-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Bond Yields Erase Mon's Rout

EXECUTIVE SUMMARY

- MNI INTERVIEW: Fed Seen Trapped Near Zero After Biden Trillions

- MNI BRIEF: US BLS: Mulling CPI Calculation Change

- MNI BRIEF: ECB Set To Flesh Out Policy Guidance

- POWELL HAS BROAD SUPPORT AMONG TOP BIDEN AIDES FOR NEW FED TERM, Bbg

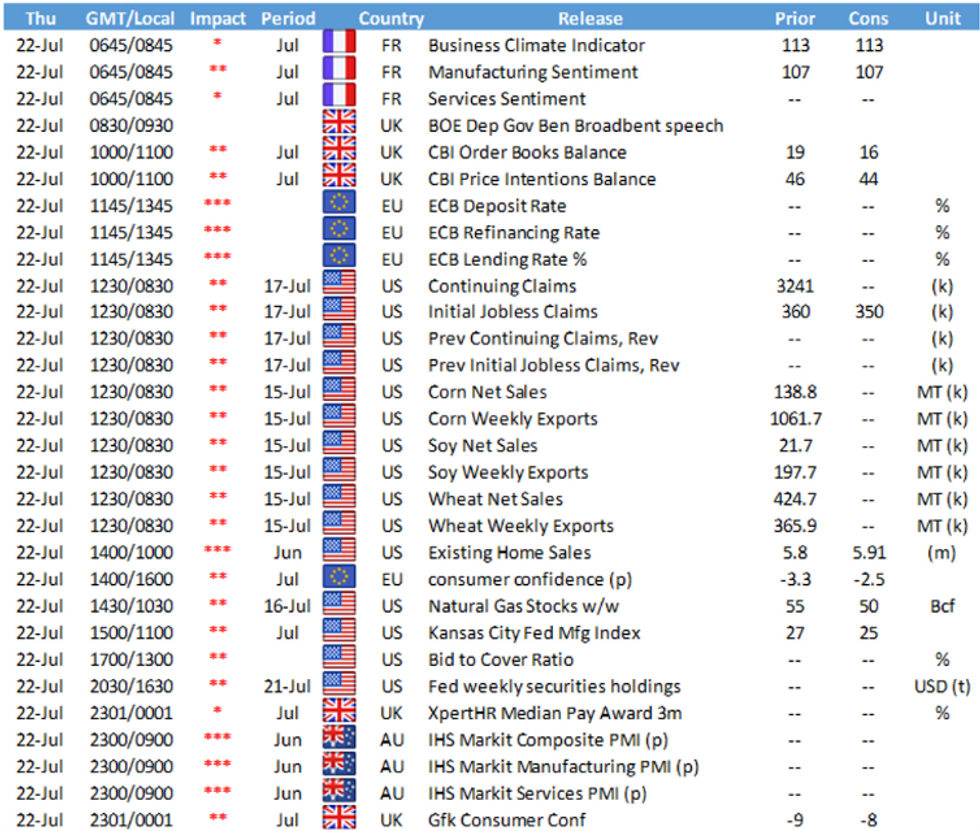

Source: MNI, Bloomberg

US

FED: A likely rise in the U.S. neutral interest rate driven by productivity gains and trillions of dollars in fiscal stimulus will be insufficient to prevent the Federal Reserve from returning to zero nominal rates in the next downturn, Kathryn Holston, who worked with New York Fed President John Williams in this area, told MNI.

- Being stuck near zero "is something that we are going to have to contend with in future crises, unless we see a meaningful rise in the natural rate of interest, which is not something that I am expecting at present in any significant way," she said. "Fiscal spending could lead to a higher natural rate," said Holston, who worked with Williams as a Fed research assistant. For more see MNI Policy main wire at 1056ET.

- "BLS is evaluating the implementation of reweighting its multiunit and single family rental housing sample so that the owned housing stock is better representative of its population," BLS economist Jonathan Church said in an email. "We have not made a determination as to if or when this will be implemented, but will make an announcement on our website prior to making any changes to the index methodology."

The Congressional Budget Office (CBO) reminds the statutory debt limit extension expires as of July 31 -- resetting to the "previous ceiling of $22.0 trillion" on August 1, "plus the cumulative borrowing that occurred during the period of suspension."

- Unless additional legislation either extends the suspension or increases the limit, existing statutes will allow the Treasury to declare a "debt issuance suspension period" and to take "extraordinary measures" to borrow additional funds for a period of time without breaching the debt ceiling.

- The CBO "projects that if the debt limit is not raised, the Treasury would probably run out of cash and be unable to make its usual payments starting sometime in the first quarter of the next fiscal year, most likely in October or November."

