-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: China CFETS Yuan Index Up 0.01% In Week of Nov 22

MNI: PBOC Net Injects CNY76.7 Bln via OMO Monday

MNI ASIA OPEN: Fed Gov Waller on NFP: Expect Very High Jobs

EXECUTIVE SUMMARY

- MNI REALITY CHECK: US July Hiring Unchecked By Covid Surge

- MNI BRIEF: Waller 'Highly Skeptical' of Fed Digital Currency

- FED GOV WALLER: EXPECTS JULY EMPLOYMENT REPORT WILL SHOW VERY HIGH JOBS, Bbg

- MNI STATE OF PLAY: Split BOE MPC Opens Door To Earlier QT

- MNI BRIEF: BOE Aims For Low Key QT Start

US

FED: Federal Reserve Governor Christopher Waller expressed strong skepticism about the need for the central bank to issue a digital currency, saying it wouldn't solve any major problem confronting the U.S. payment system and any potential benefits could be accomplished through other means.

- "At this early juncture in the Fed's discussions, I think the first order of business is to ask whether there is compelling need for the Fed to create a digital currency. I am highly skeptical," he said in prepared remarks for a speech to the American Enterprise Institute. "After careful consideration, I am not convinced as of yet that a CBDC would solve any existing problem that is not being addressed more promptly and efficiently by other initiatives," he said.

- SAYS HIS OUTLOOK FOR U.S. ECONOMY IS VERY OPTIMISTIC, Bbg

- EXPECTS JULY EMPLOYMENT REPORT WILL SHOW VERY HIGH JOBS, Bbg

- INFLATION IS AN UPSIDE RISK, Bbg

- "This recovery is in full swing," said Tom Gimbel, founder and CEO of the LaSalle Network, adding that his staffing businesses in July set a new record for 2021. "We saw an increase in temporary staffing orders and permanent position orders that were up over 100% over a year ago and up over 20% over 2019." For more see MNI Policy main wire at 1317ET.

UK

BOE: The Bank of England Monetary Policy Committee's tightening strategy review found a compromise solution with the policy rate threshold to trigger quantitative tightening not scrapped, but lowered from 1.5% to just 0.5%, with guidance stressing that QT should start at a gradual and predictable pace by not reinvesting the proceeds from Bank's maturing gilts, rather than selling existing holdings.

- The MPC's review left key questions hanging, seeming to reflect a lack of consensus on the committee. While negative rates were finally added to the policy toolkit, no answer was given to the question of how far below zero the effective lower bound was thought to be.

- The MPC stated that the factors determining where the QT threshold should include the probable impact of policy changes, that is the policy multipliers for QT and Bank Rate, and policymaker's "judgement about the effective lower bound." For more see MNI Policy main wire at 1150ET.

BOE: The Bank of England Monetary Policy Committee strategy review appears to aim at a low key start to quantitative tightening. The new approach is that when Bank Rate hits 0.5%, which the Bank's market rate curves shows is only fully priced in three years down the line, the MPC will look to stop reinvesting the proceeds of maturing gilts and they reckon this should have a muted effect on yields, with the review stating that if unwind is carried out "in a gradual and predictable manner (the impact) .. is likely to be smaller than that of asset purchases."

- The fact that the MPC can now use negative rates is one factor that helped lower the QT threshold from the previous 1.5% but the MPC did not agree a collective view of where the effective lower bound is and nor did the Bank set out the details on how tiering will work on negative rates. The Monetary Policy Report showed the Bank setting out gloomy growth forecasts for 2023 and 2024, with four quarter growth at 1.3% in Q3 2023, 2024 and inflation falling back below the 2.0% target.

