-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: May Revision Tempers June Retail Sales Beat

EXECUTIVE SUMMARY

- MNI INTERVIEW: Medical Costs to Slow US Inflation Next Year

- MNI INSIGHT: BOE To Reveal More About QE After Critical Report

- MNI BRIEF: Fed's Favored CIE Inflation Reaches 7-Year High

- ECB SAID TO DISAGREE ON STIMULUS GUIDANCE DRAFTS FOR JULY 22, Bbg

- SINGAPORE INTRODUCES VIRUS CURBS BASED ON VACCINE STATUS, Bbg

US

FED: U.S. core PCE inflation will slow to just under the central bank's 2% target next year, San Francisco Fed senior economist Adam Shapiro told MNI, as a number of coronavirus-related healthcare laws that have boosted medical prices unwinds along with today's surge in auto prices.

- "If you add together the 0.5 percentage points from used cars and around 0.3 percentage points from healthcare services, that's a little under a full percentage point that's probably not going to be there next year, and if anything you might see a drag," Shapiro said in an interview.

- Health services, one of the largest components of core PCE inflation with close to 20% of expenditures, contributed approximately 0.2pps on average to core PCE inflation in the five years preceding the pandemic, he said. Shapiro estimates the contribution from healthcare tripled to 0.6pp during the pandemic as the government set more prices, momentum that should fade or reverse in 2022.

- The Index of Common Inflation Expectations nudged up from 2.02% the prior quarter. The gain moves it closer to the highest reading in measurements back to 1999, of 2.15% set in Q1 and Q2 of 2004. The CIE index combines 21 market and survey measures into a single view of how households and businesses expect prices to behave.

UK

BOE: The Bank of England is likely to provide more detail of its assessment of the impact of quantitative easing following criticism in a report by the House of Lords Economic Affairs Committee, with its upcoming review of its tightening strategy giving it the chance for a full explanation, MNI understands.

- The LEAC report released early on Friday raised concerns about secrecy and political pressures surrounding QE and highlighted the BOE's failure to publish more estimates of the effects of the later rounds of bond purchases.

- But the Bank has found the impact of QE hard to disentangle and inconsistent through time, with Monetary Policy Committee members unable to reach a collective position on the matter, MNI understands. The uncertainty surrounding QE is also mirrored in the problem of trying to estimate the likely effects of upcoming quantitative tightening, as BOE economists review its strategy for withdrawing stimulus, and as MPC members including Michael Saunders and Dave Ramsden begin to suggest that the time to act against inflation may be drawing near. For more see MNI Policy main wire at 1239ET.

