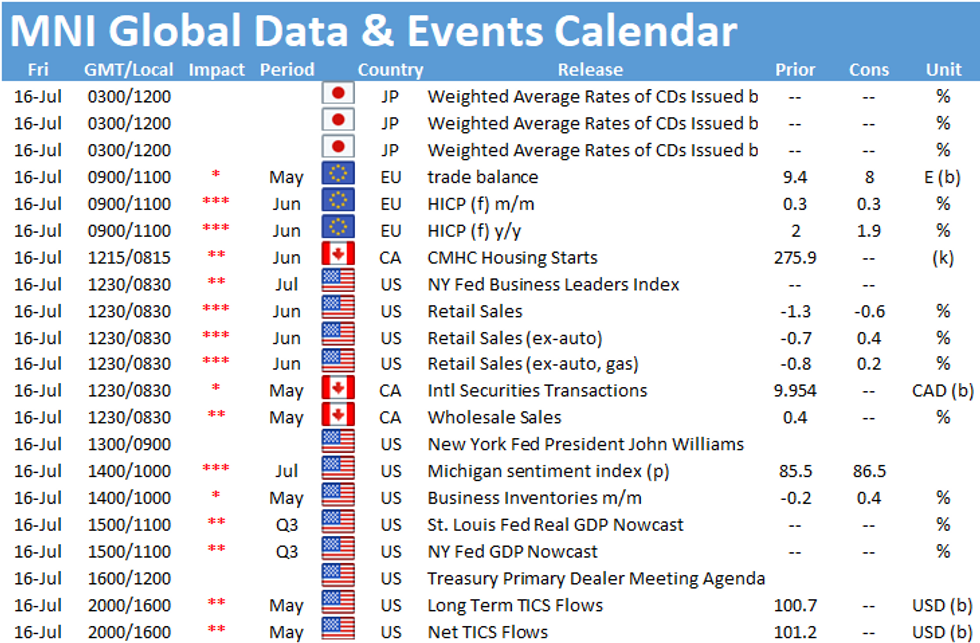

- Friday's docket will be headlined by final CPI readings from the Eurozone and then US Retail Sales.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.