EUROPE

ECB: The European Central Bank will likely adjust its forward guidance in line with its revised symmetrical inflation-targeting strategy on Thursday, though some Governing Council members may resist further significant modifications.

- The ECB could state its willingness to tolerate a moderate, transitory overshoot of its new 2% target, which replaces the old objective "close to, but below, 2%". While its current guidance already commits it to leaving key interest rates unchanged until inflation "robustly" converges close to its objective, its new formulation could also take on Isabel Schnabel's call for underlying inflation dynamics to visibly reflect changes in the medium-term outlook.

- Financial market analysts largely see a shift in policy guidance, but no shift in actual policy in July.

OVERNIGHT DATA

- US MBA: REFIS -3% SA; PURCH INDEX -6% SA THRU JUL 16 WK

- US MBA: UNADJ PURCHASE INDEX -18% VS YEAR-EARLIER LEVEL

- US MBA: 30-YR CONFORMING MORTGAGE RATE 3.11% VS 3.09% PREV

- US MBA: MARKET COMPOSITE -4.0% SA THRU JUL 16 WK

MARKETS SNAPSHOT

Key late session market levels

- DJIA up 257 points (0.74%) at 34768.83

- S&P E-Mini Future up 30 points (0.7%) at 4345.5

- Nasdaq up 97 points (0.7%) at 14595.91

- US 10-Yr yield is up 5.8 bps at 1.28%

- US Sep 10Y are down 18.5/32 at 134-3

- EURUSD up 0.0018 (0.15%) at 1.1799

- USDJPY up 0.41 (0.37%) at 110.26

- Gold is down $6.08 (-0.34%) at $1804.19

European bourses closing levels:

- EuroStoxx 50 up 70.34 points (1.78%) at 4026.68

- FTSE 100 up 117.15 points (1.7%) at 6998.28

- German DAX up 206.23 points (1.36%) at 15422.5

- French CAC 40 up 117.63 points (1.85%) at 6464.48

US TSY SUMMARY:: Reversing Mon's Risk Aversion Move

Tsys held broadly weaker but off session lows after the bell late Wednesday, bonds all the way back to last Friday's levels while equities completely erased Monday's rout as well, ESU1 marking 4348.0 in late trade.- No data to trade off of, Tsys took risk-on cues from higher global equities and softer EGBs and Gilts overnight.

- Tsys extend session lows after weak $24B 20Y auction re-open: drawing a high yield of 1.890% (2.120% last month) vs. 1.877% WI. Bid-to-cover 2.33 vs. 2.40 in June. Indirect take-up to 60.16% vs. 62.07% in June (58.77% 5M avg). Primary dealer take-up climbs to 20.91% vs. 22.60% 5M avg. Direct take-up 18.94% vs. 18.63% 5M avg.

- Moderate corporate issuance generated some two-way hedging on the day while Eurodollar futures say ongoing swap-tied flow in Greens (EDU3-EDM4).

- Focus turns to Thu's weekly claims (350k est vs. 360k prior, continuing claims (3.100M est vs. 3.241M prior).

- The 2-Yr yield is up 0.6bps at 0.2057%, 5-Yr is up 4.5bps at 0.7298%, 10-Yr is up 6bps at 1.2817%, and 30-Yr is up 5.2bps at 1.9295%.

US TSY FUTURES CLOSE

- 3M10Y +6.821, 124.188 (L: 113.97 / H: 125.191)

- 2Y10Y +6.203, 108.027 (L: 99.59 / H: 109.671)

- 2Y30Y +5.669, 173.02 (L: 165.571 / H: 176.058)

- 5Y30Y +1.321, 120.373 (L: 118.473 / H: 123.348)

- Current futures levels:

- Sep 2Y down 1.125/32 at 110-8.375 (L: 110-08.25 / H: 110-09.375)

- Sep 5Y down 9.5/32 at 124-6.25 (L: 124-06 / H: 124-18)

- Sep 10Y down 20/32 at 134-1.5 (L: 134-00 / H: 134-26.5)

- Sep 30Y down 1-20/32 at 163-25 (L: 163-11 / H: 165-23)

- Sep Ultra 30Y down 2-21/32 at 197-22 (L: 196-23 / H: 200-31)

US EURODOLLAR FUTURES CLOSE

- Sep 21 steady at 99.855

- Dec 21 steady at 99.805

- Mar 22 steady at 99.820

- Jun 22 -0.010 at 99.765

- Red Pack (Sep 22-Jun 23) -0.06 to -0.02

- Green Pack (Sep 23-Jun 24) -0.095 to -0.07

- Blue Pack (Sep 24-Jun 25) -0.115 to -0.10

- Gold Pack (Sep 25-Jun 26) -0.115

SHORT TERM RATES

US DOLLAR LIBOR: Latest Settles

- O/N -0.00162 at 0.08388% (-0.00188/wk)