OVERNIGHT DATA

- US MAY RETAIL SALES REVISED -1.7%; EX-MV -0.9%

- US JUN RET SALES EX GAS & MTR VEH & PARTS DEALERS +1.1% V MAY -1.0%

- US JUN RET SALES EX MTR VEH & PARTS DEALERS +1.3% V US JUN -0.9%

- US JUN RET SALES EX AUTO, BLDG MATL & GAS +1.3% V MAY -0.6%

- US MAY BUSINESS INVENTORIES +0.5%; SALES -0.3%

- US MAY RETAIL INVENTORIES -0.8%

- MICHIGAN PRELIM. JULY CONSUMER SENTIMENT AT 80.8; EST. 86.5

- JULY MICHIGAN CONSUMER EXPECTATIONS INDEX AT 78.4 AFTER 83.5

- FOREIGN HOLDINGS OF CANADA SECURITIES +20.8B CAD IN MAY

- CANADIAN HOLDINGS OF FOREIGN SECURITIES +10.7B CAD IN MAY

- CANADA MAY WHOLESALE SALES +0.5%; EX-AUTOS +0.5%

- MAY WHOLESALE INVENTORIES +2.1%: STATISTICS CANADA

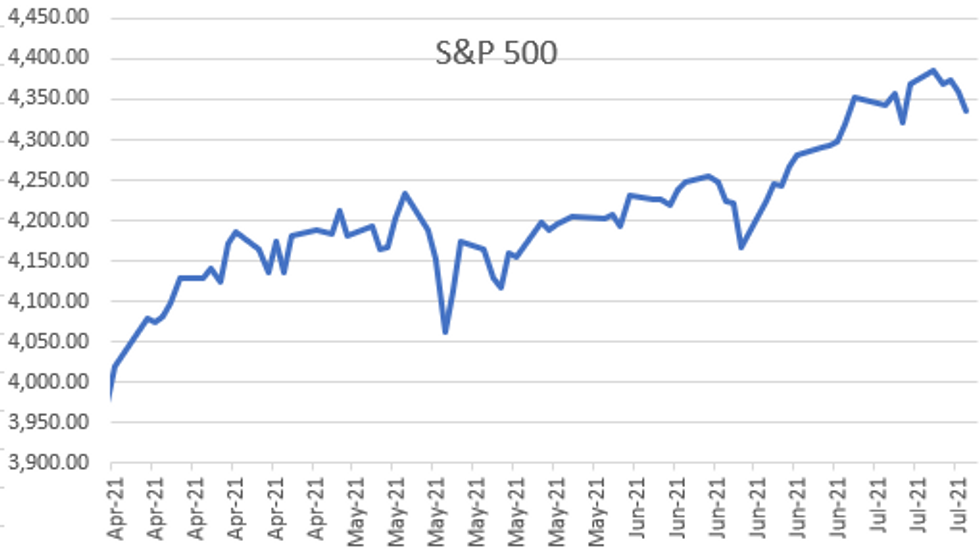

MARKETS SNAPSHOT

Key late session market levels

- DJIA down 253.57 points (-0.72%) at 34823.73

- S&P E-Mini Future down 25.5 points (-0.59%) at 4334.25

- Nasdaq down 69.5 points (-0.5%) at 14483.54

- US 10-Yr yield is up 0.5 bps at 1.3037%

- US Sep 10Y are down 1.5/32 at 133-24

- EURUSD down 0.0002 (-0.02%) at 1.1813

- USDJPY up 0.24 (0.22%) at 110.08

- WTI Crude Oil (front-month) up $0.07 (0.1%) at $71.82

- Gold is down $16.07 (-0.88%) at $1812.19

European bourses closing levels:

- EuroStoxx 50 down 20.62 points (-0.51%) at 4035.77

- FTSE 100 down 3.93 points (-0.06%) at 7008.09

- German DAX down 89.35 points (-0.57%) at 15540.31

- French CAC 40 down 33.28 points (-0.51%) at 6460.08

US TSY SUMMARY: Yld Curves Bend Steeper

Rates and equities looked to finish out the session weaker Friday, the latter slipping to lows for the week (ESU1 4320.75) before bouncing to appr 4328.0 after the rate close. Tsys weaker for the most part as well, off lows and back near early overnight levels, curves mildly steeper with short end outperforming. Light volume: TYU appr 900k after the bell.- Retail sales better than expected -- Tsy futures gapped lower immediately after June R/S came out 0.6% vs. -0.3% estimate -- but rebound to pre-release levels just as quickly as revisions factor in a "wash" w/May to -1.7% from -1.3%. Equities held onto modest gains until midmorning when better selling/positioning ahead weekend pushed levels back to last July 9 levels.

- Aside from the early data -- pre-weekend position squaring appeared to be main driver, Fed goes into media blackout at midnight, maintaining radio silence in regards to monetary policy through July 29, day after next FOMC.

- The 2-Yr yield is up 0.2bps at 0.2255%, 5-Yr is up 0.5bps at 0.7798%, 10-Yr is up 0.5bps at 1.3037%, and 30-Yr is up 1.3bps at 1.9335%.

US TSY FUTURES CLOSE

- 3M10Y +0.229, 125.303 (L: 124.4 / H: 128.82)

- 2Y10Y -0.067, 107.113 (L: 107.113 / H: 110.026)

- 2Y30Y +0.534, 169.882 (L: 169.088 / H: 172.878)

- 5Y30Y +0.11, 114.49 (L: 113.139 / H: 116.195)

- Current futures levels:

- Sep 2Y up 0.125/32 at 110-7.125 (L: 110-05.75 / H: 110-07.5)

- Sep 5Y down 0.5/32 at 123-29.25 (L: 123-23 / H: 123-30.75)

- Sep 10Y down 0.5/32 at 133-25 (L: 133-14.5 / H: 133-25.5)

- Sep 30Y down 3/32 at 163-26 (L: 163-02 / H: 163-30)

- Sep Ultra 30Y down 8/32 at 198-2 (L: 196-20 / H: 198-13)

US EURODOLLAR FUTURES CLOSE

- Sep 21 -0.005 at 99.870

- Dec 21 -0.005 at 99.815

- Mar 22 steady at 99.825

- Jun 22 steady at 99.765

- Red Pack (Sep 22-Jun 23) -0.005 to steady

- Green Pack (Sep 23-Jun 24) -0.005

- Blue Pack (Sep 24-Jun 25) -0.005 to steady

- Gold Pack (Sep 25-Jun 26) -0.01 to -0.005

SHORT TERM RATES

US DOLLAR LIBOR: Latest Settles

- O/N +0.00012 at 0.08575% (-0.00088/wk)