OVERNIGHT DATA

- US JOBLESS CLAIMS -14K TO 385K IN JUL 31 WK

- US PREV JOBLESS CLAIMS REVISED TO 399K IN JUL 24 WK

- US CONTINUING CLAIMS -0.366M to 2.930M IN JUL 24 WK

- US JUN TRADE GAP -$75.7B VS MAY -$71.0B

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 181.74 points (0.52%) at 34974.13

- S&P E-Mini Future up 16.75 points (0.38%) at 4411.5

- Nasdaq up 100.4 points (0.7%) at 14881.16

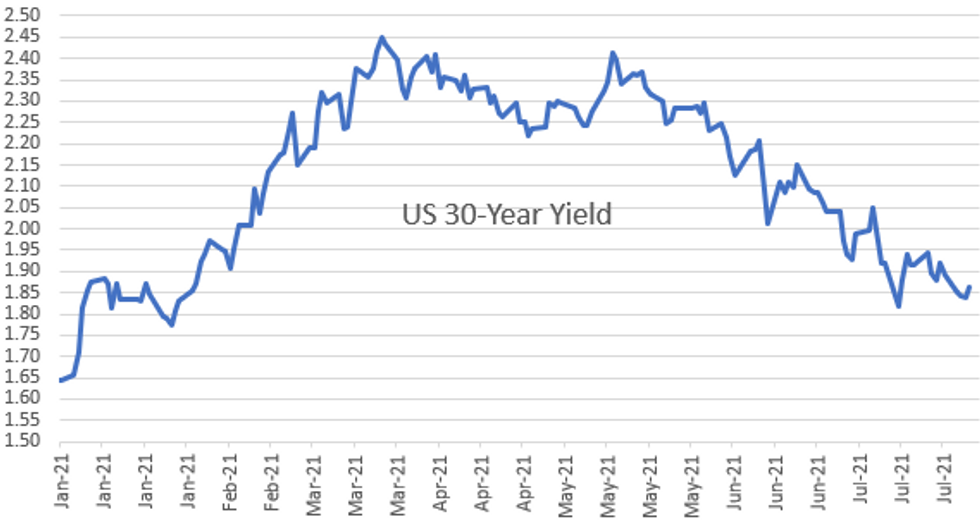

- US 10-Yr yield is up 3.5 bps at 1.2168%

- US Sep 10Y are down 11.5/32 at 134-15

- EURUSD down 0.0001 (-0.01%) at 1.1837

- USDJPY up 0.29 (0.26%) at 109.77

- WTI Crude Oil (front-month) up $0.88 (1.29%) at $69.02

- Gold is down $7.96 (-0.44%) at $1803.84

- EuroStoxx 50 up 16.18 points (0.39%) at 4161.08

- FTSE 100 down 3.43 points (-0.05%) at 7120.43

- German DAX up 52.54 points (0.33%) at 15744.67

- French CAC 40 up 34.96 points (0.52%) at 6781.19

US TSY SUMMARY: Risk-On Ahead July Employment Report

Tsys trading weaker after the bell, just off midday lows on modest risk-on tone with equities firmer (ESU1 +16.0). Generally sedate summer trade persisted while traders turn focus on Fed Gov Waller virtual event on digital currency, MN Fed Pres Kashkari at 1600ET, and Fri's headline July employment data (+870k est vs. +850k prior).- Futures had pared gains ahead weekly claims, drew two-way flurry on light volume on more-or-less in-line read (385k vs. 383k est). Futures bounce off early session low with Tsys holding mixed briefly. Support for bonds evaporated soon after, intermediates lead the sell-off into midday.

- Fed Gov Waller discussed Central Bank digital currency conf before going off script during Q&A -- touched on inflation, Fri's employment data:

- SAYS HIS OUTLOOK FOR U.S. ECONOMY IS VERY OPTIMISTIC, Bbg

- EXPECTS JULY EMPLOY REPORT WILL SHOW VERY HIGH JOBS, Bbg

- INFLATION IS AN UPSIDE RISK, Bbg

Short preview of NFP estimates breakdown on Bbg:

- Median est of +870k with 64 economists responding

- Range of +350k low to +1.2M high

- 13 economists estimate over +1M

US TSY FUTURES CLOSE

- 3M10Y +3.315, 116.448 (L: 111.375 / H: 117.448)

