-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Nov Job Gains, Fed Blackout, CPI/PPI Ahead

MNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI ASIA OPEN: 30Y Auction Sees 4th Consecutive Tail

EXECUTIVE SUMMARY

- MNI INTERVIEW: US Price Jump Seen Straining Longer Term Views

- US JUL FINAL DEMAND PPI +1.0%, EX FOOD/ENERGY +1.0%

- SAN FRANCISCO TO REQUIRE VACCINATION TO ENTER RESTAURANTS, BARS, Bbg

US

FED: Any rise in how sensitive Americans are to the recent burst of inflation when setting longer-term expectations so far remains within a pattern of stability dating back to the 1990s, Chicago Fed economists told MNI.

- "Even if sensitivity is high at the moment, it's not clear that it will remain high," researcher Gadi Barlevy said in an interview with his colleagues Jonas Fisher and May Tysinger. Their research is based on inflation views from the Michigan consumer confidence index and the Philadelphia Fed survey of economists.

- Fed officials face tough calls around whether inflation triggered by the re-opening of the economy after the pandemic struck will lift price gains to around 2% after years of downside misses, or whether their stimulus will keep prices well above that mark. Chair Jerome Powell has called the price surge transitory while others see a replay of past decades where consumers and firms bid up prices out of fear that inflation would surge continually

OVERNIGHT DATA

US JOBLESS CLAIMS -12K TO 375K IN AUG 07 WK

US PREV JOBLESS CLAIMS REVISED TO 387K IN JUL 31WK

US CONTINUIING CLAIMS -0.114M TO 2.866M IN JUL 31 WK

US JUL FINAL DEMAND PPI +1.0%, EX FOOD/ENERGY +1.0%

US JUL FINAL DEMAND PPI EX FOOD/ENERGY/TRADE SRVCS +0.9%

US JUL FINAL DEMAND PPI Y/Y +7.8%, EX FOOD/ENERGY Y/Y +6.2%

US JUL PPI: FOOD -2.1%; ENERGY +2.6%

US JUL PPI: GOODS +0.6%; SERVICES +1.1%; TRADE +1.7%

MARKET SNAPSHOT

Key late session market levels:

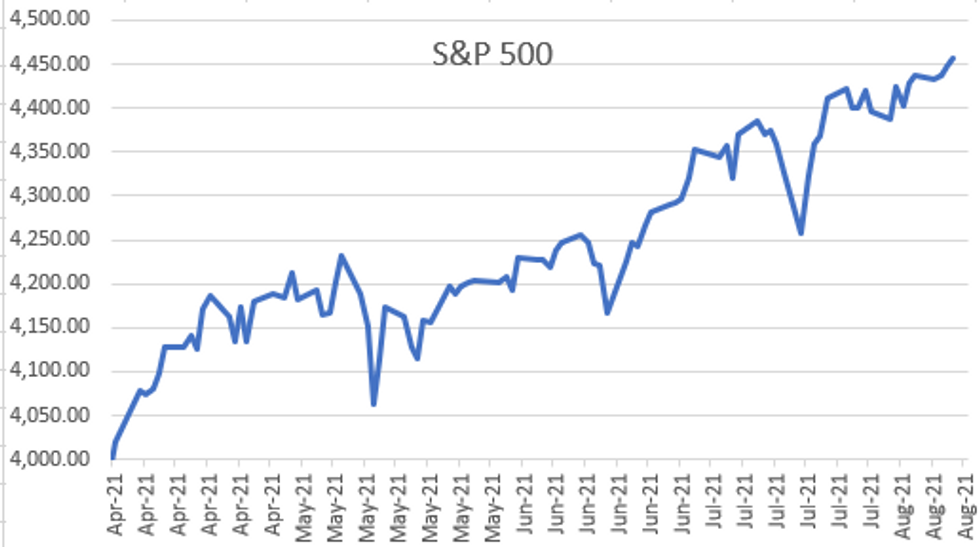

DJIA down 27.15 points (-0.08%) at 35451.99

S&P E-Mini Future up 11 points (0.25%) at 4450.5

Nasdaq up 41.1 points (0.3%) at 14806.91

US 10-Yr yield is up 3.4 bps at 1.364%

US Sep 10Y are down 3.5/32 at 133-15

EURUSD down 0.0007 (-0.06%) at 1.1732

USDJPY up 0.03 (0.03%) at 110.45

WTI Crude Oil (front-month) down $0.27 (-0.39%) at $68.99

Gold is up $1.16 (0.07%) at $1753.03

European bourses closing levels:

EuroStoxx 50 up 20 points (0.48%) at 4226.33

FTSE 100 down 26.91 points (-0.37%) at 7193.23

German DAX up 111.42 points (0.7%) at 15937.51

French CAC 40 up 24.48 points (0.36%) at 6882.47

US TSY SUMMARY: Bond Auction Tails for Fourth Time

Thursday's trade felt more animated despite lighter volumes (TYU<885k after the bell) compared to Wed that saw nearly twice the volume and in-line July CPI and lower than est core CPI (0.3%).- Tsy futures extended early session lows after PPI came out higher than forecasted (+1.0% vs. +0.6%), weekly claims as expected (-12k to 375k), while continuing claims -.114m to 2.866M. Rates held narrow range on two-way trade through midday in anticipation of 30Y bond auction.

- Yield curves bear steepened as bonds sold off/extended session lows after the fourth consecutive 30Y auction tail: 2.040% vs. 2.030% WI; 2.21x bid-to-cover off 2.29x 5 auction avg.

- Performance not as poor as the prior July auction's 2.8bp tail, or 1.8bp 3 month average for that matter -- probably what spurred round of buying/short-set unwinds in minutes after results.

- Bond futures remain weaker but off lows amid renewed selling in 10s and 30s from misc accts includes prop and fast$. No deal-tied hedging after $40B high-grade debt issued in first half of the week.

- The 2-Yr yield is up 0.6bps at 0.2247%, 5-Yr is up 2bps at 0.8278%, 10-Yr is up 3.4bps at 1.364%, and 30-Yr is up 1.3bps at 2.0114%.

US TSY FUTURES CLOSE

- 3M10Y +3.878, 131.335 (L: 125.769 / H: 132.686)

- 2Y10Y +2.959, 113.737 (L: 109.797 / H: 115.487)

- 2Y30Y +0.651, 178.274 (L: 176.678 / H: 181.083)

- 5Y30Y -0.887, 118.003 (L: 117.774 / H: 120.412)

- Current futures levels:

- Sep 2Y down 0.5/32 at 110-7.5 (L: 110-07.375 / H: 110-08.375)

- Sep 5Y down 2.5/32 at 123-25.75 (L: 123-25.25 / H: 123-31.25)

- Sep 10Y down 3.5/32 at 133-15 (L: 133-13 / H: 133-25)

- Sep 30Y down 3/32 at 162-30 (L: 162-18 / H: 163-14)

- Sep Ultra 30Y down 7/32 at 195-14 (L: 194-19 / H: 196-11)

US EURODOLLAR FUTURES CLOSE

- Sep 21 steady at 99.870

- Dec 21 steady at 99.815

- Mar 22 steady at 99.840

- Jun 22 -0.005 at 99.790

- Red Pack (Sep 22-Jun 23) -0.015 to -0.005

- Green Pack (Sep 23-Jun 24) -0.02 to -0.015

- Blue Pack (Sep 24-Jun 25) -0.015 to -0.01

- Gold Pack (Sep 25-Jun 26) -0.015 to -0.01

SHORT TERM RATES

US DOLLAR LIBOR: Latest Settles

- O/N -0.00063 at 0.07800% (-0.00050/wk)

- 1 Month -0.00113 to 0.09550% (+0.00025/wk)

- 3 Month +0.00350 to 0.12475% (-0.00363/wk) ** (Record Low: 0.11800% on 6/14)

- 6 Month +0.00000 to 0.15738% (+0.00688/wk)

- 1 Year -0.00300 to 0.23988% (+0.00250/wk)

- Daily Effective Fed Funds Rate: 0.10% volume: $68B

- Daily Overnight Bank Funding Rate: 0.08% volume: $248B

- Secured Overnight Financing Rate (SOFR): 0.05%, $904B

- Broad General Collateral Rate (BGCR): 0.05%, $371B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $350B

- (rate, volume levels reflect prior session)

- TIPS 1Y-7.5Y, $2.025B accepted vs. $4.200B submission

- Next scheduled purchases

- Fri 8/13 1010-1030ET: Tsy 0Y-2.25Y, appr $12.425B

- Mon 8/16 1010-1030ET: Tsy 10Y-22.5Y, appr $1.425B

- Tue 8/17 1010-1030ET: TIPS 7.5Y-30Y, appr $1.225B

- Wed 8/18 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.425B

- Thu 8/19 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

- Fri 8/20 1010-1030ET: Tsy 22.5Y-30Y, appr $2.025B

FED: Reverse Repo Operations, New High

NY Fed reverse repo usage climbs to $1,000.460B from 70 counterparties vs. $998.654B on Tuesday. Compares to record high of $1,039.394B on Friday, July 30.

