-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Chaotic US Pullout from Afghanistan

EXECUTIVE SUMMARY

- Spike in geopolitical risk tied to devolving US pullout from Afghanistan situation

- MNI: Fed Repo Facility Seen As 1st Step To Address Market Clogs

- MNI REALITY CHECK: US July Retail Sales Seen Slipping

- CANADA: Conservatives Lead In Forum Opinion Poll As Campaign Kicks Off

- OPEC+ SEES NO NEED TO RELEASE MORE OIL INTO MARKET AT THE MOMENT BEYOND WHAT IS ALREADY PLANNED DESPITE U.S. CALLS - FOUR OPEC+ SOURCES

US TSY SUMMARY: Equity Bounce Tempers Tsy Risk-off Bid

Second half recovery in equities tempered strong risk-off action in rates in the first half Monday. No significant data -- geopolitical risk drivers.

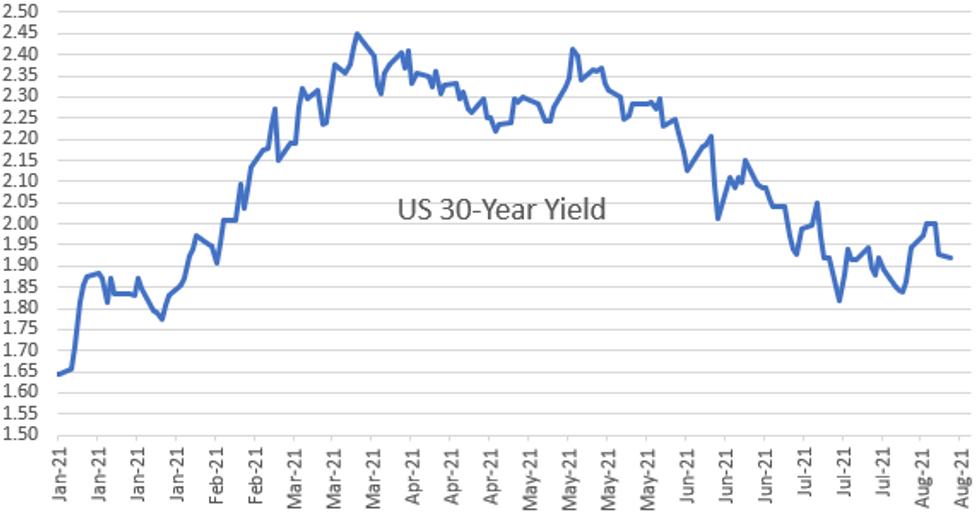

- Session volumes were already robust on geopolitical risk tied to devolving US pullout from Afghanistan situation, remains strong with equities trading weaker after the bell. 10YY 1.2217% low; 30YY slips to 1.8843% low.

- Sources report real- and fast$ buying 10s and 30s, prop and fast$ selling 2s-5s over last 45 minutes. Modest pick-up in Sep/Dec Tsy futures rolling ahead Aug 31 first notice contributed.

- Bonds extended early curve flattening rally: Tsy 30Y futures made new session highs on the heels of large 5s/ultra-bond flattener's significant buy-through in the ultra-bond leg: ratio slightly over the CME's 6:1 spd ratio, closer to 7:1:

- -17,773 FVU 124-06.5, post time offer at 0927:25ET

- +2,565 WNU 199-23, well through the 199-17 post-time offer

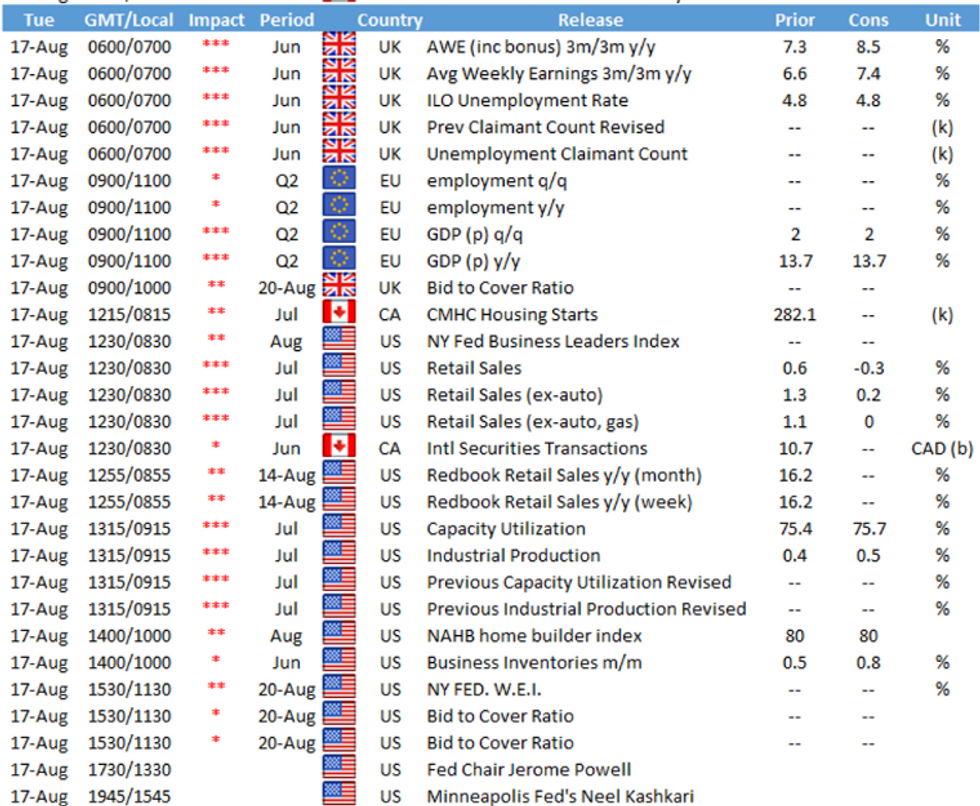

- Data picks up Tuesday w/Retail Sales (-0.2% est vs. 0.6% prior), IP/Cap-U and Fed speak including Fed Chair Powell ahead Wed's FOMC minutes.

- The 2-Yr yield is down 0.2bps at 0.2052%, 5-Yr is down 2.6bps at 0.7473%, 10-Yr is down 2.8bps at 1.2483%, and 30-Yr is down 1.1bps at 1.9182%.

US

FED: The Federal Reserve's new standing repo facility is likely just the first step in reforms guarding against a repeat of September 2019's money market frictions and last March's dash for cash, though relaxing supplementary leverage ratios may be politically out of reach, former Fed officials and Congressional sources told MNI.

- "This is a good first step, but we need to do a bunch of other stuff," said William Dudley, former New York Fed President. "I'd like to see access to the standing repo facility be a lot broader than just the primary dealers," he said, also suggesting central clearing for Treasury dealer-to-customer trades, changes to GSIB buckets imposing additional capital buffers on the most important banks, and better market transparency. For more see MNI Policy main wire at 0955ET.

- "It's possible that we could see a little deceleration in overall retail sales," said Jack Kleinhenz, chief economist at the National Retail Federation.

- Retailers have been expecting spending to move away from goods toward services through the summertime, Kleinhenz said, and household purchases of big-ticket items like vehicles and furniture, mostly made earlier this year, don't typically happen more than just a few times a year. Back to school shopping through July should push up receipts at clothing and clothing accessory stores, general merchandise and department stores, and electronics and appliance stores, Kleinhenz added, as many schools return to in-person learning this fall. For more see MNI Policy main wire at 1328ET.

CANADA: Conservatives Lead In Forum Opinion Poll As Campaign Kicks Off

The two federal opinion polls carried out in on 15 August show a sharp decline in support Prime Minister Justin Trudeau's Liberal Party compared to polling carried out before the announcement of the election to be held on 20 September. The Forum Research poll gives the centre-right Conservatives their first polling lead since September 2020. The Mainstreet Research poll gives the Liberals a 3% lead, which if reflected in the final result would deliver another Liberal minority.