- 2Y10Y +1.363, 101.319 (L: 98.08 / H: 101.924)

- 2Y30Y -0.001, 165.471 (L: 163.385 / H: 166.354)

- 5Y30Y -2.221, 113.738 (L: 112.809 / H: 116.469)

- Current futures levels:

- Sep 2Y down 1.375/32 at 110-9.5 (L: 110-09 / H: 110-10.875)

- Sep 5Y down 7.5/32 at 124-10.75 (L: 124-08.5 / H: 124-18.5)

- Sep 10Y down 11/32 at 134-15.5 (L: 134-12.5 / H: 134-29)

- Sep 30Y down 14/32 at 165-24 (L: 165-16 / H: 166-18)

- Sep Ultra 30Y down 17/32 at 201-3 (L: 200-19 / H: 202-13)

US EURODOLLAR FUTURES CLOSE

- Sep 21 -0.010 at 99.870

- Dec 21 -0.010 at 99.825

- Mar 22 -0.010 at 99.845

- Jun 22 -0.020 at 99.795

- Red Pack (Sep 22-Jun 23) -0.06 to -0.025

- Green Pack (Sep 23-Jun 24) -0.065

- Blue Pack (Sep 24-Jun 25) -0.065 to -0.060

- Gold Pack (Sep 25-Jun 26) -0.055 to -0.040

SHORT TERM RATES

US DOLLAR LIBOR: Latest Settles

- O/N -0.00250 at 0.07900% (+0.00212/wk)

- 1 Month +0.00650 to 0.09575% (+0.00525/wk)

- 3 Month +0.00363 to 0.12538% (+0.00763/wk) ** (Record Low: 0.11800% on 6/14)

- 6 Month -0.00650 to 0.14850% (-0.00462/wk)

- 1 Year +0.00175 to 0.23163% (-0.00350/wk)

- Daily Effective Fed Funds Rate: 0.10% volume: $71B

- Daily Overnight Bank Funding Rate: 0.08% volume: $250B

- Secured Overnight Financing Rate (SOFR): 0.05%, $926B

- Broad General Collateral Rate (BGCR): 0.05%, $385B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $353B

- (rate, volume levels reflect prior session)

- Tsy 22.5Y-30Y, $2.001B accepted vs. $4.931B submission

- Next scheduled purchase

- Fri 8/06 1010-1030ET: Tsy 0Y-2.25Y, appr $12.425B

FED: Reverse Repo Operations

NY Fed reverse repo usage climbs to $944.335B from 70 counterparties vs. $931.775B on Wednesday. Compares to last Friday's new record high of $1.039.394B

PIPELINE: $5B Amgen 4Pt Leads Issuance, Still Waiting on Ford Motor Cr

- Date $MM Issuer (Priced *, Launch #)

- 08/05 $5B #Amgen 4pt: $1.25B 7Y +65, $1.25B 10Y+85, $1.15B 20Y+105, $1.35B 30Y+115

- 08/05 $1.7B #Westlake Chem $300M 3NC1 +55, $350M 20Y +125, $600M 30Y +140, $450M 40Y +165

- 08/05 $850M #So-Cal Edison $400M 2Y +50, $450M 3Y +60

- 08/05 $600M #Mid-America Appts, $300M each WNG 5Y +47, WNG 30Y +107

- 08/05 $Benchmark Ford Motor Co 5Y 2.875%a

EGBs-GILTS CASH CLOSE: Bear Flattening Around Split BoE Decision

The Gilt curve bear flattened Thursday while periphery spreads tightened sharply.

- The BoE outcome was largely as expected, including a split 7-1 vote, though as our Policy Team put it, their tightening strategy review "opens the door to earlier QT". Gilts weakened sharply after the decision but had fully recovered by the time the press conference started an hour later.

- The afternoon saw global core FI weaken anew though, with Bunds coming off session highs and Gilts retesting Wednesday's lows.