PIPELINE: No New Issuance

- Date $MM Issuer (Priced *, Launch #)

- 08/12 No new $Benchmark issuance Thursday

- $4.8B Priced Wednesday

- 08/11 $1.1B *Air Lease Corp $600M 3Y +60, $500M 7Y +125, relaunched, upsized to $1.1B

- 08/11 $1B *Royal Caribbean 5NC 5.5%

- 08/11 $1B *Equifax 10Y +105

- 08/11 $800M *Public Service Co Oklahoma $400M 10Y +90, $400M 30Y +115

- 08/11 $500M *Ventas Realty 10Y +120

- 08/11 $400M *Sichuan Development 5Y 2.8%

EGBs-GILTS CASH CLOSE: Peripheries Impress

Bunds and Gilts weakened slightly Thursday, with Gilts underperforming amid bear steepening.

- Periphery spreads took advantage, with Italy outperforming. 10Y BTP spreads/Bunds came tantalizingly close to the key 100bp mark again.

- Bonds initially pushed lower after the higher US PPI print, but we have since faded off the lows.

- Little in the way of European-specific catalysts otherwise.

- Issuance is done until Tuesday next week, and there are no central bank speakers.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 0.2bps at -0.746%, 5-Yr is up 0.4bps at -0.724%, 10-Yr is up 0.4bps at -0.46%, and 30-Yr is up 0.2bps at -0.007%.

- UK: The 2-Yr yield is up 3.2bps at 0.155%, 5-Yr is up 3.9bps at 0.313%, 10-Yr is up 3bps at 0.601%, and 30-Yr is up 4.1bps at 0.987%.

- Italian BTP spread down 2.7bps at 100.4bps/ Spanish down 1.9bps at 68.2bps

FOREX: GBP, AUD and NZD Give Up US CPI Inspired Gains

- Broad dollar indices are trading around 0.15% higher on Thursday as US yields reversed yesterday's move lower.

- G10 movers were concentrated in Antipodean FX and Sterling, all retreating over 0.5% and given back the entirety of yesterday's advance.

- EURUSD and USDJPY lacked inspiration both trading in incredibly narrow 20-pip ranges. EURUSD's lack of traction higher leaves the 1.1704-06 key support vulnerable in the short-term.

- EURGBP had a notable move back to the 0.85 level, that had marked previous support for the pair before the move down to 0.8450, representing the lowest level since February last year. Moving average studies remain in a bear mode highlighting a downside theme.

- For cable, the pair remains below the 50-day EMA at 1.3886, the key upside level. Support undercuts at the Jul 27 low of 1.3767. Should this give way, the outlook deteriorates, opening scope toward the bear trigger of 1.3572.

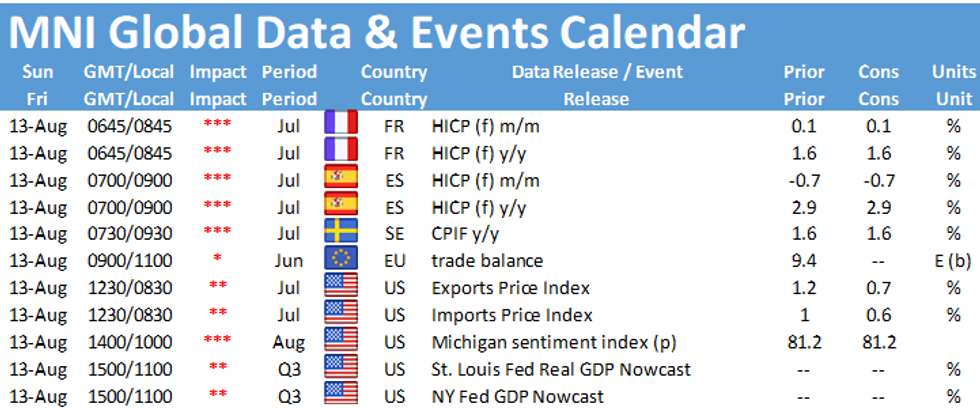

- Friday's docket is doubtful to trigger any significant currency volatility, with University of Michigan Sentiment data unlikely to move the dial. Attention will likely turn towards next week's US retail sales report as well as the latest set of FOMC minutes on Wednesday.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.