- Mainstreet Research Federal Polling: Liberals: 33% (-), Conservative: 30% (-4), New Democratic Party (NDP): 19% (+3), Bloc Quebecois (BQ): 6% (-2), People's Party (PPC): 6% (+4), Greens (GPC): 4% (-3). / August 15, 2021 / n=1331 / MOE 2.7% / IVR (% Change with 2019 election)

- Forum Research Federal Polling: Conservative: 31% (-3), Liberals: 28% (-5), NDP: 19% (+3), Greens: 8% (+1), BQ: 7% (-1), People's Party (PPC): 5% (+3), . August 15, 2021 / n=1203 / MOE 3% / IVR (% Change with 2019 election)

- These polls certainly sit as outliers compared to those carried out prior to the election announcement. The 5% and 6% support recorded for the right-wing populist People's Party of Canada are the highest opinion polling support levels the party has recorded since the 2019 federal election.

OVERNIGHT DATA

- US NY FED EMPIRE STATE MFG INDEX 18.3 AUG

- US NY FED EMPIRE MFG NEW ORDERS 14.8 AUG

- US NY FED EMPIRE MFG EMPLOYMENT INDEX 12.8 AUG

- US NY FED EMPIRE MFG PRICES PAID INDEX 76.1 AUG

- CANADA JUN WHOLESALE SALES -0.8%; EX-AUTOS -1.4%

- CANADA JUN WHOLESALE INVENTORIES -0.6%

- CANADA JUN MANUFACTURING SALES +2.1% MOM

- CANADA JUN FACTORY INVENTORIES +1.9%; INVENTORY-SALES RATIO 1.56

MARKET SNAPSHOT

Key late session market levels:

- DJIA up 9.58 points (0.03%) at 35524.3

- S&P E-Mini Future down 0.5 points (-0.01%) at 4461.75

- Nasdaq down 62.8 points (-0.4%) at 14760.39

- US 10-Yr yield is down 2.8 bps at 1.2483%

- US Sep 10Y are up 12.5/32 at 134-11

- EURUSD down 0.002 (-0.17%) at 1.1777

- USDJPY down 0.38 (-0.35%) at 109.21

- WTI Crude Oil (front-month) down $0.99 (-1.45%) at $67.27

- Gold is up $7.26 (0.41%) at $1787.05

- EuroStoxx 50 down 27.26 points (-0.64%) at 4202.44

- FTSE 100 down 64.73 points (-0.9%) at 7153.98

- German DAX down 51.71 points (-0.32%) at 15925.73

- French CAC 40 down 57.27 points (-0.83%) at 6838.77

US TSY FUTURES CLOSE

- 3M10Y -3.099, 118.742 (L: 116.591 / H: 122.597)

- 2Y10Y -1.948, 104.616 (L: 102.052 / H: 107.456)

- 2Y30Y -0.292, 171.509 (L: 168.319 / H: 173.283)

- 5Y30Y +1.573, 117.012 (L: 114.591 / H: 117.437)

- Current futures levels:

- Sep 2Y up 0.625/32 at 110-8.875 (L: 110-08.5 / H: 110-09.375)

- Sep 5Y up 6.25/32 at 124-6.5 (L: 124-02 / H: 124-10)

- Sep 10Y up 12/32 at 134-10.5 (L: 134-02 / H: 134-18)

- Sep 30Y up 24/32 at 165-5 (L: 164-20 / H: 165-26)

- Sep Ultra 30Y up 32/32 at 199-11 (L: 198-17 / H: 200-21)

US EURODOLLAR FUTURES CLOSE

- Sep 21 steady at 99.875

- Dec 21 steady at 99.820

- Mar 22 +0.005 at 99.850

- Jun 22 +0.005 at 99.805

- Red Pack (Sep 22-Jun 23) +0.010 to +0.040

- Green Pack (Sep 23-Jun 24) +0.045 to +0.070

- Blue Pack (Sep 24-Jun 25) +0.065 to +0.070

- Gold Pack (Sep 25-Jun 26) +0.055 to +0.060

Short Term Rates

US DOLLAR LIBOR: Latest Settles

- O/N +0.00062 at 0.07825% (-0.00087 total last wk)

- 1 Month -0.00425 to 0.08850% (-0.00250 total last wk)

- 3 Month +0.00025 to 0.12450% (-0.00413 total last wk) ** (Record Low: 0.11800% on 6/14)

- 6 Month -0.00125 to 0.15538% (+0.00613 total last wk)

- 1 Year -0.00200 to 0.23675% (+0.00138 total last wk)