- Earlier, German factory orders beat expectations. In supply, Spain sold E4.7bln of Bono/Obli, while France sold E7.5bln of LT OAT.

- Friday sees Belgium conduct an ORI for E0.5bln. Most attention will be on US payrolls data.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 0.5bps at -0.776%, 5-Yr is up 0.6bps at -0.762%, 10-Yr is up 0.3bps at -0.498%, and 30-Yr is down 0.7bps at -0.047%.

- UK: The 2-Yr yield is up 2.9bps at 0.092%, 5-Yr is up 1bps at 0.234%, 10-Yr is up 1.2bps at 0.524%, and 30-Yr is up 0.2bps at 0.935%.

- Italian BTP spread down 2.6bps at 102.8bps / Spanish down 2.8bps at 70.3bps

FOREX: Major Pairs Subdued Ahead Of U.S. Employment Data

- The Greenback is broadly unchanged on Thursday as markets tentatively await July jobs data from the U.S on Friday. EURUSD managed just a 29-pip daily trading range.

- USDJPY firmed a quarter of a percent, narrowly extending Wednesday's strong bounce following the ISM services data. Gains for the pair remain to be considered corrective with firm short-term resistance at 110.70, Jul 14 high, a break of which would alter the picture.

- The Bank of England MPC decision spurred some volatility in GBP but the price swings amounted to little. GBPUSD held onto gains seen prior to the decision/statement, settling around 1.3930 (+0.3%).

- Similar gains were seen for AUD and CAD, as oil prices steadied and commodity indices approach the close in the green.

- Overnight RBA's Lowe is due to testify before the House of Representatives Standing Committee, before the release of the RBA's Monetary Policy Statement.

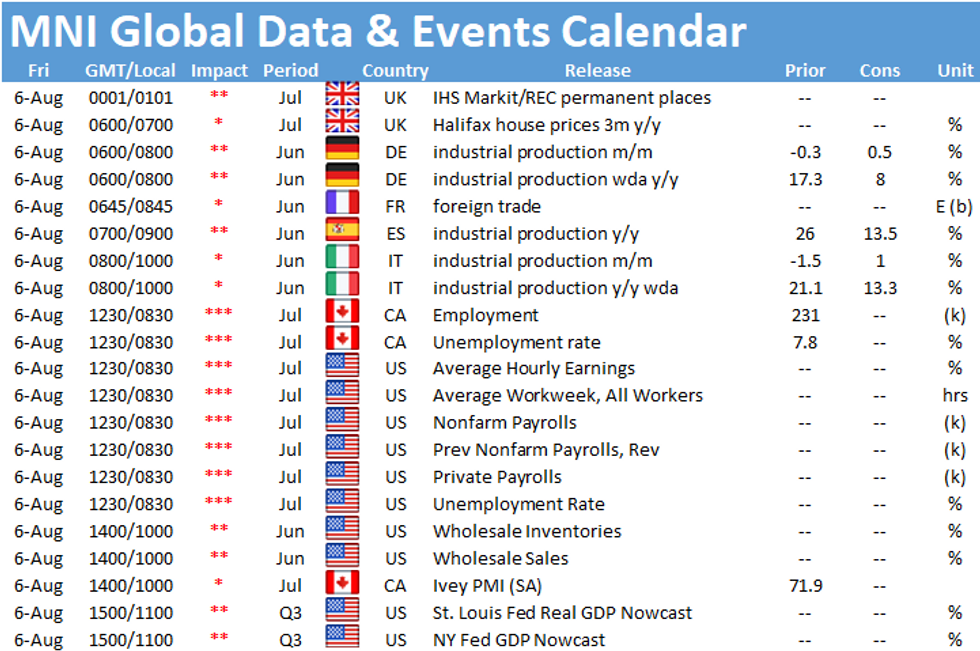

- Friday's docket will be headlined by US employment data where the current Bloomberg estimate expects +870k change in Non-farm payrolls and the unemployment rate to fall to 5.7%. Canadian employment data will also be published.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.