- 1 Month -0.00550 to 0.08363% (-0.01650/wk)

- 3 Month +0.00037 to 0.13425% (+0.00562/wk) ** (Record Low: 0.11800% on 6/14)

- 6 Month -0.00112 to 0.15213% (+0.00112/wk)

- 1 Year +0.00113 to 0.24213% (+0.00325/wk)

- Daily Effective Fed Funds Rate: 0.10% volume: $73B

- Daily Overnight Bank Funding Rate: 0.08% volume: $253B

- Secured Overnight Financing Rate (SOFR): 0.05%, $933B

- Broad General Collateral Rate (BGCR): 0.05%, $378B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $348B

- (rate, volume levels reflect prior session)

- Tsy 7Y-10Y, $3.201B accepted vs. $9.733B submission

- Next scheduled purchases

- Mon 7/19 1010-1030ET: Tsy 10Y-22.5Y, appr $1.425B

- Tue 7/20 1010-1030ET: TIPS 7.5Y-30Y, appr $1.225B

- Wed 7/21 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.425B

- Thu 7/22 1010-1030ET: Tsy 22.5Y-30Y, appr $2.025B

- Fri 7/23 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

FED: Reverse Repo Operations

NY Fed reverse repo usage slips to $817.566B from 72 counterparties vs. $776.216B on Thursday. Remains well off June 30 record high of $991.939B.

PIPELINE: MS, BoA Help Push High-Grade Issuance Over $42B/wk

- Date $MM Issuer (Priced *, Launch #)

- 07/?? $1.2B Xiaomi $800M 10Y, $400M 30Y Green bond

- $24.15B Priced Thursday; $42.385B for week

- 07/15 $8.5B *Morgan Stanley $2B 3.5NC2.5 +57, $3B 6NC5 +75, $3.5B 11NC10 +95

- 07/15 $7.75B *Bank of America $2B 6NC5 tap +77, $3.75B 11NC10 +100, $2B31NC30 +103

- 07/15 $2.75B *African Development Bank (AFDB) 5Y +1

- 07/15 $2.25B *New Development Bank (NDB) 3Y +14

- 07/15 $1.3B *Royalty Pharma $600M 10Y +105, $700M 30Y +155

- 07/15 $1B *ADT Security 8Y 4.12%

- 07/15 $600M *Cibanco 10Y +312.5

FOREX: NZD Consolidates Gains, GBP Fades As UK Cases Rise

- A firm Q2 NZ CPI print saw the headline reading print above the RBNZ's target band, triggering an extension of NZD strengthening post the RBNZ earlier this week. This left the NZD atop the G10 FX table, up 0.45%

- Mild pressure in equities saw a firmer dollar for the majority of the session, however, the dollar index slowly inched back to unchanged on the day heading into the close.

- Despite the gradual retreat of the greenback, GBPUSD was the weakest currency pair on Friday, breaching the 1.38 mark and likely to close around 1.3780, down 0.35%. Potentially weighing on Sterling, headlines confirmed over 50,000 new coronavirus cases for the first time in six months Friday amid a warning from the British government's top medical adviser that the number of people hospitalized with COVID-19 could hit "quite scary" levels within weeks.

- Most other G10 currencies held narrow ranges on Friday with a lack of market catalysts to spark any price action approaching the weekend.

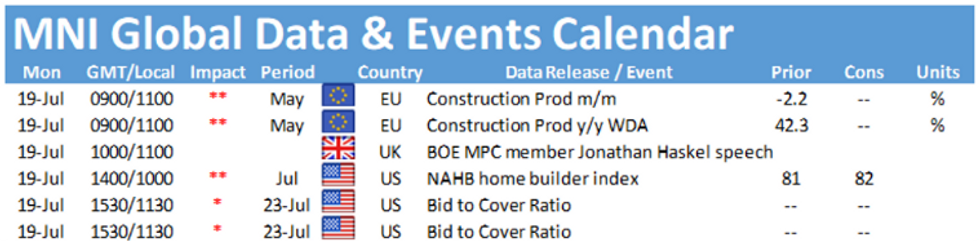

- BOE MPC Member Jonathan Haskel due to speak on Monday, with US NAHB Housing Market Index the only US data point.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.