- Daily Effective Fed Funds Rate: 0.10% volume: $65B

- Daily Overnight Bank Funding Rate: 0.08% volume: $249B

- Secured Overnight Financing Rate (SOFR): 0.05%, $893B

- Broad General Collateral Rate (BGCR): 0.05%, $385B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $364B

- (rate, volume levels reflect prior session)

- Tsy 10Y-22.5Y, $1.401B accepted vs. $3.259B submission

- Next scheduled purchases

- Tue 8/17 1010-1030ET: TIPS 7.5Y-30Y, appr $1.225B

- Wed 8/18 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.425B

- Thu 8/19 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

- Fri 8/20 1010-1030ET: Tsy 22.5Y-30Y, appr $2.025B

FED: REVERSE REPO OPERATION

NY Fed reverse repo usage slips to $1,036.418 from 70 counterparties vs. 1,050.941B on Friday. Record: $1,087.342B on Thursday, Aug 12.

PIPELINE: Athene, Southwest Energy Outpace Pfizer

- Date $MM Issuer (Priced *, Launch #)

- 04/16 $1.25B #Athene Global Funding $550M 3Y +50, $350M 3Y FRN/SOFR+56, $350M 7Y +95

- 04/16 $1.2B #Southwest Energy 8.5NC3.5 5.37

- 04/16 $1B #Pfizer 10Y +53

- 04/16 $600m #Norfolk Southern 30Y +103

- 04/16 $Benchmark HDFC Bank inaugural 5Y

EGBs-GILTS: Bund Flattening Reverses

Bunds and Gilts weakened all morning but rebounded in the afternoon as equities headed down. Geopolitical risk (Afghanistan headlines) and weak China economic data weighed on risk appetite.

- The Gilt curve bear flattened, but Bunds notably reversed early flattening (5s30s hit lowest since early Feb) to end steeper. Most yields changed across the UK and German curves.

- Periphery spreads widened, but narrowed vs widest levels in mid-afternoon. BTPs underperformed.

- UK said it would sell a 2nd Green Gilt in October, following the 1st in September.

- No data flow today, but picks up Tuesday with UK and Eurozone employment numbers, and Eurozone 2Q prelim GDP. Also Tuesday, UK sells GBP2bln of Jan-46 Gilt and Germany sells E6bln of Schatz.

- Germany: The 2-Yr yield is unchanged at -0.739%, 5-Yr is up 0.3bps at -0.727%, 10-Yr is down 0.2bps at -0.469%, and 30-Yr is up 0.2bps at -0.02%.

- UK: The 2-Yr yield is up 0.8bps at 0.144%, 5-Yr is up 0.7bps at 0.302%, 10-Yr is unchanged at 0.573%, and 30-Yr is unchanged at 0.961%.

- Italian BTP spread up 2.1bps at 103.4bps / Spanish up 0.8bps at 69.3bps

FOREX: Souring Risk Sentiment Sees Modest Haven Demand

- Developments in Afghanistan combined with softer Chinese economic activity data overnight kept risk on the backfoot to start the week.

- As such, the Japanese Yen and Swiss Franc were favoured amid a slightly stronger greenback against most other G10 currencies. USDJPY extended Friday's move below 110, putting pressure on the 109 handle. Attention to the downside remains on 108.72, low Aug 04, and then 108.47, a Fibonacci retracement.

- Aussie (-0.45%) faced additional headwinds, following domestic equities lower as markets responded to the NSW state government tightening COVID restrictions and placing the whole state into a strict 1-week lockdown. With cross/JPY falling victim to bearish sentiment, AUDJPY experienced the biggest shift lower, retreating around 0.85%.

- NZD, CAD, and NOK all traded with risk and particular weakness in oil prices weighed firmly on the Canadian dollar and Norwegian Krone.

- Despite US equity indices edging into the green approaching the close, there has been little FX price action of note. In the EM space, broad indices suffered with ZAR and CLP the key underperformers. The Turkish lira bucked the trend, rising 0.77% against the dollar.

- Overnight we will see Australian Monetary Policy meeting minutes before the focus turns to U.K. employment data and Eurozone Flash GDP.

- In the US, the docket will be headlined by July Retail Sales and Industrial Production data.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.