- 1 Month -0.00237 to 0.08663% (+0.00300/wk)

- 3 Month -0.00037 to 0.13788% (+0.00363/wk) ** (Record Low: 0.11800% on 6/14)

- 6 Month +0.00038 to 0.15313% (+0.00100/wk)

- 1 Year +0.00125 to 0.24300% (+0.00088/wk)

- Daily Effective Fed Funds Rate: 0.10% volume: $70B

- Daily Overnight Bank Funding Rate: 0.08% volume: $259B

- Secured Overnight Financing Rate (SOFR): 0.05%, $855B

- Broad General Collateral Rate (BGCR): 0.05%, $373B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $348B

- (rate, volume levels reflect prior session)

- Tsy 2.25Y-4.5Y, $8.401B accepted vs. $31.868B submission

- Next scheduled purchases

- Thu 7/22 1010-1030ET: Tsy 22.5Y-30Y, appr $2.025B

- Fri 7/23 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

FED: Reverse Repo Operation

NY Fed reverse repo usage climbs to $886.206B from 71 counterparties vs. $848.102B on Tuesday (compares to June 30 record high of $991.939B).

PIPELINE: Indonesia Launched

- Date $MM Issuer (Priced *, Launch #)

- 07/21 $1.65B #Indonesia $600M 10Y 2.2%, $750M 30Y tap 3.1%, $300M 50Y 3.35%

- 07/21 $2.4B Carnival 7NCL 1st lien 4%a (adds to $3.5B 6NCL 5.75% on Feb 10)

- 07/21 $750M #Goldman Sachs 5Y 3.65%

- 07/21 $1B #Constellation Brands 10Y +100

- 07/21 $600M *Nonghyup Bank $300M each 3Y +55, 5Y +60

- 07/21 $Benchmark Chalco HK 3Y +125a, 5Y +145a

EGBs-GILTS CASH CLOSE: Flattening Retraces Ahead Of ECB Decision

The German and UK curves bear steepened Wednesday, retracing some of the earlier week's flattening amid a rebound in equities and ahead of the ECB meeting Thursday.

- Periphery spreads were flat/tighter in a broadly risk-on session.

- Little impactful on the headline front, with data being of a 2nd tier nature (UK public finances) and the only bond supply from Germany (Bund, EUR1.23bn allotted).

- Of note, the UK gov't demanded a re-write of the Northern Ireland protocol in the Brexit Withdrawal Agreement, setting up a showdown with the E.U. in coming months.

- Attention turns firmly to the ECB decision, which is the only calendar item of note Thursday.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 0.1bps at -0.715%, 5-Yr is up 0.6bps at -0.682%, 10-Yr is up 1.5bps at -0.395%, and 30-Yr is up 3bps at 0.088%.

- UK: The 2-Yr yield is up 0.9bps at 0.102%, 5-Yr is up 1.9bps at 0.301%, 10-Yr is up 3.9bps at 0.603%, and 30-Yr is up 4.6bps at 1.056%.

- Italian BTP spread down 1.3bps at 108.3bps / Spanish spread down 0.1bps at 67bps

FOREX: CAD and NOK Enjoy Oil Price Recovery

- With crude futures retracing the majority of Monday's sell-off, the Canadian Dollar and Norwegian Krone were the clear outperformers on Wednesday.

- After taking out the overnight lows through 1.2675, USDCAD saw steady supply throughout US hours, with little to halt the CAD ascent. 1.2526 marked the low before a small bounce but USDCAD remains 1% lower for the session. CADJPY enjoyed a 1.5% rally, continuing the bounce from the 85.43 April lows matched on Monday.

- In similar vein, NOK enjoyed a strong reversal higher (EURNOK -1.24%) after reaching near 7-month lows during Monday's oil price rout.

- Overall greenback weakness helped favour NZD and GBP, both rising roughly 0.7%.

- Firmer risk sentiment left the Japanese Yen trading with a heavy tone for a second consecutive session. USDJPY rose back above 110 and eyes key resistance at 110.70, Jul 14 high in order to maintain technical bearish conditions.

- EURUSD held a relatively narrow 50 pip trading range as futures volumes indicated limited interest in the pair despite rising back to the 1.18 mark. Markets await tomorrow's July ECB monetary policy statement and accompanying press conference.

- With President Lagarde taking the spotlight, US jobless claims and consumer confidence data are unlikely to move the dial, while in the UK, MPC member Broadbent may deliver remarks at a BOE hosted event.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.